Microplastic Filtration Systems Market Size, Share, Trends, Industry Analysis Report

: By System Type, Application (Waste Water Treatment, Air Filtration, Marine & Environmental Protection, Research & Development, and Others), End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 180

- Format: PDF

- Report ID: PM5559

- Base Year: 2024

- Historical Data: 2020-2023

Microplastic Filtration Systems Market Overview

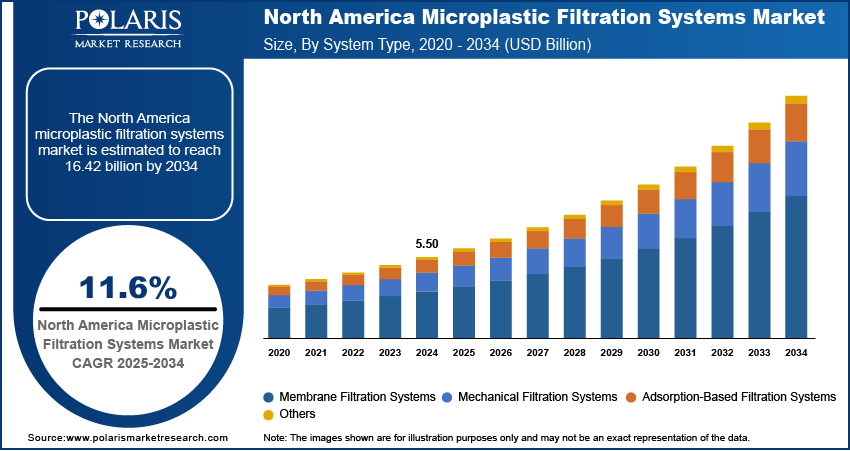

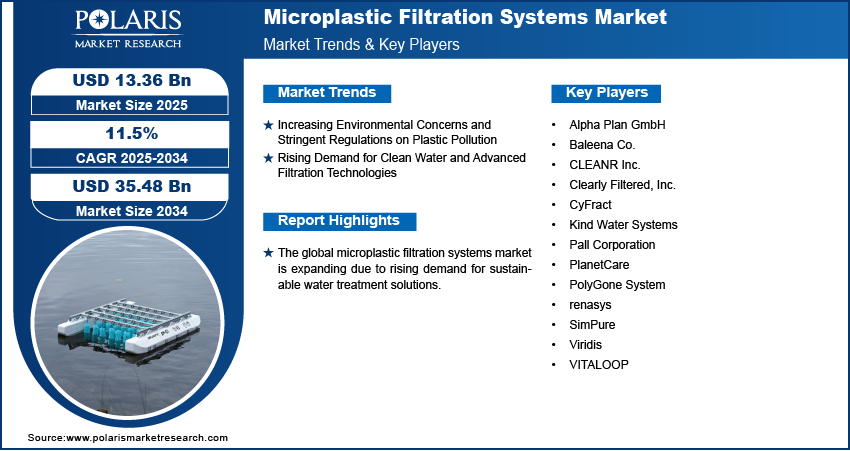

The global microplastic filtration systems market size was valued at USD 12.82 billion in 2024 and is expected to reach USD 13.36 billion by 2025 and USD 35.48 billion by 2034, exhibiting a CAGR of 11.5% during 2025–2034.

The global microplastic filtration systems market growth is attributed to the increasing demand for sustainable water treatment solutions. Factors such as rising concerns associated with the surge in microplastic pollution across water bodies have significantly amplified the need for efficient filtration technologies. Industries, particularly in the wastewater management and manufacturing sectors, are investing in advanced filtration systems to meet stringent environmental regulations. Additionally, growing consumer awareness regarding water quality and governmental policy mandates are fuelling the demand for wastewater treatment, resulting in the microplastic filtration systems market opportunities. North America, backed by strong regulatory frameworks and investments in clean water infrastructure, has emerged as a key contributor to the overall microplastic filtration systems market revenue share.

