Microcarriers Market Size, Share, Trends, Industry Analysis Report

: By Product (Consumables and Equipment), Application, Therapy, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 118

- Format: PDF

- Report ID: PM4360

- Base Year: 2024

- Historical Data: 2020 – 2023

Microcarriers Market Overview

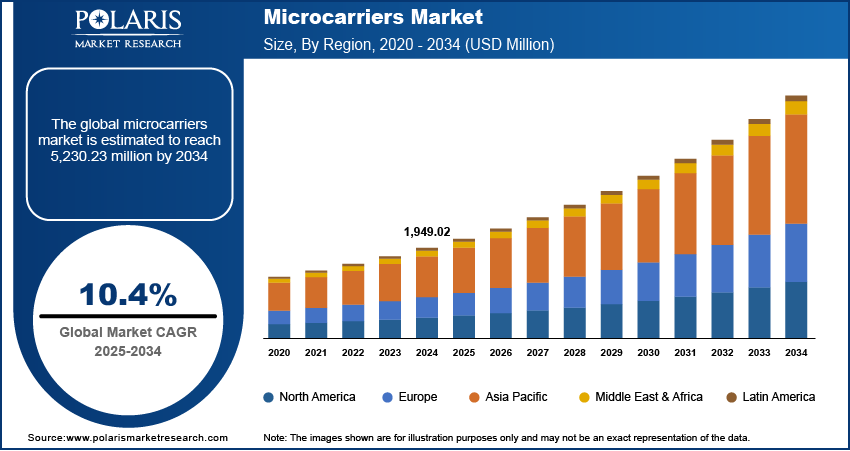

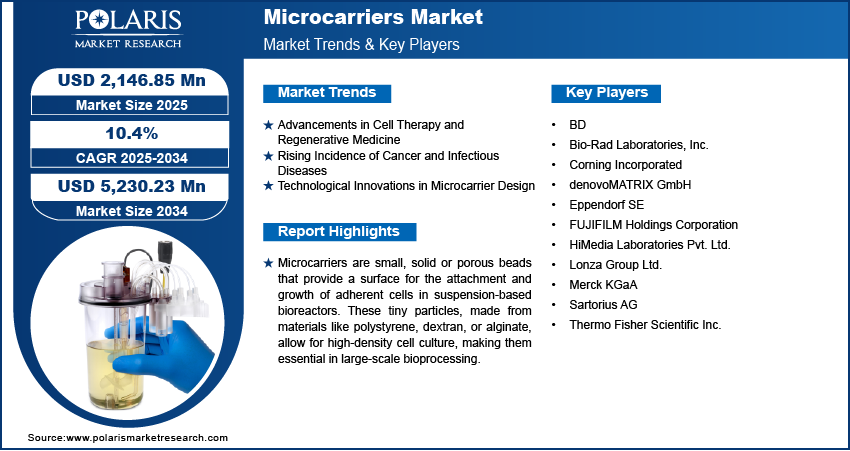

The microcarriers market size was valued at USD 1,949.02 million in 2024. The market is projected to grow from US 2,146.85 million in 2025 to USD 5,230.23 million by 2034, exhibiting a CAGR of 10.4% during 2025–2034.

The microcarriers market plays a crucial role in cell culture technology, providing a surface for the growth of adherent cells in biopharmaceutical and regenerative medicine applications. These tiny beads are widely used in the large-scale production of vaccines, cell-based therapies, and monoclonal antibodies. The increasing demand for advanced cell culture techniques, along with the expansion of the biopharmaceutical industry, is driving market growth. Additionally, the rising prevalence of chronic diseases and the growing focus on personalized medicine are further accelerating the adoption of microcarriers across research and clinical applications.

Advancements in biotechnology and increasing investments in cell therapy research are influencing the microcarriers market dynamics. The market is expanding due to the rising need for cost-effective and scalable bioprocessing solutions. Moreover, the growing preference for single-use technologies and automation in bioprocessing is expected to drive the market growth. The continuous innovation and the introduction of novel microcarrier materials are expected to create new growth opportunities in the coming years.

