MENA Fabry Disease Treatment Market Size, Share, & Industry Analysis Report

By Route of Administration (Intravenous Route and Oral Route), By Therapy, By Distribution Channel, and By Country – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5774

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

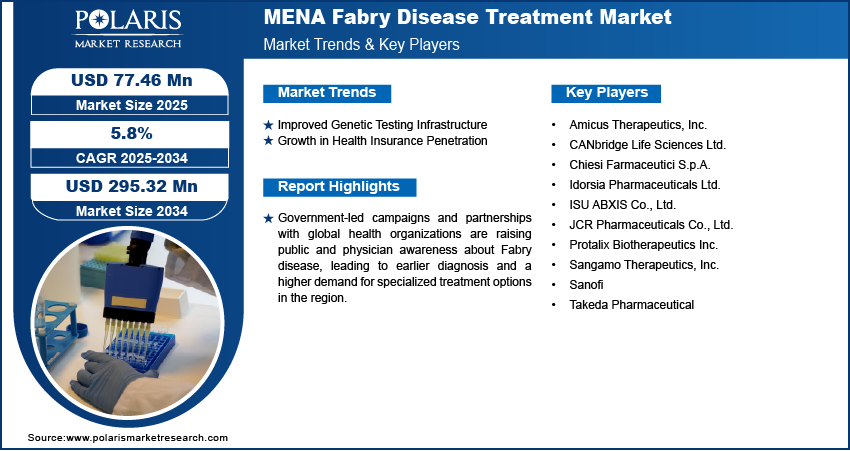

The MENA fabry disease treatment market size was valued at USD 167.76 million in 2024 and is projected to grow at a CAGR of 5.8% during 2025–2034. Government-led campaigns and partnerships with global health organizations are raising public and physician awareness about fabry disease, leading to earlier diagnosis and a higher demand for specialized treatment options in the region. For instance, the MENA Congress for Rare Diseases plays a key role in advancing educational campaigns focused on rare diseases across the Middle East. By bringing together healthcare professionals, researchers, patient advocates, and policymakers, it fosters awareness, knowledge exchange, and collaboration to improve diagnosis, treatment, and support for patients.

Fabry disease is a rare genetic disorder that affects the body's ability to break down specific fatty substances, leading to their expansion in various organs. The market for fabry disease treatment has grown in response to the need for managing and slowing the progression of this lifelong condition. The market contains therapies that target the root cause of the disease as well as those that manage its symptoms, such as enzyme replacement therapy, Chaperone Therapy, and others. These treatments aim to improve the quality of life for patients and reduce complications that arise from damage to the heart, kidneys, and nervous system. Regional hospitals and research centers are increasingly participating in global fabry disease clinical trials, accelerating local access to investigational therapies and enhancing medical expertise.

The rise of medical tourism hubs and advanced hospitals in urban centers is attracting patients seeking high-quality fabry disease care, further driving market growth in tertiary treatment services. Additionally, investments in molecular diagnostic laboratories and partnerships with international diagnostic firms are making genetic testing more accessible, allowing for precise identification of fabry mutations and personalized treatment plans, which is further fueling overall expansion.

Market Dynamics

Improved Genetic Testing Infrastructure

Investments in modern diagnostic facilities across the MENA are improving access to advanced genetic testing for rare diseases such as fabry. Many governments are prioritizing early detection by equipping hospitals and labs with the capability to perform precise gene sequencing. Collaborations between regional health authorities and global diagnostic firms help streamline technology transfer and training for local professionals. This has resulted in rapid and more accurate identification of fabry gene mutations, making it easier for clinicians to diagnose the condition at an earlier stage. Early diagnosis allows for more personalized and effective treatment strategies, which is essential for managing disease progression and improving patient outcomes in both pediatric and adult populations.

Growth in Health Insurance Penetration

Health insurance coverage is expanding across major economies in the MENA, including Saudi Arabia, the UAE, and Qatar. For instance, the General Authority for Statistics has published the 2024 Healthcare Statistics for Saudi Arabia, indicating that 100% of Saudi citizens had healthcare coverage, while the overall coverage rate for the entire population was 95.9%. Public and private insurers are increasingly offering reimbursement for high-cost treatments, such as enzyme replacement therapy used in fabry disease. This shift is making treatment more affordable and accessible for patients who previously could not bear the financial burden. Greater insurance penetration also encourages patients to seek early diagnosis and consistent follow-up, reducing long-term complications. The introduction of mandatory health coverage in some countries has further boosted access to specialized care for rare diseases, helping to support a more sustainable treatment ecosystem and better long-term disease management for fabry patients.