An important factor driving the microplastic filtration systems market demand is the adoption of innovative membrane technologies. Membrane filtration, including ultrafiltration and reverse osmosis, offers enhanced filtration efficiency by removing the smallest microplastic particles. Their application in water treatment plants, industrial facilities, and marine protection systems plays an important role in promoting market opportunity. Companies are continuously advancing material technologies, including polymeric and ceramic membranes, to enhance durability and filtration capabilities. Therefore, such technological advancement creates significant growth prospects for businesses seeking to enter the microplastic filtration systems market.

To Understand More About this Research: Request a Free Sample Report

An emerging microplastic filtration systems market trend is the integration of smart filtration technologies such as Internet of Things (IoT)-enabled monitoring systems, remote monitoring, control platforms, and others. Advanced sensor-equipped filtration systems are now capable of real-time monitoring and analysis of microplastic contamination levels, providing actionable insights for effective water management. Additionally, artificial intelligence (AI) and data analytics are being used to optimize filtration processes, thereby enhancing operational efficiency and reducing energy consumption. For example, the integration of AI-powered predictive maintenance systems has enabled companies to minimize downtime and extend the lifespan of filtration units. As industries are increasingly prioritizing sustainability and regulatory compliance, the adoption of intelligent microplastic filtration systems is expected to witness significant growth in the coming years.

Microplastic Filtration Systems Market Dynamics

Increasing Environmental Concerns and Stringent Regulations on Plastic Pollution

Governments and regulatory bodies across the globe are enforcing strict policies to curb challenges arising from plastic pollution. Factors such as the rising accumulation of plastic waste in areas including oceans, freshwater sources, and the air are fuelling the urgency for filtration technologies, such as microplastic filtration systems. Moreover, regulatory frameworks, such as the European Union’s Microplastic Restriction Initiative ((EU) 2023/2055)) and the US Clean Water Act, compel enterprises to implement effective filtration mechanisms. Thus, such an initiative made by the government to limit the increase of plastic waste in the environment has forced waste material generators to integrate microplastic filtration systems.

The European Chemicals Agency (ECHA) has introduced bans and restrictions on the usage of microplastic across various sectors, including cosmetics, detergents, and artificial sports surfaces, prompting manufacturers to adopt filtration technologies. This regulatory momentum has resulted in companies proactively aligning with the evolving regulations and gaining a competitive edge within the microplastic filtration systems market ecosystem.

Rising Demand for Clean Water and Advanced Filtration Technologies

At the global level, countries are constantly facing issues related to fresh and clean water for drinking and daily applications. The growing scarcity of clean water has elevated the need for advanced filtration technologies that are capable of removing microplastics from drinking and wastewater sources. Sectors, including municipals, industries, and households, are generating a large volume of wastewater on a daily basis, causing a threat to biodiversity. Therefore, these sectors seek reliable filtration solutions to ensure safe and sustainable water consumption. Moreover, rising public awareness regarding water contamination and the risks associated with it is providing investment opportunities for companies in the next-generation filtration technologies. Governments and private entities are actively funding research and infrastructure development to enhance filtration efficiency, leading to the widespread adoption of microplastic filtration systems.

Factors such as increasing emphasis on clean water access and industries such as food & beverage, pharmaceuticals, and others are deploying nanotechnology-based filtration systems in wastewater treatment plants to manage issues related to microplastic contamination. These advanced systems are designed to provide sustainable solutions for water purification while meeting regulatory requirements. Moreover, as the global demand for clean water is rising, the microplastic filtration market is gaining significant acknowledgment by industrial and commercial sectors. For instance, in an effort for clean water solutions, companies such as Veolia have deployed membrane-based filtration systems in municipal wastewater treatment plants to address microplastic contamination. These advanced filtration technologies use ultrafiltration and nanofiltration membranes to effectively capture microplastics and provide cleaner water for industrial, commercial, and residential consumption.

