Molecular Imaging Market Size, Share, Trends, Industry Analysis Report

: By Modality, By Application, By End Use (Hospitals, Diagnostics Imaging Centers, and Research Institutes), and Region– Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5682

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

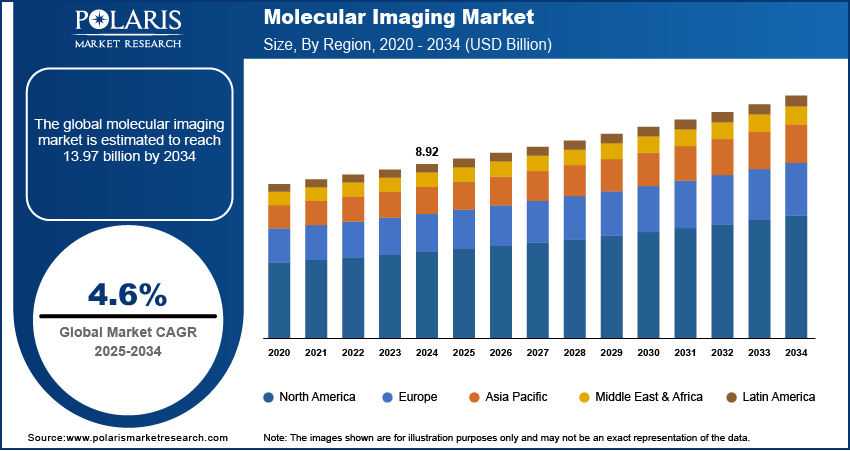

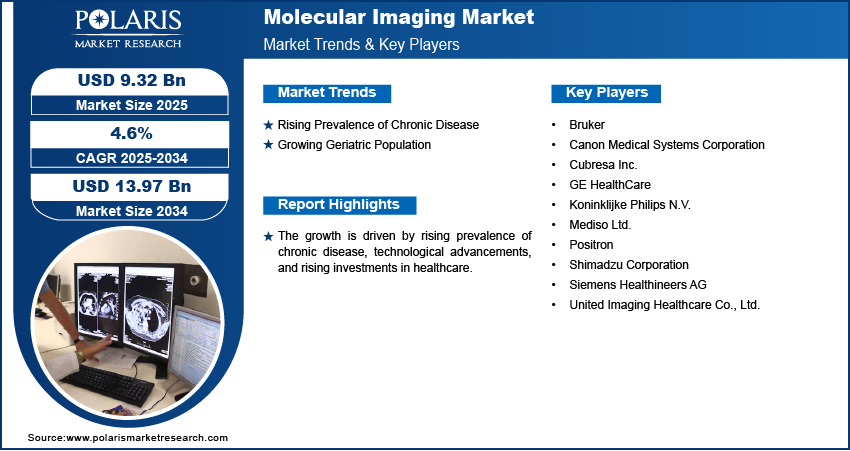

The global molecular imaging market size was valued at USD 8.92 billion in 2024 and is projected to exhibit a CAGR of 4.6% during 2025–2034. The growth is driven by rising prevalence of chronic disease, technological advancements, and rising investments in healthcare.

Molecular imaging is a biomedical technique that allows visualization, characterization, and measurement of biological processes at the molecular and cellular levels in living organisms. It combines imaging technologies (such as PET-CT Scanner Device, MRI, or fluorescence) with molecular probes to detect specific targets, enabling early disease detection and monitoring of treatment response.

The rising demand for personalized medicine is driving the need for molecular imaging. Personalized medicine focuses on treating patients based on their unique genetic and molecular makeup rather than using a one-size-fits-all approach. Molecular imaging is used in this field to demonstrate how a person’s specific disease behaves and responds to different treatments. For example, it helps identify which cancer therapy is most likely to work for a particular patient. Doctors need better tools to guide their decisions as healthcare moves toward more personalized care, making molecular imaging an important part of this shift.

To Understand More About this Research: Request a Free Sample Report

Recent improvements in imaging technology have made molecular imaging more effective and accessible. Advanced machines such as hybrid PET/MRI scanners provide clearer images and more information at once, reducing the need for multiple tests. At the same time, developers are creating better imaging agents that target specific disease markers, making it easier to detect illnesses at an early stage. These innovations are making molecular imaging faster, more accurate, and more reliable. More healthcare providers are likely to invest in these tools as technology continues to evolve, boosting the demand for molecular imaging.

