Non-Volatile Memory Market Share, Size, Trends, Industry Analysis Report

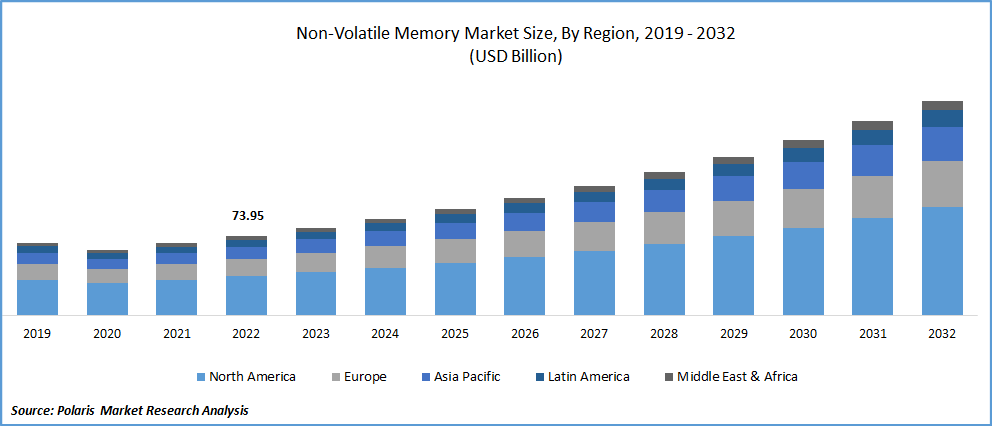

By Type (Flash, EPROM, nvSRAM, EEPROM, 3D NAND, MRAM, FRAM, NRAM, ReRAM, and PMC); By Wafer Size; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: pdf

- Report ID: PM3006

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

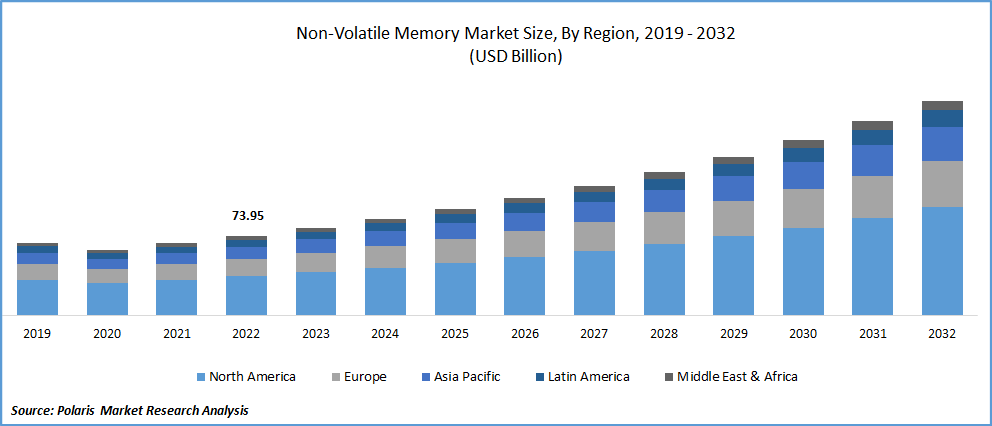

The global non-volatile memory market was valued at USD 81.47 billion in 2023 and is expected to grow at a CAGR of 10.40% during the forecast period.

The rising proliferation of the use of non-volatile memory in a wide range of critical applications including data centers, electronics, healthcare, and aerospace due to its high endurance, efficient power consumption, faster switching time, and also ability to store without continuous power supply are key factors boosting the growth and demand of the global market.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking the non-volatile memory market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

Know more about this report: Request for sample pages

Moreover, with the continuously flourishing consumer electronics industry, users demand more powerful devices, that provide various new functionality with incredible speed, and easy access to store movies, pictures, and music files. Thus, several key market players are focusing on the development of new and more advanced memory products to cater the growing demand.

For instance, in July 2022, Western Digital Technologies announced that the company has started shipping its new 22TB HDDS while targeting three different segments including IT/data center, network attached storage and smart/video surveillance. The new devices are integrated with industry’s first OptiNAND technology, triple-stage actuator, and HelioSeal to deliver industry’s areal density to its customers.

Furthermore, with the growing evolution of next-generation 5G technology and continuously increasing deployment of 5G infrastructure networks, the demand and prevalence for high-performance computing and rise in the implementation of small data centers near customer locations is growing extensively across the globe. In addition, quick access to storage benefits associated with non-volatile memory improves the overall performance of next generation storage and platforms of various enterprises.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the non-volatile memory market. The emergence of deadly coronavirus has negatively impacted a wide range of end-user industries of non-volatile memories such as automotive and smartphone industries. Due to imposed lockdowns and many other restrictions across many countries, many manufacturing facilities and shopping centers were temporarily closed, which resulted in a decline in the sales of various end-user products, and in turn, the demand for non-volatile memory has also declined during the pandemic.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Higher technological advancements in semiconductor memory chips have supported and promoted the adoption of integrated circuits across a wide range of industry verticals including smartphones and smart wearables owing to an increase in demand for high-capacity memory solutions with fast data transfer rates in these devices, are key major factors expected to drive the growth of the global market during the anticipated period. Non-volatile memory is basically designed with a high-performance interface for those types of applications, where power consumption needs to be reduced. Thus, it is gaining high traction across smartphones and smart wearables and augmenting the market growth.

