Mushroom Market Size, Share, Trends, Industry Analysis Report

: By Product (Button, Shiitake, Oyster, Matsutake, Truffles, and Others), By Form, By Application, By Distribution Channel, and By Region – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM1953

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

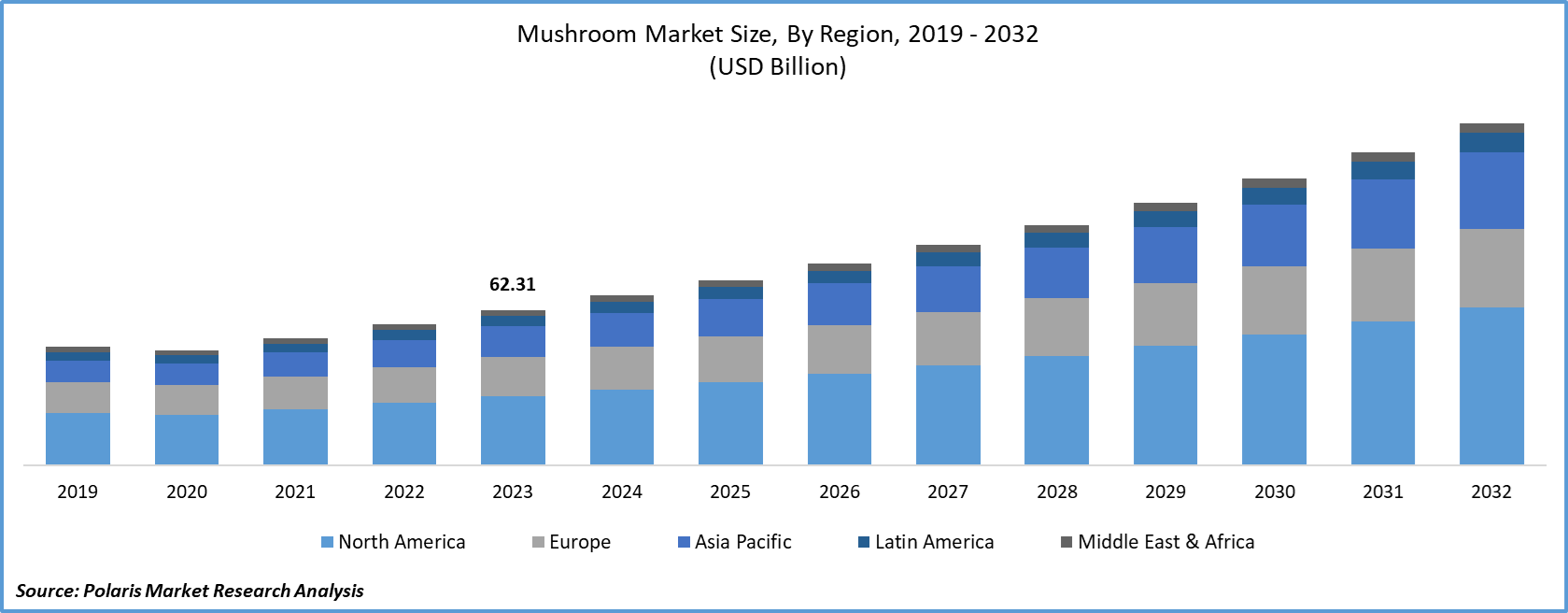

Mushroom market size was valued at USD 65.60 billion in 2024. It is projected to grow from USD 71.76 billion in 2025 to USD 163.47 billion by 2034, exhibiting a CAGR of 9.6% during 2025-2034.

Mushrooms are umbrella-shaped fungi that are rich in vitamins and minerals, including vitamin D, vitamin B, selenium, copper, potassium, and black phosphorus. They are considered a high-nutrient food with low fat and calorie content and a great source of important nutrients. It also contains antioxidants such as ergothioneine and glutathione, which help protect cells from damage caused by free radicals. Mushrooms are also a good source of dietary fiber, which helps improve digestion and promote feelings of fullness among people.

The rising vegan population globally is propelling the mushroom market growth. Mushrooms offer a meaty texture and umami flavor, making them a popular substitute in vegan dishes such as burgers, stir-fries, and stews. Many vegans prioritize nutrient-dense foods, and mushrooms provide essential vitamins, minerals, and protein, further increasing their appeal. Restaurants are also incorporating mushrooms into vegan products to cater to the growing vegan population globally. According to data published by the World Population Review, India has the highest percentage of vegans at 9% of the population and is projected to increase in the future. Moreover, food companies are also responding to this growing vegan population by developing mushroom-based products, which is leading to an expansion of the market.

