Molecular Diagnostics For Sexually Transmitted Diseases Market Size, Share, Trends, & Industry Analysis Report

By Product (Instruments & Services, Consumables, and Software), By Application, By Technology, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 123

- Format: PDF

- Report ID: PM5807

- Base Year: 2024

- Historical Data: 2020-2023

Molecular Diagnostics for STDs Market Overview

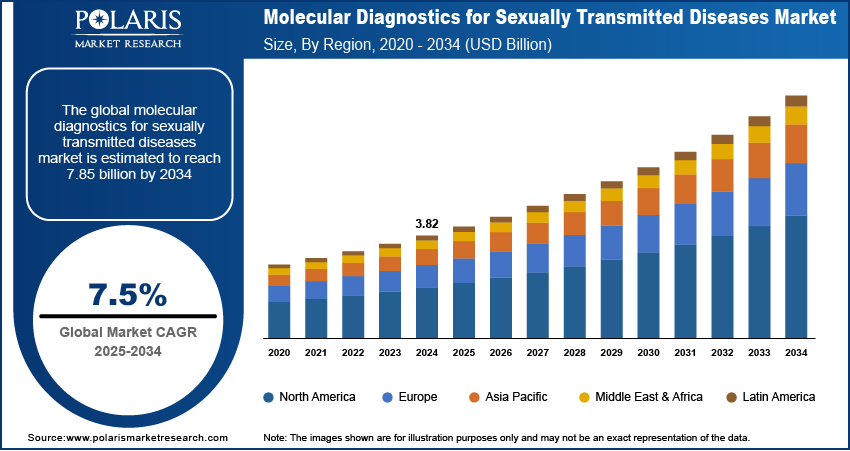

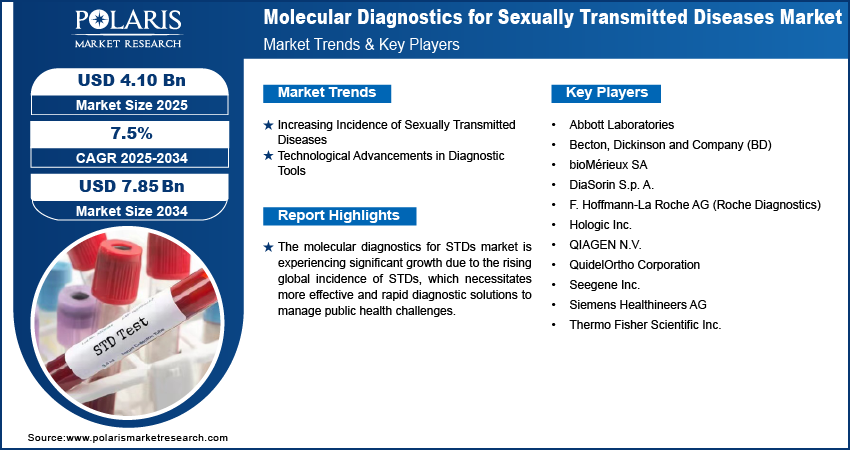

The global molecular diagnostics for sexually transmitted diseases (STDs) market size was valued at USD 3.82 billion in 2024, and is anticipated to register a CAGR of 7.5% from 2025 to 2034. The increasing number of STD cases worldwide and continuous advancements in diagnostic technologies, such as PCR and nucleic acid amplification tests (NAATs), are improving testing accuracy and speed.

Molecular diagnostics for sexually transmitted diseases (STDs) refers to advanced laboratory methods that identify specific genetic material of pathogens causing STDs. These highly accurate tests can detect infections even before antibodies are formed, allowing for earlier diagnosis and treatment.

One major driver for the molecular diagnostics for STDs industry is the increasing number of STD cases around the world. The rising cases of infections such as chlamydia, gonorrhea, and syphilis create a greater demand for effective diagnostic tools to control their spread. This growing burden highlights the ongoing need for accurate and timely testing solutions.

Another important driver is the continuous development of advanced diagnostic technologies. Molecular diagnostic methods offer high sensitivity and specificity, such as polymerase chain reaction (PCR) and nucleic acid amplification tests (NAATs). These advancements lead to faster and more reliable detection of various STDs, encouraging their wider adoption in healthcare settings. For example, the Centers for Disease Control and Prevention (CDC) often reports on the rising cases of STDs, underscoring the need for advanced diagnostic capabilities to address this public health challenge. Additionally, government initiatives, such as India's National AIDS and STD Control Programme (NACP), aim to boost testing and early detection, further driving the demand for molecular diagnostic solutions.

