Maritime Safety System Market Size, Share, Trends, & Industry Analysis Report

By Offering, By Security Type, By System, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5963

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

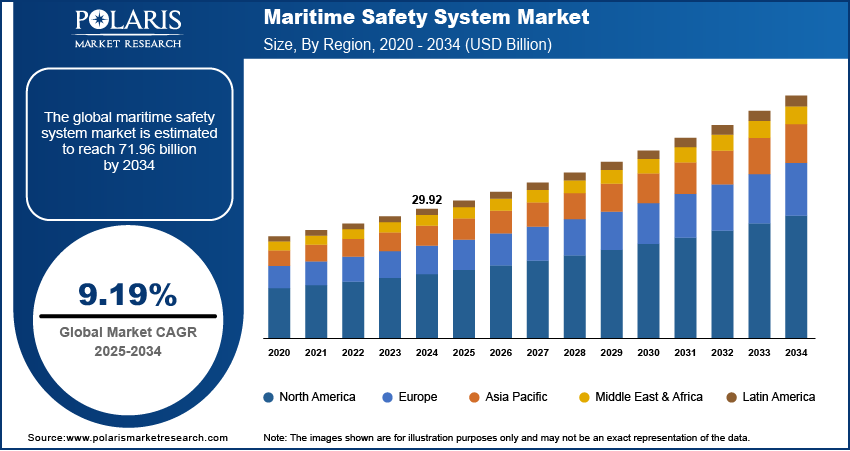

The global maritime safety system market size was valued at USD 29.92 billion in 2024, growing at a CAGR of 9.19% during 2025–2034. The growth of global maritime trade and investments in port modernization is fueling the demand for maritime safety system industry.

Maritime safety systems are designed to enhance vessel navigation and monitor operational risks while ensuring crew and cargo security during maritime operations. These systems include surveillance radar and collision avoidance technologies with distress alert mechanisms and integrated communication tools that supports situational awareness across territorial and international waters. Many compliance monitoring tools and centralized control systems are deployed to streamline safety protocols to maintain operational continuity.

Growing emphasis on maritime regulatory standards and operational risk management is boosting the adoption of scalable safety platforms compatible with port infrastructure. Manufacturers of maritime safety systems are focusing on modular system architectures, and automated response mechanisms that offer real-time data integration to strengthen onboard decision-making. Additionally, satellite tracking, AI-based hazard detection, and secure communication tools are making maritime safety systems more reliable. These features are helping shipping operators manage fleets more effectively and respond to risks with greater accuracy.

To Understand More About this Research: Request a Free Sample Report

Maritime safety systems are essential for ensuring secure vessel operations and minimizing risks during navigation. Therefore, shipping companies are integrating these solutions into daily workflows to support safe passage, monitor hazards as well as respond to emergencies in real time. These systems manage onboard alerts and track vessel movements to ensure smooth communication between crews and coastal authorities. For instance, in May 2025, European Maritime Safety Agency (EMSA) launched its third multipurpose maritime operation from Zeebrugge, focusing on pollution response, maritime safety and security. The initiative supports European Union and national authorities with enhanced surveillance and operational capabilities.

The shift toward automation and connected technologies at sea are increasing the demand for safety platforms that offer real-time data access and remote-control features. Vessel operators are adopting systems that provide automated alerts, user-friendly dashboards, and compatibility with various fleet management tools. These solutions are used for broader maritime operations to meet international safety standards and reduce operational disruptions caused by navigation-related incidents.

Industry Dynamics

Growth in Global Maritime Trade

The steady growth of global maritime trade is driving the adoption of advanced maritime safety technologies. According to UNCTAD report 2024, global maritime trade reached 12.3 billion tons in 2023, grew by 2.4% from 2022. It is rose by 2% in 2024 and expected to grow at an average rate of 2.4% each year through 2029. This rising activity fuels the need for safer navigation and better monitoring systems. Thus, shipping companies are investing in maritime safety technologies to improve safety during long-distance travel and reduce the risk of accidents at sea.

