Neurovascular Devices Market Size, Share, Trends, & Industry Analysis Report

By Device Type, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6315

- Base Year: 2024

- Historical Data: 2020-2023

Overview

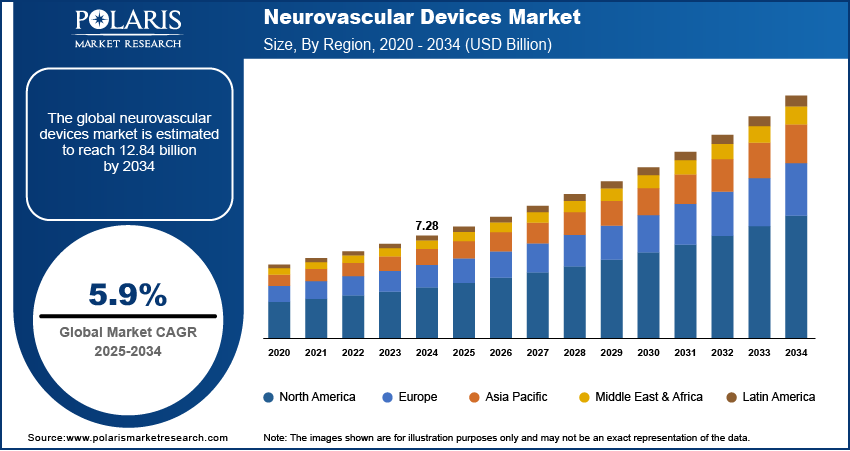

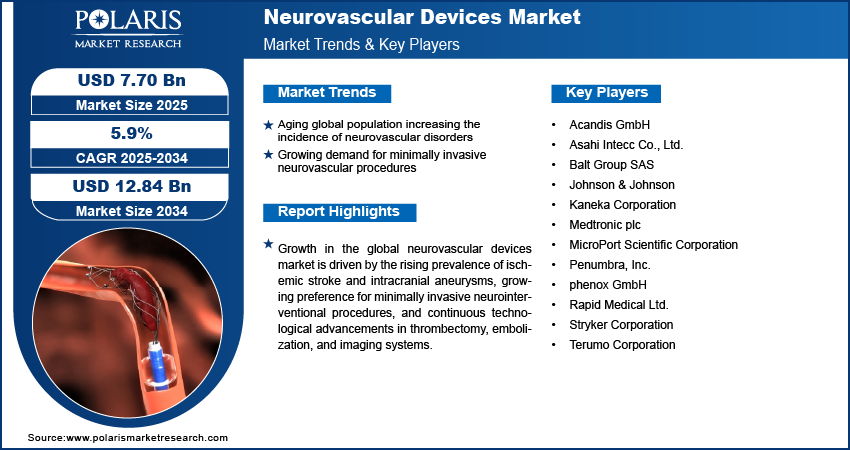

The global neurovascular devices market size was valued at USD 7.28 billion in 2024, growing at a CAGR of 5.9% from 2025–2034. The aging global population is contributing to a higher incidence of neurovascular disorders and driving greater demand for minimally invasive neurovascular procedures.

Key Insights

- The embolization devices segment dominated the global neurovascular devices market share in 2024, fueled by their extensive use in aneurysm occlusion and arteriovenous malformation treatment.

- The neurothrombectomy devices segment is projected to grow at the fastest CAGR, driven by increasing adoption of mechanical thrombectomy procedures for acute ischemic stroke management.

