Managed Detection and Response (MDR) Market Share, Size, Trends, Industry Analysis Report

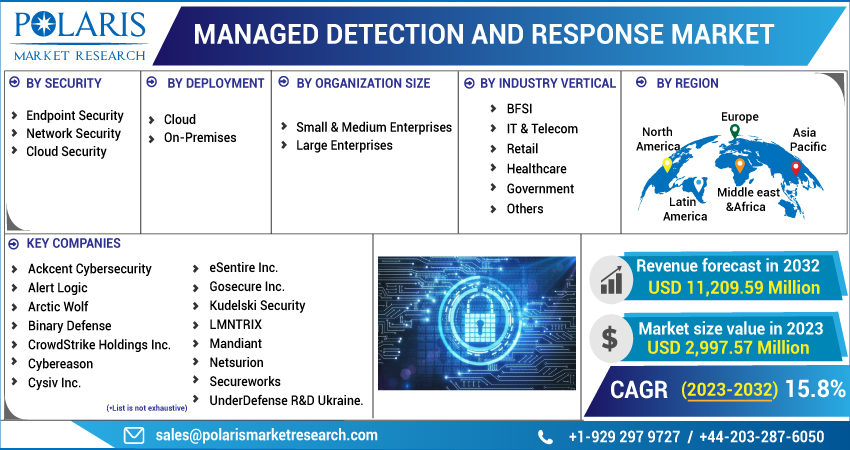

By Security (Endpoint Security, Network Security, Cloud Security); By Deployment; By Organization Size; By Industry Vertical; By Region, And Segment Forecasts, 2023-2032

- Published Date:Jun-2023

- Pages: 118

- Format: PDF

- Report ID: PM2613

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

The global managed detection and response (MDR) market was valued at USD 2,631.87 million in 2022 and is expected to grow at a CAGR of 15.8% during the forecast period. Managed detection and response (MDR) is an advanced managed service that provides security monitoring, analysis, threat intelligence, incident response, and other related services. MDR also offers security services, including network, cloud, and endpoint security.

Market Size.png)

To Understand More About this Research: Request a Free Sample Report

Managed detection and response (MDR) is a comprehensive security solution that enables real-time endpoint data collection and monitoring. It has automated response and analysis capabilities based on predefined rules. MDR's key functions include collecting and monitoring endpoint data that could indicate a potential threat and analyzing the data to identify patterns of potential threats.

Furthermore, it can automatically respond to threats by containing or removing them and notifying security experts. MDR solutions also serve as forensics and analytical tools to investigate risks and monitor suspicious activities. Moreover, with artificial intelligence and machine learning, MDR solutions can automate certain stages of investigative processes, offering advanced investigative capabilities.

Moreover, due to the increasing frequency of sophisticated cyber threats and the growing number and diversity of endpoints accessing networks, organizations need more support from managed detection and response (MDR) solutions that facilitate automated analysis and response.

The global managed detection and response (MDR) market and its opportunities were impacted by the COVID-19 pandemic. Despite the financial and cyber risks associated with the pandemic, many organizations adopted endpoint detection and response (EDR) solutions to address cyber threats and safely enhance their business operations.

The COVID-19 pandemic has impacted the global MDR market and its opportunities. Despite financial risks and cyber concerns during the pandemic, many organizations have adopted endpoint detection and response (EDR) solutions to address cyber threats and improve business operations securely. Additionally, enterprises are predicted to focus on improving data management, analysis, and efficiency of business processes post-pandemic, which will increase demand for endpoint detection and response in the coming years. Furthermore, COVID-19 has positively affected AI-integrated MDR solutions, creating promising growth opportunities for the MDR market in the future.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The primary driver behind the growth of the MDR market is the increasing adoption of cloud-based end-point results. Security attacks are also rising as more businesses shift their operations to the cloud.

The increasing diversity of cyber security attacks poses a significant risk to businesses, potentially due to the loss of business and customer data. The associated threats to data security have increased with the generation of a large amount of data. Furthermore, the digital transformation of businesses and adopting a work-from-home environment due to COVID-19 have also increased cyberattack vulnerabilities.

Vendors in the MDR market are constantly developing solutions that meet the demands of businesses of various sizes. Despite this, end-users are increasingly opting for cheaper alternatives, which negatively impacts the growth of the managed detection and response (MDR) market.

Additionally, the expenses related to maintenance and customization could improve the industry's growth. The effective functioning of end-point solutions necessitates fees for renewal, licensing, and other associated costs, which can impose a significant financial burden on businesses. Moreover, certain industries lack internal IT expertise, necessitating end-user training to optimize the efficiency of various solutions, thereby contributing to the overall cost of system ownership.