To Understand More About this Research: Request a Free Sample Report

Microcarriers Market Dynamics

Advancements in Cell Therapy and Regenerative Medicine

The growing developments in cell therapy and regenerative medicine are significantly driving the microcarriers market. As demand for cell-based treatments increases, researchers and biopharmaceutical companies require efficient large-scale cell production methods. Microcarriers provide a high-surface area for cell attachment, enabling the growth of adherent cells in bioreactors, which is crucial for regenerative medicine applications. Additionally, advancements in stem cell research, tissue engineering, and gene therapies are fueling the need for scalable and cost-effective cell culture technologies. The demand for microcarriers continues to rise with an increasing number of clinical trials and regulatory approvals for regenerative therapies, supporting innovations in drug development, personalized medicine, and tissue regeneration. This trend is expected to accelerate market growth in the coming years.

Rising Incidence of Cancer and Infectious Diseases

The increasing prevalence of cancer and infectious diseases has intensified the demand for advanced therapeutic approaches, including cell-based therapies and vaccines. Microcarriers play a crucial role in facilitating the large-scale production of cells necessary for these treatments. According to projections by CDC, the annual number of cancer cases in the US is expected to increase by 49%, from 1,534,500 in 2015 to 2,286,300 in 2050, with significant growth among adults aged 75 years and older. This anticipated rise underscores the need for scalable cell culture technologies, positioning microcarriers as essential components in the production of cell-based therapies.

Similarly, the global burden of infectious diseases remains substantial. According to U.S. Department of Health & Human Services, in 2023, approximately 630,000 people worldwide died from AIDS-related illnesses, highlighting the ongoing challenge posed by infectious diseases. The persistent impact of such diseases emphasizes the necessity for effective vaccines and therapeutic interventions. Microcarriers are integral to the efficient production of vaccines and cell-based treatments, driving microcarriers market expansion.

Technological Innovations in Microcarrier Design

Continuous technological advancements have led to the development of novel microcarrier designs that enhance cell culture efficiency. Recent studies have focused on optimizing the characteristics of microcarriers, such as size, shape, and surface properties, to improve cell attachment and growth. These innovations have resulted in more efficient and scalable cell culture processes, making microcarriers more appealing for large-scale therapeutic applications. The ongoing improvements in microcarrier technology are thus contributing to the microcarriers market demand by meeting the evolving needs of cell culture methodologies.

Microcarriers Market Segment Insights

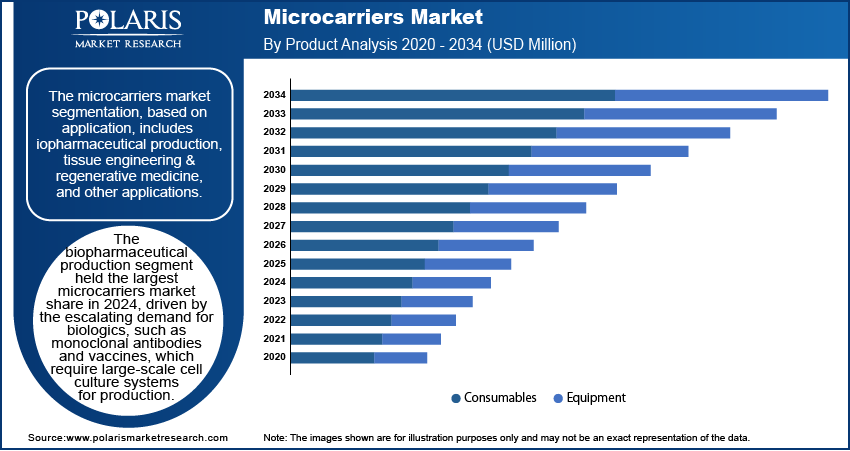

Microcarriers Market Assessment by Product

The microcarriers market segmentation, based on product, includes consumables and equipment. The consumables segment is expected to hold largest market share primarily due to the continuous and repetitive use of consumables such as media, reagents, and microcarrier beads in cell culture processes. The shift towards single-use technologies in bioprocessing has further propelled the demand for consumables, as they offer advantages such as reduced contamination risks and lower cleaning requirements. Additionally, the expanding biopharmaceutical industry, with its increasing focus on cell-based therapies and vaccine production, necessitates a consistent supply of high-quality consumables.

