Menstrual Cup Market Size, Share, Trends, Industry Analysis Report

: By Type (Reusable and Disposable), Material, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5636

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

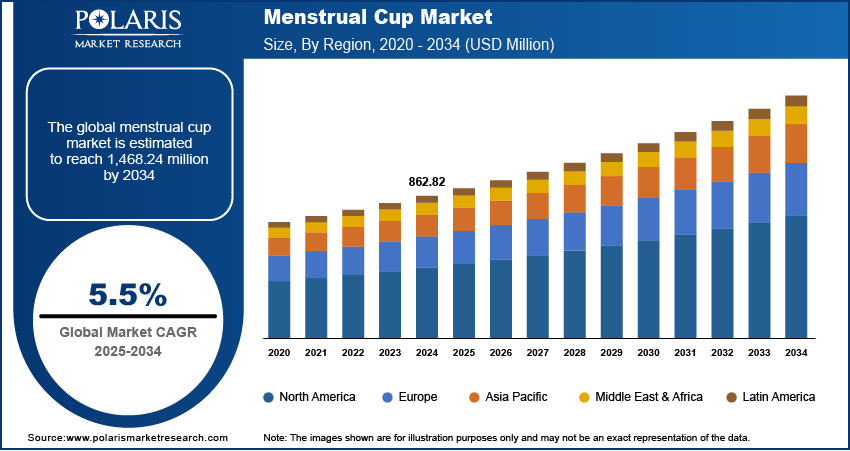

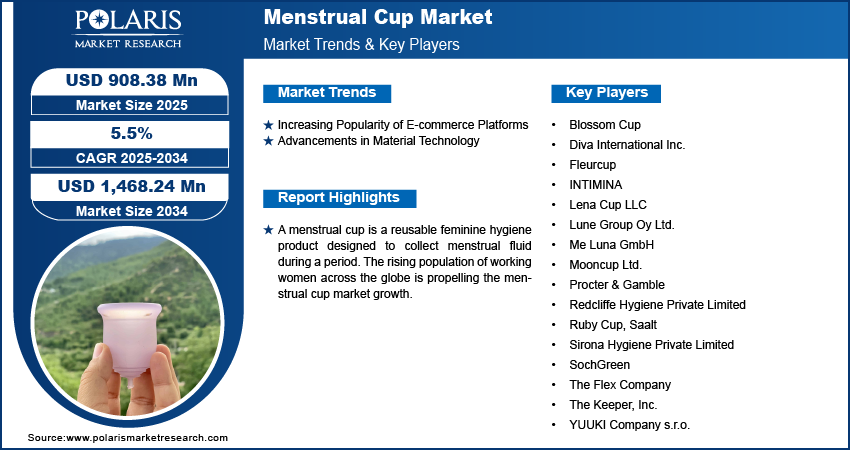

Menstrual cup market size was valued at USD 862.82 million in 2024, exhibiting a CAGR of 5.5% during 2025-2034. The market is driven by more working women seeking convenience, rising government health spending, growing e-commerce access, and advances in safe, comfortable materials.

Key Insights

- The reusable segment dominated in 2024 due to growing awareness of sustainability, cost savings, and health benefits over disposables.

- Silicone material led the market in 2024 because of its safety, durability, flexibility, and resistance to bacteria.

- Thermoplastic elastomer is experiencing rapid growth, favored for comfort, affordability, and hypoallergenic properties, especially among new users.

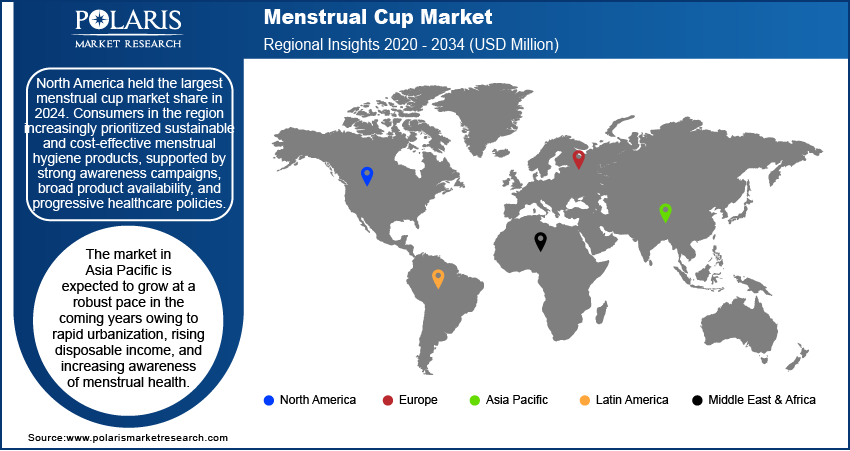

- North America held the largest market share in 2024 due to strong awareness, established e-commerce, healthcare policies, and eco-friendly preferences.

