Medical Waste Management Market Share, Size, Trends, Industry Analysis Report

By Service (Collection, Transport And Storage Services, Treatment & Disposal Services, Recycling Services); By Treatment Site; By Type Of Waste; By Waste Generator; By Region.; Segment Forecast, 2024- 2023

- Published Date:Mar-2024

- Pages: 117

- Format: PDF

- Report ID: PM4754

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

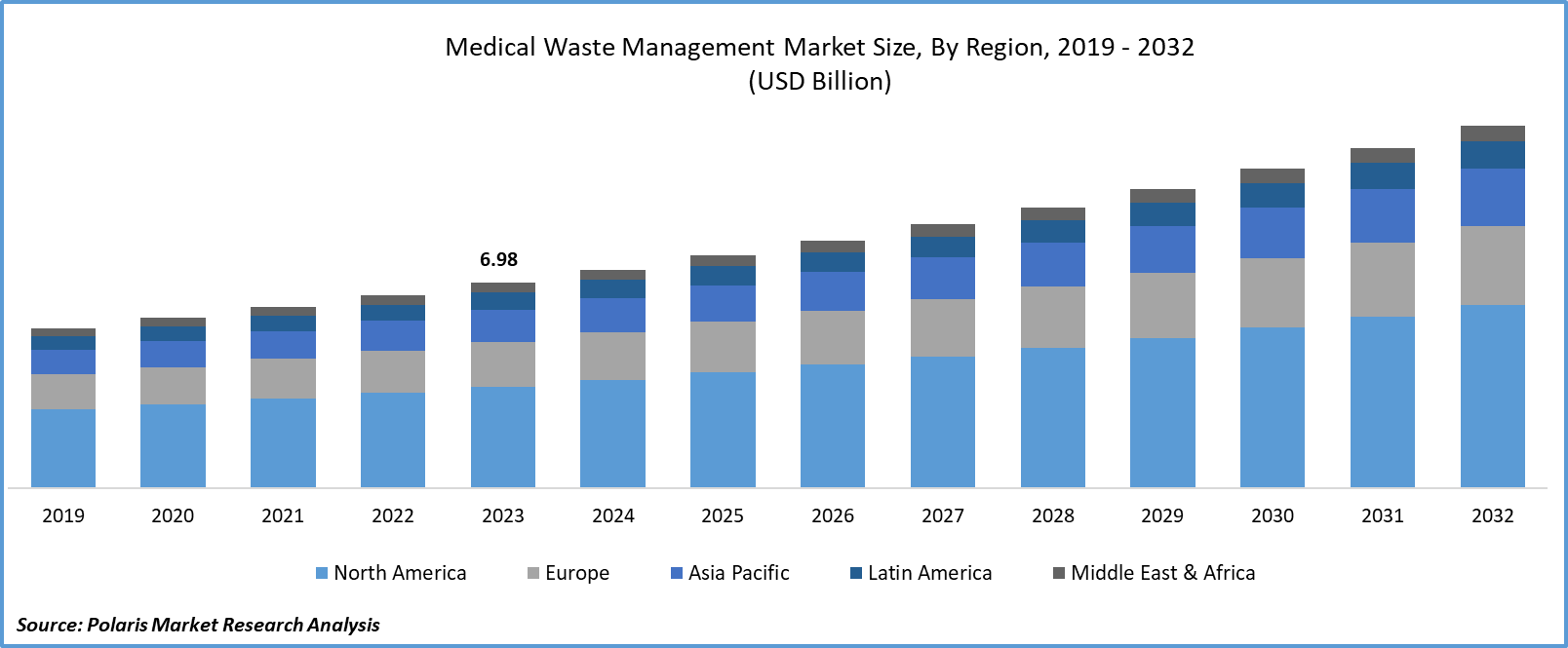

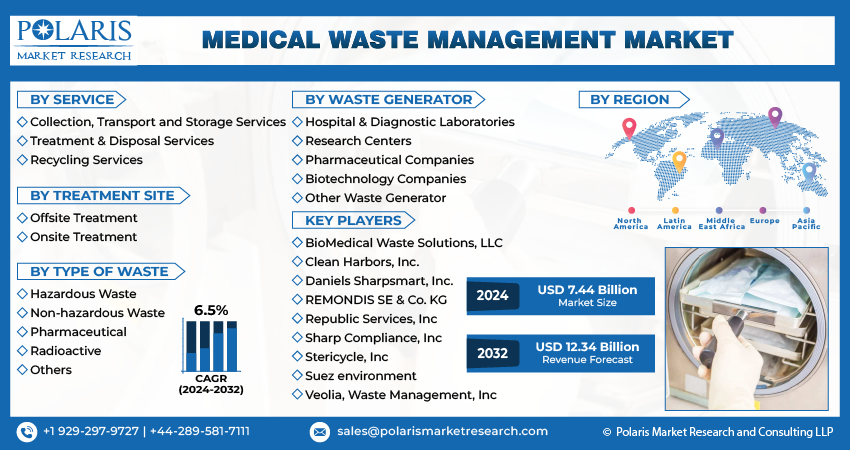

Global medical waste management market size was valued at USD 6.98 billion in 2023. The market is anticipated to grow from USD 7.44 billion in 2024 to USD 12.34 billion by 2032, exhibiting the CAGR of 6.5% during the forecast period.