Microcarriers Market Evaluation by Application

The microcarriers market segmentation, based on application, includes biopharmaceutical production, tissue engineering & regenerative medicine, and other applications. The biopharmaceutical production segment held the largest microcarriers market share in 2024, driven by the escalating demand for biologics, such as monoclonal antibodies and vaccines, which require large-scale cell culture systems for production. Microcarriers facilitate the efficient expansion of adherent cells in bioreactors, making them indispensable in biopharmaceutical manufacturing. The increasing prevalence of chronic diseases and the global emphasis on immunization programs further amplify the need for biopharmaceutical products, thereby reinforcing the dominance of this segment.

The tissue engineering & regenerative medicine segment is experiencing the highest growth rate. This surge is attributed to advancements in stem cell research and the rising adoption of regenerative therapies aimed at repairing or replacing damaged tissues and organs. Microcarriers play a crucial role in these applications by providing a surface for the proliferation and differentiation of stem cells, essential for developing effective regenerative treatments. The increasing focus on personalized medicine and the growing pipeline of regenerative medicine products contribute to the rapid expansion of this segment.

Microcarriers Market Outlook by Therapy

The microcarriers market is segmented by therapy into cell & gene therapy, tissue engineering, and others. The cell & gene therapy segment held a substantial market share driven by the escalating demand for advanced therapies aimed at treating a wide range of diseases, including various forms of cancer and genetic disorders. Microcarriers are integral to these therapies as they provide a scalable platform for the expansion of adherent cells, which are essential for the development of cell-based treatments. The increasing number of regulatory approvals for cell and gene therapies further underscores the critical role of microcarriers in this segment, thereby solidifying its leading position in the market.

Microcarriers Market Regional Insights

By region, the study provides the microcarriers market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each region's market dynamics are influenced by factors such as advancements in biotechnology, the prevalence of chronic diseases, investment in research and development, and the adoption of regenerative medicine practices.

North America held the largest share in the microcarriers market in 2024, primarily due to its robust biopharmaceutical industry and substantial investments in cell and gene therapy research. The region's advanced healthcare infrastructure and supportive government initiatives have facilitated the development and approval of numerous biologics and cell-based therapies. For instance, in December 2023, the US Food and Drug Administration (FDA) has projected an increase in the approval of cell and gene therapy products, reflecting the region's commitment to advancing these treatments. Additionally, collaborations between pharmaceutical companies to enhance cancer cell therapy further boost the market growth in North America.

Asia Pacific is witnessing the highest microcarriers market CAGR. This rapid expansion is driven by increasing investments in the biotechnology and pharmaceutical sectors, particularly in countries such as China, Japan, and South Korea. Governments in these nations are actively supporting the development of cell and gene therapies through substantial funding and favorable policies. For example, in February 2025, South Korea established a significant fund to advance cell and gene therapy initiatives, highlighting the region's dedication to fostering innovation in regenerative medicine. Furthermore, the rising prevalence of chronic diseases and the growing elderly population in Asia Pacific contribute to the escalating demand for advanced therapeutic solutions.

Microcarriers Market – Key Players and Competitive Insights

The microcarriers market features several active and independent companies offering relevant products. Notable players include Thermo Fisher Scientific Inc.; Merck KGaA; Sartorius AG; Corning Incorporated; Eppendorf SE; Bio-Rad Laboratories, Inc.; HiMedia Laboratories Pvt. Ltd.; denovoMATRIX GmbH; Lonza Group Ltd.; FUJIFILM Holdings Corporation; and BD.

The competitive landscape of the microcarriers market is characterized by a mix of established corporations and emerging enterprises, each contributing to the market growth through innovation and strategic initiatives. Companies are focusing on expanding their product portfolios, investing in research and development, and forming collaborations to enhance their market presence.

Thermo Fisher Scientific Inc. offers a comprehensive range of products and services for the microcarriers market, headquartered in Waltham, Massachusetts, USA. Their portfolio includes cell culture media, reagents, and microcarrier beads essential for large-scale cell cultivation. The company's commitment to advancing cell therapy manufacturing is evident through innovations including the Gibco CTS Detachable Dynabeads, which provide an active-release mechanism tailored for clinical applications. Thermo Fisher's extensive offerings and continuous innovation make it a significant contributor to the market.

