Vapor Recovery Units Market Size, Share, Trends, & Industry Analysis Report

: By Application (Processing, Storage, Transportation, and Railcar Loading), By End-User, By Technology, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM2518

- Base Year: 2024

- Historical Data: 2020-2023

Overview

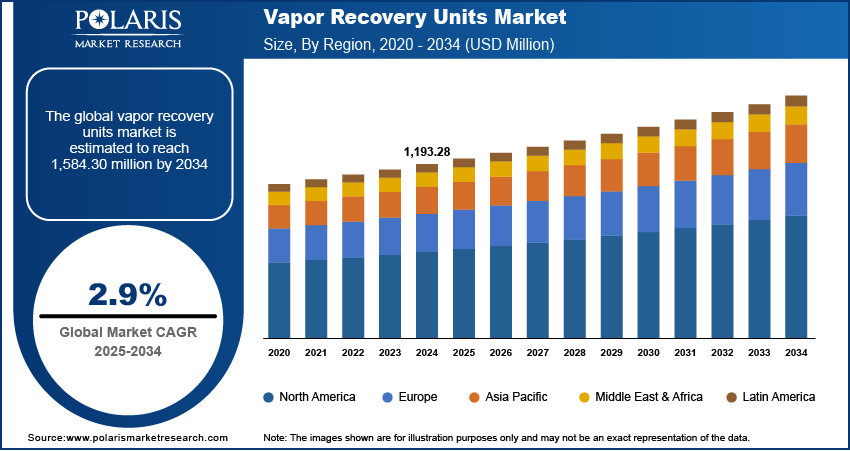

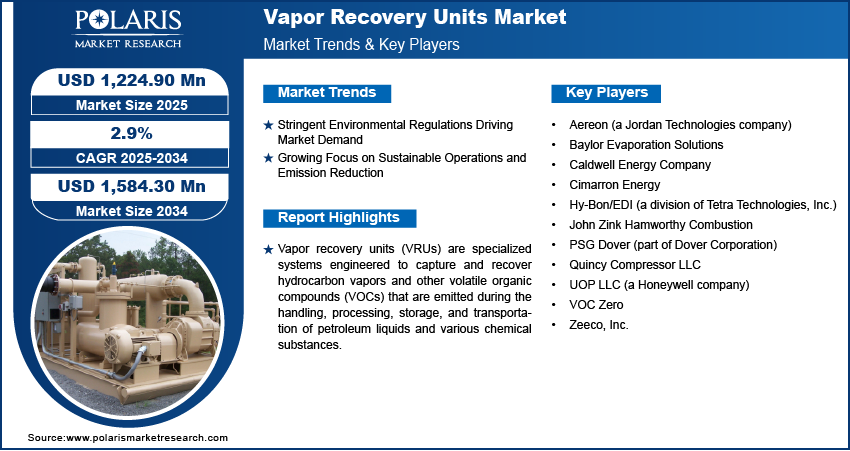

The global vapor recovery units (VRUs) market size was valued at USD 1,524.11 million in 2024, growing at a CAGR of 2.41% from 2025 to 2034. The imposition of stricter environmental regulations aimed at reducing harmful emissions and improving air quality drive the market growth. Also, growing awareness about energy efficiency and the need to capture and reuse valuable hydrocarbons propel the demand for VRUs.

Key Insights

- The absorption segment held the largest revenue share in 2024 due to proven efficiency, reliability, and widespread adoption across oil and gas facilities.

- The storage segment dominated the revenue share in 2024 as storage tanks are one of the largest sources of hydrocarbon vapor emissions in the oil & gas industry.