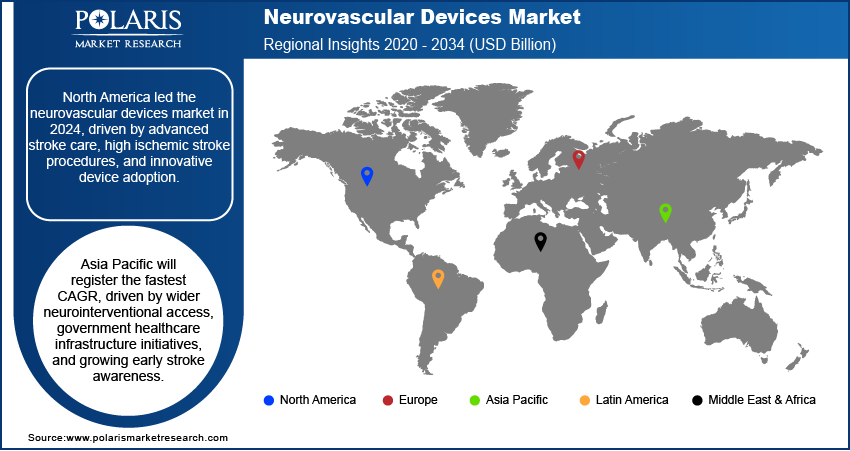

- The North America neurovascular devices market dominated the global share in 2024, driven by comprehensive stroke care infrastructure and favorable reimbursement for advanced interventional procedures.

- The U.S. neurovascular devices market accounted for the largest regional share of North America in 2024, driven by the high prevalence of ischemic stroke and strong adoption of next-generation devices in hospitals.

- The Asia Pacific neurovascular devices market is projected to grow at the fastest CAGR during the forecast period, fueled by government healthcare infrastructure development and rising awareness of early stroke intervention.

- The China neurovascular devices market is expanding rapidly, fueled by growing stroke incidence among the aging population and faster adoption of minimally invasive neurovascular procedures across tertiary hospitals.

Industry Dynamics

- Rising prevalence of ischemic stroke, intracranial aneurysms, and other neurovascular disorders is driving the demand for advanced devices to improve treatment efficiency and patient outcomes.

- Growing preference for minimally invasive neurovascular procedures is increasing the use of mechanical thrombectomy devices, flow diverters, and embolic coils in hospitals and specialized centers.

- The integration of AI-assisted imaging and robotic navigation systems creates opportunity for the industry to improve accuracy and efficiency in neurovascular procedures.

- High costs of advanced devices and limited availability of skilled neurointerventional specialists is hindering the market adoption.

Market Statistics

- 2024 Market Size: USD 7.28 Billion

- 2034 Projected Market Size: USD 12.84 Billion

- CAGR (2025–2034): 5.9%

- North America: Largest Market Share

Neurovascular devices are medical tools designed to diagnose and treat conditions that affect the brain’s blood vessels, including ischemic stroke, intracranial aneurysms, arteriovenous malformations and stenosis. The product range includes stent retrievers, aspiration catheters, flow diverters, balloon catheters, guidewires, and embolic coils. These devices are fueled by imaging and navigation systems that enable accurate placement and control during complex neurovascular procedures. Their use in minimally invasive interventions allows targeted treatment with faster recovery compared to open surgical methods.

In stroke management, mechanical thrombectomy devices are used to remove clots and restore blood flow to the brain, which helps improve patient outcomes when performed within the treatment window. Moreover, the flow diverters redirect blood away from aneurysms to support vessel wall healing, while embolic coils are applied for aneurysm occlusion to prevent rupture and reduce related complications. The adoption of such devices is growing as clinical preference shifts toward less invasive treatment options that maintain effectiveness and reduce recovery time.

The neurovascular devices industry is expanding due to the rising prevalence of stroke and other vascular conditions of the brain. As an example, in July 2025, Imperative Care received FDA clearance for its Zoom 7X catheter to treat acute ischemic stroke. The device features a pre-shaped tip to improve navigation and clot removal. Greater awareness of early intervention, improvements in healthcare infrastructure, and favorable reimbursement policies in developed markets are driving market demand. Furthermore, the emerging markets are contributing to industry growth through rising investments in advanced medical technologies. Whereas, the rapid innovation in device design and procedure techniques is expected to enhance treatment precision, safety and accessibility over the coming years.

Drivers & Opportunities

Aging Global Population Increasing the Incidence of Neurovascular Disorders: The rise in the global elderly population is leading to a higher incidence of neurovascular disorders, including ischemic stroke, intracranial aneurysms, and arteriovenous malformations. According to the WHO, the share of people aged 60 and above in the South-East Asia Region is projected to rise from 12.2% in 2024 to 22.9% by 2050. Age-related physiological changes, such as reduced vascular elasticity and increasing atherosclerosis risk, contribute to the growing disease burden. This trend is driving demand for effective diagnostic and therapeutic solutions. Healthcare systems are focusing on early detection and intervention to reduce morbidity and mortality among older patients. As the aging demographic expands worldwide, the need for advanced neurovascular devices is expected to increase, supporting sustained industry growth over the coming years.

