Messaging API Market Size, Share, Trends, Industry Analysis Report

: By Type (Open APIs and Private APIs), Function, Application, Enterprise Size, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5603

- Base Year: 2024

- Historical Data: 2020-2023

Messaging API Market Overview

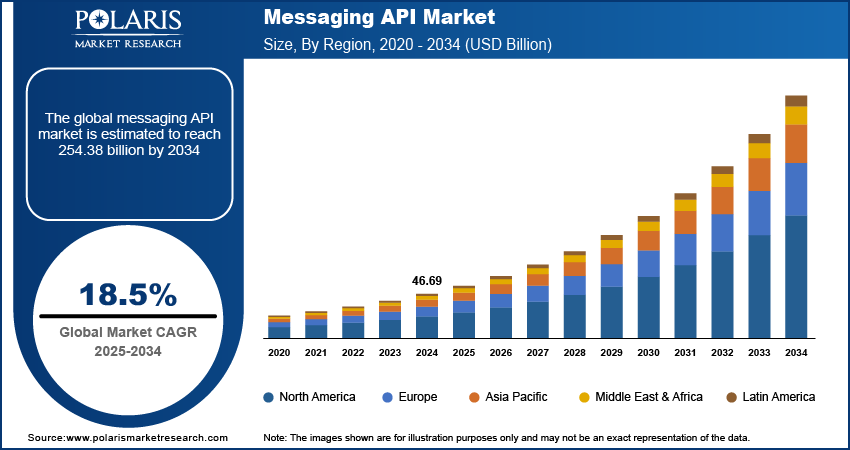

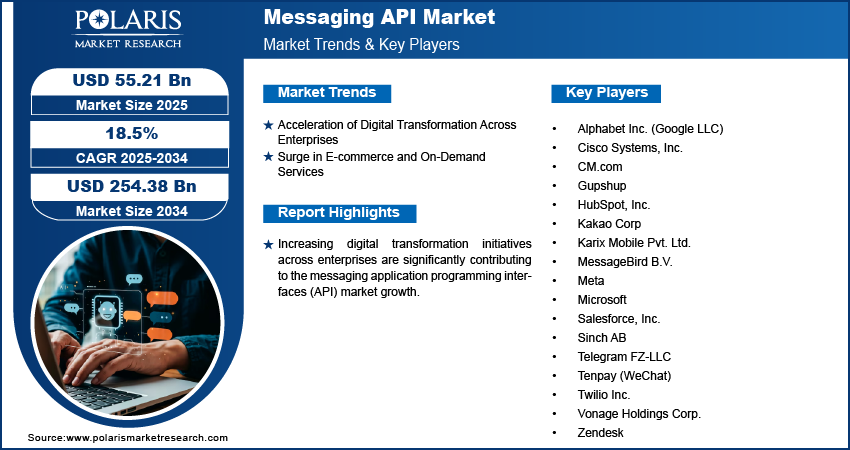

The global messaging application programming interface (API) market size was valued at USD 46.69 billion in 2024 and is expected to reach USD 55.21 billion by 2025 and USD 254.38 billion by 2034, exhibiting a CAGR of 18.5% during 2025–2034.

The messaging API market refers to the industry surrounding application programming interfaces (APIs) that enable developers and enterprises to integrate messaging functionalities such as SMS, MMS, voice, chat, and push notifications into their software, platforms, and systems. These APIs streamline real-time communication across mobile apps, websites, and enterprise networking, allowing businesses to engage users, automate notifications, enhance customer service, and facilitate secure communications at scale. Businesses are adopting messaging APIs to deliver consistent communication experiences across SMS, chat apps, voice, and social platforms, which is significantly driving the messaging API market growth.

To Understand More About this Research: Request a Free Sample Report

Increased development of mobile and progressive web apps across sectors has amplified the need for embedded communication features through APIs, boosting the messaging API market demand. Additionally, cloud-based API solutions offer scalability, flexibility, and cost efficiency, supporting their adoption across SMEs and large enterprises, which is further accelerating market expansion.