Industry Dynamics

Increasing Incidence of Sexually Transmitted Diseases

The rising number of sexually transmitted disease (STD) cases globally is driving the demand for accurate and quick diagnostic methods, such as HIV diagnosis, to prevent further spread and manage public health effectively. This growing disease burden pressures healthcare systems to adopt advanced diagnostic tools, including molecular diagnostics tools.

The World Health Organization (WHO) reported in its "Sexually Transmitted Infections (STIs)" fact sheet, updated in 2025, that over 1 million curable STIs are reported daily worldwide among people aged 15–49 years. The report also estimated 374 million new infections in 2020, with 1 of 4 curable STIs: chlamydia (129 million), gonorrhea (82 million), syphilis (7.1 million), and trichomoniasis (156 million). Additionally, the Centers for Disease Control and Prevention (CDC) stated in their "National Overview of STIs in 2023" that over 2.4 million cases of syphilis, gonorrhea, and chlamydia were diagnosed and reported in 2023 in the US. These high and increasing numbers of infections clearly show the strong demand for effective diagnostic solutions, thus driving the demand for molecular diagnostics for STDs.

Technological Advancements in Diagnostic Tools

Technological advancements in molecular diagnostics lead to more sensitive, specific, and faster diagnostic tests, making them more attractive in clinical settings. The development of new platforms and assays continues to improve the efficiency and accessibility of STD diagnostics. A study titled "Syndromic approaches for sexually transmitted infections: added value of molecular diagnosis," published in PubMed in 2025, highlights that molecular diagnostics, especially PCR-based methods, offer significant benefits, including better detection rates and the ability to test for multiple infections at once. Such technological progress enables earlier and more comprehensive diagnosis, leading to better treatment and patient outcomes, thereby fueling the expansion of the molecular diagnostics for sexually transmitted diseases market.

Segmental Insights

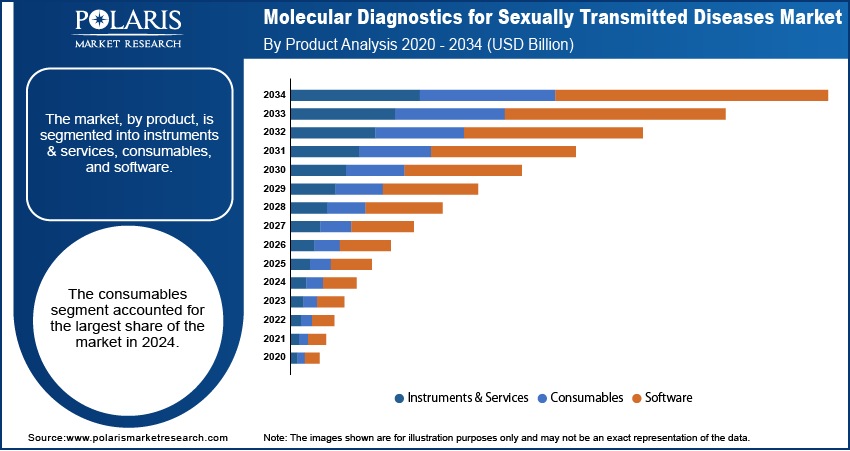

By Product

The consumables segment, which includes reagents and kits, held the largest share in 2024. This dominance is attributed to the fact that these items are single-use and required for every test. As the volume of STD testing increases due to rising incidence rates and awareness campaigns, the demand for these essential components grows proportionally. That reagents and kits comprise a significant portion of the product landscape, driven by their critical role in ensuring accurate and repeatable diagnostic procedures across various molecular testing platforms.

The instruments & services segment is anticipated to grow at the highest growth rate during the forecast period. This is largely attributed to the ongoing introduction of advanced, automated molecular diagnostic platforms that offer higher throughput and improved efficiency. Healthcare facilities are increasingly investing in sophisticated instruments that can process many samples quickly and accurately, improving laboratory workflow and reducing turnaround times. The adoption of fully automated systems that can perform multiple tests simultaneously is expanding, contributing to the rapid development of this segment.

By Application

The CT/NG testing segment held the largest share in 2024. These two infections namely chlamydia trachomatis (CT), and neisseria gonorrhoeae (NG)are among the most common STDs worldwide, affecting millions of individuals annually. The high prevalence drives a consistent and significant demand for diagnostic solutions. Public health initiatives and widespread screening programs for chlamydia and gonorrhea also contribute to the extensive use of molecular tests for these applications.