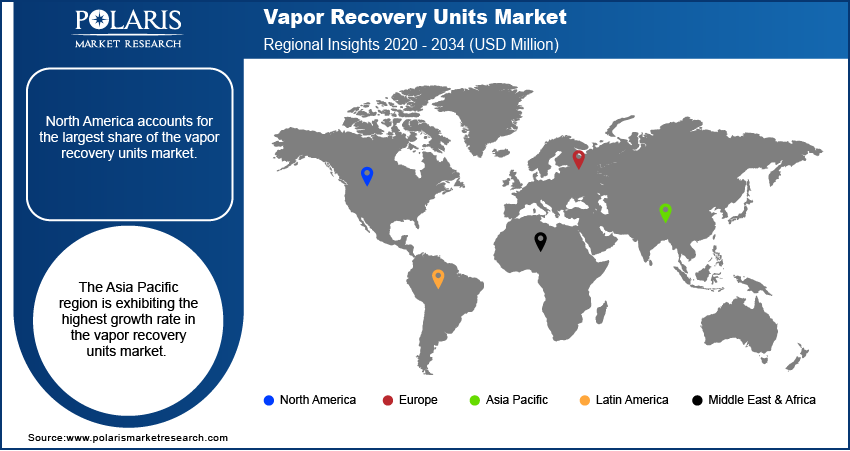

- North America held 39.01% of the global vapor recovery units market revenue share in 2024, owing to the region’s strict environmental regulations, advanced oil and gas industry, and commitment to emission reduction.

- The U.S. held 87.04% of a revenue share in the North America vapor recovery units landscape in 2024, due to its large oil & gas industry, strict regulatory framework, and increasing focus on sustainable operations.

- The industry in Asia Pacific is projected to register the highest CAGR from 2025 to 2034, owing to rapid industrial growth, rising energy demand, and increasing government focus on environmental protection.

Industry Dynamics

- Stricter government regulations on emissions are driving the adoption of vapor recovery units (VRUs) to reduce volatile organic compound (VOC) releases.

- Emphasis on energy efficiency and hydrocarbon recovery is rising as companies are under pressure to cut operational costs while maximizing resource utilization.

- Expanding oil and gas production activities would present a strong opportunity for wider VRU deployment in the coming years.

- High installation and maintenance costs remain a key restraint for market growth.

AI Impact on Vapor Recovery Units Market

- AI-powered monitoring systems can detect early signs of equipment failure, which helps in reducing downtime and extending VRU lifespan.

- AI algorithms help optimize vapor recovery efficiency by adjusting operations in real time for maximum hydrocarbon capture.

- AI enhances detection and reporting of emissions, ensuring companies meet stringent environmental regulations.

- Smarter automation through AI lowers operational and maintenance costs by minimizing manual intervention.

- AI analytics provide operators with deeper insights into performance trends, enabling better decision-making and investment planning.

Market Statistics

- 2024 Market Size: USD 1,524.11 Million

- 2034 Projected Market Size: USD 1,918.72 Million

- CAGR (2025–2034): 2.41 %

- North America: Largest Market Share

A vapor recovery unit is a system designed to capture and recover vapors, primarily hydrocarbons, that are released during the storage, loading, and transportation of oil, gas, and other volatile fuels. When combined with transportation analytics, VRUhelps operators identify emission hotspots and improve fuel logistics efficiency. Instead of allowing these vapors to escape into the atmosphere, VRUs collect and process them for reuse, which helps reduce environmental pollution and improves energy efficiency by converting emissions into valuable resources. These systems have become increasingly important as governments and industries worldwide focus on reducing greenhouse gas emissions and complying with stricter environmental regulations.

Major factors driving the growth of this industry include the tightening of environmental policies, which push energy companies to adopt technologies that reduce air pollutants and VOC emissions. In line with these regulations, there is also a rising emphasis on energy efficiency and hydrocarbon recovery, encouraging industries to deploy vapor recovery units. By capturing vapors that would otherwise be wasted, VRUs help companies stay compliant and improve resource utilization and reduce operational losses, making them both an environmental and economic solution.

The expansion of oil and gas production across emerging markets is expected to create opportunities for VRU adoption, as operators seek to align with international sustainability standards. Growing awareness about the harmful effects of emissions on public health is further influencing governments to strengthen air quality regulations, which directly boosts demand for VRUs. Technological advancements, including automation and integration with digital monitoring systems, are also improving the efficiency and reliability of these units, making them more attractive to operators.

