North America Vapor Recovery Units Market Size, Share, Trends, Industry Analysis Report

By Technology (Absorption, Condensation, Membrane Separation, Adsorption, Others), By Application, By End User, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6308

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The North America vapor recovery units (VRU) market size was valued at USD 594.62 million in 2024, growing at a CAGR of 2.55% from 2025 to 2034. Key factors driving demand for vapor recovery units in North America include rising shale gas production, expanding oil & gas infrastructure, and stringent environmental regulations.

Key Insights

- The absorption segment accounted for a 33.10% share of the North America vapor recovery units market revenue in 2024 due to its ability to handle large gas volumes.

- The storage segment held 31.87% of revenue share in 2024 due to growing regulatory pressure to control volatile organic compound (VOC) emissions.

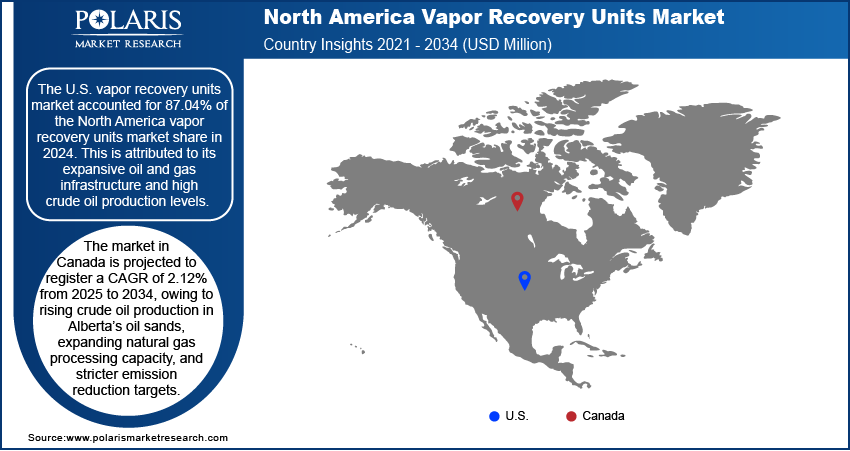

- The U.S. vapor recovery units market accounted for 87.04% of the North America vapor recovery units market share in 2024, due to high crude oil production levels and stringent environmental regulations governing VOC emissions.

- The market in Canada is projected to register a CAGR of 2.12% from 2025 to 2034, owing to expanding natural gas processing capacity.

Industry Dynamics

- The expanding oil & gas infrastructure is boosting the demand for vapor recovery units by increasing production volumes.

- The stringent environmental regulations are driving the North America vapor recovery units market growth by forcing oil and gas operators to minimize harmful emissions.

- Increasing investment in the energy sector in the region is expected to create a lucrative market opportunity during the forecast period.

- The high initial investment and operating costs of vapor recovery units hamper the market growth.

Artificial Intelligence (AI) on North America Vapor Recovery Units Market

- AI optimizes vapor recovery unit (VRU) operations by analyzing real-time data, improving energy use, and reducing emissions.

- AI-driven sensors detect equipment faults early, minimizing downtime and maintenance costs.

- AI automates control systems, ensuring consistent performance and compliance with environmental regulations.

- AI reduces operational expenses by optimizing resource allocation and improving system longevity.

Market Statistics

- 2024 Market Size: USD 594.62 Million

- 2034 Projected Market Size: USD 758.97 Million

- CAGR (2025–2034): 2.55%

Vapor recovery units (VRUs) are systems designed to capture and recover harmful vapors emitted during the storage, loading, and transportation of volatile liquids like gasoline, crude oil, and chemicals. These units prevent the release of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) into the atmosphere, reducing air pollution and health risks. VRUs also recover valuable hydrocarbons, improving efficiency and profitability. These units are commonly used in oil refineries, oil storage terminals, and fuel stations. They comply with environmental regulations while minimizing product loss.

North America vapor recovery units (VRUs) are widely deployed across the U.S. and Canada due to stringent environmental regulations such as the U.S. EPA’s Clean Air Act. The region’s oil & gas sector, including shale operations, relies heavily on VRUs to control emissions during production, storage, and distribution. Advanced technologies such as carbon adsorption and refrigeration-based systems dominate the market. Growing demand for fuel efficiency and sustainability drives innovation, with companies focusing on compact, energy-efficient designs. North America remains a key region, supported by government policies, industrial growth, and increasing awareness of emission control.