- Asia Pacific is rapidly growing, driven by urbanization, rising incomes, government initiatives, and improved menstrual health awareness and access.

Industry Dynamics

- Rising working women demand convenient, long-wear menstrual cups that support active, busy lifestyles with discreet protection and comfort.

- Growing government health spending and public campaigns increase awareness, subsidies, and accessibility for menstrual hygiene products globally.

- Innovations in medical-grade, hypoallergenic materials improve comfort, safety, durability, and usability, encouraging adoption and repeat purchases.

- Emerging markets with rising disposable incomes and digital retail growth present expanding consumer bases for menstrual cups.

- Social stigma and cultural taboos around menstruation limit product acceptance in conservative regions, slowing market growth.

- Initial hesitation regarding insertion, cleaning, and comfort can deter first-time users from adopting menstrual cups.

Market Statistics

2024 Market Size: USD 862.82 million

2034 Projected Market Size: USD 1,468.24 million

CAGR (2025–2034): 5.5%

North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

A menstrual cup is a reusable feminine hygiene product designed to collect menstrual fluid during a period. Shaped like a small, flexible bell or funnel, it is made from medical-grade silicone, synthetic rubber, or thermoplastic elastomers (TPE), ensuring safety and durability. Menstrual cups collect blood, offering advantages such as higher capacity and longer wear time, up to 12 hours, depending on flow intensity. Menstrual cups are eco-friendly as they reduce waste associated with disposable products. They are also safer than tampons since they do not pose a risk of toxic shock syndrome (TSS). Additionally, menstrual cups can hold more blood than tampons or pads, making them suitable for heavy flows.

The rising population of working women across the globe is propelling the menstrual cup market growth. Working professionals often seek products that support active lifestyles, reduce the frequency of changes, and offer discreet protection throughout long hours at work or during travel. These cups provide up to 12 hours of protection, which aligns well with the schedules of women who spend extended periods outside the home. Increased financial independence further empowers them to choose high-quality, reusable menstrual cup options that prioritize comfort, health, and environmental impact. Therefore, as more women join the workforce, the demand for practical, health-conscious menstrual cups continues to rise steadily. For instance, according to data published by the World Bank in 2023, 49% of the global female population is employed.

The menstrual cup market demand is driven by the rising government spending on health and wellness. Governments are increasingly launching public health campaigns that promote menstrual health, encouraging the use of safe and sustainable manufactured products. These initiatives often include school programs, community outreach, and partnerships with non-profits, which help dispel myths and normalize conversations around menstruation. Increased funding also supports subsidies and distribution efforts, making menstrual cups more accessible to low-income and rural populations. Therefore, as governments invest in health & wellness infrastructure, they prioritize long-term, environmentally friendly solutions, driving the adoption of menstrual ups across various demographics. For instance, as per the Economic Survey, the Total Health Expenditure by the Government of India in FY22 is estimated to be ₹9,04,461 crore or USD 104.6 billion.

Market Dynamics

Increasing Popularity of E-commerce Platforms

E-commerce retailers offer a wide range of brands, sizes, and materials, allowing consumers to compare products and read user reviews before making informed choices. Moreover, many platforms provide detailed product information, instructional videos, and customer support, which help first-time buyers feel more confident about trying reusable menstrual cups. E-commerce also reaches consumers in remote areas where physical stores may not carry such products. Promotions, discounts, and subscription models off e-commerce platforms further encourage the adoption of menstrual cups by reducing cost barriers. Therefore, the increasing popularity of e-commerce platforms is fueling the menstrual cup market expansion.

Advancements in Material Technology

Advancement in material technology boosts demand for menstrual cups by enhancing comfort, safety, and usability. Manufacturers now use medical-grade silicone, thermoplastic elastomers, and other hypoallergenic materials that reduce the risk of irritation, infections, and allergic reactions. These innovations improve flexibility and softness, making insertion and removal easier, especially for first-time users. Durable and high-quality materials also extend the product’s lifespan, offering better value and reducing waste. Some brands are further incorporating antimicrobial properties or temperature-sensitive features to improve hygiene and user experience, thereby boosting adoption.