Drivers & Opportunities

Stricter Environmental Regulations Driving Adoption: Governments and regulatory bodies are placing increasing pressure on industries, especially oil and gas, to reduce volatile organic compound (VOC) emissions and other air pollutants that contribute to environmental degradation and public health issues. These regulations often mandate the installation of emission control technologies, making VRUs a necessary investment for compliance. By capturing vapors that would otherwise be released into the atmosphere, VRUs directly address the regulatory need to cut down greenhouse gas emissions and harmful pollutants. Non-compliance with these rules can lead to heavy penalties, reputational damage, and even operational shutdowns, which makes adoption of VRUs a cost-effective and responsible choice for energy operators. As policies become more stringent worldwide, industries are expected to increasingly rely on VRUs to meet both local and international standards.

Growing Emphasis on Energy Efficiency and Hydrocarbon Recovery: Energy companies are under constant pressure to improve operational performance while reducing costs, and VRUs offer a practical way to achieve this balance. By capturing and recycling vapors during storage, transportation, or loading of fuels, VRUs convert potential waste into usable hydrocarbons that can be sold or reused in operations. This process minimizes losses and improves profitability by recovering valuable resources that would otherwise escape into the atmosphere. At the same time, using VRUs helps companies demonstrate their commitment to sustainability, which is becoming an increasingly important factor for investors and stakeholders.

Segmental Insights

Technology Analysis

Based on technology, the segmentation includes absorption, condensation, membrane separation, adsorption, and others. The absorption segment held the largest market share in 2024 due to its proven efficiency, reliability, and widespread adoption across oil and gas facilities. This method effectively captures and recovers hydrocarbon vapors using liquid absorbents, making it highly suitable for large-scale applications. Its cost-effectiveness, ease of integration with existing infrastructure, and compliance with strict environmental regulations further drive its dominance in the global market.

The growth of absorption segment is largely supported by industries seeking compact and energy-efficient solutions that can reduce operating expenses while maintaining high recovery efficiency. They are particularly attractive for facilities where space is limited and operational flexibility is required, as modular designs allow easy installation and scaling based on demand. Advancements in membrane materials have also played a critical role in improving performance, durability, and cost-effectiveness, making this technology more viable for widespread use. As energy companies continue to prioritize sustainability and stricter emission standards come into play, membrane separation is increasingly seen as a forward-looking solution. Its ability to balance efficiency, environmental responsibility, and operational savings is fueling its rapid adoption in the market.

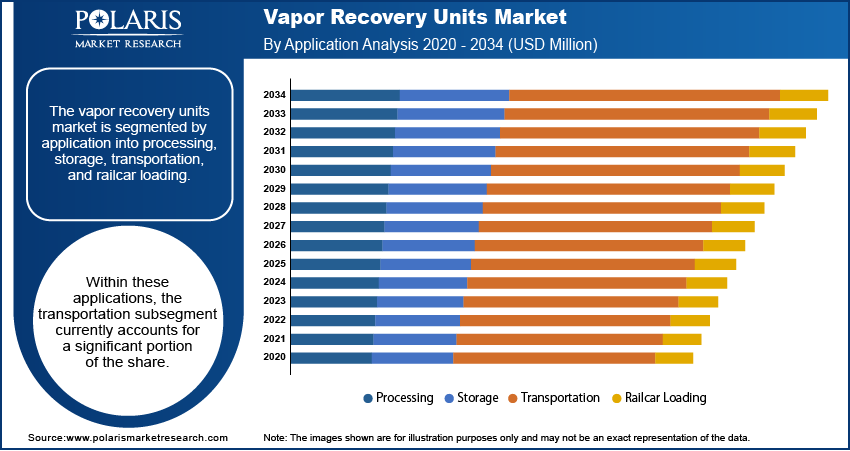

Application Analysis

Based on application, the segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment accounted for 31.9% of revenue share in 2024, as storage tanks are one of the largest sources of hydrocarbon vapor emissions in the oil and gas industry. Vapor Recovery Units (VRUs) play a crucial role in capturing emissions, processing them, and recovering valuable hydrocarbons that can be reused or sold. This makes their use in storage facilities both an economic advantage and an environmental necessity.