Microplastic Filtration Systems Market Segment Insights

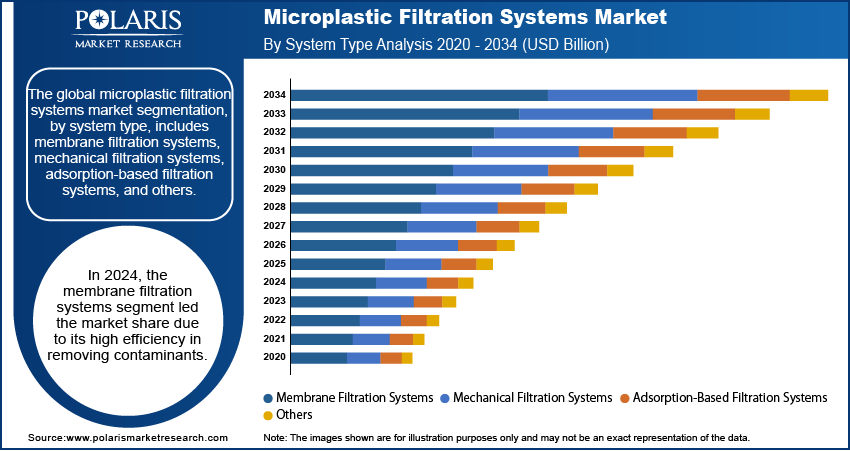

Microplastic Filtration Systems Market Assessment by System Type Outlook

The global microplastic filtration systems market segmentation, by system type, includes membrane filtration systems, mechanical filtration systems, adsorption-based filtration systems, and others. In 2024, the membrane filtration systems segment held the largest share of the microplastic filtration systems market revenue due to its high efficiency in removing microplastics. Membrane filtration systems use advanced separation technology to remove microplastics from water sources. These systems operate on principles such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis to remove microplastic from wastewater. A key driving factor fueling the growth of this segment is the rising concern over water contamination and stringent environmental policies to implement filtration systems by the industries. Industries such as food and beverages, pharmaceuticals, wastewater treatment plants, and others are increasingly adopting them to optimize filtration performance and reduce operational costs.

The advancement in filtration technologies and materials, such as polymeric and ceramic membranes, are significantly improving the filtration efficiency and durability of the system. Also, these membrane helps in resisting fouling, leading to their rising demand for long-term industrial applications. For instance, polymeric membranes, namely P-Series launched by Aqua MultiBore, are employed in several industrial applications for both water and wastewater filtration processes.

Microplastic Filtration Systems Market Evaluation by Application Outlook

The global microplastic filtration systems market, based on application, is divided into waste water treatment, air filtration, marine & environmental protection, research & development, and others. In 2024, the waste water treatment segment dominated the microplastic filtration systems market share, driven by rising concerns over microplastic contamination in water sources. The rising presence of microplastics in water is prompting industries and municipalities to implement advanced detection and filtration technologies to ensure water quality and compliance with environmental regulations. Moreover, the growing stringency of regulations aimed at curbing plastic pollution further propels the demand for microplastic filtration systems in wastewater treatment plants. Governments and environmental agencies worldwide are enforcing strict discharge limits, compelling industries to adopt efficient filtration solutions. Technological advancements, such as membrane bioreactors and nanofiltration techniques, are also enhancing the efficiency of microplastic removal, thus boosting the segmental growth.

Microplastic Filtration Systems Market Evaluation by End User Outlook

The global microplastic filtration systems market, based on end user, is segregated into waste water treatment, air filtration, marine & environmental protection, research & development, and others. The marine & environmental protection segment is expected to witness the highest growth rate during the forecast period due to increasing global efforts to combat plastic pollution in oceans, rivers, and coastal areas. Public and private bodies such as governments, environmental organizations, and regulatory bodies are imposing stringent policies to reduce microplastic contamination in marine ecosystems, leading to a surge in demand for advanced filtration technologies. Additionally, rising investments in sustainable solutions, growing awareness of the impact of microplastics on marine biodiversity, and advancements in filtration technologies tailored for large-scale environmental cleanup projects will further drive this segment’s growth. The expansion of ocean cleanup initiatives and stricter compliance with international environmental regulations, such as the United Nations Sustainable Development Goals (SDGs) and various national marine protection laws, will also contribute to the accelerated adoption of microplastic filtration systems in marine and environmental applications.

