Nuclear Waste Management System Market Share, Size, Trends, Industry Analysis Report

By Waste Type (Low-Level Waste, High-Level Waste, Intermediate-Level Waste); By Reactor Type; By Disposal Options; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 119

- Format: PDF

- Report ID: PM3439

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

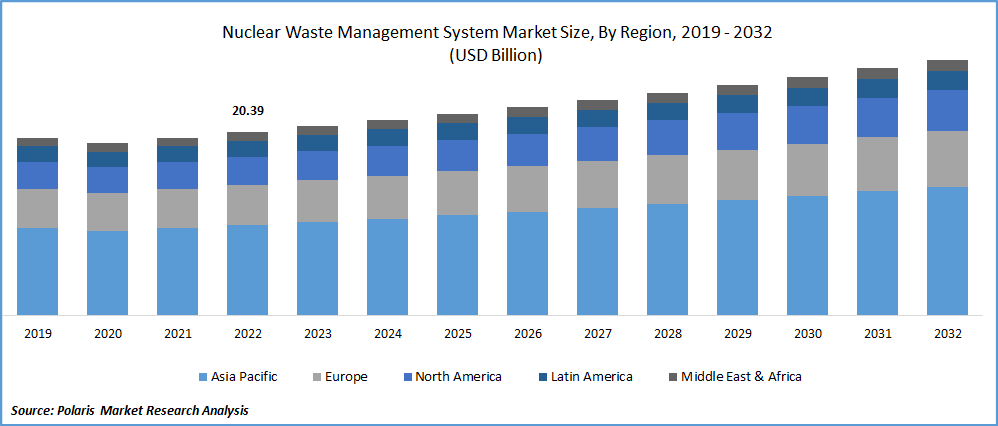

The global nuclear waste management system market was valued at USD 20.39 billion in 2022 and is expected to grow at a CAGR of 3.4% during the forecast period. The growing disposal of solid radioactive waste by countries is one of the key factors driving the growth of the nuclear waste management system market. As countries continue to generate more nuclear waste, there is a growing need for effective and safe management strategies and technologies.

To Understand More About this Research: Request a Free Sample Report

According to the International Atomic Energy Agency (IAEA), More than 80% of the total amount of solid radioactive waste is currently being disposed of, with numerous nations taking significant action to eliminate all forms of nuclear and radioactive waste. Many countries are investing in the development of new nuclear waste management systems and services to address the growing disposal challenge. These systems are designed to ensure the safe handling, transportation, and disposal of nuclear waste, minimizing the risks to public health and the environment.

Industry Dynamics

Growth Drivers

Innovations in nuclear waste management systems are helping to improve safety by reducing the risk of accidents and minimizing exposure to radiation. For example, the development of advanced robotics and automation systems has made it possible to handle nuclear waste remotely, reducing the risk to human workers. Solid grasp and projection for the national inventory of radioactive waste and spent fuel is essential for planning its safe and effective management path.

The Spent Fuel and Radioactive Waste Information System (SRIS), a new database for spent fuel and radioactive waste, was established in June 2020 by the IAEA in close collaboration with the European Commission & OECD/NEA to assist nations in this effort. In addition to facilitating information sharing, this solution streamlines national reporting on a single, user-friendly website. This will further create wide range of opportunities for the market in coming years.

For Specific Research Requirements, Request for a Customized Report

Report Segmentation

The market is primarily segmented based on waste type, reactor type, disposable options and region.

|

By Waste Type |

By Reactor Type |

By Disposable Options |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Low-Level Waste segment is expected to witness fastest growth during forecast period

The low-level waste segment is projected to experience faster growth in the study period. They are essential for the safe handling and disposal of radioactive waste generated by nuclear power plants, research facilities, hospitals, and other industries. As the demand for nuclear energy and other applications of nuclear technology continues to grow, the need for effective and reliable low-level waste management systems is also increasing.

According to IAEA report, around 95% of the amount of radioactive waste that is currently in existence has very low level (VLLW) or low level (LLW) radioactivity, 4% has intermediate level (ILW), and less than 1% has high level (HLW). This will further fuel the growth of the market in coming years.

Pressurized Water Reactor segment registered with the largest market share in 2022

The pressurized water reactor (PWR) segment is expected to witness larger market share in the study period. PWRs are the most common type of nuclear reactor in the world, accounting for around two-thirds of the global nuclear power capacity. As a result, the volume of nuclear waste generated by PWRs is also higher than other reactor types, creating a significant demand for effective and efficient waste management systems.

These reactors generate a variety of radioactive waste streams, including spent fuel, coolant, and structural materials, which require different waste management technologies and strategies. This creates a complex waste management challenge, driving the need for innovative and advanced waste management solutions.