Regional Volume and Pricing Analysis

|

Manufacturer |

Drug Name |

Dosage (IU/vial) |

Unit Price per Vial (USD) |

Annual Dose per Patient (vials/year) |

Patients (approx.) |

Total Sales Volume (vials/year) |

|

Algeria |

Agalsidase alfa (Replagal), Generic Alpha-Gal A |

1 mg |

200–580 |

52 |

40–130 |

2,080–6,760 |

|

Iraq |

Agalsidase alfa (Replagal), Generic Alpha-Gal A |

1 mg |

220–500 |

52 |

40–60 |

2,080–3,120 |

|

Iran |

Agalsidase alfa (Replagal), Generic Alpha-Gal A |

1 mg |

350–800 |

52 |

100–200 |

5,200–10,400 |

|

Saudi Arabia |

Agalsidase alfa (Replagal), Agalsidase beta (Fabrazyme), Migalastat (Galafold) |

1–123 mg |

92–1,350 |

52–365 |

80–200 |

6,240–29,200 |

Algeria's shows high demand for Imiglucerase and generic alternatives to treat 80-180 patients annually. The 400 IU dosage requires 26 vials per patient yearly, generating total market volume of 2,080-4,680 vials. Competitive pricing at USD 500-1,350 per vial reflects generic availability, creating an accessible yet substantial therapeutic market worth millions annually.

Segment Insights

Market Assessment by Route of Administration

Based on route of administration, the segmentation includes intravenous route and oral route. In 2024, the intravenous route segment was valued at USD 110 million. The segment led the market due to the established use of enzyme replacement therapies (ERTs) that require infusion-based delivery. Hospitals and specialty clinics across the MENA are increasingly equipped to administer IV treatments, offering trained staff and controlled environments for managing infusion protocols. Patients receiving IV therapy benefit from higher treatment precision, and physicians prefer this route for consistent dosing and controlled absorption. The demand is further reinforced by physicians’ familiarity with IV-based regimens and the ongoing reliance on these protocols to manage moderate to severe fabry disease symptoms effectively.

The oral route segment is projected to register a CAGR of 6.0% from 2025 to 2034 supported by rising adoption of substrate reduction therapies and patient preference for noninvasive treatment options. Oral therapies improve convenience and adherence, especially for patients managing fabry disease over long durations. Healthcare systems in the MENA are increasingly approving oral formulations, reflecting broader regulatory acceptance and faster market entry for such therapies. Pharmaceutical firms are also working to increase the availability of oral drugs across retail and specialty channels, improving access and reducing reliance on hospital visits for therapy, which supports the growth trajectory of this segment.

Market Assessment by Therapy

Based on therapy, the segmentation includes enzyme replacement therapy (ERT), substrate reduction therapy (SRT), and others. In 2024, the enzyme replacement therapy (ERT) segment was valued at approximately USD 115 million and held the largest revenue share, driven by its status as the most established therapeutic approach for fabry disease. Physicians across the MENA continue to favor ERT due to its proven clinical efficacy in reducing disease burden and improving quality of life. Government and private payers are increasingly including ERT in reimbursement frameworks, recognizing its long-term benefits despite high upfront costs. The availability of multiple ERT formulations, including next-generation biologics with improved safety profiles, further reinforces the dominance of this segment in the treatment landscape.

The substrate reduction therapy segment is expected to register a CAGR of 6.1% from 2025 to 2034, driven by increasing clinical adoption and patient preference for oral treatment regimens. This segment offers an alternative for patients who experience infusion-related side effects or prefer to manage their treatment outside clinical settings. Regulatory agencies in the MENA are becoming more supportive of innovative treatment approaches, encouraging the entry and approval of new SRT options. Additionally, physician awareness of complementary or substitute therapy pathways is expanding, leading to more personalized treatment strategies that integrate SRT where appropriate, particularly in cases of mild or moderate disease expression.

Market Evaluation by Distribution Channel

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. In 2024, the hospital pharmacies segment was valued at approximately USD 75 million. The segment dominated the market, supported by their critical role in the administration of infusion-based therapies such as ERT. Many MENA healthcare systems centralize treatment access through hospital networks, where fabry patients are managed under close clinical supervision. This ensures proper storage, dispensing, and monitoring of high-cost biologics, which often require cold-chain logistics and specialized handling. Hospitals also remain the preferred setting for newly diagnosed patients and those requiring regular evaluations, reinforcing the dominance of this distribution channel. The integration of specialty pharmacy services into hospital systems further strengthens their position in this market.