Microplastic Filtration Systems Market Regional Analysis

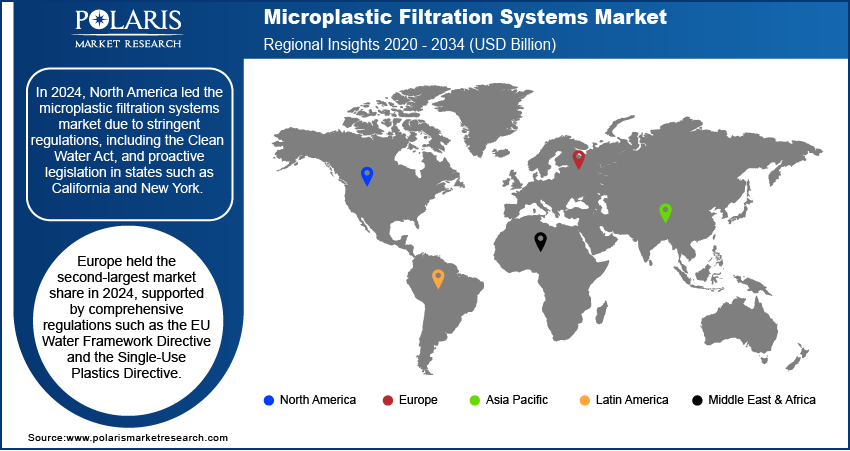

By region, the study provides microplastic filtration systems market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global microplastic filtration systems market revenue. This dominance is attributed to the increasing regulatory pressure, growing technological advancements, and rising awareness of plastic pollution’s environmental and health impacts. Countries such as the US and Canada are among the key countries that are promptly adopting advanced filtration solutions, with government agencies, research institutions, and private enterprises investing heavily in wastewater treatment and environmental protection. North America is a hub for technological innovation, with companies and research institutions pioneering advanced microplastic detection and filtration techniques. Emerging technologies such as AI-driven filtration monitoring, membrane bioreactors, and nanofiltration systems are being rapidly adopted to improve efficiency. Additionally, collaborations between industry players and environmental organizations are driving large-scale clean-up projects, reinforcing the region’s leadership in microplastic filtration solutions.

The US Environmental Protection Agency (EPA) has introduced stringent regulations under the Clean Water Act, compelling industries and municipalities to implement effective microplastic filtration systems. Several states, including California and New York, have passed legislation targeting microplastic contamination, further accelerating microplastic filtration systems market expansion. The increasing prevalence of microplastics in drinking water sources has also led to heightened consumer concerns, prompting utilities to enhance filtration processes.

In Canada, the government has taken proactive steps by classifying plastic waste as toxic under the Canadian Environmental Protection Act (CEPA). This move has spurred investments in innovative filtration technologies across industries, particularly in wastewater treatment and marine conservation. The country’s strong commitment to achieving sustainability goals, including reducing plastic pollution in the Great Lakes and other water bodies, has further fueled demand for microplastic filtration solutions.

Europe holds the second-largest share in the global microplastic filtration systems market, driven by strict environmental regulations, advanced wastewater treatment infrastructure, and strong governmental initiatives to combat plastic pollution. The European Union (EU) Water Framework Directive, Marine Strategy Framework Directive, and Single-Use Plastics Directive are significantly helping the region to attain its goal for reducing microplastic contamination. Countries such as Germany, France, the UK, and the Netherlands are among the key adopters of microplastic filtration technologies, particularly in wastewater treatment and marine protection. Additionally, rising investments in research and development (R&D), coupled with increasing public awareness, have fueled innovation in filtration techniques, including membrane bioreactors and nanofiltration systems, further strengthening Europe’s position in the market.

