Migraine Drugs Market Share, Size, Trends, Industry Analysis Report

By Product Type (Acute/Abortive Treatment, Preventive/Prophylactic Treatment); By Therapeutic Class; By Route of Administration; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 118

- Format: PDF

- Report ID: PM1391

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

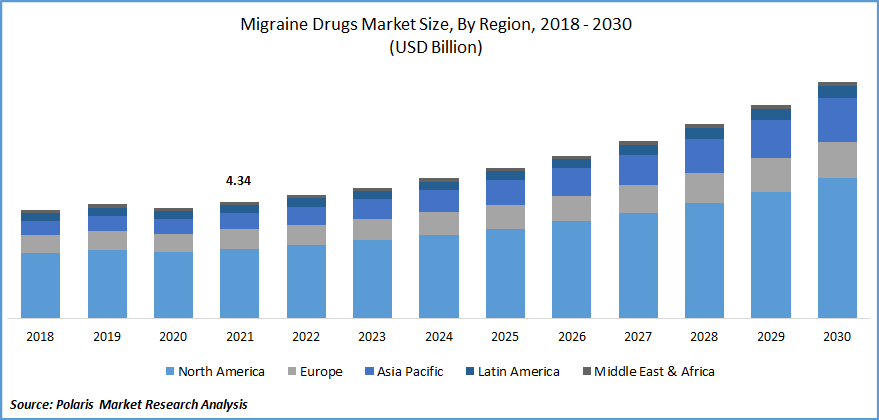

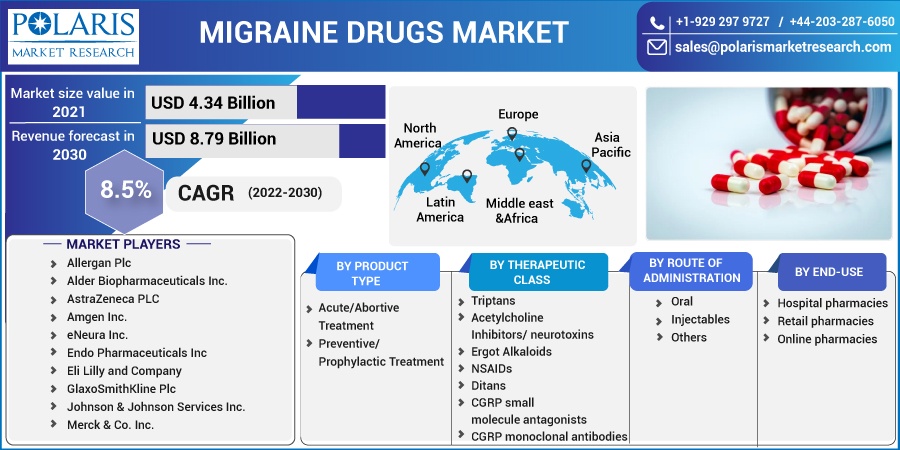

The global migraine drugs market was valued at USD 4.34 billion in 2021 and is expected to grow at a CAGR of 8.5% during the forecast period. One of the primary factors driving the growth of the market is the rise in migraine prevalence around the world. The increase in R&D in pharmaceutical companies for improving various types of migraine drugs, as well as the tentative approval of pipeline candidates, is accelerating the migraine drugs market expansion.

Know more about this report: Request for sample pages

Increased patient awareness about migraine prevention and treatment, as well as increased manufacturer collaboration, all have an impact on the migraine drugs market. Furthermore, increased awareness, increased healthcare expenditure, technological advancement, and an increase in the number of research projects all have a beneficial impact on the migraine drugs industry.

Migraine is a neurological medical disease in which the sufferer experiences throbbing and violent headaches. Associated symptoms may include vomiting, stiffness, nausea, and difficulty speaking. Migraines are also considered to be genetically connected and can affect people of various ages.

External causes such as stress, alcohol, hormone changes, and dietary allergies can all cause a pounding headache. Migraines are frequently self-limiting. However, in extreme situations, drugs such as nonsteroidal anti-inflammatory drugs, analgesics, and antipsychotics, among others, are required.

The rising prevalence of sedentary lifestyles has predisposed the younger generation to migraines. This tendency is expected to have a beneficial impact on the migraine drugs market growth in the future years. Migraine is typically diagnosed through an examination of the patient's past medical history and complaints, as well as blood tests, magnetic resonance imaging (MRI), and computed tomography (CT) scans. Over-the-counter (OTC) medications and prescription injections are already available to ease symptoms and lessen the frequency and intensity of migraine attacks.

The emergence of growth potential in emerging markets is projected to open up new doors for major companies. However, there is little awareness of migraine, and a lack of knowledge about adequate migraine treatment in developing countries is expected to stymie market expansion. The side effects associated with migraine drugs are a factor impeding the migraine drugs market growth.

The neurologic signs of COVID-19 suggest that the virus may have entered the nervous system by the olfactory groove or the circulation. There is compelling evidence that COVID-19 mortality is linked to cardiac and pulmonary illnesses. Furthermore, migraine increases the burden of vascular illnesses, putting migraine sufferers at a larger risk of poor COVID-19 results.

Acute COVID-19 symptoms such as fever, sleep disruption, and dehydration may precipitate a migraine attack. COVID-19 headaches were characterized as pulsing, pressing, or penetrating in quality, were mostly bilateral, lasted longer, were resistant to analgesia, and were more common in men. This makes migraine sufferers particularly sensitive to the pandemic's chronic and indirect consequences, such as poor mood, post-viral tiredness, anxiety, and depression.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The rising government regulations for migraine drugs, increased adoption of innovative drugs classes, and increasing FDA approvals are the major factors driving the market growth over the forecast period. For instance, in September 2021, QULIPTATM (atogepant) was approved by the US FDA for the prevention of episodic migraine in adults, according to AbbVie. QULIPTA is the first and sole oral calcitonin gene-related peptide (CGRP) receptor antagonist (gepant) designed exclusively for migraine prevention.