Growing Demand for Minimally Invasive Neurovascular Procedures: The shift toward minimally invasive surgery is accelerating as healthcare providers and patients seek safer treatment options with shorter recovery times. Lancet Neurology reported that in 2021, over 3 billion people worldwide were living with a neurological condition. According to the WHO 2024 report, more than 80% of neurological deaths and health loss occur in low- and middle-income countries, where access to care is limited and high-income countries have up to 70 times more neurological specialists per 100,000 people. These procedures, which include mechanical thrombectomy, aneurysm coiling, and flow diversion, reduce surgical trauma and hospital stay while maintaining high treatment efficacy. Advancements in device design, imaging integration, and navigation systems are enabling greater precision in complex interventions. Hospitals and specialized centers are rapidly adopting such techniques to improve patient outcomes and optimize resource utilization. Rising awareness of their clinical benefits, coupled with favorable reimbursement in developed markets, is further fueling demand for neurovascular devices globally.

Segmental Insights

Device Type Analysis

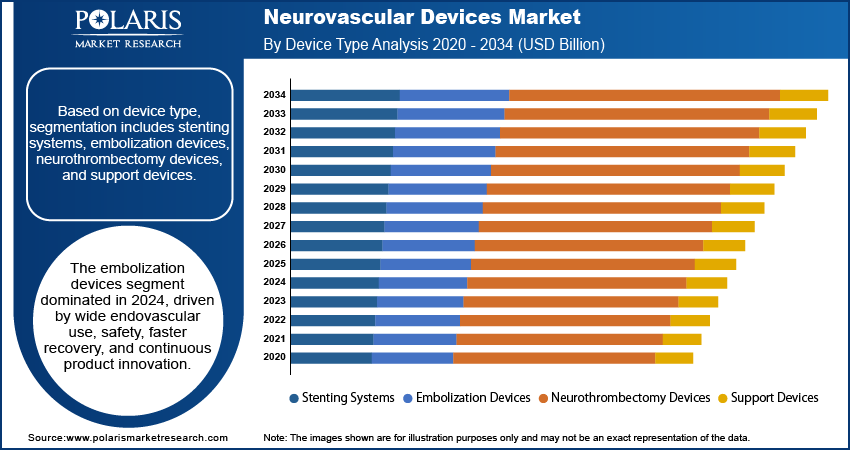

Based on device type, the segmentation includes stenting systems, embolization devices, neurothrombectomy devices, and support devices. The embolization devices segment dominated the market in 2024, driven by their widespread use in aneurysm occlusion and arteriovenous malformation treatment. These devices, including coils and liquid embolics, effectively block abnormal blood flow, reducing the risk of rupture and associated complications. The segment’s dominance is fueled by their minimally invasive nature, which allows for precise deployment and faster patient recovery. Rising awareness of early intervention in neurovascular disorders is expected to sustain this segment’s strong market position.

The neurothrombectomy devices segment is projected to grow at the fastest CAGR during the forecast period, due to increasing use in acute ischemic stroke management. These devices, such as stent retrievers and aspiration catheters, restore blood flow by mechanically removing clots within the treatment window, significantly improving patient outcomes. This growth is further driven by updated clinical guidelines recommending mechanical thrombectomy as the standard of care for eligible patients. Expanding stroke care infrastructure and greater availability of comprehensive stroke centers are fueling rapid adoption.

Application Analysis

Based on application, the segmentation includes cerebral aneurysms, ischemic stroke, and other application. The ischemic stroke segment dominated the market in 2024, driven by the high global prevalence of stroke cases requiring urgent intervention. Mechanical thrombectomy and aspiration techniques have become standard treatment approaches, reducing disability and improving survival rates. Hospitals and stroke centers are rapidly equipped with specialized teams and devices to manage such emergencies effectively. Rising supportive reimbursement policies in developed markets and growing patient awareness of early treatment benefits are further contributing to the strong demand for neurovascular devices in ischemic stroke management.