The North America vapor recovery units market demand is driven by the rising shale gas production. According to the U.S. Energy Information Administration, in 2023, about 78% (37.87 trillion cubic feet) of total US dry natural gas production was from shale formations. Shale gas production requires companies to capture emissions rather than vent them into the atmosphere, boosting VRU demand. Additionally, higher gas output means more storage tanks and transport facilities, which use VRUs to recover valuable hydrocarbons and reduce waste. Therefore, the growing shale gas production is fueling the demand for vapor recovery units in North America.

Drivers & Opportunities

Expanding Oil & Gas Infrastructure: Expanding oil and gas infrastructure is increasing the number of storage tanks, pipelines, and processing facilities. All of these release volatile organic compounds (VOCs) and hydrocarbon vapors that require control, creating the need for vapor recovery units. Larger infrastructure also leads to higher production volumes, leading to more vapors that need recovery, while the economic benefit of selling captured gases incentivizes operators to adopt VRUs. Therefore, as oil & gas networks grow, the demand for efficient vapor recovery solutions rises to maintain operational efficiency and environmental standards.

Stringent Environmental Regulations: Stringent environmental regulations, such as the Clean Air Act, are forcing oil and gas operators to minimize harmful emissions, directly increasing demand for vapor recovery units (VRUs). Governments and agencies are imposing strict limits on VOCs and methane releases, requiring companies to capture and process vapors instead of flaring or venting them. These rules mandate the use of VRUs at storage tanks, loading terminals, and processing facilities to ensure compliance with air quality standards. Fines and penalties for non-compliance are also pushing operators to invest in VRU technology, while sustainability goals and corporate responsibility initiatives further drive adoption. Hence, as regulations tighten, the oil and gas industry increasingly relies on VRUs to meet legal requirements and reduce environmental impact.

Segmental Insights

Technology Analysis

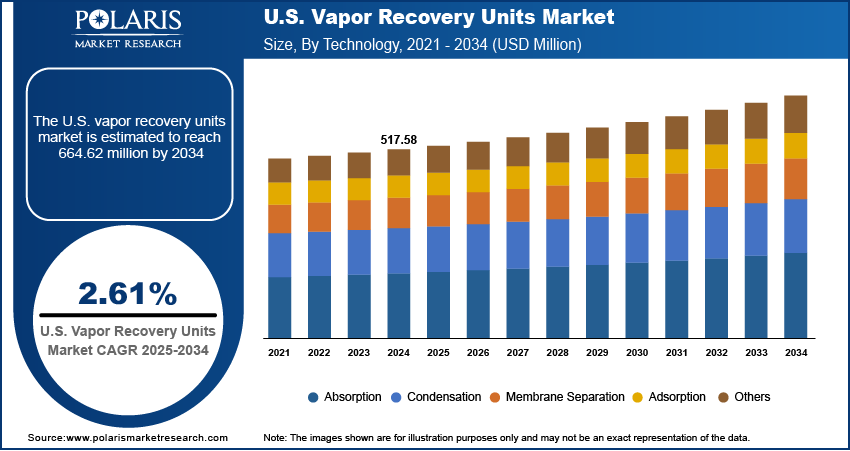

Based on technology, the segmentation includes absorption, condensation, membrane separation, adsorption, and others. The absorption segment accounted for 33.10% of the North America vapor recovery units market share in 2024. The dominance is attributed to its ability to deliver high recovery efficiency, handle large gas volumes, and support continuous operation in diverse industrial applications. Refineries and petrochemical plants increasingly adopted absorption systems to comply with stringent emissions regulations from agencies such as the U.S. Environmental Protection Agency (EPA). The technology’s capability to recover a wide range of volatile organic compounds (VOCs) while minimizing operational downtime further strengthened its market position. Additionally, the growing focus on reducing environmental impact and maximizing hydrocarbon recovery from storage and loading operations drove investments in advanced absorption systems.

The membrane separation segment is projected to register a CAGR of 2.9% from 2025 to 2034. The growth is driven by its energy efficiency, compact design, and lower maintenance requirements compared to conventional methods. Rising demand for cost-effective vapor recovery solutions in small to mid-sized facilities, particularly in the oil and gas and chemical sectors, supports the adoption of this technology. Membrane systems enable selective separation of hydrocarbon vapors with minimal energy input, which aligns with industry goals of reducing operational costs and carbon footprints. Moreover, ongoing advancements in membrane materials that enhance durability and separation efficiency are encouraging end users to shift from traditional recovery systems to modern membrane-based solutions.