Market Dynamics

Rising Prevalence of Chronic Disease

Chronic diseases such as cancer, heart problems, and neurological conditions are increasing globally. According to the American Cancer Society, the number of cancer patients in the US alone was 2,001,140 in 2024. These illnesses need early and accurate diagnosis to manage effectively. Molecular imaging helps doctors to demonstrate how diseases behave at the molecular level, often before physical symptoms appear. These rising cases of chronic diseases are pushing hospitals, clinics, and researchers to adopt molecular imaging devices more widely, thereby driving molecular imaging demand.

Growing Geriatric Population

The world’s population is aging, with more people aged more than 65 years. According to the Euro Stat, the number of people aged 65 years and above was 449.3 million in 2024. Older adults are more likely to suffer from chronic conditions such as Alzheimer’s disease, cancer, and heart problems. These diseases need advanced diagnostic tools for accurate monitoring and treatment planning. The need for healthcare services that include molecular imaging increases as the number of older adults increases, thereby driving the demand for molecular imaging techniques.

Segment Analysis

Molecular Imaging Market Assessment by Application

The cardiovascular segment is expected to witness significant growth during the forecast period due to the rising global burden of heart-related diseases and the increasing need for early and accurate diagnosis. According to the American Heart Association, heart disease in the US is expected to affect at least 60% of adults by 2050. Molecular imaging allows doctors to assess blood flow, detect heart damage, and evaluate the effectiveness of treatments at a molecular level. Healthcare providers are turning more to molecular imaging for managing cardiovascular conditions effectively as awareness about heart health is growing and new imaging agents are being developed, thereby driving segmental growth.

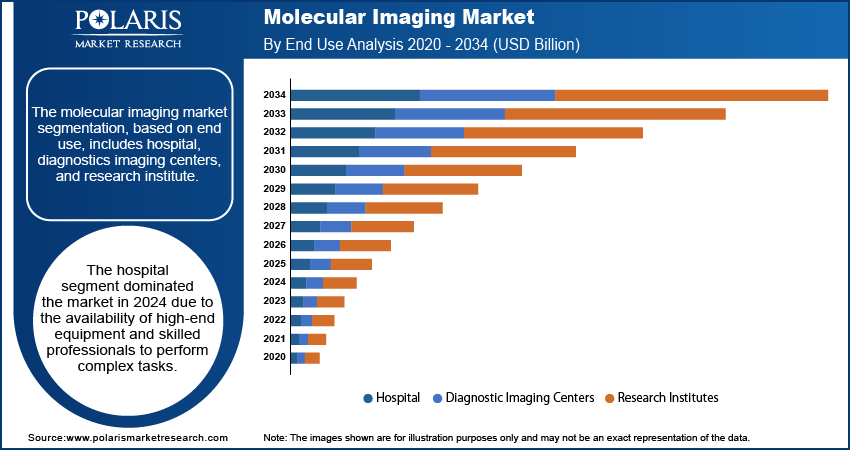

Molecular Imaging Market Evaluation by End Use

The hospital segment dominated in 2024 due to the widespread availability of advanced imaging equipment and skilled professionals in these settings. Hospitals serve as primary points for diagnosis and treatment, making them major users of molecular imaging technologies for conditions such as cancer, heart disease, and neurological disorders. Their ability to invest in high-end equipment and integrate imaging into patient care workflows gives them a strong advantage, driving segmental dominance.