Deep Geological Disposal segment is expected to hold the significant revenue share

The deep geological disposal segment is projected to witness a larger revenue share due to its increased safety and effectiveness in disposing of nuclear waste. DGD involves burying nuclear waste in deep geological formations, several hundred meters below the Earth's surface, which provide a stable and isolated environment for the waste. The waste is stored in specialized containers that are placed in engineered barriers, such as clay, rock salt, or crystalline rock formations, which provide multiple layers of protection against the release of radioactive materials.

Compared to other disposal methods, DGD is considered the most reliable and safe way to manage nuclear waste, with the potential to isolate waste from the environment for up to millions of years. As a result, many countries around the world, such as the United States, Sweden, France, and Finland, have invested heavily in DGD facilities.

APAC registered with the highest growth rate in the study period

APAC is projected to witness higher growth for the market in the forecast time frame. This region is experiencing a significant increase in the use of nuclear power for energy generation, driven by the growing demand for electricity and the need to reduce greenhouse gas emissions. This increase in nuclear power generation will inevitably lead to a corresponding increase in the amount of nuclear waste generated, which will drive the demand for effective nuclear waste management systems. There is an increasing awareness and concern about the safe management of nuclear waste in the Asia-Pacific region, which has led to increased government funding for research and development in this area.

For example, countries such as China, India, and Japan have all announced plans to develop deep geological repositories for high-level nuclear waste, which will require sophisticated nuclear waste management systems. China intends to invest $440 billion by 2035 to build at least 150 new nuclear reactors, according to Defence One. The government expects that advancements in CiADS technology will increase the amount of spent nuclear fuel from these reactors that is recycled. This will further fuel the growth of the in coming years.

North America is projected to witness larger revenue share in the study period

North America is expected to have a larger revenue share for the market throughout forecast period. This region has a well-established nuclear power generation industry, which has led to a significant amount of nuclear waste being generated. As a result, there is a high demand for effective nuclear waste management solutions in the region, which is expected to drive the growth of the market. The establishment of nuclear power plants can decrease carbon dioxide emissions, which is one of the key drivers of the growth of the nuclear waste management system market.

According to the Nuclear Energy Institute (NEI) estimates in 2021, the United States will have prevented more than 476.5 million metric tonnes of carbon dioxide emissions. That is more than all other sustainable energy sources put together and is the equivalent of taking 100 million automobiles off the road. As more countries focus on reducing their carbon footprints, there is a growing interest in nuclear power as a way to generate electricity without contributing to climate change. This is driving the establishment of new nuclear power plants and the expansion of existing ones, which in turn increases the amount of nuclear waste that needs to be managed.

Competitive Insight

Some of the major players operating in the global market include Augean, Bechtel, EnergySolutions, EDF, Holtec International, Studsvik, Swedish Nuclear Fuel and Waste Management, US Ecology, Waste Control Specialists, Westinghouse Electric Company, GNS Gesellschaft für Nuklear-Service, Veolia Environnement, Perma-Fix Environmental Services, AECOM, Bechtel National, Fluor, Sellafield, Nuvia, Kurion, Deep Isolation, American Ecology, Enercon Services, Studsvik Scandpower, Tetra Tech, WM Nuclear Services, Canadian Nuclear Laboratories, Rosatom, JGC, SNC-Lavalin.

Recent Developments

- In March 2023, Sempra Infrastructure Partners, investment commitment for the development, building, and management of the Port Arthur LNG 1 project at Texas.

- In January 2023, Deep Isolation, a start-up of nuclear waste management, established a new Deep Borehole Centre.

Nuclear Waste Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 21.04 billion |

|

Revenue forecast in 2032 |

USD 28.43 billion |

|

CAGR |

3.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Waste Type, By Reactor Type, By Disposal Options, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Augean, Bechtel, EnergySolutions, EDF, Holtec International, Studsvik, Swedish Nuclear Fuel and Waste Management, US Ecology, Waste Control Specialists, Westinghouse Electric Company, GNS Gesellschaft für Nuklear-Service, Veolia Environnement, Perma-Fix Environmental Services, AECOM, Bechtel National, Fluor, Sellafield, Nuvia, Kurion, Deep Isolation, American Ecology, Enercon Services, Studsvik Scandpower, Tetra Tech, WM Nuclear Services, Canadian Nuclear Laboratories, Rosatom, JGC, SNC-Lavalin. |

FAQ's

The global nuclear waste management system market size is expected to reach USD 28.43 billion by 2032.

Key players in the nuclear waste management system market are Augean, Bechtel, EnergySolutions, EDF, Holtec International, Studsvik, Swedish Nuclear Fuel and Waste Management.

North America contribute notably towards the global nuclear waste management system market.

The global nuclear waste management system market is expected to grow at a CAGR of 3.4% during the forecast period.

The nuclear waste management system market report covering key segments are waste type, reactor type, disposable options and region.