Industry Trend

Medical waste management involves the proper handling, disposal, and treatment of waste generated in healthcare facilities, laboratories, and similar medical settings, often referred to as biomedical, healthcare, or medical waste. This waste encompasses materials potentially hazardous due to infectious, chemical, or radioactive properties. Essential to this process is the segregation of waste at its source, ensuring different types, such as sharps, infectious waste, pharmaceuticals, and radioactive materials, are separated for safe disposal.

The global medical waste management market has been steadily expanding, driven by increased healthcare activities, growing waste generation, and heightened awareness of proper disposal practices. Stringent regulations worldwide, enforced by governments and environmental agencies, emphasize safe waste management. This includes guidelines promoting environmentally sustainable practices like recycling and waste-to-energy initiatives. With healthcare activities rising globally and environmental concerns intensifying, the demand for responsible medical waste management market is expected to continue growing.

To Understand More About this Research: Request a Free Sample Report

The escalating volume of medical waste, propelled by worldwide population growth and the corresponding increase in patients, has prompted governments to take action. For example, in India, the Ministry of Environment and Forests introduced rules governing medical waste management, along with amendments and guidelines issued by the Central Pollution Control Board. Additionally, various government-sponsored programs and adherence to laws by agencies such as OSHA, CDC, FDA, DOT, and DEA are driving market growth. These initiatives, along with efforts by governments worldwide, are further contributing to the expansion of the medical waste management market size.

Advancement is the development of sophisticated waste treatment technologies. These include advanced sterilization techniques, such as autoclaving and microwaving, which ensure thorough disinfection of medical waste, minimizing the risk of infection transmission. Additionally, technologies like chemical disinfection and encapsulation are becoming increasingly prevalent, offering alternative methods for rendering waste harmless. Moreover, automation and robotics are streamlining waste-handling processes within healthcare facilities. Automated systems for waste collection, segregation, and transportation not only reduce manual labor but also enhance precision and consistency in waste management practices. Robotics are also being utilized in sorting facilities to improve the efficiency of waste segregation and recycling efforts.

- For instance, in 2022, Envetec Sustainable Technologies Limited introduced its groundbreaking GENERATIONS technology. This cleantech solution safely treats biohazardous waste and materials, including plastics, glass, PPE, sharp containers, and laboratory consumables on-site. Envetec is a pioneer in environmentally friendly solutions for laboratories in various industries. With GENERATIONS, Envetec becomes one of the first cleantech companies globally to offer validated on-site treatment, eliminating the need for harmful waste disposal methods.

However, continued advancements in waste treatment technologies offer market opportunities for more efficient and cost-effective solutions. Innovations in sterilization methods, recycling techniques, and waste-to-energy processes can enhance the effectiveness of medical waste management market share.

Key Takeaway

- North America dominated the largest market and contributed to more than 35% of share in 2023.

- Asia Pacific region is expected the witness the fastest growing CAGR during the forecast period.

- By service category, collection, transport and storage services segment accounted for the largest market share in 2023.

- By waste generator industry category, the hospital & diagnostic laboratories segment is projected to grow at a fastest CAGR during the projected period.

What are the market drivers driving the demand for the medical waste management market?

A rigorous regulatory framework is set to propel the growth of the medical waste management market.

The medical waste management market is experiencing growth due to the enforcement of stringent regulatory guidelines globally. Governments and environmental agencies have established comprehensive frameworks to ensure the safe collection, transportation, treatment, and disposal of medical waste, given its potential hazards. Compliance with these regulations is crucial for public health and environmental protection. The expansion of healthcare infrastructure, coupled with population growth and medical technological advancements, contributes to increased waste generation, necessitating efficient waste management solutions. Growing awareness of the environmental impact of medical waste drives demand for sustainable disposal practices. The adoption of innovative technologies minimizes ecological footprints.

Advancements in waste treatment technologies, such as autoclaving and microwave treatment, enhance waste disposal effectiveness and environmental friendliness. Recycling initiatives align with circular economy principles. Events like the COVID-19 pandemic emphasize the importance of responsive waste management systems, especially for infectious waste. Proper waste management is vital for public health, as inadequate practices can spread infections and pose risks to healthcare workers and the public. Corporate social responsibility drives healthcare institutions and waste management companies to implement responsible practices, enhancing compliance and public perception. Hence, the medical waste management market share is expected to rise in the upcoming years.

Which factor is restraining the demand for the Medical Waste Management Market?

High initial cost investment is likely to impede market growth.

The establishment of advanced medical waste treatment facilities entails significant upfront capital investment, posing a substantial barrier to smaller healthcare facilities or waste management companies and potentially limiting the growth of the medical waste management market. High costs associated with acquiring and implementing high-tech technologies and specialized equipment and ensuring regulatory compliance are key factors.