Regional Analysis

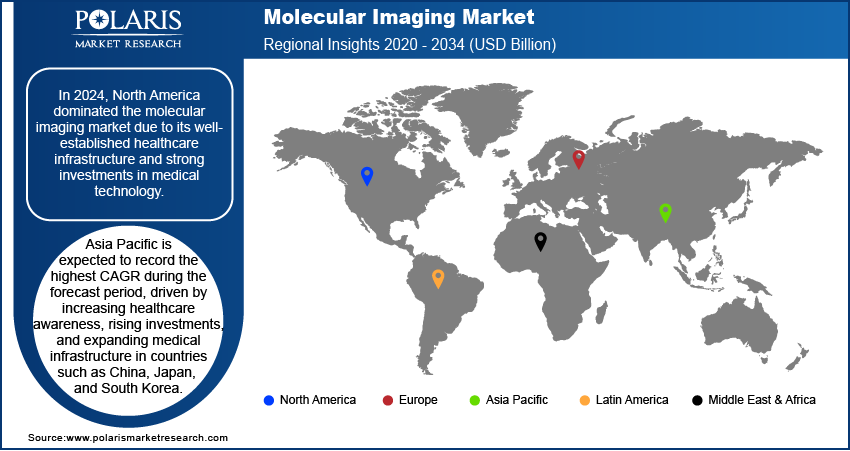

By region, the study provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its well-established healthcare infrastructure and strong investments in medical technology. The US leads the region with widespread use of advanced imaging systems, a high rate of chronic diseases, and significant government and private funding for research. Additionally, the presence of major industry players such as Bruker and GE and the rapid adoption of new imaging techniques drive the demand for molecular imaging. Additionally, ongoing advancements in personalized and hyper-personalized medicine and early disease detection further boost demand in the region.

The Asia Pacific molecular imaging market is expected to record the highest CAGR during the forecast period, driven by increasing healthcare awareness, rising investments, expanding medical infrastructure, and high medical per capita expenditure, supported by high disposable income and a comprehensive insurance system. According to the World Economic Forum, Japan has a universal health insurance system that covers 30% of medical expenses. Additionally, the need for accurate diagnostic tools is rising as the region is facing a growing number of cancer and cardiovascular cases. Governments are supporting healthcare modernization and research, which is helping to introduce advanced imaging technologies, thereby driving the Asia Pacific market.

The India molecular imaging market is experiencing substantial growth due to rapidly developing healthcare sector and increasing burden of chronic diseases such as cancer and heart disorders. According to the India Brand Equity Foundation, as of 202,4 healthcare sector is the largest employer in India, with 7.5 million people employed in the sector. Urban hospitals and diagnostic centers are adopting advanced imaging technologies to improve early diagnosis and treatment planning. Government initiatives to improve healthcare infrastructure and support for medical research are further fueling the demand for molecular imaging techniques, thereby propelling the growth of market.

Key Players and Competitive Analysis

The opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new regions.

New companies are impacting the industry by introducing innovative products to meet the demand from end users. This competitive trend is amplified by continuous progress in product offerings. A few major players include Bruker; Canon Medical Systems Corporation; Cubresa Inc.; GE HealthCare; Koninklijke Philips N.V.; Mediso Ltd.; Positron; Shimadzu Corporation; Siemens Healthineers AG; and United Imaging Healthcare Co., Ltd.

Siemens Healthineers AG is a medical technology company headquartered in Erlangen, Germany, and operates as a subsidiary of Siemens AG. The company provides healthcare solutions and services across more than 70 countries. Its operations are divided into four main segments: Imaging, Diagnostics, Cancer Care Technologies (including Varian), and Advanced Therapies. The Imaging segment produces diagnostic equipment such as magnetic resonance imaging (MRI), computed tomography (CT) scanner, X-ray, molecular imaging, and ultrasound systems, which are used for disease detection and diagnosis. The Diagnostics segment focuses on in-vitro diagnostic products and services, including laboratory and point-of-care testing systems, supporting clinical laboratories with instruments, reagents, and software solutions. The Cancer Care Technologies segment, bolstered by the acquisition of Varian, offers radiotherapy equipment and digital oncology solutions for cancer treatment. The Advanced Therapies segment provides equipment for minimally invasive, image-guided treatments, including angiography systems, mobile C-arms, and hybrid operating rooms used in interventional radiology and surgery. Additionally, Siemens Healthineers offers healthcare IT, managed services, and consulting aimed at improving operational processes in healthcare facilities. The company’s operations span multiple regions, including Europe, the Americas, the Middle East, Africa, and Asia Pacific. Within Asia Pacific, China is treated as a separate region due to its significant market size and growth. Siemens Healthineers serves a wide range of customers, such as hospitals, clinics, laboratories, and public health institutions. The company employs ∼72,000 people globally. Its product and service offerings are designed to support healthcare providers in diagnostics, treatment, and operational management. Siemens Healthineers offers molecular imaging solutions, including advanced PET/CT and PET/MRI systems, designed for disease detection, therapy planning, and personalized cancer care, supporting clinical decision-making and innovative approaches such as theranostics in healthcare institutions.

