North America Gummy Market Share, Size, Trends, Industry Analysis Report

By Product, By Ingredient (Gelatin, Plant-based Gelatin substitutes), By End-use, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4586

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

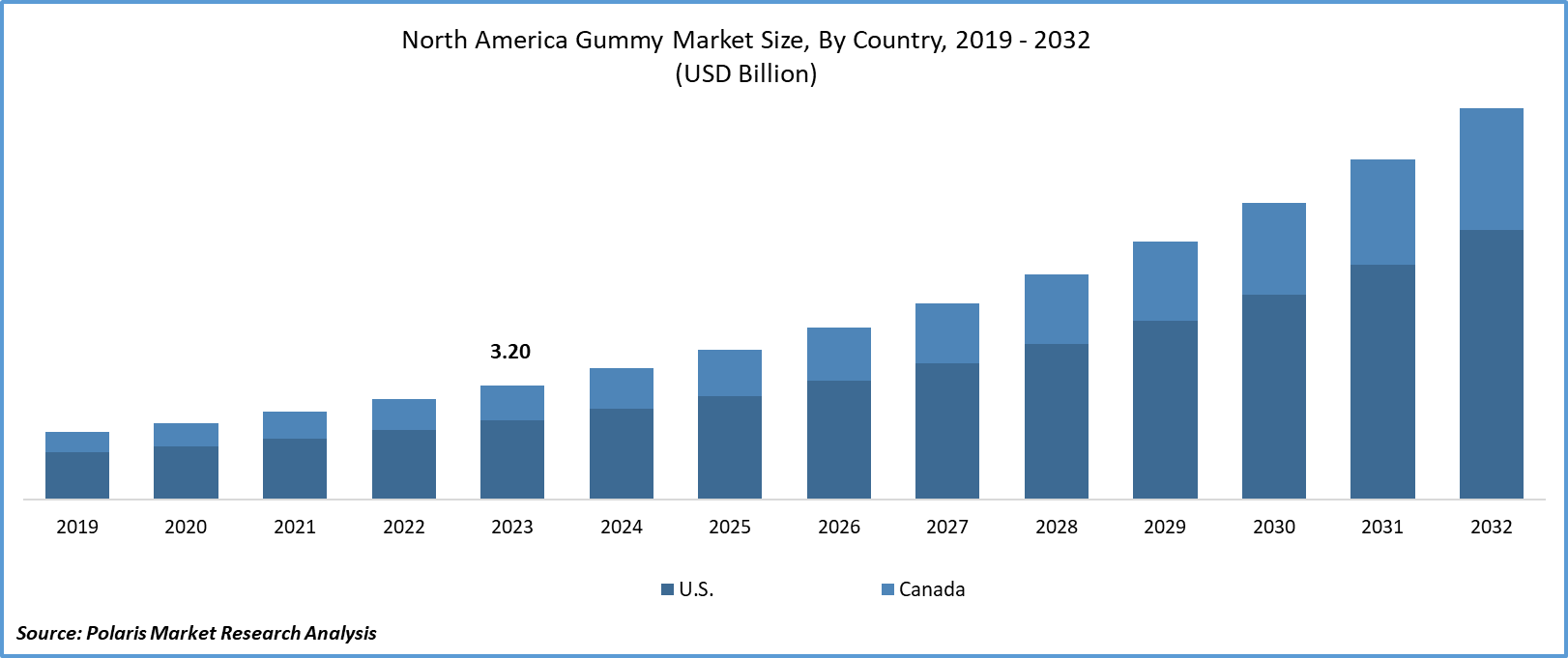

The north america gummy market size was valued at USD 3.20 billion in 2023. The market is anticipated to grow from USD 3.67 billion in 2024 to USD 10.97 billion by 2032, exhibiting the CAGR of 14.7% during the forecast period.