Additionally, ongoing operational expenses, including energy consumption, staff training, regulatory compliance monitoring, and equipment maintenance, further strain financial resources. While regulatory frameworks drive the industry, they also present challenges, as compliance with diverse and stringent regulations across regions requires constant monitoring and adaptation, resulting in additional costs for stakeholders impede the medical waste management market.

Report Segmentation

The market is primarily segmented based on service, treatment site, type of waste, waste generator, and region.

|

By Service |

By Treatment Site |

By Type of Waste |

By Waste Generator |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Service Insights

Based on service analysis, the market is segmented into collection, transport, and storage services, treatment & disposal services, and recycling services. The collection, transport, and storage services held the largest market share in 2023. Collection, transport, and storage are fundamental components of medical waste management. Healthcare facilities generate medical waste daily, requiring regular and efficient collection to prevent accumulation and ensure compliance with regulatory standards. Regulatory frameworks mandate proper collection, transport, and storage of medical waste to minimize health and environmental risks. Healthcare facilities must adhere to regulations governing waste segregation, packaging, labeling, and transportation to licensed treatment facilities. Specialized equipment, such as leak-proof containers and vehicles, is necessary to ensure the safe handling and transportation of medical waste.

By Waste Generator Insights

Based on waste generator analysis, the market has been segmented on the basis of hospital & diagnostic laboratories, research centers, pharmaceutical companies, biotechnology companies, and other waste generators. The hospital & diagnostic laboratories segment is expected to witness the fastest-growing CAGR during the forecast period. Hospitals and diagnostic laboratories are essential healthcare facilities that experience continuous growth in activities such as patient care, diagnostic testing, and medical research. As these facilities expand their operations to meet the growing demand for healthcare services, the volume of medical waste generated also increases, driving the need for comprehensive waste management solutions.

Regulatory agencies impose stringent guidelines and standards on healthcare facilities regarding the proper management of medical waste to minimize health and environmental risks. Hospitals and diagnostic laboratories are subject to rigorous regulatory compliance requirements, necessitating investment in specialized waste management services to ensure adherence to regulations. There is increasing awareness among healthcare providers and the general public about the environmental impact of improper medical waste disposal. This includes implementing waste reduction strategies, recycling initiatives, and efficient disposal methods.

Regional Insights

North America

North America accounted for the largest market share in 2023. North America, particularly the United States and Canada, has a well-established regulatory framework governing medical waste management. Regulatory agencies such as the Environmental Protection Agency (EPA), the Occupational Safety and Health Administration (OSHA), and provincial health authorities in Canada impose strict guidelines and standards on the handling, transportation, treatment, and disposal of medical waste. Compliance with these regulations drives the demand for professional waste management services. North America boasts advanced healthcare infrastructure, including hospitals, diagnostic laboratories, clinics, and research institutions.

Asia Pacific

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. The Asia Pacific region is undergoing rapid urbanization and industrialization, due to an increase in healthcare infrastructure and industrial activities. The expansion of hospitals, clinics, diagnostic laboratories, and manufacturing facilities results in a higher volume of medical waste generation, driving the demand for comprehensive waste management solutions. Rising healthcare expenditure and investments in healthcare infrastructure by governments and private organizations in countries such as China, India, and Japan contribute to the growth of the medical waste management market share.

Competitive Landscape

The medical waste management market is characterized by a diverse array of players offering comprehensive waste management solutions. Key companies in the medical waste management sector invest in cutting-edge technologies to enhance waste treatment efficiency, reduce environmental impact, and comply with stringent regulations. The integration of advanced treatment methods and digital solutions for waste tracking and management gives companies a competitive advantage. Companies engage in strategic partnerships and collaborations to expand their geographic reach, improve service offerings, and strengthen their market position.

Some of the major players operating in the global market include:

- BioMedical Waste Solutions, LLC

- Clean Harbors, Inc.

- Daniels Sharpsmart, Inc.

- REMONDIS SE & Co. KG

- Republic Services, Inc

- Sharp Compliance, Inc

- Stericycle, Inc

- Suez environment

- Veolia

- Waste Management, Inc

Recent Developments

- In September 2023, the Ministry of Health, in collaboration with UNDP and the Government of Japan, is set to enhance the healthcare waste management system. The healthcare waste management supplies include a total value of $1 million, 112 fully automated autoclaves or waste sterilizers, alongside PPE (Personal Protective Equipment) gear valued at $81,000 and 100 weighing scales.

Report Coverage

The medical waste management market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, service, type of waste, treatment site, waste generator, and their futuristic growth opportunities.

Medical Waste Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.44 Billion |

|

Revenue forecast in 2032 |

USD 12.34 billion |

|

CAGR |

6.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By service, By type of waste, By treatment site, By waste generator, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The global medical waste management market size is expected to reach USD 12.34 billion by 2032

Key players in the market are Clean Harbors, Inc., BioMedical Waste Solutions, LLC, Republic Services, Inc., REMONDIS SE & Co. KG

North America contribute notably towards the global Medical Waste Management Market

Medical waste management market exhibiting the CAGR of 6.5% during the forecast period.

The Medical Waste Management Market report covering key segments are service, treatment site, type of waste, waste generator, and region.