Liquid Makeup Market Share, Size, Trends, Industry Analysis Report

By Product (Foundation, Eye Products, Concealer, Lip Products, and Others); By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2801

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

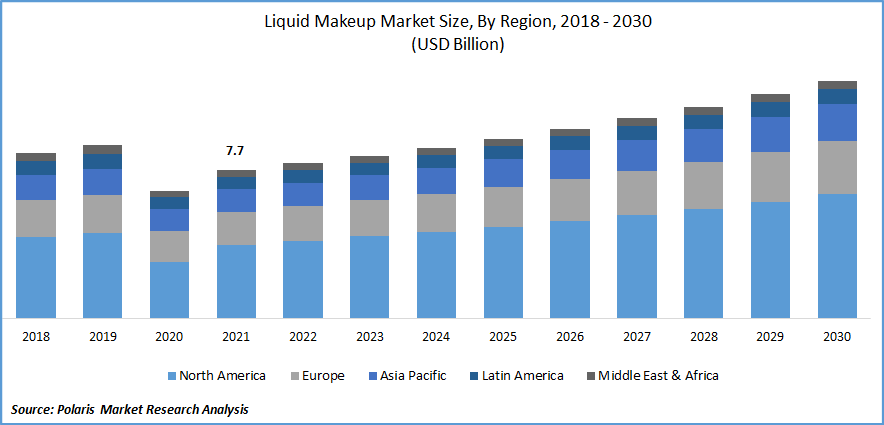

The global liquid makeup market was valued at USD 7.7 billion in 2021 and is expected to grow at a CAGR of 5.47% during the forecast period.

The increasing popularity of social media channels such as YouTube, and Instagram impact demographic groups and brands by creating a huge demand from younger generation for beauty products, cosmetics, and make-up products, including foundation, concealer, lipsticks, and eye-shadow & eye liners. Grooming, look good, and the feel-good trend is trending worldwide, with women at the epicenter of the cosmetics industry. The emerging glamour industry is boosting the demand for makeup products.

Know more about this report: Request for sample pages

Social media strongly influences millennials and Gen-Z, with attractive product promotions showcasing newer trends. In recent times, India has become a significant market for makeup brands, with major players in the Indian market including, Nykaa, Maybelline, Loreal Paris, Sugar Cosmetics, M.A.C, Lakme, and Faces Canada, among others.

People across the world are involved in the fashion and entertainment industry. Hence the demand for these products is anticipated to grow at a fast rate. The rapidly expanding urban population and the influence of fashion celebrities and social media beauty influencers will positively impact the sales of liquid makeup products. In September 2020, Maybelline introduced “Falsies Lash Lift Mascara,” an innovative solution with fiber-infused lifting mascara.

The market has grown with women’s rising purchasing power in urban areas and their growing inclination toward beauty and fashion products. International players are making their way to the Indian market, focusing on innovation and catering to the specific needs of Indian women. Further, rising awareness regarding men’s grooming products has increased demand for products such as BB cream and eyeliners. TikTok and Instagram allow male beauty influencers to showcase their art & talent to a broader audience.

Several male beauty influencers are known to have broken the traditional barriers of makeup being a women’s domain. The makeup industry has exceptional talent, and brands create products specifically for men. MËNAJI's Worldwide LLC manufactures makeup and skincare products exclusively for men and has a product portfolio, including concealers, foundation, face powder, and starter kits.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the market. The emergence of the deadly virus has stimulated the consumer's desire to not visit the salons due to the closure of salons and other services globally. The need for grooming sessions paused as consumers started spending more time at home, which slowed down the product demand.

The pandemic caused a significant change in buying behaviors, and a shift in consumer purchasing priorities for essential and daily needs has been seen. Production facilities worldwide were shut down in 2020 due to a government-imposed lockdown, and supply chain & raw materials faced disruption due to transportation stops. The increase in cases and imposing lockdown had substantially affected lives, health, and businesses.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

With the rising awareness of harmful chemical ingredients for their health and the environment, consumers’ buying behaviors have shifted to organic and natural products. And sustainability has become a priority across all industries. Consumers are becoming more conscious of what they are putting on their skin and body. They are turning to clean makeup products. Many plant-based makeup brands are creating richly pigmented products that apply beautifully to the skin compared to synthetic chemical products.