The dominance of the storage segment is driven by stricter government regulations and global environmental policies, which mandate emission control systems at storage sites. Refineries, terminals, and petrochemical plants are increasingly investing in VRUs for storage applications to reduce volatile organic compound (VOC) emissions and meet sustainability goals. As a result, storage remains the most critical and revenue-generating application within the VRU market.

End User Analysis

In terms of end user, the segmentation includes oil & gas, chemicals & petrochemicals, landfills, and others. The oil & gas segment accounted for USD 966.20 million revenue share in 2024, mainly due to the industry’s strong focus on reducing emissions and improving efficiency across operations. During exploration, production, storage, and transportation, large volumes of hydrocarbon vapors are released, which harm the environment and result in product losses. Vapor recovery units help address both challenges by capturing these vapors and converting them back into usable resources. With global energy demand continuing to grow and oil and gas companies expanding operations, the adoption of VRUs in this sector has become both a necessity and a long-term investment.

The landfills segment is projected to capture 10.81% share of the market by 2034 due to its rising focus on controlling methane and other harmful gas emissions generated from decomposing waste. Landfills are significant contributors to greenhouse gases, primarily through landfill gas emissions, and regulatory bodies across the globe are enforcing stricter emission standards to address environmental and public health concerns.

Regional Analysis

The North America vapor recovery units market dominated with 39.01% of revenue share in 2024. This strong position is largely attributed to the region’s strict environmental regulations, advanced oil and gas industry, and commitment to emission reduction. In the U.S., for example, the Environmental Protection Agency (EPA) has set tough standards under the Clean Air Act, requiring oil storage and transportation facilities to limit VOC emissions. This has made the use of vapor recovery units almost essential for compliance. The region’s extensive shale oil and gas production also creates a steady demand for VRUs to prevent product losses and improve efficiency.

U.S. Vapor Recovery Units Market Insights

The U.S. accounted for a 87.04% of the revenue share in the North America vapor recovery units landscape in 2024, mainly because of its large oil and gas industry, strict regulatory framework, and increasing focus on sustainable operations. As the world’s leading producer of crude oil and natural gas, the country faces significant challenges with vapor emissions during storage, processing, and transportation. To tackle this, the Environmental Protection Agency (EPA) has introduced strict rules under the Clean Air Act, requiring facilities to curb volatile organic compound (VOC) emissions. This has made vapor recovery units a vital part of operations across refineries and terminals.

Asia Pacific Vapor Recovery Units Market Trends

The Asia Pacific market is projected to hold 22.83% of the global market share in 2034, driven by rapid industrial growth, rising energy demand, and increasing government focus on environmental protection. Countries such as China, India, and South Korea are witnessing significant expansion in oil refining, petrochemicals, and storage infrastructure, which naturally raises concerns about emissions from hydrocarbons. Governments in the region are tightening regulations on air quality and VOC emissions, encouraging industries to adopt vapor recovery technologies. At the same time, growing investments in oil and gas exploration, particularly in offshore and onshore projects, are creating opportunities for wider deployment of VRUs.

China Vapor Recovery Units Market Overview

The demand for vapor recovery units in China is being driven by the country’s rapid industrialization, rising energy consumption, and strict government efforts to curb air pollution. With China being one of the largest oil refiners and consumers of petroleum products, emissions from storage tanks, refineries, and transportation facilities have become a major concern. To address this, authorities have introduced stringent regulations on VOC emissions, pushing companies to adopt vapor recovery technologies. Additionally, the expansion of refining capacity and fuel storage infrastructure is further supporting the installation of VRUs, making them essential for both compliance and efficiency.