Assessment by Segment

Market Evaluation by Type

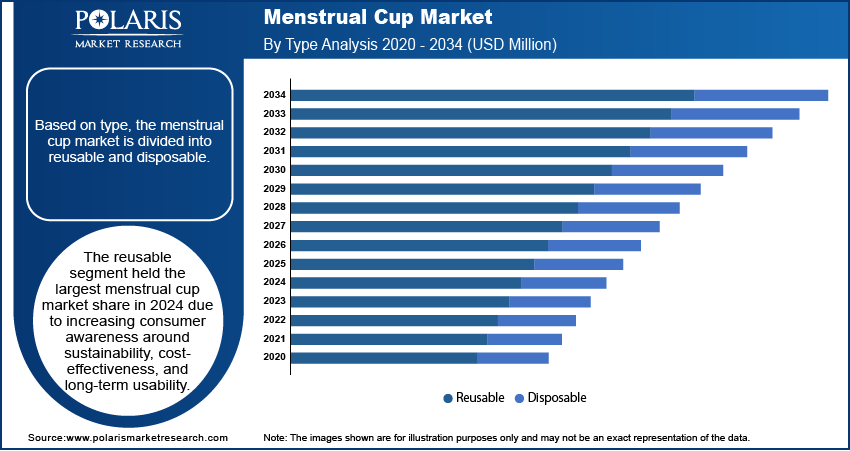

Based on type, the menstrual cup market is divided into reusable and disposable. The reusable segment held the largest menstrual cup market share in 2024 due to increasing consumer awareness around sustainability, cost-effectiveness, and long-term usability. Many consumers favored reusable menstrual cups due to their lower environmental impact compared to disposable alternatives, which often contribute significantly to plastic waste. Health-conscious individuals also lean toward reusable products as they contain fewer harmful chemicals and reduce the risk of irritation and infections. Additionally, the rising support from governments and NGOs advocating for eco-friendly menstrual hygiene products significantly boosted the adoption of reusable menstrual cups.

Market Insight by Material

In terms of material, the menstrual cup market is segregated into silicone, thermoplastic elastomer, latex, and rubber. The silicone segment accounted for a major market share in 2024 due to its superior biocompatibility, flexibility, and durability. Medical-grade silicone offered a safe, non-toxic option that appealed to health-conscious consumers, particularly those with sensitivities or allergies to latex. Its long lifespan and resistance to bacterial growth also supported growing demand among users seeking reliable and hygienic menstrual care solutions. Manufacturers favored silicone due to its ease of molding and ability to retain shape over time, which allowed for greater product innovation and comfort. Moreover, increasing consumer education around the benefits of medical-grade materials and rising environmental concerns pushed many buyers toward high-quality, reusable options made from silicone.

The thermoplastic elastomer segment is expected to grow at a robust pace in the coming year, owing to its balance between affordability, comfort, and adaptability. Many consumers appreciate its softer texture and easier insertion, especially those new to menstrual care products. Thermoplastic elastomer hypoallergenic properties and lightweight structure further enhance its appeal among younger users and those with latex sensitivities. Manufacturers increasingly choose thermoplastic elastomers for their recyclability and ability to support customizable designs, responding to rising demand for personalized and accessible menstrual care solutions.

Regional Analysis

By region, the menstrual cup market report provides insight into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America held the largest menstrual cup market share in 2024. Consumers in the region increasingly prioritized sustainable and cost-effective menstrual hygiene products, supported by strong awareness campaigns, broad product availability, and progressive healthcare policies. The presence of several key market players and a well-established e-commerce infrastructure further boosted menstrual cup growth. Additionally, widespread acceptance of reusable hygiene solutions, coupled with a growing emphasis on reducing single-use plastic waste, accelerated the shift toward more eco-friendly alternatives. Educational initiatives and a rising preference for non-toxic, chemical-free materials also played a significant role in shaping the menstrual cup market in the region.

The market in Asia Pacific is expected to grow at a robust pace in the coming years owing to rapid urbanization, rising disposable income, and increasing awareness of menstrual health. Countries such as India and China continue to witness a strong push from government bodies, non-governmental organizations, and social enterprises working to improve access to menstrual hygiene education and products. Expanding retail penetration and mobile-based health platforms have made menstrual cups more accessible across diverse demographics, further contributing to the region’s growth.