The human papillomavirus (HPV) testing segment is anticipated to register the highest growth rate during the forecast period. This growth is largely attributed to increased awareness about the link between HPV and cervical cancer, along with the rising adoption of HPV testing as a primary screening method. There is a growing emphasis on early detection and prevention of cervical cancer, which is often caused by high-risk HPV types. As a result, more countries and healthcare guidelines are recommending HPV testing for routine screening.

By Technology

The laboratory testing segment held the largest share in 2024. This dominance is primarily attributed to the established infrastructure of centralized laboratories, which are equipped with high-throughput instruments capable of processing a large volume of samples with high accuracy and precision. These facilities also benefit from skilled personnel and rigorous quality control measures, ensuring reliable results. The ability to perform various molecular tests, including complex multiplex assays, contributes to laboratory testing's continued widespread use and leading position in the market.

The point-of-care (POC) testing segment is anticipated to grow at the highest growth rate during the forecast period. This surge is driven by the increasing demand for rapid results, ease of use, and accessibility, particularly in remote areas or settings where immediate treatment decisions are critical. POC tests offer the advantage of providing results quickly, often within the same patient visit, which helps reduce loss to follow-up and enables immediate initiation of treatment. This shift toward decentralized testing solutions that can be performed outside traditional laboratory settings rapidly expands the reach and adoption of molecular diagnostics for STDs.

Regional Analysis

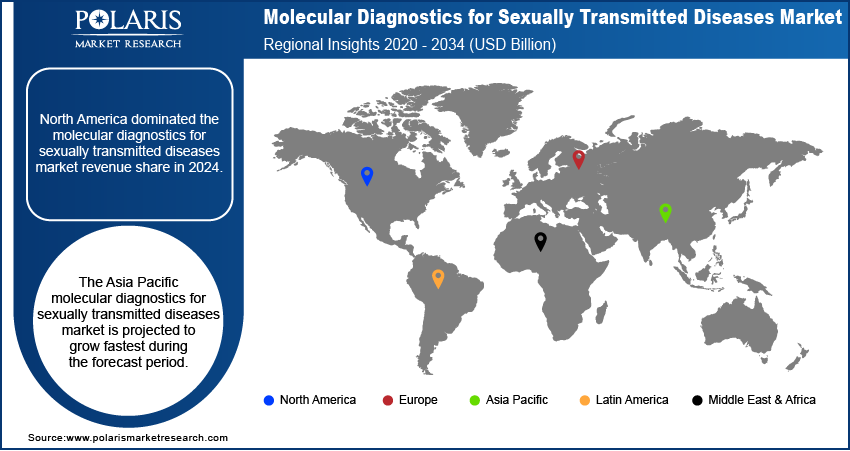

The North America molecular diagnostics for sexually transmitted diseases market held the largest share across the globe in 2024, driven by its advanced healthcare infrastructure, high awareness regarding sexual health, and substantial healthcare spending. The region benefits from the early adoption of advanced diagnostic technologies and a strong presence of key industry players. Public health initiatives and government support for STD prevention and control programs further contribute to the demand for molecular diagnostic tests across the region. The increasing prevalence of various STDs also fuels the need for accurate and timely diagnosis.

US Molecular Diagnostics for Sexually Transmitted Diseases Market Insight

The US is a leading country in the North America market, due to a high incidence of STDs, robust research and development activities, and favorable reimbursement policies for diagnostic tests. The presence of major diagnostic companies and continuous innovation in testing platforms support the widespread availability and adoption of advanced molecular diagnostic solutions. Moreover, public health organizations' focus on early detection and prevention strategies significantly contributes to the market's strong performance in the US.

Europe Molecular Diagnostics for Sexually Transmitted Diseases Market

Europe represents a substantial market for molecular diagnostics for STDs, characterized by well-established healthcare systems, increasing awareness about sexual health, and government efforts to reduce STD prevalence. The region has seen the adoption of advanced molecular testing platforms, including point-of-care diagnostics, which offer faster results and improved patient management. Regulatory frameworks in Europe also support developing and commercializing new diagnostic technologies, further driving market growth across the region. The Germany molecular diagnostics for sexually transmitted diseases market contributes to a major revenue share in Europe. The country benefits from a highly developed healthcare system, a strong focus on research and innovation, and a growing emphasis on preventive medicine. German healthcare providers are increasingly integrating molecular diagnostic tests into routine clinical practice, driven by their accuracy and efficiency in detecting STDs. Furthermore, the rising awareness among the population and sustained public health initiatives contribute to the robust demand for these diagnostic solutions in Germany.