Messaging Application Programming Interfaces Market Dynamics

Acceleration of Digital Transformation Across Enterprises

Increasing digital transformation initiatives across enterprises are significantly contributing to the messaging API market development. According to the Harvard Business School Publishing, approximately 89% of large enterprises worldwide are currently engaged in initiatives focused on digital transformation and the implementation of artificial intelligence (AI) technologies. Organizations across industries are integrating messaging APIs into their enterprise systems to streamline internal operations and elevate external communications. These APIs enable seamless interaction between business applications and communication platforms, facilitating automated responses, transactional messaging, and CRM integration. Whether in logistics, where updates and tracking are automated, or in customer relationship management, where personalized engagement is essential, messaging APIs enhance operational efficiency and responsiveness. This alignment of communication infrastructure with digital strategies is driving the messaging API market expansion and strengthening enterprise resilience in a competitive digital economy.

Surge in E-commerce and On-Demand Services

The rapid evolution of e-commerce platforms and on-demand service ecosystems is expected to create a substantial messaging API market opportunity during the forecast period. The US Census Bureau projected that the US retail e-commerce sales for Q4 2024 reached USD 352.9 billion, reflecting a 22.1% increase compared to Q3 2024. Real-time notifications, delivery tracking, order confirmations, and customer service messaging are now baseline expectations in sectors such as online retail, ride-hailing, and food delivery. Messaging APIs allow these platforms to integrate instant, context-aware communication that enhances user experience and operational accuracy. The increasing reliance on mobile-first interactions and hyper-personalized services is fueling demand for messaging APIs across these sectors. The ability to deliver secure, scalable, and reliable communication services through APIs is directly contributing to long-term market growth.

Messaging Application Programming Interface (API) Market Segment Insights

Messaging API Market Assessment by Type Outlook

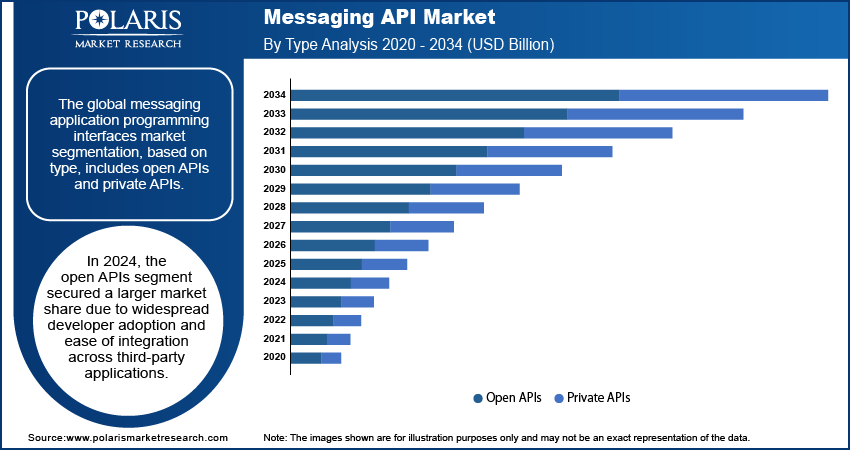

The global messaging application programming interfaces market segmentation, based on type, includes open APIs and private APIs. In 2024, the open APIs segment secured a larger market share due to widespread developer adoption and ease of integration across third-party applications. Open APIs provide a flexible architecture that enables cross-platform communication, allowing businesses to rapidly deploy messaging functions without deep backend reconfiguration. This approach supports omnichannel communication strategies, especially for enterprises focusing on scalability and cost-efficiency. The ability to integrate open APIs into marketing automation, customer engagement platforms, and logistics workflows is driving market expansion. Transparent documentation, community support, and faster deployment cycles are enhancing adoption across startups and large-scale digital service providers alike.

The private APIs segment is expected to register a higher CAGR during the forecast period. The rising demand for secure, customized communication infrastructures is accelerating the adoption of private APIs, especially in sectors that prioritize data protection and compliance. Enterprises are leveraging private messaging APIs to tightly control their communication environments, ensuring end-to-end encryption, robust access management, and integration with proprietary systems. Tailored functionalities, such as personalized customer interactions and secure data transmission, are supporting market growth in high-stakes domains such as fintech and healthcare.

Messaging API Market Evaluation by End Use Outlook

The global messaging application programming interfaces market segmentation, based on end use, includes e-commerce & retail, banking & financial services, healthcare, travel & hospitality, IT & telecom, and others. In 2024, the e-commerce & retail segment accounted for the largest messaging API market share due to high transactional volumes and the need for real-time customer interaction. These platforms utilize APIs to send order confirmations, shipping updates, personalized offers, and cart abandonment reminders directly to users via their preferred messaging channels. This integration is optimizing customer engagement and retention strategies while minimizing operational latency. Enhanced omnichannel communication capabilities are supporting the seamless integration of customer relationship management systems, enabling businesses to unify voice, text, and chatbot interactions. This segment's reliance on immediacy and scalability is contributing significantly to the messaging API market expansion and shaping its competitive landscape.