To Understand More About this Research:Request a Free Sample Report

The mushroom market demand is driven by the rising popularity of online food & grocery stores. These online stores often offer a greater variety of mushroom types, including exotic and specialty varieties, which attracts curious shoppers and food enthusiasts. Subscription services and meal kits delivered through these stores frequently include mushrooms as a key ingredient, introducing them to new customers. Additionally, online food & grocery stores use targeted promotions and recipe suggestions to highlight mushrooms, encouraging more purchases. The convenience of home delivery linked with these online stores ensures that even busy consumers incorporate mushrooms into their meals, further driving demand. Therefore, as the popularity of online food & grocery stores expands in emerging nations and remote locations, the demand for mushrooms surges.

Market Dynamics

Growing Urbanization Globally

Urban lifestyles often prioritize quick and healthy meals, and mushrooms fit this demand due to their versatility, short cooking time, and high nutritional value. The high presence of supermarkets, hypermarkets, and online grocery platforms in urban areas makes mushrooms more accessible for growing urban population, driving their adoption. According to the World Bank, the urban population is expected to more than double by 2050. Additionally, urban consumers tend to be more health-conscious and environmentally aware, driving interest in plant-based proteins like mushrooms as alternatives to meat. Restaurants and fast-food chains in urban areas frequently feature mushroom-based dishes to cater to evolving dietary trends, further increasing their consumption. Hence, as urban populations grow, the demand for mushrooms as a staple also expands.

Rising Awareness Regarding Health and Wellness

Mushrooms are low in calories yet rich in essential nutrients such as vitamin D, B vitamins, antioxidants, and immune-boosting compounds, making them a powerhouse for health-conscious consumers. Many individuals prioritize functional foods that support immunity, gut health, and overall well-being, and mushrooms, particularly varieties including shiitake, reishi, and lion’s mane, fit this trend due to their proven anti-inflammatory and cognitive-enhancing properties. Fitness enthusiasts also favor mushrooms for their high fiber and protein content, which aids in satiety and muscle recovery. Additionally, the growing popularity of plant-based and clean-eating diets positions mushrooms as a versatile, whole-food alternative to processed ingredients. Therefore, as awareness regarding health and wellness increases among people, the demand for mushrooms surges.

Market Segmentation

Market Evaluation by Product

Based on product, the market is divided into button, shiitake, oyster, matsutake, truffles, and others. The button segment dominated the mushroom market share in 2024 due to its widespread availability, affordability, and high consumer acceptance across both developed and emerging economies. Its mild flavor, ease of incorporation into a wide range of cuisines, and longer shelf life compared to other types made it the preferred choice for households, restaurants, and food processing industries. The growth of the processed food sector further boosted demand for button mushrooms, as they are frequently used in canned, frozen, and ready-to-eat meals. Additionally, its consistent production yields and relatively low cultivation costs contributed to its dominance, making it a staple in large-scale commercial farming operations.

The shiitake segment is expected to grow at a robust pace in the coming years, driven by increasing consumer awareness of its nutritional and medicinal benefits. Rich in umami flavor and bioactive compounds, shiitake is increasingly favored in functional food and nutraceutical applications. The growing demand for plant-based diets and natural immune boosters has elevated their popularity, particularly in North America and Europe. Furthermore, advancements in cultivation technology, including the production of sawdust blocks and vertical farming, have improved yield efficiency and year-round availability. These factors, combined with the expansion of distribution networks and inclusion in gourmet and health-conscious recipes, position it as a key segment in the market.

Market Insight by Form

In terms of form, the market is segmented into fresh and processed products. The fresh segment dominated the market share in 2024 due to rising demand for unprocessed, natural food products. Consumers increasingly prioritized clean-label and minimally processed ingredients, which elevated the appeal of fresh produce mushrooms. Retail chains and supermarkets expanded their offerings of organic and locally sourced varieties, making fresh options more accessible to a broader customer base. The surge in home cooking trends, particularly following the pandemic, also played a key role in driving sales of fresh-produced mushrooms. Restaurants and food service providers favored fresh supply for its superior taste, texture, and nutritional value, which enhanced the quality of their culinary offerings. Additionally, improvements in cold chain logistics and packaging extended shelf life of mushrooms, reduced spoilage, and supported broader distribution networks.

Regional Outlook

By region, the mushroom market report provides insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major market share in 2024 due to strong domestic consumption, well-established cultivation practices, and the cultural significance of fungi in regional diets. China dominated this region, accounting for the highest production and consumption volumes. The country’s extensive agricultural infrastructure, favorable climate conditions, and government support for commercial farming created a robust supply chain of mushrooms. Consumers in China, Japan, South Korea, and other Southeast Asian nations incorporate mushrooms into daily meals due to their health benefits, versatility, and affordability. Additionally, the presence of major exporters and a growing focus on sustainable farming techniques contributed to the region’s dominance.