The retail pharmacies segment is expected to register a CAGR of 6.0% from 2025 to 2034, driven by improved access to oral fabry therapies and expanding pharmacy networks in urban areas. Increasing health insurance coverage is enabling more patients to fill prescriptions outside hospital systems, particularly for maintenance therapies. Retailers are also enhancing their role in chronic disease management, including rare diseases, by offering pharmacist-led support services and medication counseling. Pharmaceutical partnerships with retail chains are streamlining drug availability, while digital tools help facilitate prescription refills and patient education, supporting consistent therapy adherence and helping retail outlets play a larger role in fabry disease care.

Country Analysis

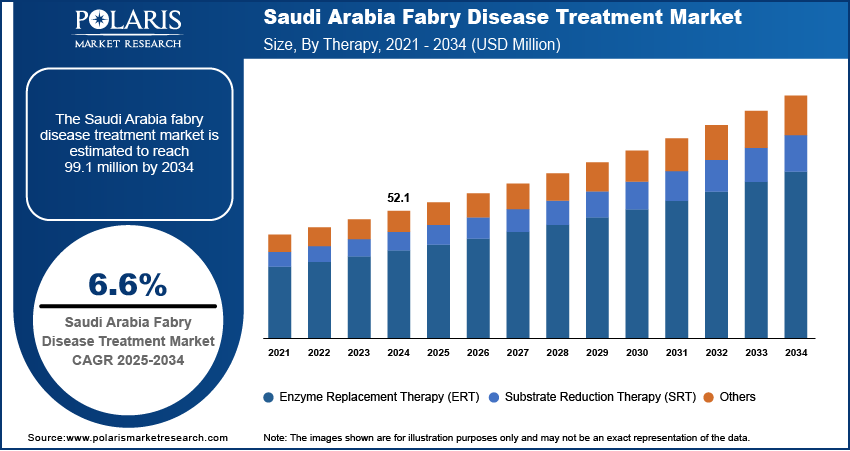

Saudi Arabia Fabry Disease Treatment Market

The Saudi Arabia fabry disease treatment market accounted for approximately 31% of the total regional revenue share in 2024, driven by the government’s strong investments in rare disease genetic testing. The country’s Vision 2030 healthcare goals are pushing for the development of precision medicine capabilities and expanded access to specialized treatments. For instance, under Vision 2030, the Saudi Arabian Government plans to invest over USD 65 billion to enhance healthcare infrastructure, privatize health services and insurance, establish 21 health clusters nationwide, and expand telehealth services for improved accessibility and efficiency. Fabry disease is being increasingly recognized by public health authorities, leading to more widespread screening programs and early diagnosis. Major hospitals in Riyadh, Jeddah, and Dammam are building capacity to manage lysosomal storage disorders and offer enzyme replacement therapies. Increased collaboration between local providers and international pharmaceutical firms is improving the availability of novel treatment options. Awareness campaigns by patient advocacy groups and better insurance coverage are also allowing more patients to initiate and continue therapy, supporting sustained market growth in the country’s rapidly modernizing healthcare ecosystem.

Egypt Fabry Disease Treatment Market

The Egypt fabry disease treatment market is projected to register a CAGR of 6.2% from 2025 to 2034. The growth is largely fueled by improved diagnostic capacity and greater public-private collaboration. Healthcare institutions in urban centers such as Cairo and Alexandria are enhancing molecular diagnostics and rare disease clinics, which help increase the detection rate of fabry disease. Multinational companies are working with Egyptian health authorities to provide access to enzyme replacement therapies and build awareness among healthcare providers. Expansion of training programs focused on lysosomal storage disorders is also supporting accurate identification and treatment planning. Additionally, efforts by nongovernmental organizations and academic research initiatives are generating local data on fabry disease prevalence and response to therapy. Government investments and programs focusing on equitable access to rare disease treatments are creating more opportunities for underserved populations to receive advanced care, making Egypt an emerging growth hub for this niche market segment. For instance, El-Said highlighted that the FY2024 plan allocates approximately USD 3.75 billion, which is approximately 4.6% of total public and private investments in healthcare development initiatives aimed at improving health services across Egypt.

Turkey Disease Treatment Market

The Turkey fabry disease treatment market was valued at approximately USD 34 million in 2024. The market in the country is driven by expanded access to specialized therapies and ongoing regulatory support for rare diseases. The country’s healthcare system is increasingly focusing on integrating orphan drug access and rare disease care into mainstream medical services. National hospitals and academic institutions in Istanbul, Ankara, and Izmir are equipping themselves to diagnose and manage lysosomal storage disorders more effectively. Policy reforms have led to a more structured approval process for high-cost biologics, including enzyme replacement therapies used in fabry disease. In addition, collaborations between domestic firms and global biotechnology players are improving drug availability and affordability. Public health education campaigns and the promotion of early screening are helping identify patients earlier, which contributes to more favorable treatment outcomes. Insurance coverage for rare disease management is gradually expanding, further encouraging patient adherence and boosting the market’s value.