The cerebral aneurysms segment is projected to grow at the fastest CAGR during the forecast period, due to the rising adoption of flow diverters and embolic coils for aneurysm treatment. In July 2025, Q’Apel Medical received FDA clearance for its Zebra Neurovascular Access System, now preparing for a full U.S. launch in 6 Fr and 7 Fr sizes. The catheter’s innovative laser-cut striped design offers enhanced flexibility and support for navigating complex neurovascular anatomy. Minimally invasive endovascular techniques is growing preference over open surgical clipping, as they offer shorter recovery times and reduced complication risks. Moreover, the increasing availability of advanced imaging systems is enabling early detection, leading to timely intervention. Additionally, the expanding access to neurointerventional procedures in emerging economies is expected to drive further segment growth.

End User Analysis

Based on end user, the segmentation includes hospitals, specialty clinics, and other end user. The hospitals segment dominated the market in 2024, driven by the presence of advanced infrastructure and specialized neurointerventional teams. Hospitals handle the majority of emergency neurovascular cases, including ischemic stroke and aneurysm ruptures, requiring immediate access to advanced devices. Integration of diagnostic imaging, catheterization labs, and surgical facilities in one location supports efficient patient management. The segment’s dominance is driven by strong referral networks and availability of trained specialists.

The specialty clinics segment is projected to grow at the fastest CAGR during the forecast period, due to increasing demand for focused and personalized neurovascular care. These clinics offer dedicated treatment for conditions such as aneurysms, arteriovenous malformations, and stroke rehabilitation, providing shorter wait times and more individualized attention. Moreover, technological advancements in portable imaging and minimally invasive devices are enabling complex procedures to be performed outside traditional hospital settings. Rising patient preference for specialized centers, coupled with expanding healthcare investments is expected to boost adoption of advanced neurovascular devices in specialty clinics over the coming years.

Regional Analysis

North America neurovascular devices market dominated the global market in 2024. This is due to the strong presence of comprehensive stroke centers and highly advanced healthcare infrastructure across the US and Canada. Moreover, increasing adoption of next-generation clot retrieval devices, flow diverters, and embolization systems, driven by favorable reimbursement frameworks, is driving a higher volume of neurovascular procedures. The region benefits from a well-established network of specialized medical professionals and access to continuous device innovation, ensuring sustained market leadership over the forecast period.

The U.S. Neurovascular Devices Market Insight

The U.S. held a largest market share in the North America neurovascular devices landscape in 2024, fueled by the high prevalence of ischemic stroke cases that require urgent, device-based interventions. According to the U.S. Centers for Disease Control and Prevention (CDC), stroke caused 1 in 6 deaths from cardiovascular disease in 2022. The stroke death rate declined from 39.5 per 100,000 in 2022 to 39.0 in 2023. Each year, over 795,000 people in the U.S. experience a stroke, and about 87% of these are ischemic strokes caused by blocked blood flow to the brain. In addition, continuous investment in research and development by domestic medical device manufacturers is enabling the launch of advanced technologies that improve treatment accuracy, reduce procedural time, and enhance patient recovery rates. The presence of a robust hospital network, fueled by government health programs, further accelerates the adoption of neurovascular devices across urban and rural healthcare settings.

Europe Neurovascular Devices Market

The neurovascular devices landscape in Europe is projected to hold a substantial share in 2034. This is owing to the driven by strong adoption of minimally invasive neurointerventional techniques in leading countries such as Germany, France, and the UK. In addition, supportive public healthcare policies and pan-European stroke care improvement initiatives are enhancing access to advanced devices. Additionally, the widespread availability of specialized neurosurgical centers and the growing number of trained interventional neurologists are enabling higher procedural volumes, making Europe a key region for technological adoption and procedural advancement in neurovascular care. For instance, in June 2025, Philips launched SmartCT in Europe after receiving CE marking, enabling real-time 3D imaging for faster stroke diagnosis and treatment. The solution streamlines workflows and supports precise neurovascular interventions.

Asia Pacific Neurovascular Devices Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is expanding due to the rising accessibility to neurovascular procedures in countries such as China, India, and Japan. Furthermore, government-based healthcare infrastructure development initiatives, including the establishment of specialized stroke units and catheterization labs, are increasing procedural capacity. Growing public awareness regarding the importance of early stroke diagnosis and intervention is pushing faster adoption of advanced neurovascular devices in urban hospitals and tertiary care facilities across the region.