Asia Pacific Molecular Diagnostics For Sexually Transmitted Diseases Market Overview

The Asia Pacific molecular diagnostics for STD market is anticipated to grow at the highest growth rate during the forecast period. This growth is attributed to improving healthcare infrastructure, increasing healthcare spending, and a large patient population susceptible to STDs. Rising awareness regarding sexual health, coupled with government initiatives to control the spread of infections, is driving the adoption of molecular diagnostic tests. Countries within this region also see an expansion of diagnostic capabilities and an increasing emphasis on early disease detection and management. In Asia Pacific, the China molecular diagnostics for sexually transmitted diseases market holds a significant share. The country's vast population, coupled with a rising incidence of STDs, creates a substantial demand for diagnostic testing. The Chinese government's focus on enhancing healthcare access and promoting public health awareness campaigns is a key factor driving the adoption of molecular diagnostics. Furthermore, increasing investments in healthcare infrastructure and a growing number of local manufacturers contributing to developing affordable and accessible diagnostic solutions are propelling the market expansion in China.

Key Players and Competitive Insights

The competitive landscape of the molecular diagnostics for sexually transmitted diseases (STDs) market is dynamic and characterized by intense competition among several established companies and emerging players. Companies constantly focus on developing innovative and more efficient diagnostic solutions, especially in multiplex testing and point-of-care diagnostics. Collaborations, product launches, and geographical expansions are common strategies these players use to strengthen their presence and gain a larger share. The drive for faster, more accurate, and accessible testing methods shapes the competitive strategies within this field.

A few prominent companies in the industry include Abbott Laboratories; F. Hoffmann-La Roche AG (Roche Diagnostics); bioMérieux SA; QIAGEN N.V.; Hologic Inc.; Becton, Dickinson and Company (BD); Siemens Healthineers AG; DiaSorin S.p.A.; Thermo Fisher Scientific Inc.; QuidelOrtho Corporation; and Seegene Inc.

Molecular Diagnostics for STDs Market Key Players

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- bioMérieux SA

- DiaSorin S.p. A.

- F. Hoffmann-La Roche AG (Roche Diagnostics)

- Hologic Inc.

- QIAGEN N.V.

- QuidelOrtho Corporation

- Seegene Inc.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Industry Developments

February 2025: bioMérieux announced the launch of GENE-UP TYPER, a real-time PCR diagnostic solution. This solution includes both a test and a web application for the rapid characterization of microorganism strains, indicating an advancement in their molecular biology offerings.

January 2025: bioMérieux announced its acquisition of SpinChip Diagnostics ASA, a privately held Norwegian diagnostics company. This acquisition is significant as SpinChip Diagnostics has developed an innovative immunoassay diagnostics platform, which will strengthen bioMérieux's portfolio and capabilities in the diagnostics space.

Molecular Diagnostics for Sexually Transmitted Diseases Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Instruments & Services

- Consumables

- Software

By Application Outlook (Revenue – USD Billion, 2020–2034)

- CT/NG Testing

- Syphilis Testing

- Gonorrhea Testing

- HSV Testing

- HPV Testing

- HIV Testing

- Trichomonas

- Ureaplasma + Mycoplasma

- Others

By Technology Outlook (Revenue – USD Billion, 2020–2034)

- Laboratory Testing

- Commercial/Private Labs

- Public Health Labs

- PoC Testing

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Molecular Diagnostics for Sexually Transmitted Diseases Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.82 billion |

|

Market Size in 2025 |

USD 4.10 billion |

|

Revenue Forecast by 2034 |

USD 7.85 billion |

|

CAGR |

7.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization per your requirements concerning countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.82 billion in 2024 and is projected to grow to USD 7.85 billion by 2034.

The global market is projected to register a CAGR of 7.5% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Abbott Laboratories; F. Hoffmann-La Roche AG (Roche Diagnostics); bioMérieux SA; QIAGEN N.V.; Hologic Inc.; Becton, Dickinson and Company (BD); Siemens Healthineers AG; DiaSorin S.p.A.; Thermo Fisher Scientific Inc.; QuidelOrtho Corporation; and Seegene Inc.

The consumables segment accounted for the largest share of the market in 2024.

The instruments & services segment is expected to grow fastest during the forecast period.