Europe Vapor Recovery Units Market Analysis

The industry in Europe is projected to register a CAGR of 1.37% from 2025 to 2034, owing to the region’s strict environmental rules and push for cleaner industrial practices. The European Union has introduced strong emission reduction goals, encouraging companies to adopt technologies such as VRUs to cut down volatile organic compound (VOC) emissions. Countries such as Germany, France, and the UK are investing in refining and storage infrastructure, further creating demand for these systems. Alongside regulations, growing public awareness and pressure to move toward sustainable operations are making VRUs an important part of Europe’s energy landscape.

Key Players & Competitive Analysis

The vapor recovery units market features a competitive landscape dominated by established defense and marine technology firms. Leading players in the market are adopting a variety of strategies to maintain and enhance their position, including forming strategic partnerships, investing in the development of advanced VRU technologies, and expanding their presence in key regions with high demand. Companies are focusing on developing next-generation VRUs that incorporate features like automation, remote monitoring, and modular designs, allowing them to meet Japan's stringent environmental regulations and operational needs. Furthermore, there is a strong emphasis on improving system efficiency, reducing long-term maintenance costs, and providing tailored solutions for sectors such as fuel storage facilities, refineries, and renewable energy infrastructure. The entry of tech-driven startups offering innovative emission monitoring and digital control technologies is further intensifying the competition, prompting established players to continually innovate and upgrade their offerings to stay ahead in the market.

A few major companies operating in the vapor recovery units industry include Dover Corporation; Cimarron Energy, Inc.; PETROGAS Systems; John Zink Hamworthy; Zeeco, Inc.; Kilburn Engineering Ltd.; Kappa GI; Flogistix LP; VOCZero Ltd.; and Aereon Inc. .

Key Companies

- Aereon Inc.

- Cimarron Energy, Inc.

- Dover Corporation

- Flogistix LP

- John Zink Hamworthy

- Kappa GI

- Kilburn Engineering Ltd.

- PETROGAS Systems

- VOCZero Ltd.

- Zeeco, Inc.

Vapor Recovery Units Industry Developments

February 2025: Zeeco Inc. revealed the establishment of its Advanced Research Complex in the U.S. The new facility is designed to help heavy industries develop, test, and scale up new combustion and pollution control technologies.

July 2024: Dover Corporation announced the acquisition of Demaco Holland B.V. The acquisition was made through Dover’s Clean Energy Solutions business unit. The company revealed that the strategic move will help it improve its clean energy product offerings and capabilities.

In June 2024, SCS Technologies unveiled a new line of pre‑engineered vapor recovery units (VRUs) at the Methane Mitigation Technology & Innovation Summit. These units are designed for rapid customization and deployment. It enables companies to configure them quickly and cost-efficiently to align with the EPA’s Quad O regulations standards aimed at sharply reducing methane and other emissions from oil and gas operations.

Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2021–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2021–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2021–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

By Regional Outlook (Revenue, USD Million, 2021–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,524.11 Million |

|

Market Size in 2025 |

USD 1,548.28 Million |

|

Revenue Forecast by 2034 |

USD 1,918.72 Million |

|

CAGR |

2.41% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,524.11 million in 2024 and is projected to grow to USD 1,918.72 million by 2034.

The global market is projected to register a CAGR of 2.41% during the forecast period.

North America dominated the market in 2024

A few of the key players in the market are Dover Corporation; Cimarron Energy, Inc.; PETROGAS Systems; John Zink Hamworthy; Zeeco, Inc.; Kilburn Engineering Ltd.; Kappa GI; Flogistix LP; VOCZero Ltd.; and Aereon Inc.

The absorption segment dominated the market revenue share in 2024.

The transportation segment is projected to witness the fastest growth during the forecast period.

Vapor Recovery Units (VRUs) are engineered systems designed to capture and recover hydrocarbon vapors and other volatile organic compounds (VOCs) that are released during various industrial processes, primarily in the oil and gas, chemical, and petrochemical industries. These vapors are often generated during the storage, processing, and transportation of petroleum products and other volatile liquids. Instead of allowing these vapors to escape into the atmosphere, where they can contribute to air pollution and pose safety hazards, VRUs collect them and process them for reuse or safe disposal.