Key Players & Competitive Analysis Report

The competitive landscape of the MENA fabry disease treatment market is shaped by targeted industry analysis, increased product launches, and strong market expansion strategies. Leading players are forming strategic alliances with regional healthcare providers and leveraging joint ventures to strengthen their distribution capabilities across key countries. Technological advancements such as digital health platforms and remote patient monitoring tools are gaining traction, enhancing treatment adherence and outcome tracking. Post-merger integration efforts have also improved efficiency in local operations, enhancing access to fabry-specific therapeutics. Regulatory frameworks across MENA are evolving to accommodate accelerated approval pathways for orphan drugs, allowing multinational firms to introduce novel therapies more rapidly. Mergers and acquisitions among regional biotech companies are enhancing research capacity and expanding therapeutic pipelines. Stakeholders are also capitalizing on health insurance reforms and public-private initiatives to build a sustainable ecosystem for rare disease management. This dynamic competitive environment is fostering rapid development of treatment access, patient support services, and personalized care models.

List of Key Companies with Approved Drugs

- Chiesi Farmaceutici S.p.A.

- JCR Pharmaceuticals Co., Ltd.

- Protalix BioTherapeutics Inc.

- Sanofi

- Takeda Pharmaceutical

List of Companies with Drugs Under Clinical Trial Phase

- Amicus Therapeutics, Inc.

- Idorsia Pharmaceuticals Ltd.

- Idorsia Pharmaceuticals Ltd.

- ISU ABXIS Co., Ltd.

- Sangamo Therapeutics, Inc.

MENA Fabry Disease Treatment Industry Developments

In January 2024, Abdul Latif Jameel Health acquired a majority stake in Genpharm, a partner specializing in rare diseases with market access in the Middle East, North Africa, and Turkey, thereby strengthening its position in delivering specialized therapies in these regions.

In August 2023, the Abu Dhabi Health Services Company, a division of PureHealth, collaborated with Sanofi aimed at improving diagnostic precision and efficiency in rare diseases. This partnership specifically targets the acceleration of screening protocols for lysosomal storage disorders (LSDs), with the objective of minimizing the average diagnostic timeline for patients affected by rare diseases.

In January 2022, Genpharm and Amicus partnered to commercialize Migalastat in the Gulf Cooperation Council. European Medicines Agency approved Galafold (123 mg capsules), Migalastat, which is indicated for patients aged 12 and above with a confirmed diagnosis of fabry disease.

MENA Fabry Disease Treatment Market Segmentation

By Route of Administration Outlook (Revenue USD Million, 2020–2034)

- Intravenous Route

- Oral Route

By Therapy Outlook (Revenue USD Million, 2020–2034)

- Enzyme Replacement Therapy (ERT)

- Substrate Reduction Therapy (SRT)

- Others

By Distribution Channel Outlook (Revenue USD Million, 2020–2034)

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Country Outlook (Revenue USD Million, 2020–2034)

- Saudi Arabia

- Turkey

- Iran

- Egypt

- Algeria

- Morocco

- Iraq

- Libya

- Rest of MENA

MENA Fabry Disease Treatment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 167.76 million |

|

Market Size in 2025 |

USD 77.46 million |

|

Revenue Forecast by 2034 |

USD 295.32 million |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The MENA market size was valued at USD 167.76 million in 2024 and is projected to grow to USD 295.32 million by 2034.

The MENA market is projected to register a CAGR of 5.8% during the forecast period.

The Saudi Arabia Fabry disease treatment market accounts for approximately 31% of the total regional revenue share, driven by the government strong investments in rare disease care.

A few of the key players are Amicus Therapeutics, Inc.; CANbridge Life Sciences Ltd.; Chiesi Farmaceutici S.p.A.; Idorsia Pharmaceuticals Ltd.; ISU ABXIS Co., Ltd.; JCR Pharmaceuticals Co., Ltd.; Protalix Biotherapeutics Inc.; Sangamo Therapeutics, Inc.; Sanofi; and Takeda Pharmaceutical.

In 2024, the intravenous route segment was valued at USD 110 million. The segment dominated the market revenue share due to the established use of enzyme replacement therapies (ERTs) that require infusion-based delivery.

In 2024, the enzyme replacement therapy (ERT) segment was valued at approximately USD 115 million. The segment led the revenue share, driven by its status as the most established therapeutic approach for Fabry disease.