Industrial Safety Market Share, Size, Trends, Industry Analysis Report

By Offering; By Type; By End-Use (Oil & Gas, Power, Chemical, Water & Wastewater Treatment, Pharmaceuticals, Paper & Pulp, Mining & Metals, Food & Beverage); By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 119

- Format: PDF

- Report ID: PM2691

- Base Year: 2024

- Historical Data: 2020-2023

The global Industrial safety market was valued at USD 8.42 billion in 2024 and is expected to grow at a CAGR of 6.7% during the forecast period. Strict standards for workplace health and safety claim that the primary driver of the market growth for workplace safety systems is the mandatory usage of industrial safety systems in workplaces.

Key Insights

- Emergency shutdown systems accounted for the largest market share in 2024. This is driven by increasing industrial automation and stringent safety regulations .

- The hardware sector is expected to witness significant growth during the forecast period. This is due to advancements in sensor technologies and real-time monitoring systems.

- The oil and gas sector accounted for the largest market share in 2024. This is fueled by high-risk operational environments and the necessity for robust safety systems.

- The demand in Asia Pacific is expected to witness significant growth over the anticipated years due to rapid industrialization and stringent safety regulations.

Industry Dynamics

- Growth in manufacturing, construction, and mining sectors emphasizes worker protection and compliance with safety regulations, which boosts the market demand.

- The need for real-time hazard detection and risk assessment has boosted the expansion opportunities.

- The industrial safety market is witnessing growth due to the adoption of automation and robotics, which enhance operational efficiency and safety.

- Sensor technology, wearable safety devices, and data analytics advancement have boosted the market demand.

Market Statistics

- 2024 Market Size: USD 8.42 Billion

- 2034 Projected Market Size: USD 16.13 Billion

- CAGR (2025-2034): 6.7%

- Asia Pacific: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Industrial Safety Market

- AI helps to monitor real-time hazard detection.

- AI helps to automate safety compliance monitoring, and streamlining documentation.

- AI helps to integrate with safety management platforms, collecting data for comprehensive analysis.

- AI helps to enable predictive maintenance, monitoring equipment data to forecast potential failures.

The adoption of industrial safety solutions is expected to be sped up by initiatives done by various governments & regulatory authorities, such as the Department Of Occupational Safety & Health (NIOSH) and the Work Health and Safety Regulations (OSHA).

Intelligent clothing, smart personal protective equipment, smart safety, & autonomous cars are just a few of the new, developing trends that will likely present profitable prospects for the workplace safety sector to expand.

The need for industrial safety solutions is expected to increase throughout the projected period due to the remarkable growth that the surveillance sector is experiencing, particularly in North America and Europe. As the market for workplace safety has grown, several companies have begun using real-time location monitoring equipment (RTLMS), safety and environmental systems (EHS), and monitoring and surveillance solutions to protect their assets.

The COVID-19 epidemic has had a significant global influence on several businesses. Due to shifts in consumer behavior, poor output, and industrial closures, several industries saw a significant impact. However, because of consumer demand or the restart of production procedures, these industries are anticipated to rebound swiftly.

One of the major sectors that needs safety systems and parts is the oil and gas industry. Major users of valves include the energy and chemical & power sectors, both of which saw their demand for valves decline due to the worldwide pandemic. Due to the nationwide lockdown, there were limits on international trade, including the closure of international borders and operational distribution channels as well as additional public health and safety precautions.

Industry Dynamics

Growth Drivers

Usually, the need for safety legislation in many businesses drives the expansion of a industrial safety sector. Governments in the US and Europe are attempting to avert disasters by enforcing regulations on worker and process safety & placing approved equipment in hazardous places, including actuators, switches, & explosion-proof sensors.

Companies such as the International Standard Organization (ISO), the Occupational Safety and Health Administration (OSHA), the American National Standards Institute (ANSI), as well as the International Electrotechnical Commission (IEC) have implemented safety standards and regulatory procedures to monitor and enhance the efficacy of industrial processes in a variety of industries. Machine safety legislation, such as the OSHA standards in North America and the EU Machinery Directives, have helped the industrial safety products business grow globally.

Report Segmentation

The market is primarily segmented based on type, offering, end-use, and region.

|

By Type |

By Offering |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Emergency shutdown type accounted for the largest market share in 2024

The market is anticipated to be dominated by the emergency shutdown system (ESD) in 2024. This industry's expansion is explained by the fact that more governments are implementing safety requirements, and demand is expanding in process sectors like oil & gas. Additionally, these systems are employed in the petrochemical, industrial, pharmaceutical, healthcare, and power sectors.

However, it is anticipated that throughout the projection period, the category for fire and gas monitoring systems would see the greatest CAGR. The requirement to detect, isolate, & reduce the uncontrolled discharge of hazardous and flammable liquids and gases across industrial and processing sectors is what is driving the growth of this market segment.