Koninklijke Philips N.V., commonly known as Philips, operates in various industries, including healthcare technology, consumer electronics, and lighting. Philips provides medical equipment, software, and services in healthcare, including imaging systems, patient monitoring systems, and clinical informatics solutions. Philips produces various products in consumer electronics, including televisions, audio equipment, and personal care products. The company also offers in the lighting industry, providing energy-efficient lighting solutions for homes, businesses, and public spaces. Philips home appliances cover various categories, including kitchen appliances, personal care devices, and household equipment. Philips offers air fryers, blenders, food processors, coffee makers, juicers, toasters, and electric kettles in the kitchen appliances segment. These appliances are designed to provide convenience, efficiency, and ease of use in the kitchen, catering to diverse cooking and beverage preparation needs. In the personal care category, Philips offers a diverse range of products like electric toothbrushes, shavers, hair dryers, hair straighteners, grooming kits, and skincare devices. The company also offers home appliances like air purifiers, vacuum cleaners, and garment care devices. These appliances are designed to create a clean and healthy living environment, ensuring fresh air quality and efficient maintenance of household items. Philips offers a range of computed tomography (CT) systems featuring AI-enabled tools, advanced imaging software, and multi-energy technology, designed to improve diagnostic accuracy, workflow efficiency, and cost-effectiveness for healthcare providers, including refurbished options for sustainability.

Key Companies

- Bruker

- Canon Medical Systems Corporation

- Cubresa Inc.

- GE HealthCare

- Koninklijke Philips N.V.

- Mediso Ltd.

- Positron

- Shimadzu Corporation

- Siemens Healthineers AG

- United Imaging Healthcare Co., Ltd.

Molecular Imaging Industry Developments

In December 2024, GE HealthCare acquired the Nihon Medi-Physics from Sumitomo Chemical, gaining full ownership to strengthen its molecular imaging capabilities and expand radiopharmaceutical development for neurology, cardiology, oncology, and theranostics across Asia and globally.

In June 2024, Siemens Healthineers received FDA clearance for its Biograph Trinion PET/CT scanner, launching a high-performance, energy-efficient system designed to meet clinical needs in oncology, cardiology, theranostics, and neurology, with advanced imaging, AI-driven workflow, and low operational costs.

Molecular Imaging Market Segmentation

By Modality Outlook (Revenue USD Billion, 2020–2034)

- Molecular Ultrasound Imaging

- Positron Emission Tomography (PET)

- Single Photon Emission Computed Tomography (SPECT)

- Nuclear Magnetic Resonance (NMR) Spectrometer

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Cardiovascular

- Neurology

- Oncology

- Respiratory

- Gastrointestinal

By End Use Outlook (Revenue USD Billion, 2020–2034)

- Hospitals

- Diagnostic Imaging Centers

- Research Institutes

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Molecular Imaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 8.92 billion |

|

Market Size Value in 2025 |

USD 9.32 billion |

|

Revenue Forecast in 2034 |

USD 13.97 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The size was valued at USD 8.92 billion in 2024 and is projected to grow to USD 13.97 billion by 2034.

The market is projected to register a CAGR of 4.6% during the forecast period.

North America held the largest share in 2024.

A few key players are Bruker; Canon Medical Systems Corporation; Cubresa Inc.; GE HealthCare; Koninklijke Philips N.V.; Mediso Ltd.; Positron; Shimadzu Corporation; Siemens Healthineers AG; and United Imaging Healthcare Co., Ltd.

The hospital segment dominated the market in 2024 due to the availability of high-end equipment and skilled professionals to perform complex task.

The cardiovascular segment is expected to witness significant growth during the forecast period due to the rising prevalence of cardiovascular disease worldwide.