The market in Europe is expected to grow at a robust pace in the coming years, driven by rising health consciousness, increased demand for plant-based foods, and advancements in organic farming. Countries such as the Netherlands and Poland are leading the market with high-yield indoor cultivation systems and export-oriented production models. Germany, however, stands out as the regional leader due to its strong consumer preference for fresh and organic produce, as well as its well-developed retail infrastructure. The European market is also benefiting from policy support that encourages sustainable agriculture and innovation in functional food products. Europe is poised to become a significant consumer of mushrooms in the coming years as awareness of nutritional and medicinal properties of edible fungi grows.

Key Players & Competitive Analysis Report

The global mushroom market is highly competitive, with key players leveraging mergers, acquisitions, product portfolio expansions, partnerships, and collaborations to strengthen their market position. Major companies such as Monterey Mushrooms, Inc., Bonduelle Group, and Costa Group have pursued strategic acquisitions to expand their production capabilities and geographic reach. Product portfolio diversification remains a critical strategy, as companies introducing organic, exotic, and value-added mushroom products to meet the rising consumer demand for healthy and sustainable foods. Partnerships and collaborations are also shaping the competitive landscape. For instance, Smaller Farms partnered with retailers such as Walmart and Kroger to improve distribution networks. Additionally, research collaborations between agri-tech firms and mushroom producers are driving innovation in cultivation techniques, such as AI-driven farming and sustainable packaging solutions.

The market is fragmented, with numerous global and regional market players present. Major players in the market are Bonduelle Group; CMP Mushroom; Costa Group; Drinkwater Mushrooms; Greenyard; Monaghan Group; Monterey Mushroom, Inc.; OKECHAMP S.A.; and The Mushroom Company.

The Mushroom Company, based in Cambridge, Maryland, is North America's largest processor of commercially grown mushrooms, with a legacy dating back to 1931. The company specializes in delivering mushrooms harvested at the peak of freshness, ensuring superior flavor, texture, and color that rival freshly picked mushrooms. The company’s product range is extensive, including canned, refrigerated, frozen, roasted, organic, kosher, seasoned, enrobed, and sauced mushrooms, catering to diverse manufacturing processes and recipe requirements. The Mushroom Company also produces specialty mushrooms such as portabella, crimini, shiitake, and oyster varieties, along with organic and kosher-certified products.

Drinkwater Mushrooms Ltd. is a distinguished, family-run business based in rural north Lancashire, England, with a heritage that stretches back to its founding in 1969 by Ken and Barbara Drinkwater. The company has established itself as a leading supplier of high-quality mushrooms to major UK supermarkets, specializing in both white and chestnut mushrooms. Drinkwater Mushrooms operates from Hampson Farm near Lancaster, where it combines traditional expertise with modern sustainable practices. The company’s reputation for reliability and excellence has enabled it to maintain long-standing relationships with leading retailers, ensuring that fresh, locally grown mushrooms reach consumers across the UK.

List of Key Companies

- Bonduelle Group

- CMP Mushroom

- Costa Group

- Drinkwater Mushrooms Ltd.

- Greenyard

- Monaghan Group

- Monterey Mushroom, Inc.

- Maverick and Farmer

- OKECHAMP S.A

- The Mushroom Company

Mushroom Market Developments

March 2025: Maverick and Farmer, a Bengaluru-based artisanal coffee brand, created new infusion technology for mushroom coffee.

October 2021: Big Mountain Foods, a Vancouver-based food producer, partnered with Sprouts Farmers Market, a key player in gut-healthy foods, to launch its Lion’s Mane mushroom products across North America.

Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020-2034)

- Button

- Shiitake

- Oyster

- Matsutake

- Truffles

- Others

By Form Outlook (Revenue, USD Billion, 2020-2034)

- Fresh

- Processed

By Application Outlook (Revenue, USD Billion, 2020-2034)

- Food

- Pharmaceuticals

- Cosmetics

By Distribution Channel Outlook (Revenue, USD Billion, 2020-2034)

- Direct to Customer

- Grocery Stores

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Stores

By Regional Outlook (Revenue, USD Billion, 2020-2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Mushroom Market Report Scope

|

Report Attributes |

Details |

|

Market Value in 2024 |

USD 65.60 Billion |

|

Market Forecast in 2025 |

USD 71.76 Billion |

|

Revenue Forecast in 2034 |

USD 163.47 Billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 65.60 billion in 2024 and is projected to grow to USD 163.47 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

Asia Pacific had the largest share in 2024.

Some of the key players are Bonduelle Group; CMP Mushroom; Costa Group; Drinkwater Mushrooms; Greenyard; Monaghan Group; Monterey Mushroom, Inc.; OKECHAMP S.A.; and The Mushroom Company.

The fresh segment dominated the market in 2024.

The shiitake segment is expected to grow at the fastest pace in the coming years.