China Neurovascular Devices Market Overview

The market in China is expanding rising incidence of stroke among the aging population in public and private hospitals. As per the Government of China, the country’s average life expectancy increased to 78.6 years. By 2035, the population aged 60 and above is projected to exceed 400 million, representing over 30% of the total population compared to 21% in 2025. Moreover, rapid expansion of tertiary care hospitals equipped with modern catheterization labs and advanced imaging systems is enabling wider adoption of minimally invasive neurovascular interventions. Moreover, the growing focus on improvements in healthcare funding and strategic collaborations with global medical device manufacturers are enhancing the country’s capacity to provide high-precision neurovascular treatments in major metropolitan areas.

Key Players & Competitive Analysis Report

The neurovascular devices market is moderately competitive, with leading manufacturers focusing on the development of advanced, minimally invasive solutions for managing ischemic stroke, cerebral aneurysms, and other neurovascular disorders. Companies are enhancing their product portfolios with improved thrombectomy devices, high-precision embolization systems, and next-generation flow diverters to achieve better clinical outcomes and safety profiles. Moreover, strategic collaborations between medical device companies, academic research institutions, and healthcare providers are driving innovation and enabling the introduction of region-specific treatment solutions, supporting long-term competitiveness across hospitals, specialty clinics, and emerging neurointerventional care markets.

Major companies operating in the neurovascular devices industry include Medtronic plc, Stryker Corporation, Penumbra, Inc., Terumo Corporation, MicroPort Scientific Corporation, Balt Group SAS, Kaneka Corporation, Johnson & Johnson, Acandis GmbH, phenox GmbH, Rapid Medical Ltd., and Asahi Intecc Co., Ltd.

Key Players

- Acandis GmbH

- Asahi Intecc Co., Ltd.

- Balt Group SAS

- Johnson & Johnson

- Kaneka Corporation

- Medtronic plc

- MicroPort Scientific Corporation

- Penumbra, Inc.

- phenox GmbH

- Rapid Medical Ltd.

- Stryker Corporation

- Terumo Corporation

Industry Developments

- January 2025: Radical Catheter Technologies received FDA 510(k) clearance for its 8-F Radical neurovascular catheter, an upgraded version of its 7-F platform. The company also expanded to a new manufacturing facility to support commercial growth.

- February 2025: Johnson & Johnson MedTech launched the CEREGLIDE 92 catheter system in the U.S. to enhance navigation and access in acute ischemic stroke procedures. The system offers improved visibility, flexibility, and procedural control for efficient revascularization.

Neurovascular Devices Market Segmentation

By Device Type Outlook (Revenue, USD Billion, 2020–2034)

- Stenting Systems

- Embolization Devices

- Neurothrombectomy Devices

- Support Devices

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cerebral Aneurysms

- Ischemic Stroke

- Other Application

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals

- Specialty Clinics

- Other End User

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Neurovascular Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.28 Billion |

|

Market Size in 2025 |

USD 7.70 Billion |

|

Revenue Forecast by 2034 |

USD 12.84 Billion |

|

CAGR |

5.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.28 billion in 2024 and is projected to grow to USD 12.84 billion by 2034.

The global market is projected to register a CAGR of 5.9% during the forecast period.

North America dominated the neurovascular devices market in 2024, driven by the presence of comprehensive stroke centers, strong healthcare infrastructure, and favorable reimbursement for advanced neurointerventional procedures.

A few of the key players in the market are Medtronic plc, Stryker Corporation, Penumbra, Inc., Terumo Corporation, MicroPort Scientific Corporation, Balt Group SAS, Kaneka Corporation, Johnson & Johnson, Acandis GmbH, phenox GmbH, Rapid Medical Ltd., and Asahi Intecc Co., Ltd.

The embolization devices segment dominated the market in 2024, driven by their widespread use in aneurysm occlusion and arteriovenous malformation treatment, fueled by continuous innovations in delivery systems and bioactive materials.

The specialty clinics segment is projected to grow at the fastest CAGR, due to increasing demand for focused neurovascular care, shorter wait times, and greater adoption of minimally invasive treatment techniques outside hospital settings.