Medical Waste Container Market Size, Share, Trends, Industry Analysis Report

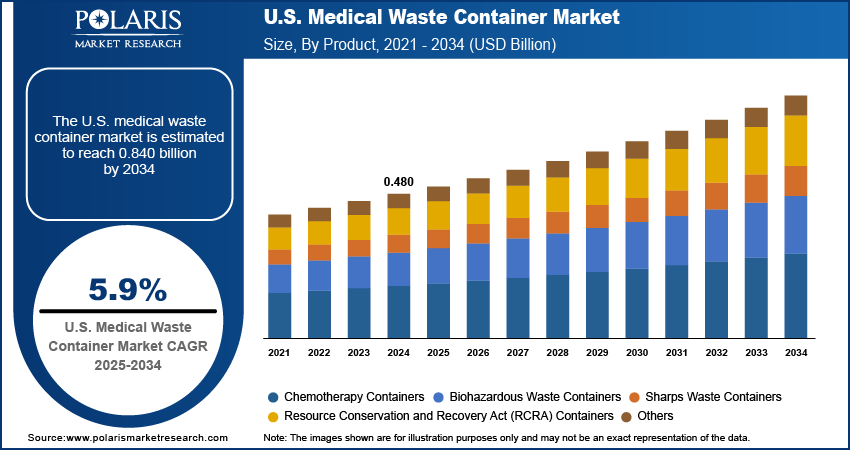

By Product (Chemotherapy Containers, Biohazardous Waste Containers, Sharps Waste Containers), By Waste Type, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1754

- Base Year: 2024

- Historical Data: 2020-2023

Overview

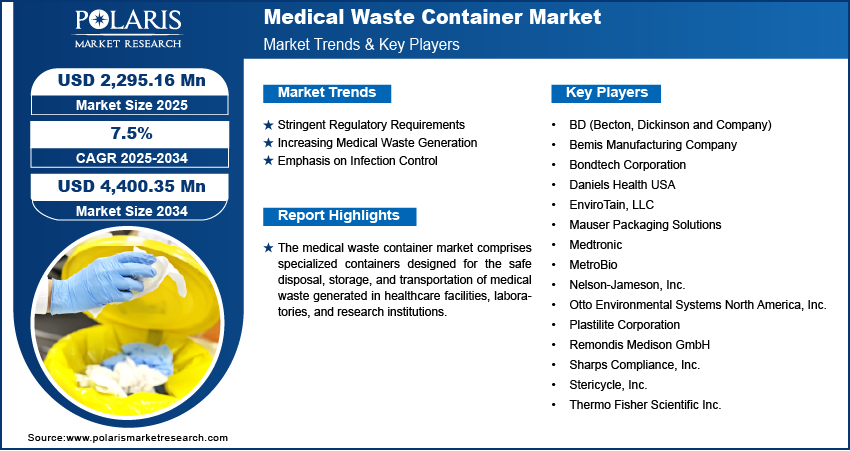

The global medical waste container market size was valued at USD 2.24 billion in 2024, growing at a CAGR of 5.94% from 2025 to 2034. A few key factors driving demand for medical waste containers include stringent government regulations and compliance requirements, expanding healthcare spending, and rising prevalence of chronic diseases.

Key Insights

- The chemotherapy containers segment accounted for 36.52% of revenue share in 2024 due to the rising volume of hazardous cytotoxic waste.

- The general waste segment held 36.91% of revenue share in 2024, due to the high volumes of non-hazardous general waste, such as packaging materials, generated by healthcare facilities.

- Europe accounted for 38.82% share of the global medical waste container market revenue in 2024, owing to strict regulatory frameworks.

- Germany held 24.88% of the revenue share in the Europe medical waste container landscape in 2024, due to the biohazard waste ordinance regulation.

- The industry in Asia Pacific is projected to register a CAGR of 7.60% from 2025 to 2034, owing to expanding healthcare infrastructure, particularly in China and India.