Further, in February 2020, Lundbeck announced that VYEPTI (eptinezumab-jjmr) was approved by the US FDA for the prevention of migraine in adults. The suggested dose is 100 mg every three months. VYEPTI is the first FDA-approved intravenous (IV) medication for migraine prophylaxis. VYEPTI's safety and effectiveness have been shown in two phases III clinical trials.

Further, in October 2019, the FDA authorized Eli Lilly and Company's migraine medication, Reyvow. In adults, the medication has been licensed to treat acute migraine accompanied or without aura, a sensory phenomenon, or visual disturbance. The majority of presently offered drugs are licensed for the acute version of the illness, with generic triptans serving as the first-line treatment. With the launch of CGRP-based drugs and the acceptance of novel medication classes, including ditans, gepants, and triptan reformulation for both persistent and episodic migraine, the market is witnessing a transition in terms of significant R&D.

Report Segmentation

The market is primarily segmented based on product type, therapeutic class, end-use, route of administration, and region.

|

By Product Type |

By Therapeutic Class |

By Route of Administration |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The CGRP Therapies Segment is Expected to Witness Fastest Growth

CGRP migraine treatment is a novel method of preventing and treating migraine discomfort. These drugs inhibit a protein known as calcitonin gene-related peptide (CGRP). In migraine sufferers, CGRP may trigger inflammation and discomfort in the neurological system. CGRP migraine drugs are also known as anti-CGRP, CGRP inhibitors, and CGRP antagonists.

If an individual suffers from chronic migraine, they may experience severe headache pain and other signs for 15 days or more each month. CGRP migraine medication may assist in avoiding and reducing the severity of migraine attacks.

Further, in April 2019, Teva Pharmaceutical Industries Ltd. stated that the European Commission (EC) had approved AJOVY (fremanezumab) 225 mg solutions for injection in which was before syringing for migraine prophylaxis in people with at least four migraine days each month. AJOVY is a humanized monoclonal antibody (mAb) that attaches to the CGRP receptor and prevents it from interacting with the receptor. Thus, the launches of CGRP-based therapies for migraine treatment are boosting the market growth over the forecast period.

Acute/Abortive Treatment Segment Industry Accounted For the Highest Market Share in 2021

Triptans, NSAIDs, and other non-specific drugs provided over-the-counter (OTC), such as aspirin, ibuprofen, and acetaminophen, are examples of acute treatment. The treatment classes are differentiated by the manner of administration, with drugs available in oral, injection, nasal spray, and other forms.

Precautionary treatment includes the use of off-label and generic drugs such as beta-blockers like atenolol and propranolol, as well as anti-epileptics like topiramate and divalproex sodium. All migraine patients require acute treatment, regardless of whether they are simultaneously receiving prophylactic treatments. Furthermore, acute therapies are employed in conjunction with preventive therapy.

In June 2021, Rimegepant (Nurtec ODT) was initially licensed by the FDA for acute use to manage an existing migraine. On May 27, the FDA extended its approval for use in migraine prevention. Significant migraine medication firms are performing research and development of innovative acute therapies, and it is projected that major treatments launched will enhance the market throughout the forecast period.

The Demand in North America is Expected to Witness Significant Growth

The region is dependent on factors such as significant companies' choice to introduce the product in the region, increased access to prescription and over-the-counter pharmaceuticals, and a developed healthcare system, among others. North America is expected to maintain its position for the length of the prediction.

Furthermore, the Americas' healthcare infrastructure is being built, which helps to market growth. Furthermore, large pharmaceutical companies with headquarters in the United States contribute to the development of the migraine drugs market in the Americas.

Europe, on the other hand, is expected to have the second-largest market share. This is due to factors such as advantageous reimbursement regulations and non-government supportive services that help raise knowledge about migraine and its drugs treatment choices.

Meanwhile, there is a lack of understanding about migraine treatment alternatives in Asia Pacific countries. Lower awareness about the severity of migraine illness is expected to be a limiting factor in the region's market progress. Increasing disposable income in nations such as India and China, on the other hand, may encourage market expansion in the coming years.

Competitive Insight

Some of the major players operating in the global market include Allergan Plc, Alder Biopharmaceuticals Inc., AstraZeneca PLC, Amgen Inc., eNeura Inc., Endo Pharmaceuticals Inc Eli Lilly and Company, GlaxoSmithKline Plc, Johnson & Johnson Services Inc., Merck & Co. Inc., Pfizer Inc., and Teva Pharmaceutical Industries Ltd

Recent Developments

- In February 2022, Biohaven Pharmaceutical and Pfizer revealed favorable top-line findings from an Asia-Pacific Phase 3 clinical investigation of rimegepant to treat migraine.

Migraine Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.34 billion |

|

Revenue forecast in 2030 |

USD 8.79 billion |

|

CAGR |

8.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Product Type, By Therapeutic Class, By Route of Administration, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Allergan Plc, Alder Biopharmaceuticals Inc., AstraZeneca PLC, Amgen Inc., eNeura Inc., Endo Pharmaceuticals Inc Eli Lilly and Company, GlaxoSmithKline Plc, Johnson & Johnson Services Inc., Merck & Co. Inc., Pfizer Inc., and Teva Pharmaceutical Industries Ltd |