Merck KGaA is a science and technology company headquartered in Darmstadt, Germany, with an effective presence in the microcarriers market. The company provides a wide array of life science products, including cell culture media and reagents, supporting various bioprocessing needs. Merck’s microcarrier offerings are integral to large-scale cell culture processes, particularly in vaccine production and regenerative medicine applications. With its innovative solutions like the Mobius bioreactor systems, Merck enables efficient workflows for cell expansion and biomanufacturing. Additionally, Merck’s global reach and commitment to sustainability further strengthen its leadership in the life sciences sector.

List of Key Companies in Microcarriers Market

- BD

- Bio-Rad Laboratories, Inc.

- Corning Incorporated

- denovoMATRIX GmbH

- Eppendorf SE

- FUJIFILM Holdings Corporation

- HiMedia Laboratories Pvt. Ltd.

- Lonza Group Ltd.

- Merck KGaA

- Sartorius AG

- Thermo Fisher Scientific Inc.

Microcarriers Market Developments

- October 2023: Kuraray Co., Ltd., based in Chiyoda-ku, Tokyo, and led by President Hitoshi Kawahara, developed PVA hydrogel microcarriers for cell cultures in regenerative medicine. These innovative products are set to launch in Japan in January 2024, with plans for expansion into the United States and other global markets.

- October 2023: Semarion, a biotechnology company focused on advanced cell culture solutions, introduced its Early Adopter Programme for the SemaCyte Microcarrier Platform. This initiative aims to encourage early adoption and integration of the new microcarrier platform within the scientific and research community.

Microcarriers Market Segmentation

By Product Outlook (Revenue-USD Million, 2020–2034)

- Consumables

- Equipment

By Application Outlook (Revenue-USD Million, 2020–2034)

- Biopharmaceutical Production

- Tissue Engineering & Regenerative Medicine

- Other Applications

By Therapy Outlook (Revenue-USD Million, 2020–2034)

- Cell & Gene Therapy

- Tissue Engineering

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Microcarriers Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,949.02 million |

|

Market Size Value in 2025 |

USD 2,146.85 million |

|

Revenue Forecast by 2034 |

USD 5,230.23 million |

|

CAGR |

10.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The microcarriers market has been segmented into detailed segments of product, application, and therapy. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy of the microcarriers market revolves around product innovation, strategic partnerships, and geographic expansion. Companies are investing in research and development to introduce advanced microcarrier solutions that enhance cell culture efficiency. Collaborations with biopharmaceutical firms and research institutions help strengthen market presence and drive adoption. Additionally, expanding manufacturing capabilities in emerging markets, particularly in Asia Pacific, supports growth by catering to the rising demand for cell and gene therapy solutions. Digital marketing, scientific conferences, and regulatory approvals further enhance brand visibility and customer engagement, ensuring a competitive edge in the evolving biotechnology landscape.

FAQ's

The microcarriers market size was valued at USD 1,949.02 million in 2024 and is projected to grow to USD 5,230.23 million by 2034.

The market is projected to register a CAGR of 10.4% during the forecast period, 2024-2034.

North America had the largest share of the market in 2024.

Key players in the microcarriers market include Thermo Fisher Scientific Inc.; Merck KGaA; Sartorius AG; Corning Incorporated; Eppendorf SE; Bio-Rad Laboratories, Inc.; HiMedia Laboratories Pvt. Ltd.; denovoMATRIX GmbH; Lonza Group Ltd.; FUJIFILM Holdings Corporation; and BD.

The biopharmaceutical production segment accounted for the largest market share in 2024.

Microcarriers are small, spherical particles that provide a surface for the attachment and growth of adherent cells in large-scale cell culture processes. They are commonly used in bioreactors to support the expansion of cells for applications in biopharmaceutical production, cell & gene therapy, vaccine manufacturing, and regenerative medicine. Made from materials such as polystyrene, dextran, or alginate, microcarriers enhance cell proliferation by offering a three-dimensional environment, improving cell yield while maintaining viability. Their use is critical in industries where high cell densities are required, such as in the production of monoclonal antibodies, stem cell therapies, and viral vaccines.