Industry Dynamics

- The stringent government regulations and compliance requirements are driving the demand for medical waste containers by mandating healthcare facilities to properly use certified medical waste containers to segregate, store, and dispose of medical waste.

- The rising prevalence of chronic diseases is driving the medical waste container market as chronic diseases are increasing hospital visits and diagnostic procedures, leading to higher volumes of medical waste.

- The rising investments in cancer research are expected to create a lucrative market opportunity during the forecast period.

- Lack of awareness regarding the collection of medical wastes in specific containers hampers the market growth.

Market Statistics

- 2024 Market Size: USD 2.24 Billion

- 2034 Projected Market Size: USD 3.99 Billion

- CAGR (2025–2034): 5.94%

- Europe: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

AI Impact on Medical Waste Container Market

- Direct integration of artificial intelligence (AI) into medical waste containers is in early stages.

- AI technologies are expected to enhance smart waste management capabilities, which will help improve the way medical waste containers are designed, monitored, and used during the forecast period.

Medical waste container is a specialized vessel or box designed to safely collect, segregate, store, and transport medical waste generated from healthcare activities. Medical waste includes any waste material contaminated or potentially contaminated with infectious agents, such as blood-soaked gloves, sharps like filter needles and scalpels, human tissues, laboratory cultures, pharmaceutical products, and various hazardous substances arising from hospitals, clinics, laboratories, and veterinary offices. The container plays a critical role in containing this waste to protect healthcare workers, waste handlers, patients, and the environment from infection risks or injury.

Medical waste containers come in distinct types made from puncture-resistant and biohazard-labeled materials. Color coding on these containers differentiates the categories of medical waste: red containers typically handle regulated infectious waste, yellow ones hold cytotoxic or chemotherapy waste, black ones are used for pharmaceutical waste, and blue containers collect non-hazardous or pharmaceutical waste items. Labels on containers clarify the waste category and comply with regulatory requirements.

The global medical waste container market demand is driven by the expanding healthcare spending. Health spending in the U.S. increased by 7.5% in 2023 from 2022. This is fueling the construction of more of healthcare facilities to treat patients with chronic diseases, wound, and other diseases, which is creating the need for proper disposal solutions for hazardous and non-hazardous waste, driving the demand for medical waste containers. Additionally, rising healthcare spending is creating awareness of infection control and environmental safety, pushing healthcare providers to invest in high-quality medical waste management, ensuring steady market growth for medical waste containers.

Drivers & Opportunities

Stringent Government Regulations and Compliance Requirements: Government regulations and compliance requirements are mandating healthcare facilities to properly use certified medical waste containers to segregate, store, and dispose of medical waste to prevent contamination and public health risks, and to meet safety and environmental standards. Authorities worldwide are imposing heavy fines or penalties for non-compliance, pushing healthcare providers to invest in high-quality, regulation-approved containers. Therefore, as regulations tighten globally, demand increases for specialized containers that ensure safe handling of hazardous waste, directly driving market growth for medical waste containers.

Rising Prevalence of Chronic Diseases: Chronic diseases are increasing hospital visits, long-term treatments, and diagnostic procedures, leading to higher volumes of medical waste such as used syringes, bandages, and contaminated materials, creating the demand for medical waste containers. WHO said that by around 2050, chronic diseases such as cardiovascular diseases, cancer, diabetes, and respiratory illnesses are projected to account for 86% of the 90 million deaths each year. Additionally, the increasing prevalence of chronic diseases is driving governments worldwide to set strict infection control measures, which is further compelling hospitals and clinics to use specialized containers that comply with disposal regulations, ensuring steady market growth for these products.

Segmental Insights

Product Analysis

Based on product, the segmentation includes chemotherapy containers, biohazardous waste containers, sharps waste containers, resource conservation and recovery act (RCRA) containers, and others. The chemotherapy containers segment accounted for 36.52% of revenue share in 2024 due to the increasing prevalence of cancer and the rising volume of hazardous cytotoxic waste generated from chemotherapy treatments. The surge in oncology procedures across hospitals, specialty clinics, and cancer research centers also drove demand for safe and compliant disposal solutions. These containers offer specialized features such as puncture resistance, leak-proof seals, and clear labeling, which are essential for handling highly toxic pharmaceutical waste. The growing emphasis on patient safety and occupational health standards further compelled healthcare facilities to adopt high-grade chemotherapy waste containers, particularly in developed regions with stringent regulatory frameworks such as North America and Europe.