Microplastic Filtration Systems Market – Key Players and Competitive Analysis Report

The microplastic filtration systems market is highly competitive, with a blend of established industry leaders and emerging players striving to enhance their market presence. Key companies prioritize product innovation, strategic collaborations, and investments in research & development (R&D) to advance filtration technologies and meet evolving environmental and industrial demands. However, competition remains intense as new entrants introduce advanced filtration solutions, leveraging advancements in nanofiltration, membrane technology, and AI-driven monitoring systems. While the market offers substantial growth opportunities, challenges such as stringent regulatory requirements and competition from alternative water treatment solutions push companies to continuously refine their technologies and expand their capabilities to secure a larger share in the evolving microplastic filtration sector.

CLEANR, Inc. develops advanced microplastic filtration systems, focusing on high-efficiency washing machine filters. The company’s product portfolio includes, Premium Microplastic Filter that removes over 90% of microplastics as small as 50 microns, significantly reducing microfiber pollution. Cleanr has introduced VORTX separation technology, a system that enhances filtration efficiency by over 300% compared to conventional methods. The company aims to provide scalable, high-performance solutions for microplastic reduction in wastewater. CLEANR’s technology is designed for residential and commercial applications, addressing a critical source of environmental contamination

Alpha Plan GmbH specializes in developing and manufacturing membrane-based filtration systems, including microplastic filters. The company’s product range comprises of standard and customized hollow fiber modules for ultrafiltration, microfiltration, endotoxin removal, and gas transfer applications. Alpha Plan provides contract development and production services, specializing in customized membrane filtration solutions tailored to specific applications.

List of Key Companies in Microplastic Filtration Systems Market

- Alpha Plan GmbH

- Baleena Co.

- CLEANR Inc.

- Clearly Filtered, Inc.

- CyFract

- Kind Water Systems

- Pall Corporation

- PlanetCare

- PolyGone System

- renasys

- SimPure

- Viridis

- VITALOOP

Microplastic Filtration Systems Industry Developments

March 2022: Electrolux launched a washing machine filter that captures 90% of microplastic fibers (over 45µm) from laundry, reducing ocean pollution. Made with 50% recycled plastic, it traps fibers for disposal in household waste.

February 2022: Wärtsilä and Grimaldi Group developed a scrubber-based system that filters microplastics from ship exhaust wash water, capturing particles under 10µm. Tests show ~76 particles/m³ removed. The solution integrates with existing scrubbers, requiring minimal operational changes while reducing ocean microplastic pollution.

Microplastic Filtration Systems Market Segmentation

By System Type Outlook (Revenue, USD Billion, 2020–2034)

- Membrane Filtration Systems

- Mechanical Filtration Systems

- Adsorption-Based Filtration Systems

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Waste Water Treatment

- Air Filtration

- Marine & Environmental Protection

- Research & Development

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Municipal Water Treatment Facilities

- Industrial Sector

- Consumer Goods

- Non-Governmental Organizations (NGOs)

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Microplastic Filtration Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 12.82 billion |

|

Market Size Value in 2025 |

USD 13.36 billion |

|

Revenue Forecast by 2034 |

USD 35.48 billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global microplastic filtration systems market size was valued at USD 12.82 billion in 2024 and is projected to grow to USD 35.48 billion by 2034.

The global market is projected to register a CAGR of 11.5% during the forecast period.

In 2024, North America accounted for the largest market share in 2024.

A few of the key players in the market are CLEANR Inc.; PlanetCare; Alpha Plan GmbH; PolyGone System; SimPure; Clearly Filtered, Inc.; Kind Water Systems; Pall Corporation; CyFract; Viridis; VITALOOP; renasys; and Baleena Co.

In 2024, the membrane filtration systems segment held the largest market share due to high efficiency in microplastic removal, widespread adoption in wastewater treatment, and technological advancements in filtration membranes.

By 2034, the marine & environmental protection segment is expected to witness significant market growth due to rising concerns over ocean pollution, stricter regulations on plastic waste, and increased government initiatives for marine ecosystem preservation.