Market Overview

Factors such as the increasing demand for functional and fortified gummies, the availability of diverse flavors, rising interest in natural products, and the growing preference for vegan options are expected to drive the growth. Gummies serve as a convenient and user-friendly method for delivering various active ingredients, including vitamins, minerals, and supplements. The rising popularity of gummies as a delivery format significantly contributes to the expansion of the industry.

In the United States, the embrace of vegan and vegetarian lifestyles has surged, impacting purchasing patterns across diverse product ranges, including dietary supplements. Gummy supplements, typically containing gelatin, are undergoing a shift to accommodate the preferences of a more plant-focused consumer demographic. Producers are progressively selecting plant-derived substitutes like pectin, agar-agar, and other botanical gelling agents to supplant the conventional animal-sourced gelatin, a move anticipated to boost market expansion in the forecasted duration.

To Understand More About this Research: Request a Free Sample Report

Although facing competition from traditional supplement formats like pills and capsules, the market distinguishes itself through the unique attributes of gummies, such as their delightful taste, convenient consumption, and varied formulations. Gummies stand out as preferred choices, particularly for consumers who perceive traditional supplement formats as less appealing. The ongoing innovation in gummy formulations serves as a barrier to straightforward substitution.

Growth Factors

Nutritional Fortification of Gummies

Changing consumer preferences in food and nutritional supplements have led to a significant increase in demand for nutritional products. This surge is driven by heightened health awareness and concerns regarding the adverse effects of processed foods and artificial ingredients.

Consumers now prioritize products that not only taste good but also offer health benefits. This trend is particularly evident in the market for fortified chews containing vitamins, minerals, & other nutrients. The growing popularity of such chewing gum reflects a heightened awareness of the importance of maintaining good health through proper nutrition. People are increasingly conscious of their body's nutritional needs and seek convenient and enjoyable ways to supplement their diet.

Rising Adoption of Gummies in Different Shapes and Designs

The market is experiencing a rise in various gummy presentations. Apart from the traditional gummy bear shape, producers are introducing inventive designs and fresh formats to increase consumer attraction. These formats include gummies shaped as slices, cubes, and even elaborate forms corresponding to health concepts. The assortment in presentation not only addresses aesthetic inclinations but also enables innovative product distinctiveness. This expansion resonates positively with consumers, providing them with a wider range of options that match their preferences and tastes, thus fostering the market's growth.

Restraining Factors

Stringent Regulatory Compliance

Adherence to regulatory standards, notably those mandated by entities like the FDA in the U.S., impacts product development, manufacturing protocols, labeling, and marketing strategies. Market participants must comply with these regulations to guarantee the safety and quality of their gummy offerings.

Report Segmentation

The market is primarily segmented based on product, ingredient, end use, distribution channel, and region.

|

By Product |

By Ingredient |

By End-Use |

By Distribution Channel |

By Country |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Insights

Vitamin Gummies Segment Accounted for the Largest Market Share in 2023

The vitamin gummies segment dominated the market. The increasing popularity of vitamin gummies can be attributed to their resemblance to traditional gummy candies, making them attractive to consumers seeking a more enjoyable supplement experience. Many manufacturers are expanding their product lines by offering vitamin gummies in a variety of colors, shapes, and innovative flavors. Additionally, growing consumer health consciousness is driving the demand for vitamin gummies.

For instance, as per WHO, around 2 billion individuals across the globe lack vitamins & minerals, with vitamin A, iodine, iron, & zinc being particularly deficient. These individuals reside in low-income nations and often experience deficits in multiple micronutrients.

The CBD/ CBN gummies segment will grow rapidly. Consumers increasingly favor these gummies for their ability to alleviate symptoms of anxiety, depression, and pain relief. The growing demand for gummies is fueled by heightened stress levels stemming from busy lifestyles. Moreover, regulatory constraints surrounding CBD & CBN present challenges for manufacturers looking to expand their product lines. Nonetheless, U.S. manufacturers are incorporating minor cannabinoids like cannabigerol to diversify their offerings.