The resource conservation and recovery act (RCRA) containers segment is projected to grow at a CAGR of 7.25% from 2025 to 2034 owing to rising enforcement of environmental compliance in medical waste disposal, especially in the United States where RCRA guidelines dictate strict protocols for handling hazardous waste. These containers support regulatory adherence by offering durable, tamper-proof construction and compatibility with labeling and tracking systems. Additionally, growing awareness among healthcare providers about environmental sustainability and legal obligations is expected to accelerate the adoption of RCRA containers, particularly in large hospitals, diagnostic laboratories, and pharmaceutical manufacturing units.

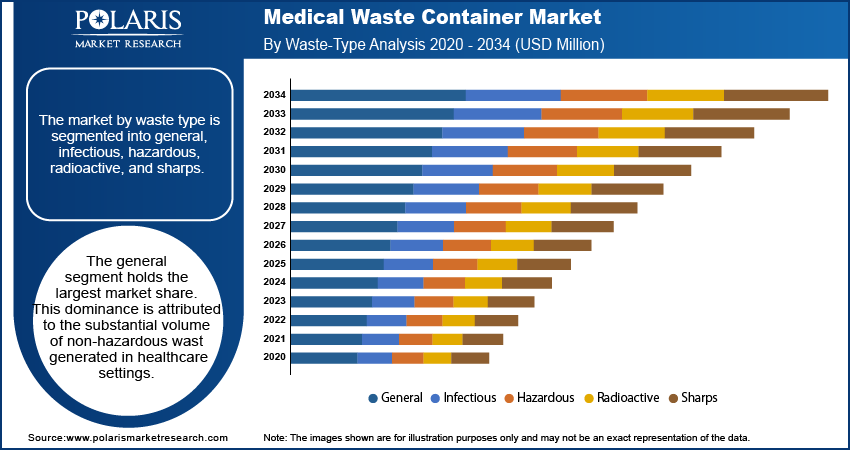

Waste type Analysis

In terms of waste type, the segmentation includes general waste, infectious waste, hazardous waste, radioactive waste, and sharps waste. The general waste held 36.91% of the revenue share in 2024. Healthcare facilities generated high volumes of non-hazardous general waste, such as packaging materials, food scraps, and non-contaminated disposables, which significantly contributed to the segment's dominance. The widespread adoption of standardized disposal solutions, coupled with stringent waste management regulations, further strengthened the segment’s position. Additionally, the increasing number of healthcare facilities globally, particularly in emerging economies, fueled the demand for cost-effective and efficient general waste disposal systems.

The infectious waste segment is expected to register a CAGR of 7.12% from 2025 to 2034, owing to increasing hospital admissions, rising surgical procedures, and a surge in infectious disease outbreaks. Waste contaminated with blood, bodily fluids, cultures, and swabs requires specially designed leak-proof and puncture-resistant containers to ensure infection control and occupational safety. The growing global emphasis on infection prevention and control is further driving the segment’s growth in the coming years.

End Use Analysis

In terms of end use, the segmentation includes hospitals & private clinics, diagnostic laboratories, pharmaceutical and biotechnology companies & CROs, academic research institutes, and others. The hospitals & private clinics segment dominated the major revenue share in 2024, holding 38.67%. This is attributed to their high patient inflow and stringent waste management regulations. These facilities generate substantial volumes of general waste, including non-hazardous materials like packaging, food scraps, and disposable items, which require proper disposal. The increasing number of surgical procedures, rising hospital admissions, and growing awareness of infection control further fueled demand for efficient containment solutions. Additionally, governments and healthcare authorities imposed strict guidelines to ensure safe waste segregation, boosting waste container adoption in hospitals & private clinics.

