Middle East Finished Lubricants Market Share, Size, Trends, & Industry Analysis Report

By Type (Metal Working Fluids, Transformer Oils, Gear Oils, Hydraulic Oils & Engine Oils), By Base Oil Source, By Grade, by Application, By End-Use: Segment Forecast, 2018 – 2026

- Published Date:Mar-2019

- Pages: 120

- Format: PDF

- Report ID: PM1599

- Base Year: 2017

- Historical Data: 2015-2016

Report Outlook

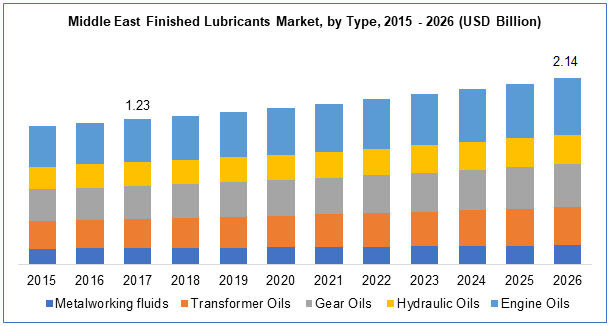

Middle East finished lubricants market size was valued at USD 1.23 billion in 2017 and is forecasted to grow at a CAGR of 6.5% from 2018 to 2026. Increase in demand of finished lubricants in the region in attributed to the growing automobile industry along with its aftermarket and the development of other end-use industries such as the mining, industrial, metal working, sectors. Moreover, the presence of the world’s largest oil & gas industry and significant development in petrochemicals and chemicals sector.

Countries in the region including Iran, Egypt, UAE, Turkey ad Lebanon are among the leading car manufacturing nations. These countries during a period of rapid industrialization and development, the sector transformed itself from an assembly-based partnership to a full-fledged manufacturing industry with even design capacity and massive productions. Hence, demand from the automotive sector in the region is significant. Moreover, aftermarket finished lubricant sales is the fastest growing retailing segment for these products.

Know more about this report: request for sample pages

The fuel marketing business/industry generally follows the economic trend of a country/region. In respect to the higher fuel prices in the region and the low crude oil prices it is anticipated that the next few years will be a time span of challenging market circumstances. The marginally healthy sales volumes of finished lubricants in 2017 can be considered as an interesting achievement for the industry participants given the challenging economic environment and a heated competition for strategic pricing among the companies operating in the local markets.

Nonetheless, the Middle East finished lubricants market business continues to emphasis on its long-term growth strategies and is expected to do so over the forecast period through maintaining its existing customer base and exploring new customer segments and wining new accounts across all of the product categories of finished lubricants. Industry participants operating in the country focus mainly on the operational excellence, innovation of novel products and portfolio expansion as the primary value propositions in order to sustain leading positions in the industry.

The finished lubricants industry in the region can be considered as a fairly unorganized market that currently comprise of merely more than 35 operating companies offering products in the local market under different brand names. The country’s fast industrialization, rapid development of infrastructure including airports, roadways, seaports, increasing fleet of vehicles that is supported by the country’s favorable demographics has led to increasing demand for the finished lubricant products.

Retailing plays the primary role for sales in Middle East finished lubricants market. The region’s OME sector has grown moderately over the past decade and has shown steady increase in financial performance over the past few years owing to stable business models of the participants and the country’s favorable market dynamics. However, the OEMs has been witnessing high volume business but lesser profit margins over the last five years.

In the present industry scenario, companies are focused on increasing their finished lubricants sales volumes in an effort to mitigate the competitive and pressure of coat escalations. Competitiveness of the lubricant industry in the region has been increasing, as the industry participants have been trying to tap the growing product demand from several end-use industries including chemical, petrochemical, aviation, automobile, oil refining and metal working.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Segment Analysis

The Middle East finished lubricants market has been divided under six primary levels i.e. including types of lubricant products, base oil source, base oil grades, viscosity grades, its applications and the end-use sectors for these products. Product segments included are metal working lubricants, gear oils, transformer oils, engine oils and hydraulic oils. Engine oil category is further segmented into several viscosity grades. These include 0W, 10W, 5W, and 15W, 25W, 20W.

The market study is categorized into several base oil categories. That include synthetic, semi- synthetic, mineral base oil and others. Different grades of base oil included are 1, 2, 3, 4 & 5. The application categories included are transformers, compressors, bearings, hydraulics, natural gas engines, heat transfer equipment, metal working, and others. End-use categories included are oil refining, automotive, metalworking, industrial, textile manufacturing, petrochemical and others.

Middle East Finished Lubricant Market Report Scope

By Product |

By Base Oil |

By Application |

By End User |

By Country |

|

|

|

|

|

Know more about this report: request for sample pages

Regional Analysis

In 2015, Saudi Arabia was the largest market in the region. The country is based on several export-oriented industries including metals, oil & gas, mining, agrochemicals, food & beverage and logistics, the Kingdom of Saudi Arabia has the largest network of industrial establishments and hence the highest output.

The country has several key advantages that makes it one of the leading automotive manufacturing hubs in the region and development of a local car manufacturing sector. The country also benefits from being a direct shipping route to the mass automotive industries in the Asia Pacific region. Owing to this, automobile production in the county is increasing yearly at a significant rate with new plant facilities coming up every year. These factors have been crucial in driving demand for finished lubricants in the country.

Competitive Landscape

Few of the leading industry participants operating in the region include Shell, Omanoil, Total, Al Maha Petroleum Products Marketing Co., Castrol, Gulf Petrochem, Total Oil and BP. Few of the leading lube distributor in the region include AAsaha International Trade. LLC, ABDUL FATAH MOHD NOOR CO. L.L.C, Advanced Oilfield Technology Company, Al Hassan Engineering Co. S.A.O.G., and Furturetech Gulf LLC.