By Ingredient Insights

Gelatin Segment Held the Largest Share of Gummy Market

The gelatin segment dominated the largest North America gummy market share. Manufacturers widely adopt these gummies as they offer an optimal texture, cost-efficiency, and compatibility with various ingredients, making them highly sought after by consumers. Additionally, gelatin-based gummies provide a chewy texture that appeals to consumers' preferences. For instance, in October 2023, Cargill presented consumer research findings at a trade show in Las Vegas, U.S. According to the research, 50% of respondents expressed a preference for the firmer texture of gummies, which is achieved using gelatin.

Plant-based alternatives are expected to grow at the fastest rate. This growth is driven by the growing consumer awareness of clean-label products and the increasing vegan population in the U.S., which has spurred demand for plant-based alternatives in gummy products. Furthermore, numerous manufacturers are introducing vegan or plant-based gummies to meet the rising consumer demand in this segment. For instance, AbsoluteXtracts offers cannabis-infused gummies in 3 flavors, made from vegan & all-natural ingredients, including THC oil.

By End Use Insights

Adults Segment Held the Largest Share of Gummy Market

The adult segment dominated the market. The growing demand for gummies among adults can be attributed to their appealing taste and texture. With gummies available in various flavors, they are more attractive to adults compared to traditional supplements like pills or capsules. Additionally, gummies are easier to consume, especially for individuals who struggle with swallowing pills or capsules, a problem affecting an estimated 10% to 40% of adults in the U.S., according to the National Library of Medicine.

Regional Insights

United States emerged as the largest market

U.S. held the largest revenue share in 2023 and is likely to hold its dominance over the North America gummy market forecast period. This growth is primarily due to awareness among the individuals. As per a Glanbia Nutritional’s article from August 2021, over three-quarters of consumers in the U.S. regularly consume vitamin, mineral, or supplement products. Among the different formats available, gummies remain the top choice, especially among younger consumers. Around 67% of individuals aged 18 to 34 who currently use or intend to use vitamins, minerals, or supplements prefer the gummy format.

Key Market Players & Competitive Insights

Manufacturers are directing their efforts towards innovation to align with changing consumer preferences. A variety of functional gummies, enriched with vitamins, minerals, and supplements, have been introduced to meet the rising demand for health-oriented products. Moreover, there is a discernible trend towards the launch of CBD-infused gummies in regions where regulatory guidelines allow their consumption.

Some of the major players operating in the market include:

- Bayer AG

- Boscogen, Inc.

- Church & Dwight Co., Inc.

- Garden of Life

- Haleon plc

- Herbaland Gummy

- Nature’s Bounty

- Pharmavite, LLC

- SCN BestCo

- SmartyPants Vitamins

- SMP Nutra

Recent Developments in the Industry

- In October 2023, Garden of Life extended its popular Vitamin Code series by introducing a new selection of gummy supplements. This range comprises seven products designed to address diverse requirements.

- In June 2023, Nature's Bounty introduced Sleep3 Gummies, featuring a blend of L-theanine, melatonin, & quick-release melatonin, all packaged conveniently in a gummy form. This inventive product aims to prime the body for a peaceful night's sleep and promotes uninterrupted rest for adults experiencing occasional sleeplessness.

- In May 2023, SmartyPants Vitamins introduced gelatin-free multivitamin gummies. These new multivitamins are available in formulations for adults, children, & toddlers and are formulated without gelatin, with an emphasis on lower sugar content.

Report Coverage

The North America gummy market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, ingredient, end use, distribution channel, and their futuristic growth opportunities.

North America Gummy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.67 billion |

|

Revenue forecast in 2032 |

USD 10.97 billion |

|

CAGR |

14.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in North America Gummy Market are Bayer, Boscogen, Church & Dwight, Garden of Life, Haleo, Herbaland Gummy

The north america gummy market exhibiting the CAGR of 14.7% during the forecast

The North America Gummy Market report covering key segments are product, ingredient, end use, distribution channel, and region.

key driving factors in North America Gummy Market are Rising adoption of gummies in different shapes and designs

The North America gummy market size is expected to reach USD 10.97 billion by 2032