The diagnostic laboratories segment is projected to register a CAGR of 5.92% from 2025 to 2034, owing to the rapid expansion of diagnostic testing and the rising prevalence of chronic and infectious diseases. These labs produce high amounts of biohazardous waste, such as used needles, specimen containers, and contaminated materials, necessitating specialized disposal systems. The growing emphasis on early disease detection, coupled with advancements in diagnostic technologies, is further accelerating demand. Moreover, increasing investments in lab infrastructure and stricter compliance with environmental safety standards are estimated to contribute to segment growth.

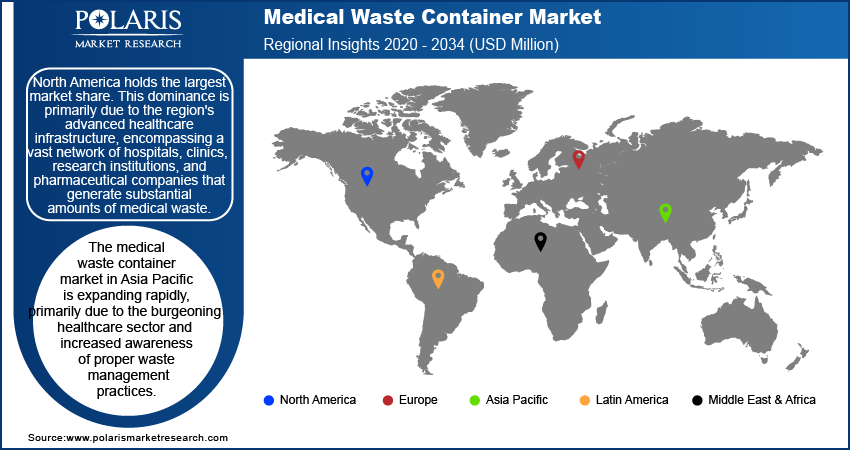

Regional Analysis

The Europe medical waste container market accounted for 38.82% of the global revenue share in 2024. This dominance is attributed to strict regulatory frameworks, such as the EU Waste Framework Directive and Medical Devices Regulation (MDR), which mandate proper segregation, handling, and disposal of medical waste. Growing environmental concerns and the push for sustainable waste management fueled the adoption of reusable and eco-friendly containers. Additionally, the rising number of hospitals, clinics, and long-term care facilities, along with increasing surgical procedures and medical treatments in the region, contributed to higher medical waste generation, leading to market dominance.

Germany Medical Waste Container Market Insights

Germany held 24.88% of the revenue share in the Europe medical waste container landscape in 2024, due to its strict national regulations, including the German Medical Devices Act (MPG) and Biohazard Waste Ordinance, ensuring safe disposal practices. The country’s advanced healthcare infrastructure, high volume of medical research activities, and aging population is increasing medical waste generation, leading to market growth. Germany also promoted recyclable and reusable waste containers to achieve its sustainability initiatives, while the expansion of private healthcare facilities and pharmaceutical production further drove market growth in Germany.

North America Medical Waste Container Market Trends

The market in North America is projected to hold 24.80% of revenue share in 2034 due to stringent government regulations, such as OSHA, EPA, and DOT guidelines in the U.S. and Health Canada’s medical waste policies. The region’s high healthcare expenditure, increasing surgical volumes, and growing prevalence of chronic diseases are contributing to medical waste generation and market growth. The rise of telehealth and home healthcare services in the region is also increasing the need for smaller, portable waste containers.

U.S. Medical Waste Container Market Overview

The demand for medical waste containers in the U.S is being driven by the expansion of hospitals, ASCs (Ambulatory Surgical Centers), and diagnostic labs. The growing pharmaceutical and biotech sectors, along with rising medical research and clinical trials in the U.S. are generating significant biohazard waste, which is creating the need for medical waste containers. Furthermore, technological advancements, such as smart waste containers with tracking systems, and increasing focus on sustainability are driving the adoption of medical waste containers in the U.S.