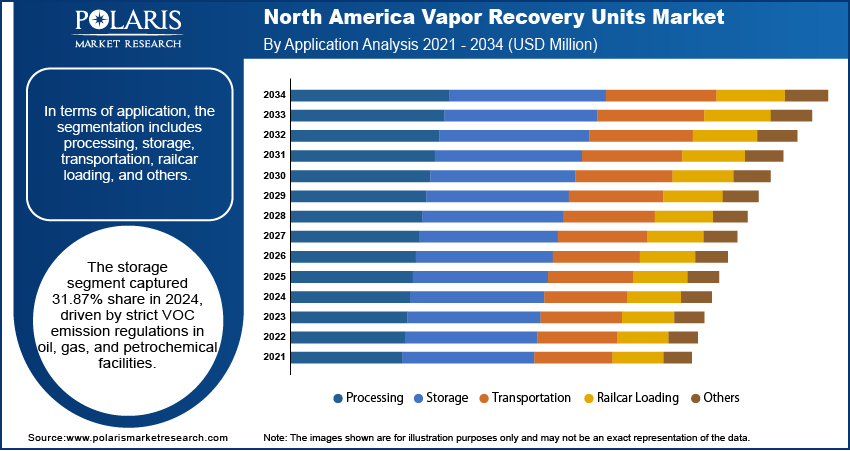

Application Analysis

In terms of application, the segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment held 31.87% of revenue share in 2024. The dominance is fueled by growing regulatory pressure to control VOC emissions from aboveground and underground storage tanks in oil and gas terminals, refineries, and petrochemical facilities. Facility operators invested heavily in vapor recovery systems to meet strict compliance requirements set by agencies such as the U.S. Environmental Protection Agency (EPA) and the Canadian Environmental Protection Act. The segment also benefited from rising crude oil and refined product storage capacity, driven by fluctuations in production and distribution patterns. The need to reduce product losses and enhance operational efficiency further encouraged adoption, as vapor recovery in storage applications enables operators to capture and reuse hydrocarbons that would otherwise be released into the atmosphere.

The transportation segment is expected to grow at a CAGR of 2.99% from 2025 to 2034, owing to increasing movement of crude oil, refined products, and petrochemicals across pipelines, tanker trucks, and marine vessels. Stricter emission control standards during loading, unloading, and transfer operations are prompting fleet owners and logistics companies to implement vapor recovery units. The technology helps prevent fugitive emissions, protect worker safety, and improve fuel economy by recovering usable hydrocarbons. The growing cross-border trade of petroleum products between the U.S., Canada, and Mexico is also creating a strong demand base for transportation-focused vapor recovery systems. Furthermore, the shift toward integrating compact, skid-mounted VRUs in mobile and modular formats is making it easier for operators to deploy them across diverse transportation modes, accelerating adoption in the coming years.

End User Analysis

The segmentation, based on end user, includes oil & gas, chemicals & petrochemicals, landfills, and others. The oil & gas segment accounted for 63.39% of the North America vapor recovery units market share in 2024. The regional market growth is attributed to the extensive use of VRUs in upstream, midstream, and downstream operations to capture VOCs and reduce greenhouse gas emissions. Refining facilities, crude oil storage terminals, and pipeline transfer stations increasingly deployed vapor recovery systems to meet stringent air quality regulations from agencies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada. The rising emphasis on operational efficiency and product recovery also contributed to adoption, as recovered vapors can be condensed into liquid hydrocarbons and resold, generating additional revenue. Expanding shale oil and gas production, along with upgrades in existing infrastructure, further amplified demand for VRUs in the oil & gas sector.

The chemicals & petrochemicals segment is estimated to grow at a CAGR of 1.6% from 2025 to 2034, owing to rising focus on environmental compliance, process efficiency, and sustainability. Facilities that manufacture and store volatile chemicals face stringent emission control requirements, making vapor recovery an essential part of operational design. The ability of VRUs to prevent hazardous air pollutants (HAPs) release while enabling the capture and reuse of valuable chemical feedstocks supports their growing adoption. Increasing investments in petrochemical capacity in the U.S. Gulf Coast, coupled with rising exports of chemical products, are strengthening demand for advanced recovery solutions.