The banking & financial services segment is expected to register the highest CAGR during the forecast period. Growing emphasis on secure and instant customer communication is accelerating API adoption in the banking and financial services sector. Institutions are deploying messaging APIs to facilitate two-factor authentication, real-time transaction alerts, and personalized financial notifications, all while adhering to strict regulatory standards. The increasing use of mobile banking and the demand for round-the-clock service availability are contributing to the messaging API market growth.

Messaging API Market Regional Analysis

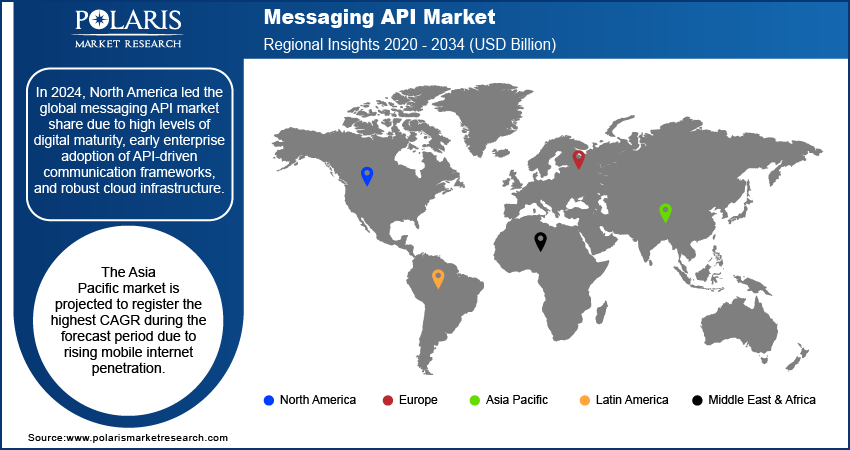

By region, the study provides messaging application programming interfaces market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share of the messaging API market revenue due to high levels of digital maturity, early enterprise adoption of API-driven communication frameworks, and robust cloud infrastructure. In October 2024, SEIDOR enhanced its Cloud infrastructure by establishing two additional data centers in the US. Enterprises across industries, ranging from fintech to retail, are heavily investing in customer engagement solutions that rely on programmable messaging interfaces for automation and personalization. Strong API-first development cultures within major tech ecosystems and the proliferation of SaaS platforms are accelerating deployment across various digital channels.

The Asia Pacific messaging application programming interfaces market is projected to experience the highest CAGR during the forecast period due to rising mobile internet penetration, rapid digital transformation of SMEs, and the explosive growth of on-demand services. The Internet in India Report 2024 shows that active internet users have reached 886 million, marking an 8% year-on-year growth. Rural India leads this expansion, accounting for 488 million users, or 55% of the total user base, highlighting increased connectivity in underserved regions. Localized messaging app dominance, particularly in countries such as India, China, and Indonesia, is encouraging the integration of APIs to facilitate transactional communication, real-time updates, and AI-enabled customer interactions. The region’s expanding e-commerce, fintech, and logistics sectors are generating sustained demand for scalable and multilingual messaging interfaces.

Messaging API Market – Key Players & Competitive Analysis Report

The competitive landscape of the messaging API market is characterized by intense innovation, rapid product iterations, and a surge in strategic collaborations. Industry analysis indicates that companies are pursuing aggressive market expansion strategies through mergers and acquisitions to gain access to new customer bases and broaden their technological capabilities. Post-merger integration is focused on consolidating messaging platforms, improving API scalability, and optimizing cloud-native infrastructure to enhance service delivery. Joint ventures and strategic alliances between API providers and cloud communication platforms are becoming increasingly prevalent, aimed at leveraging synergies in real-time data exchange and global connectivity. Technology advancements in AI-driven chatbots, natural language processing (NLP), and multichannel orchestration are reshaping product offerings and driving differentiation in an otherwise commoditized API environment. The market is witnessing a steady increase in developer-focused launches tailored to specific use cases such as financial alerts, transactional messaging, and omni-channel marketing automation. Customizable SDKs and low-code platforms are further intensifying competition, enabling faster integration and reducing time-to-market. Providers are also investing heavily in compliance and data security frameworks to meet evolving global regulations, which is becoming a crucial factor in enterprise adoption. Overall, the messaging application programming interfaces market dynamics reflect a shift toward ecosystem-centric strategies and intelligent automation to meet rising customer expectations and achieve sustained market competitiveness.