Asia Pacific Medical Waste Container Market Outlook

The industry in the Asia Pacific is projected to register a CAGR of 7.60% from 2025 to 2034, owing to expanding healthcare infrastructure, particularly in China, India, and Japan. Government initiatives to improve medical waste management, such as China’s 2020 Medical Waste Management Regulations and India’s Bio-Medical Waste Management Rules, are contributing to market growth. The rising prevalence of infectious diseases, increasing hospital admissions, and growth in medical tourism are contributing to higher waste volumes, leading to increasing demand for medical waste containers.

Key Players & Competitive Analysis

The medical waste container industry is highly competitive, with key players such as Becton Dickinson and Co., Cardinal Health Inc., and Stericycle Inc. dominating through extensive product portfolios and strong distribution networks. Becton Dickinson and Cardinal Health lead with innovative, compliance-driven solutions for sharps and biohazard waste, while Stericycle specializes in waste management services, including disposal and recycling. Emerging competitors like Daniels Sharpsmart Inc. and EnviroTain, LLC, focus on sustainable and reusable container systems, appealing to eco-conscious healthcare facilities. Henry Schein Inc. and Medegen Medical Products provide cost-effective, durable containers, targeting small clinics and hospitals. Meanwhile, GPC Medical Ltd. and Bondtech Corporation compete in cost-sensitive segments with affordable yet compliant alternatives. Regulatory compliance and infection control remain critical differentiators, pushing companies to enhance safety features and smart technologies.

A few major companies operating in the medical waste container industry include Becton Dickinson and Co; Bemis; Bondtech Corporation; Cardinal Health Inc.; Daniels Sharpsmart Inc.; EnviroTain, LLC; GPC Medical Ltd.; Henry Schein Inc.; Medegen Medical Products; and Stericycle Inc.

Key Players

- Becton Dickinson and Co

- Bemis

- Bondtech Corporation

- Cardinal Health Inc.

- Daniels Sharpsmart Inc.

- EnviroTain, LLC

- GPC Medical Ltd.

- Henry Schein Inc.

- Medegen Medical Products

- Stericycle Inc.

Medical Waste Container Industry Developments

In October 2023, BD announced that it recycled 40,000 pounds of medical waste in a circular economy pilot project.

In August 2023, Stericycle, Inc., announced the launch of its re-engineered one-gallon SafeDrop Sharps Mail Back and one-gallon CsRx Controlled Substance Wastage containers to provide customers with a contemporary design.

Medical Waste Container Market Segmentation

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Chemotherapy Containers

- Biohazardous Waste Containers

- Sharps Waste Containers

- Resource Conservation and Recovery Act (RCRA) Containers

- Others

By Waste Type Outlook (Revenue, USD Billion, 2021–2034)

- General Waste

- Infectious Waste

- Hazardous Waste

- Radioactive Waste

- Sharps Waste

By End Use Outlook (Revenue, USD Billion, 2021–2034)

- Hospitals & Private Clinics

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies & CROs

- Academic Research Institutes

- Others

By Regional Outlook (Revenue, USD Billion, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Medical Waste Container Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.24 Billion |

|

Market Size in 2025 |

USD 2.37 Billion |

|

Revenue Forecast by 2034 |

USD 3.99 Billion |

|

CAGR |

5.94% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.24 billion in 2024 and is projected to grow to USD 3.99 billion by 2034.

The global market is projected to register a CAGR of 5.94% during the forecast period.

Europe dominated the market in 2024.

A few of the key players in the market are Becton Dickinson and Co; Bemis; Bondtech Corporation; Cardinal Health Inc.; Daniels Sharpsmart Inc.; EnviroTain, LLC; GPC Medical Ltd.; Henry Schein Inc.; Medegen Medical Products; and Stericycle Inc.

The chemotherapy containers segment dominated the market revenue share in 2024.

The diagnostic laboratories segment is projected to witness the fastest growth during the forecast period.