The growing trade volume brings challenges such as congested sea lanes and greater chances of vessel collisions. As a result, maritime safety systems are adopted by shipping companies to manage these challenges more effectively. Many tools that support route planning and early threat detection are essential for faster emergency response. Hence, these solutions help reduce delays and prevent losses during transit to support smooth trade operations on a global scale.

Investments in Port Infrastructure and Smart Shipping

Growing focus on ports modernization to handle larger vessels and faster turnaround times boost the demand for the maritime safety technologies. Many ports are now shifting to smart port models that use digital systems for cargo handling and safety management. For instance, in June 2025, the port of Barcelona approved key agreements to support its growth and sustainability goals, focusing on infrastructure development, environmental responsibility and boosting its role in international trade. These developments are increasing the demand for safety systems that integrates with port management platforms to improve visibility and support safe port operations. Moreover, systems with real-time location systems and automated alerts are now more commonly used to support safe docking and smooth vessel movement within the port.

Additionally, shipping companies are focusing on smart shipping technologies to improve efficiency and reduce risks. Ships equipped with digital control systems and advanced sensors need industrial safety platforms that works seamlessly with onboard automation. This shift is pushing developers to build modular safety systems that support port and vessel operations.

Segmental Insights

Offering Analysis

The segmentation, based on offering includes, solutions and services. The solutions segment is projected to reach significant at a revenue share by 2034. Most shipping operators and port authorities are investing in integrated safety solutions that support real-time monitoring, risk alerts and safe navigation. These systems offer better control over vessel movement and help reduce safety incidents during cargo handling and docking. The demand for platform-based solutions that combine communication, navigation and surveillance tools continues to remain strong as maritime operations become more complex. Many ports and vessel operators prefer scalable and modular solutions that are easy to upgrade, allowing it adapt to evolving security threats and technological advancements without significant infrastructure overhauls.

The services segment is projected to grow at a robust pace in the coming years, due to the rising need for system upgrades with maintenance and remote support. Maritime safety systems require regular updates and expert assistance to ensure proper functioning across vessels and ports. Service providers are offering training programs, on-demand technical support and managed services to improve operational readiness. This is helping operators maintain safety compliance while controlling long-term system costs. As fleets become more connected, operators are seeking service contracts that include 24/7 monitoring and proactive system checks. This trend is supporting recurring revenue models and driving continuous market engagement.

Security Type Analysis

The segmentation, based on security type includes, port & critical infrastructure security, coastal security, vessel security, crew security, cargoes and containers safety, ship system and equipment (SSE) safety, other security types. The port and critical infrastructure security segment accounted for substantial market share in 2024, as ports serve as high-traffic zones with continuous vessel movement, cargo operations and customs processing. These areas are equipped with surveillance cameras, access control systems and intrusion detection tools to prevent unauthorized access and reduce operational risks. Governments and private operators are investing in technologies that improve situational awareness and ensure smooth port functioning without delays or safety breaches. This is also driven by the growing adoption of integrated systems that support multi-agency coordination during emergencies, which helps ports respond quickly to disruptions and meet international safety standards.

The vessel security segment is projected to grow at a significant pace during the assessment phase, as ship operators adopt advanced systems to protect onboard operations and ensure safe transit. These systems help monitor external threats, detect equipment faults and support emergency communication. Vessels become more automated and sail across high-risk routes, the demand for onboard safety systems that support predictive alerts and remote access is increasing. Shipowners are also adding fire detection, intrusion alarms and engine monitoring to reduce manual checks, as these upgrades are essential for meeting classification society rules and insurance conditions.