Country Analysis

The U.S. vapor recovery units market accounted for 87.04% of the North America vapor recovery units market share in 2024. This is attributed to its expansive oil and gas infrastructure, high crude oil production levels, and stringent environmental regulations governing VOC emissions. Refineries, storage terminals, and petrochemical facilities across key states such as Texas, Louisiana, and California invested heavily in VRU installations to meet compliance requirements set by the U.S. Environmental Protection Agency (EPA). The shale boom further accelerated deployment in upstream and midstream segments, while increasing crude exports strengthened the need for vapor control during storage and transportation. The combination of economic incentives from recovered hydrocarbons and the growing corporate focus on sustainability initiatives also made the U.S. a dominant country in the region.

The market in Canada is projected to grow at a CAGR of 2.12% from 2025 to 2034. The market is propelled by the rising crude oil production in Alberta’s oil sands, expanding natural gas processing capacity, and stricter emission reduction targets under the Canadian Environmental Protection Act. Operators are investing in VRUs to address fugitive emissions in both storage and transportation applications, particularly in the midstream sector. Increasing investments in pipeline projects and marine terminals are also boosting demand for vapor recovery systems to ensure compliance with federal and provincial environmental regulations. Furthermore, the Canadian government’s push toward methane reduction and carbon neutrality is encouraging oil and gas companies to integrate VRUs as part of their broader emissions control strategies.

Key Players & Competitive Analysis

The North America vapor recovery unit (VRU) market is highly competitive, characterized by the presence of established players such as Cimarron Energy, Inc., Hy-Bon/EDI, Whirlwind Methane Recovery Systems, and PSG Dover. These companies dominate the market through advanced technologies, extensive service networks, and strong customer relationships. Competition is driven by regulatory compliance, as stringent EPA and state-level emissions standards push demand for efficient VRUs. Key differentiators include energy efficiency, low maintenance, and adaptability to varying gas compositions. Emerging players are leveraging IoT and automation to enhance monitoring and performance, challenging incumbents. The market is also witnessing consolidation, with larger firms acquiring niche players to expand product portfolios. Regional oil & gas activity influences demand, with the U.S. leading due to shale production, while Canada focuses on environmental sustainability.

A few major companies operating in the North America vapor recovery units industry include Aereon, Inc.; Cimarron Energy, Inc.; Cool Sorption A/S; Dover Corporation; Flogistix, LP; John Zink Hamworthy Combustion; PSG Dover / Blackmer; S&S Technical, Inc.; SCS Technologies; Symex Technologies LLC; and Zeeco, Inc.

Key Players

- Aereon, Inc.

- Cimarron Energy, Inc.

- Cool Sorption A/S

- Dover Corporation

- Flogistix, LP

- John Zink Hamworthy Combustion

- PSG Dover / Blackmer

- S&S Technical, Inc.

- SCS Technologies

- Symex Technologies LLC

- Zeeco, Inc.

North America Vapor Recovery Units Industry Developments

June 2024: SCS Technologies unveiled a new line of pre-engineered vapor recovery units (VRUs). These configurable systems are designed to meet specific customer needs while offering cost-efficient pricing.

May 2023: Cimarron, Inc., a leading provider of BTEX environmental solutions for the oil and gas production and transportation sectors, announced a strategic alliance to deliver an integrated BTEX and emissions control solution. This collaboration combines the strengths and expertise of both organizations to offer cost-effective, reliable, and innovative systems that recover methane and return it to the value stream.

North America Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2021–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2021–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2021–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

By Country Outlook (Revenue, USD Million, 2021–2034)

- U.S.

- Canada

North America Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 594.62 Million |

|

Market Size in 2025 |

USD 605.24 Million |

|

Revenue Forecast by 2034 |

USD 758.97 Million |

|

CAGR |

2.55% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 594.62 million in 2024 and is projected to grow to USD 758.97 million by 2034.

The market is projected to register a CAGR of 2.55% during the forecast period.

The U.S. dominated the market in 2024.

A few of the key players in the market are Aereon, Inc.; Cimarron Energy, Inc.; Cool Sorption A/S; Dover Corporation; Flogistix, LP; John Zink Hamworthy Combustion; PSG Dover/Blackmer; S&S Technical, Inc.; SCS Technologies; Symex Technologies LLC; and Zeeco, Inc.

The absorption segment dominated the market revenue share in 2024.

The chemicals & petrochemicals segment is projected to witness the fastest growth during the forecast period.