Report Segmentation

The market is primarily segmented based on security, deployment, organization size, industry vertical, and region.

|

By Security |

By Deployment |

By Organization Size |

By Industry Vertical |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The SMEs Segment Held the Highest CAGR Rate in 2022

In 2022, the small and medium enterprises (SMEs) segment held the highest CAGR rate in MDR market. SMEs are represented as associations with up to 1,000 employees. Due to their limited staff and tight financial budgets, SMEs face various IT challenges. Cyberattacks targeting SMEs can result in significant data and financial losses. With most businesses struggling due to the COVID-19 pandemic, there is a growth in demand for business, especially by SMEs, to minimize operational risks and ensure business continuity due to remote work tendencies during the pandemic while staying compliant to prevent penalties. SMEs' acceptance and adoption of MDR can help boost their customer base and improve business efficiency.

The Cloud Segment Held the Largest Market Share in 2022

In 2022, the cloud segment held the largest market share. The adoption of cloud-based MDR software has emerged as a popular delivery model for businesses, allowing customers to access endpoint solutions through the internet using a web browser. The widespread use of cloud technology in businesses has led various companies to develop app-based managed detection and response solutions, presenting significant growth opportunities for the industry.

The North America Held the Largest Market Share in 2022

In 2022, the North American region held the largest market share of managed detection and response market. This region is known for adopting advanced technologies, including endpoint solutions. Additionally, favorable government policies, high risks associated with cyber-attacks, and advanced infrastructure capabilities in developed countries like the U.S. and Canada are expected to create significant growth opportunities for the industry.

The increasing use of mobile devices, web applications, and social media platforms in North America has also impacted the managed detection and response market. Additionally, the rising adoption of cloud technologies and demand from small and medium-sized businesses have contributed to the region's growth of managed detection and response solutions. Furthermore, favorable government policies, advanced infrastructure capabilities, and a high risk of cyber-attacks, particularly in developed countries like the U.S. and Canada, have provided significant growth opportunities for the industry in North America.

The Asia-Pacific market is projected to exhibit a moderate revenue growth rate during the forecast period. Increasing incidents of malware, phishing, SQL injection, and DNS tunneling attacks in the region drive this growth. Rapid digitalization, low awareness of cybersecurity, and inadequate training and regulations are major factors fueling the demand for managed detection and response solutions against cyberattacks in the Asia-Pacific region. This emerging trend presents a significant opportunity for managed detection and response service providers to expand their regional presence.

Competitive Insight

The major global market players include Alert Logic, Ackcent Cybersecurity, Arctic Wolf, Binary Defense, Cybereason, Cysiv Inc., CrowdStrike Holdings Inc., eSentire Inc., Kudelski Security, Gosecure Inc., LMNTRIX, Netsurion, Mandiant, Secureworks, Rapid7, UnderDefense R&D Ukraine, Red Canary, Proficio, SentinelOne, Expel, Sophos, Trustwave, Deepwatch, Critical Insight, and Critical Start.

Recent Developments

- In April 2022, Cisco issued security updates for three of its products that were deemed highly vulnerable: TelePresence, RoomOS, and Umbrella VA. These products were at high risk of exploitation to create Denial-of-Service (DOS) attacks.

- In March 2022, Crowdstrike introduced the industry's first fully managed identity threat protection solution, "Falcon" Identity Threat Protection Complete.

- On April 12, 2022, Vista Equity Partners, an American investment firm, provided funding of USD 215 million to Critical Start Inc. This startup offers managed detection and response solutions in the United States. The funding will be used to design and simplify breach prevention in enterprises by leveraging a deep pool of behavioral data, thereby resolving the vast majority of cyber-attacks.

- On May 2, 2022, Microsoft, a multinational technology corporation based in the United States, introduced a managed detection and response solution under its Microsoft Security Experts category. This service will allow businesses to receive assistance from external cybersecurity experts with tasks such as threat and managed detection and response.

Managed Detection and Response (MDR) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2,997.57 million |

|

Revenue forecast in 2032 |

USD 11,209.59 million |

|

CAGR |

15.8% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Security, By Deployment, By Organization Size, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Alert Logic, Ackcent Cybersecurity, Arctic Wolf, Binary Defense, Cybereason, Cysiv Inc., CrowdStrike Holdings Inc., eSentire Inc., Kudelski Security, Gosecure Inc., LMNTRIX, Netsurion, Mandiant, Secureworks, Rapid7, UnderDefense R&D Ukraine, Red Canary, Proficio, SentinelOne, Expel, Sophos, Trustwave, Deepwatch, Critical Insight, and Critical Start |

FAQ's

The global managed detection and response (MDR) market size is expected to reach USD 11,209.59 million by 2032

North America contribute notably towards the global Managed Detection and Response (MDR) market

Key Players in the Managed Detection and Response (MDR) market are Ackcent Cybersecurity, Arctic Wolf, Binary Defense, Cybereason, Cysiv Inc., CrowdStrike Holdings Inc., eSentire Inc., Kudelski Security.

The global managed detection and response (MDR) market expected to grow at a CAGR of 15.8% during the forecast period.

The Managed Detection and Response (MDR) market report covering key segments are security, deployment, organization size, industry vertical, and region.