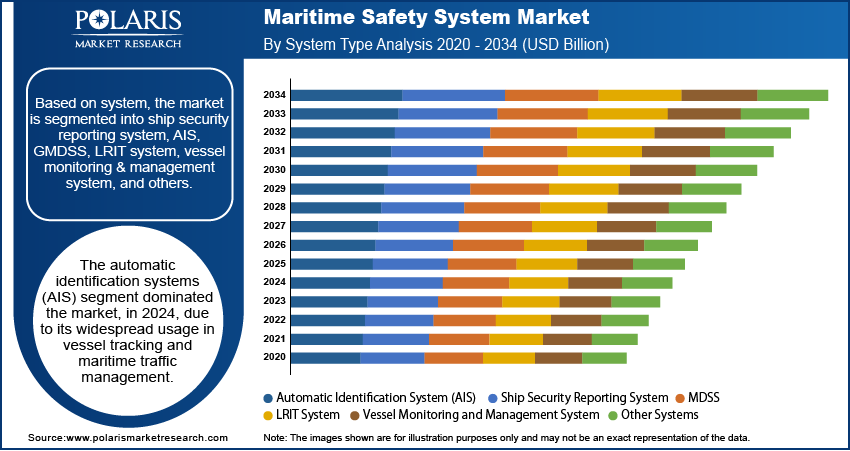

System Analysis

The segmentation, based on system includes, ship security reporting system, automatic identification system (AIS), global maritime distress safety system (GMDSS), long range tracking and identification (LRIT) system, vessel monitoring and management system, other systems. The automatic identification systems (AIS) segment dominated the market, in 2024, due to its widespread usage in vessel tracking and maritime traffic management. AIS systems transmit real-time vessel location, speed and route data to nearby ships and coastal stations. These systems help avoid collisions and improve coordination in congested sea lanes. Most vessels are now required to carry AIS equipment under international regulations, which continues to drive consistent adoption. The growing number of connected ships is also boosting demand for AIS data integration into traffic control systems. These efforts are improving marine logistics efficiency and reducing operational delays.

The vessel monitoring and management systems segment is estimated to hold a substantial market share in 2034, as shipping companies look for tools that offer end-to-end control of ship operations. These systems help monitor fuel use, engine performance, route compliance and onboard safety in one dashboard. The demand is rising for systems that support remote diagnostics and improve voyage efficiency without compromising safety. Operators are also integrating these tools with weather forecasting and cargo handling platforms. This allows better planning, fewer breakdowns and optimized energy use during long voyages.

Application Analysis

The segmentation, based on application includes, loss prevention & detection, security & safety management, counter piracy, monitoring & tracking, environment protection, search & rescue, communication management, other applications. The monitoring and tracking segment is projected to grow at a significant CAGR during the forecast period, as operators rely on these tools for real-time location updates, route adjustments and operational safety. For instance, in December 2024, Europe Space Agency (ESA) launched a new Sentinel-1 satellite to enhance Earth observation and maritime traffic monitoring, providing improved radar imaging for environmental tracking and vessel detection across all weather conditions. These systems support better traffic control, reduce risks of collision and ensure timely arrival at ports. It is widely used across commercial fleets and are often integrated with other ship management systems. Tracking systems are also becoming more advanced with satellite data and predictive route planning features. This helps in lowering fuel consumption and meeting delivery schedules more effectively.

The security and safety management segment is estimated to hold a significant market share in 2034, as ship owners prioritize onboard safety and regulatory compliance. These systems help in managing crew safety protocols, tracking incident reports and responding quickly to emergencies. With rising concerns around piracy, mechanical faults and regulatory enforcement, the focus on full-scale safety management platforms is growing rapidly. Operators are also looking for platforms that automate incident logging and provide analytics on safety trends. These features help in improving safety audits and preparing for regulatory inspections.

End User Analysis

The segmentation, based on end user includes, government & defense, marine & construction, oil & gas, shipping & transportation. The government and defense segment dominated the market, in 2024, due to the public agencies and naval forces are investing in advanced surveillance, tracking and emergency response systems to secure national waters and coastal zones. These systems support operations such as border patrol, anti-smuggling efforts and disaster management. In March 2025, Thales delivered the world’s first autonomous mine-hunting system to the Royal Navy, combining unscrewed surface vessels, towed sonars, and AI for safe and efficient underwater threat detection. Many countries are also upgrading naval fleets and port surveillance to address rising maritime risks. Defense departments prefer integrated platforms that allow real-time data sharing and multi-unit coordination. This ensures better control over territorial waters and helps in responding quickly to unauthorized movements or threats.