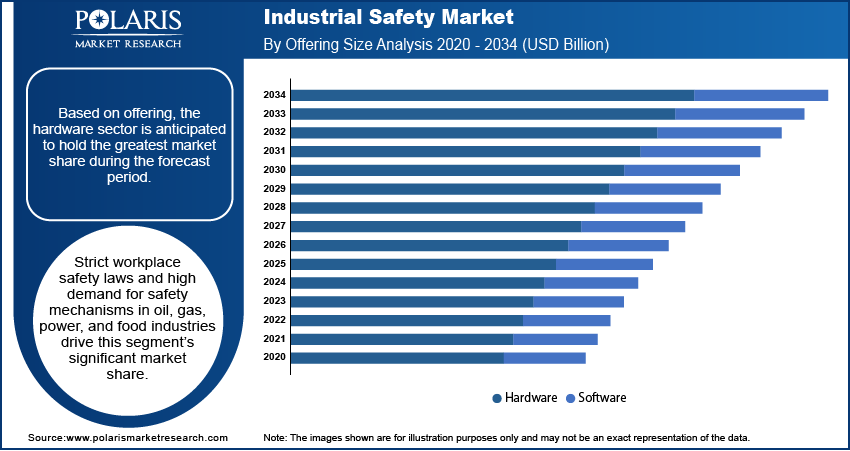

Hardware sector is expected to witness significant growth during the forecast period

Based on offering, the hardware sector is anticipated to hold the greatest market share during the forecast period. The strict workplace safety laws and the strong need for safety mechanisms in the oil and gas, electricity and power, & food & beverage industries are also responsible for this segment's significant market share. Although, the software category is anticipated to record the greatest CAGR. The industry expansion of workplace safety systems as a whole, as well as the increased deployment of technology, including cutting-edge technologies like IoT, AI, & cloud-based services, are both credited with the rise of this particular market sector.

Oil & gas sector accounted for the largest market in 2024

The oil and gas sector accounted major share of the market due to the requirement for industrial safety systems to identify and manage dangers in order to prevent accidents and fatalities; this market is expected to develop. As a result of the ignition of volatile vapors or gases, employees in the oil and gas sectors run the danger of fire and explosion. This has prompted the oil and gas sector to deploy safety systems widely.

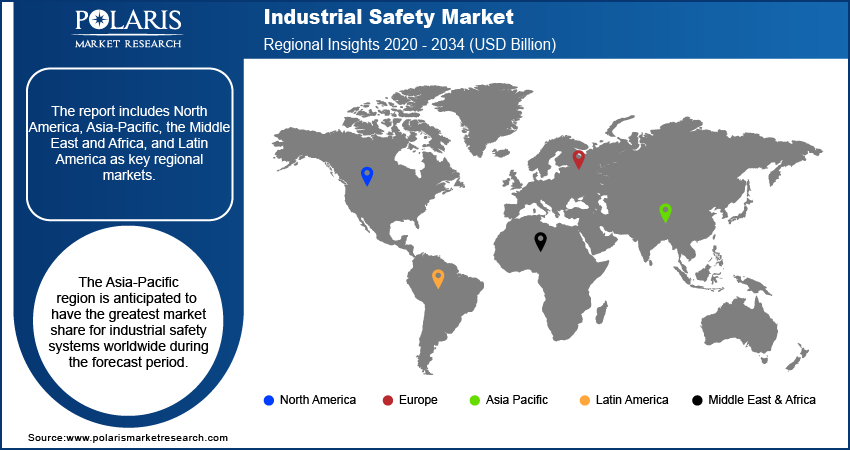

The demand in Asia Pacific is expected to witness significant growth over anticipated years

The Asia-Pacific region is anticipated to have the greatest market share for industrial safety systems worldwide during the forecast period. The rising nations like China and India are becoming more industrialized. Safety and health regulations have already been implemented in China and India in several industries, including power generation and oil and gas exploration. The Asia-Pacific manufacturing sectors have adopted more industrial safety systems as a result of rapid industrialization, which has boosted the market for industrial safety.

Competitive Insight

Some major global players operating in the global market include Siemens, Yokogawa, Hima Paul, Rockwell, Emerson, OMRON Corp, Honeywell, Johnson Controls, ABB, and Balluff GmbH.

Recent Developments

In February 2024: Schneider Electric acquired Itron, Inc., enhancing its capabilities in smart grid and metering technologies. Thus strengthening its position in industrial automation and control systems essential for industrial safety.

In Dec 2021: Honeywell acquired US Digital Designs, Inc. to expand public safety communications capabilities.

In Nov 2021: Compressor Controls LLC & Yokogawa Electric Corporation launched a jointly developed integrated solution for process and turbomachinery control.

Industrial safety Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.42 billion |

| Market size value in 2025 | USD 8.97 billion |

|

Revenue forecast in 2034 |

USD 16.13 billion |

|

CAGR |

6.7% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Type, By Offering, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Siemens, Yokogawa, Hima Paul, Rockwell, Emerson, OMRON Corp, Honeywell, Johnson Controls, ABB, and Balluff GmbH. |

FAQ's

• The global market size was valued at USD 8.42 billion in 2024 and is projected to grow to USD 16.13 billion by 2034.

• The global market is projected to register a CAGR of 6.7% during the forecast period.

• Asia Pacific dominated the market in 2024.

• A few of the key players in the market are Siemens, Yokogawa, Hima Paul, Rockwell, Emerson, OMRON Corp, Honeywell, Johnson Controls, ABB, and Balluff GmbH.

• The Oil & gas segment dominated the market in 2024.