Product innovation and manufacturers’ involvement in R&D, coupled with the rising trend of naturally-derived ingredients, will encourage manufacturers to launch sustainable makeup products. Further, growing celebrity and influencer involvement in promoting sustainable beauty, makeup, and skincare products resonates well with millennials and Gen-Z population. They spend much time researching products until they find a product of their choice. Influential celebrities such as Hailey Bieber promoted bare minerals, and Jessica Alba co-founded The Honest Company, which will positively contribute to market growth.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Foundation segment is expected to dominate the market

Foundation segment will significantly dominate the market and maintain its position during the forecast period as most consumers tend to opt for liquid foundations. These products also come in various coverage levels like sheer, medium, full, and HD. The Maybelline Superstay Full Coverage Foundation, a highly pigmented foundation, uses saturated color pigments to deliver a concentrated coverage. The product is also lightweight and long-lasting, giving a flawless full-coverage finish that can last all day.

These features are often looked at by consumers and have recently gained popularity as they are suitable for people with oily, dry, and combination skin. Liquid foundations help in correcting skin tone and cover up scars & blemishes.

Online sector is expected to hold the significant revenue share

Online segment is expected to grow fast owing to the ease of availability of local and international brands on the platforms. The most popular marketplaces, including eBay and Amazon, offer many product categories with great discounts, cash-on-delivery options, and easy returns. Consumers seek value-driven products that reflect their personalities and lifestyles. For instance, Too Faced, a U.S.-based brand of innovative makeup products, has a wide range of lines and saw a substantial annual turnover of $350m in 2022.

With internet usage in developing countries such as India and China, consumer preference for online shopping has increased. Hence major market participants are rapidly building their online platforms. Further, as emerging countries’ buying behaviors changes and purchasing power grow and become urbanized, they offer lucrative opportunities for international brands to enter the untapped market.

The demand in Asia Pacific is expected to witness significant growth

The region is anticipated to dominate the global market throughout the forecast period. Factors such as rising disposable income and the need to improve physical appearance will propel the demand for liquid makeup. Increasing awareness regarding organic makeup products, innovative product branding, advertising strategies, and sustainable packaging are driving market growth.

Further, increasing developments in sustainable makeup products are creating lucrative opportunities. COVID-19 has influenced Asian consumers’ spending patterns and buying decisions. Manufacturers are turning towards online channels, hence, the online channels for purchasing beauty and makeup products will witness rapid growth in the forthcoming years.

In North America, the market is expected to grow at a steady pace owing to ever-changing and busy lifestyles of the consumers. The majority of chemical-free liquid makeup products are consumed in the U.S. due to growing consumer awareness of organic products and adverse effects of chemical ingredients. The demand for multifunctional beauty products requiring minimal application time is anticipated to lead to the growing demand for premium and luxury beauty products.

The region provides opportunities for innovation and expansion regarding liquid makeup products. In addition, brands are focusing on celebrity and influencer ambassador marketing. Celebrities and social media content creators have a large fan following, influencing the young generation and positively contributing to rising sales. In 2020, Arianna Grande, a singer based in the U.S. launched her brand, R.E.M Beauty, including lip stain markers and liquid eye shadows.

Competitive Insight

Some of the major players operating in the global market include Shiseido, FENTY BEAUTY, Benefit Cosmetics, Estée Lauder, e.l.f. Beauty, and Pacifica Beauty, Dior, L’Oréal, Avon Company, KIKO USA, HUDA BEAUTY, among others.

Recent Developments

In March 2022, Shiseido Company Limited released the Perfect Cover foundation series for consumers with skin problems such as birthmarks, any changes from medical treatment, burn spots, and scars. The series includes Perfect Cover Foundation MC and Perfect Cover Foundation (vitiligo cover), covering skin dis-colorations that were difficult to conceal with the traditional foundations.

In August 2022, Lady Gaga, a celebrity based in U.S. launched its liquid foundation and added the product to its existing products range, which includes Hy-Power Pigment Paint, Power Sculpt Velvet Bronzer, and Bio-Radiant Gel-Powder Highlighter. The foundation, Triclone Skin Tech Medium Coverage Foundation comes in 51 different shades, ranging from dark to fair to suit a skin undertone-cool, warm, or neutral.

Liquid Makeup Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 8.06 billion |

|

Revenue forecast in 2030 |

USD 12.3 billion |

|

CAGR |

5.47% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Shiseido Co., Ltd., FENTY BEAUTY, Benefit Cosmetics LLC, Estée Lauder Inc., e.l.f. Beauty, Inc., and Pacifica Beauty LLC, Dior, L’Oréal Paris, The Avon Company, KIKO USA, Inc., HUDA BEAUTY |