The shipping and transportation segment is projected to grow at a robust pace during the forecast period. This growth is driven by increasing size of global fleets and rising trade volumes. Commercial shipping companies are adopting safety systems to manage navigation, cargo handling and crew protection across international routes. These systems help reduce delays, avoid accidents and maintain compliance with global maritime standards. Ship operators face stricter safety rules and pressure to optimize voyages, thus investing in platforms that support predictive maintenance and route planning. These upgrades are helping improve delivery timelines and reduce operational disruptions.

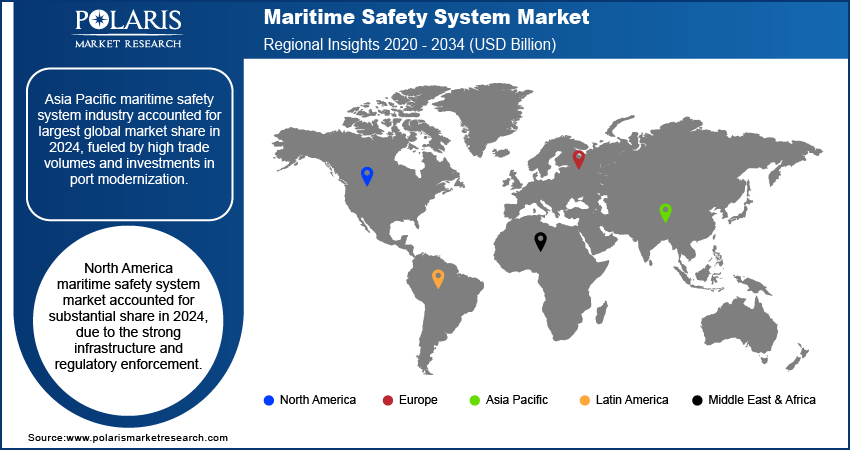

Regional Analysis

Asia Pacific maritime safety system industry accounted for largest global market share in 2024, fueled by high trade volumes and investments in port modernization. Countries such as China, Japan, South Korea, and India are adopting safety platforms to manage increasing vessel traffic and strengthen coastal monitoring. The region is witnessing rapid deployment of integrated systems for tracking, alerting, and automation across smart ports and shipping corridors. Moreover, government programs aim to improve maritime safety and compliance with international standards, this in turn fuels the maritime safety solution market growth.

China Maritime Safety System Market Insight

The China dominated the regional market share in 2024, due to its large merchant fleet and high cargo throughput. The country’s investment in smart port infrastructure in cities such as Shanghai and Shenzhen is accelerating the deployment of advanced safety technologies. As an example, in November 2024, ZTE, China MSA, and China Telecom Shanghai partnered to develop a 5G‑Advanced (5G‑A) smart vessel traffic system, which integrates high-speed comms with sensing (ISAC) to enable all‑weather, real‑time waterway monitoring. This is already deployed on Shanghai’s Huangpu River to enhances safety by detecting vessels within one‑second updates, reducing accidents and cutting deployment costs by up to 90%.

Middle East & Africa Maritime Safety System Market

The Middle East & Africa maritime safety system industry is projected to reach at a significant share of the market by 2034. This is attributed to the rising oil and gas transport, expanding port infrastructure, and increasing strategic importance of maritime routes. As per the US Energy Information Administration (EIA), OPEC’s total oil export revenues in real 2022 dollars stood at approximately USD 622 billion in 2021 and it reached around USD 682 billion by 2024, reflecting a modest increase of 9.6% over the period. Moreover, the key countries including the UAE, Saudi Arabia and South Africa are adopting safety platforms that support secure vessel navigation, automated risk alerts and real-time tracking. Thus, the demand for scalable and modern safety systems is expected to grow rapidly across the region.

North America Maritime Safety System Market Overview

North America maritime safety system market accounted for substantial share in 2024, due to the strong infrastructure and regulatory enforcement. The US and Canada are upgrading port safety systems, vessel monitoring tools and coastal surveillance networks. For instance, in November 2024, the US Maritime Administration announced to invest USD 580 million in 31 port improvement projects under the Bipartisan Infrastructure Law. This move is expected to boost demand in the maritime safety system market by enhancing port capacity, operational efficiency and safety infrastructure across US waterways. Additionally, government agencies are investing in systems that protect critical marine routes and support maritime security to focus on operational efficiency and environmental safety. This is expected to boost the demand for maritime safety system in this region during the forecast period.