Alphabet Inc. is engaged in technology and internet-related services, specializing in search engines, advertising platforms, and cloud computing. The company was founded in 2015 through the restructuring of Google, Alphabet, and is headquartered in California, USA. Its product portfolio includes Google Search, Gmail, Google Maps, YouTube, and Android operating systems, alongside hardware such as Pixel devices and Nest smart home products. Alphabet also operates subsidiaries such as Waymo (autonomous vehicles), Verily (life sciences), and DeepMind (AI research). Its services span advertising solutions through Google Ads and cloud computing via Google Cloud. Alphabet maintains a global presence across North America, Europe, Asia Pacific, Africa, and the Middle East. In the messaging API market, the company leverages platforms such as Google Meet and Google Chat to integrate messaging functionalities into its ecosystem.

Cisco Systems, Inc. specializes in networking hardware, software, telecommunications equipment, and IoT solutions. Founded in December 1984 by Leonard Bosack and Sandy Lerner, Cisco is headquartered in California, US. Its diverse product portfolio includes routers, switches, Webex videoconferencing tools, Duo Security for authentication, and Jasper IoT platforms. Cisco provides various services such as network management software and cybersecurity solutions to enterprises globally. The company has a presence in over 100 countries across six continents with regional hubs in cities such as London, Tokyo, Dubai, and Sydney. In the messaging application programming interfaces market, Cisco’s Webex platform supports seamless communication for businesses through APIs that enable integration with third-party applications.

List of Key Companies in Messaging API Market

- Alphabet Inc. (Google LLC)

- Cisco Systems, Inc.

- CM.com

- Gupshup

- HubSpot, Inc.

- Kakao Corp

- Karix Mobile Pvt. Ltd.

- MessageBird B.V.

- Meta

- Microsoft

- Salesforce, Inc.

- Sinch AB

- Telegram FZ-LLC

- Tenpay (WeChat)

- Twilio Inc.

- Vonage Holdings Corp.

- Zendesk

Messaging API Industry Developments

In January 2025, Meta launched a dedicated AI Chats section in WhatsApp to enhance user experience with personalized interactions, strengthening its enterprise communication tools.

In August 2024, Twilio Inc. added WhatsApp Business Calling API and RCS to its portfolio, boosting voice and branded messaging capabilities. The WhatsApp API entered private beta, while RCS was piloted alongside SMS/MMS support.

In February 2024, Sinch AB partnered with Aduna (an Ericsson-backed venture) to expand global access to mobile network APIs, enabling businesses to integrate secure communications such as authentication and identity verification.

Messaging Application Programming Interfaces (API) Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Open APIs

- Private APIs

By Function Outlook (Revenue – USD Billion, 2020–2034)

- Messaging APIs

- Authentication & Identity APIs

- Voice & Video Call APIs

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Customer Engagement

- Collaboration Tools

- Marketing and Notifications

- IoT & Automation

- Others

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- E-commerce & Retail

- Banking & Financial Services

- Healthcare

- Travel & Hospitality

- IT & Telecom

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Messaging API Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 46.69 billion |

|

Market Size Value in 2025 |

USD 55.21 billion |

|

Revenue Forecast in 2034 |

USD 254.38 billion |

|

CAGR |

18.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global messaging API market size was valued at USD 46.69 billion in 2024 and is projected to grow to USD 254.38 billion by 2034.

The global market is projected to register a CAGR of 18.5% during the forecast period.

In 2024, North America held the largest market share due to high levels of digital maturity, early enterprise adoption of API-driven communication frameworks, and robust cloud infrastructure.

A few of the key players in the market are Alphabet Inc. (Google LLC); Cisco Systems, Inc.; CM.com; Gupshup; HubSpot, Inc.; Kakao Corp; Karix Mobile Pvt. Ltd.; MessageBird B.V.; Meta; Microsoft; Salesforce, Inc.; Sinch AB; Telegram FZ-LLC; Tenpay (WeChat); Twilio Inc.; Vonage Holdings Corp.; and Zendesk.

In 2024, the open APIs segment secured a larger market share due to widespread developer adoption and ease of integration across third-party applications.

In 2024, the e-commerce & retail segment accounted for the largest market share due to high transactional volumes and the need for real-time customer interaction.