Menstrual Cup Key Market Players & Competitive Analysis Report

The global menstrual cup market is witnessing intense competition, driven by strategic mergers, acquisitions, partnerships, and collaborations as key players aim to expand their market presence and product offerings. Major companies are leveraging these strategies to enhance their technological capabilities, access new consumer segments, and strengthen distribution networks. Furthermore, companies such as Saalt and Intimina are focusing on innovative product portfolios, introducing features like customizable sizes, shapes, and materials to cater to diverse consumer preferences. These innovations not only differentiate their offerings but also address unmet needs in comfort, hygiene, and usability. The competitive landscape is further intensified by regional players entering the market with cost-effective solutions tailored to local demands.

The menstrual cup market is fragmented, with the presence of numerous global and regional market players. Major players in the market are Blossom Cup; Diva International Inc.; Fleurcup; INTIMINA; Lena Cup LLC; Lune Group Oy Ltd.; Me Luna GmbH; Mooncup Ltd.; Procter & Gamble; Redcliffe Hygiene Private Limited; Ruby Cup; Saalt; Sirona Hygiene Private Limited; SochGreen; The Flex Company; The Keeper, Inc.; and YUUKI Company s.r.o.

Saalt is a major brand in menstrual care, offering high-quality menstrual cups designed for comfort, sustainability, and versatility. Made from medical-grade silicone, Saalt cups are reusable, eco-friendly alternatives to disposable tampons and pads, lasting up to 10 years. They come in two primary sizes: Small (20 ml capacity) and Regular (30 ml capacity), catering to users with varying flow levels and cervix positions. The brand also offers the Saalt Teen cup for younger users or those with petite physiques. Saalt cups are available in two firmness levels, Regular and Soft, allowing users to choose based on their activity levels and sensitivity. The firmer option is ideal for active individuals, while the softer version provides enhanced comfort for those prone to bladder pressure.

INTIMINA is a Swedish brand established in 2009, specializing in products for women’s intimate health, including menstrual care and pelvic floor strengthening. Among its offerings, INTIMINA’s menstrual cups stand out as eco-friendly, reusable alternatives to traditional tampons and pads. Made from medical-grade silicone, these cups prioritize comfort, hygiene, and sustainability. They are designed to fit various needs, offering options like the Lily Cup One for beginners, the collapsible Lily Cup Compact for portability, and the Ziggy Cup 2, which allows period protection during sexual activity. Each cup is durable enough to last up to 10 years, significantly reducing waste and saving money compared to disposable products.

Key Companies

- Blossom Cup

- Diva International Inc.

- Fleurcup

- INTIMINA

- Lena Cup LLC

- Lune Group Oy Ltd.

- Me Luna GmbH

- Mooncup Ltd.

- Procter & Gamble

- Redcliffe Hygiene Private Limited

- Ruby Cup

- Saalt

- Sirona Hygiene Private Limited

- SochGreen

- The Flex Company

- The Keeper, Inc.

- YUUKI Company s.r.o.

Menstrual Cup Industry Developments

January 2023: Dr. Bharati Pravin Pawar, Hon'ble Minister of State for Health and Family Welfare, Government of India, launched three new brands of HLL's Menstrual Cups at HLL Corporate R&D Centre.

Menstrual Cup Market Segmentation

By Type Outlook (Revenue, USD Million, 2020-2034)

- Reusable

- Disposable

By Material Outlook (Revenue, USD Million, 2020-2034)

- Silicone

- Thermoplastic Elastomer

- Latex

- Rubber

By Distribution Channel Outlook (Revenue, USD Million, 2020-2034)

- Online Pharmacy

- Retail Pharmacy

By Regional Outlook (Revenue, USD Million, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Menstrual Cup Market Value in 2024 |

USD 862.82 Million |

|

AI-Powered Enterprise Automation Forecast in 2025 |

USD 908.38 Million |

|

Revenue Forecast in 2034 |

USD 1,468.24 Million |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global menstrual cup market size was valued at USD 862.82 million in 2024 and is projected to grow to USD 1,468.24 million by 2034.

The global market is projected to grow at a CAGR of 5.5% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are Blossom Cup; Diva International Inc.; Fleurcup; INTIMINA; Lena Cup LLC; Lune Group Oy Ltd.; Me Luna GmbH; Mooncup Ltd.; Procter & Gamble; Redcliffe Hygiene Private Limited; Ruby Cup; Saalt; Sirona Hygiene Private Limited; SochGreen; The Flex Company; The Keeper, Inc.; and YUUKI Company s.r.o

The reusable segment dominated the menstrual cup market revenue in 2024.

The thermoplastic elastomer segment is expected to grow at the fastest pace in the coming years.