Key Players & Competitive Analysis Report

The maritime safety system industry is moderately competitive, driven by increasing global trade, rising security concerns, and continuous port infrastructure upgrades. Market participants are focusing on integrated and modular solutions that support vessel tracking, real-time communication, and emergency response. Development priorities include remote diagnostics, AI-based threat detection, and interoperability with smart port systems. Companies are enhancing their portfolios with cloud-based monitoring tools, automated alert systems, and scalable safety platforms designed for different vessel types. Partnerships with naval agencies, investments in AI technologies and upgrades in satellite-based tracking are further helping players strengthen their position in commercial and defense segments.

Key companies in the maritime safety system industry include Saab AB, Kongsberg Gruppen, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales Group, Japan Radio Co., Ltd., Furuno Electric Co., Ltd., Honeywell International Inc., Leonardo S.p.A., ORBCOMM Inc., Wärtsilä Corporation, and OSI Maritime Systems Ltd.

Key Players

- Entrust Corporation

- Furuno Electric Co., Ltd.

- Honeywell International Inc.

- Japan Radio Co., Ltd.

- Kongsberg Gruppen

- Leonardo S.p.A.

- Northrop Grumman Corporation

- ORBCOMM Inc.

- OSI Maritime Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- Wärtsilä Corporation

Industry Developments

September 2024: Cobham SATCOM introduced its new SAILOR XTR GMDSS terminals at SMM 2024 in Hamburg, Germany. These next-generation maritime safety terminals are designed to enhance global maritime distress and safety communications (GMDSS), supporting current and future satellite services while ensuring compliance with evolving regulatory requirements.

September 2024: Iridium launched Iridium Certus GMDSS, a new maritime satellite safety service offering global coverage, fast distress response, and integrated compliance features including voice, MSI, and LRIT. It enables compact, cost-effective, and SOLAS-compliant communication even in polar regions.

March 2024: EUSPA introduced the new EGNOS Safety of Life Assisted Service for Maritime Users, enhancing navigation accuracy and reliability for safer maritime operations. The service supports key applications such as port approaches and coastal navigation across Europe.

Maritime Safety System Market Segmentation

By Offering Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Services

- Professional Service

- Managed Service

- Training and Education

- Support and Maintenance

By Security Type Outlook (Revenue, USD Billion, 2020–2034)

- Port & Critical Infrastructure Security

- Coastal Security

- Vessel Security

- Crew Security

- Cargoes and Containers Safety

- Ship system and equipment (SSE) Safety

- Other Security Types

By System Type Outlook (Revenue, USD Billion, 2020–2034)

- Ship Security Reporting System

- Automatic Identification System (AIS)

- Global Maritime Distress Safety System (GMDSS)

- Long Range Tracking and Identification (LRIT) System

- Vessel Monitoring and Management System

- Other Systems

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Loss prevention &detection

- Security & Safety Management

- Counter piracy

- Monitoring & Tracking

- Environment Protection

- Search & Rescue

- Communication Management

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Government & Defense

- Marine & Construction

- Oil & Gas

- Shipping & Transportation

- Shipping Companies

- Ship Crews

- Passengers & Cargo Owners

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Maritime Safety System Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.92 Billion |

|

Market Size in 2025 |

USD 32.61 Billion |

|

Revenue Forecast by 2034 |

USD 71.96 Billion |

|

CAGR |

9.19% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 29.92 billion in 2024 and is projected to grow to USD 71.96 billion by 2034.

The global market is projected to register a CAGR of 9.19% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Saab AB, Kongsberg Gruppen, Raytheon Technologies Corporation, Northrop Grumman Corporation, Thales Group, Japan Radio Co., Ltd., Furuno Electric Co., Ltd., Honeywell International Inc., Leonardo S.p.A., ORBCOMM Inc., Wärtsilä Corporation, and OSI Maritime Systems Ltd.

The automatic identification systems (AIS) segment dominated the market, in 2024

The services segment is projected to grow at a robust pace in the coming years.