Furthermore, the growing need to replace currently existing traditional memories with emerging non-volatile memories due to the limitations associated with traditional memories like high latency, low scalability, and slow switching rate is fueling the market growth for non-volatile memory. In addition, the growing penetration of artificial intelligence and Internet of Things across the globe is further likely to create higher demand for these memories at a rapid pace shortly.

Report Segmentation

The market is primarily segmented based on type, wafer size, end-use, and region.

|

By Type |

By Wafer Size |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Flash memory segment accounted for the largest market share in 2022

The growth of the segment market is mainly driven by continuously growing demand for various types of consumer electronics, which led to flash memory applications in laptops, smartphones, digital cameras, and many others. In addition, rapid growth in the adoption of innovative cloud solutions and growing prevalence of ML, AI, and IoT devices have significantly propelled the growth and demand for flash memory across the globe.

For instance, in November 2022, Samsung Electronics started mass production of a 1 TB triple-level cell 8th generation vertical NAND with the highest bit density. It also features highest storage capacity date and enables large storage space in next-generation systems worldwide.

300 mm wafer size segment is expected to witness highest growth

The 300 mm wafer size segment is projected to register a high growth rate during the anticipated period. The growing efforts by key manufacturers across the globe to build 300 mm fabrications and a high number of newly designed equipment with 12” wafers introduced by large manufacturers are major factors fueling the growth of the segment market.

300 mm wafers are highly used in the production of solar cells, integrated circuits, and many others coupled with the growing popularity of these wafers, as it offers a range of current and voltage handling capacity with high durability, reliability, and heat resistance. As a result, these sizes of wafers are being extremely adopted across diverse industries like consumer electronics, energy generation, defense, automotive, and telecommunication. Thus, the growth and demand for the segment market are likely to have a positive impact over the next coming years.

Consumer electronics segment held the largest market revenue share in 2022

The growth of the segment market can be attributed rapidly growing need and demand for high storage density and low power consumption memories in consumer electronics including smartphones, digital cameras, wearables, and gaming devices. Now, most computers have begun using non-volatile memory with better processing power and memory density.

Moreover, a surge in the production of high-performance smartphone that mainly utilizes advanced processors and NVM for faster access to data and enables end-user satisfaction along with new NAND flash memory that supports faster performance is further anticipated to boost the growth of the segment market.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific is projected to expand at highest growth rate over the coming years, which is mainly driven by high population density in countries like India and China and growing proliferation of a variety of consumer electronic products along with the rapid development in healthcare infrastructure that requires better and high-performance memory devices to efficiently manage patient information. The region has gained high traction as a hub for semiconductor and integrated circuits manufacturing owing to several reasons, which further influences the demand for non-volatile memory in the region.

Moreover, North America led the industry and accounted for a significant market share in 2022 on account of growing construction activities of various new infrastructures including data centers, and high development of digital economy in countries such as United States and Canada. In addition, rising investment in research & development activities of non-volatile memory devices by key market companies in the region to cater to the demand for innovative devices is also likely to fuel growth in the coming years.

Competitive Insight

Some of the major players operating in the global market include Western Digital, KIOXIA Technologies, Micron Technology, HYNIX, Microchip Technology, Renesas Electronic, STMicroelectronics, Infineon Technologies, Nantero, Crossbar, Everspin Technologies, SMART Modular Technologies, HT Micron, SkyHigh Memory, and Pure Storage.

Recent Developments

- In May 2022, Toshiba Electronic & Japan Semiconductor have together developed a new analog platform along with embedded non-volatile memory for various automotive applications. The new platform offers an optimized combination of devices and processes and is mainly applied to analog integrated circuits.

- In December 2021, SK Hynix announced the completion of first phase for acquisition of Intel’s NAND and solid-state drive businesses with a value of USD 7 billion. The company said that they have completed the first transaction phase with the acquisition of Intel SSD Business and the manufacturing facility of Dalian NAND flash in China.

Non-Volatile Memory Market Report Scope

|

Report Attributes |

Details |

| Market size value in 2024 |

USD 89.79 billion |

|

Revenue forecast in 2032 |

USD 198.79 billion |

|

CAGR |

10.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Wafer Size, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Western Digital Technologies, KIOXIA Technologies, Micron Technology, HYNIX Inc., Microchip Technology Inc., Renesas Electronic Corporation, STMicroelectronics, Infineon Technologies AG, Nantero Inc., Crossbar Inc., Everspin Technologies, SMART Modular Technologies, HT Micron, SkyHigh Memory Limited, and Pure Storage Inc. |

We provide our clients the option to personalize the non-volatile memory market report to suit their needs. By customizing the report, you can get data as per your format and definition. Also, the customization option allows you to gain a deeper dive into a specific segment, region, customer, or market competitor.

FAQ's

Non-Volatile Memory Market Size Worth $198.79 Billion By 2032.

Some of the major players operating in the global market include Western Digital, KIOXIA Technologies, Micron Technology, HYNIX, Microchip Technology, Renesas Electronic, STMicroelectronics, Infineon Technologies

Asia Pacific contribute notably towards the global non-volatile memory market

The global non-volatile memory market expected to grow at a CAGR of 10.4% during the forecast period.

key segments are type, wafer size, end-use, and region.