Nutrigenomics Market Size, Share, Trends, Industry Analysis Report

By Product (Reagents & Kits and Services), By Application, By Technique, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5954

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

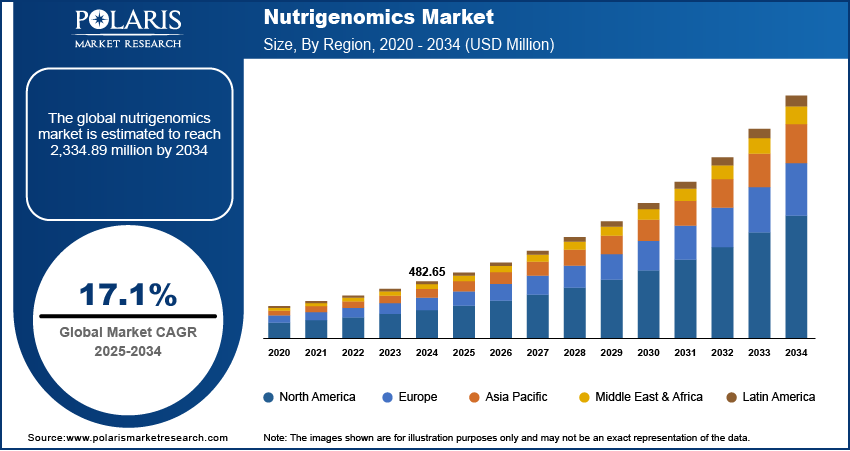

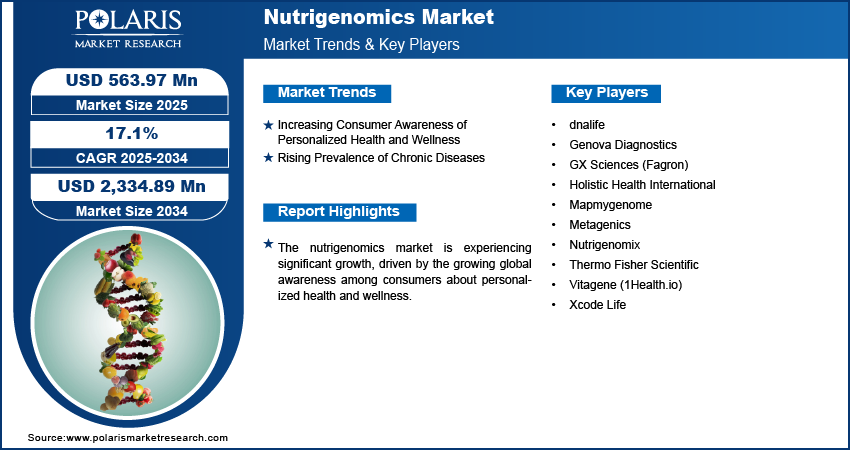

The global nutrigenomics market size was valued at USD 482.65 million in 2024 and is anticipated to register a CAGR of 17.1% from 2025 to 2034. The nutrigenomics industry is primarily driven by the increasing awareness among consumers about personalized health and wellness and growing demand for tailored nutrition solutions based on individual genetic makeup.

Key Insights

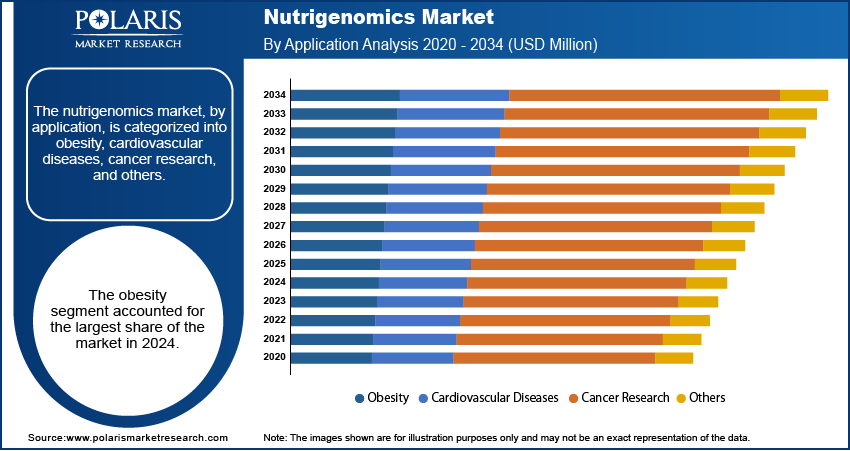

- By application, the obesity segment held the largest share in 2024.

- The reagents & Kits segment, by product, held the largest share in 2024.

- In terms of technique, the saliva collection segment held the largest share in 2024.

- By end use, the hospitals & clinics segment held the largest share in 2024.

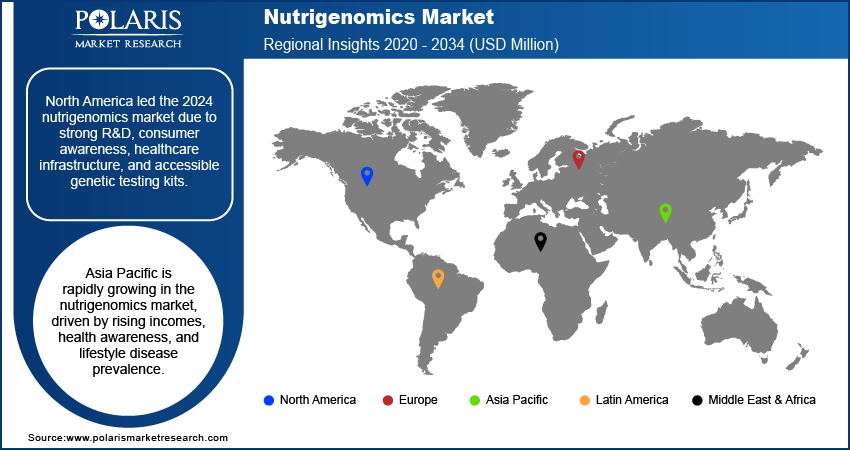

- North America held the largest share of the global nutrigenomics industry in 2024.

To Understand More About this Research: Request a Free Sample Report

The nutrigenomics industry involves the study of how an individual's genetic makeup interacts with nutrients and dietary components to influence their health. It focuses on developing personalized nutrition plans and products based on genetic information to improve overall well-being and help prevent or manage diseases.

Continuous progress in genetic testing methods and broader biotechnologies is a powerful force driving the nutrigenomics industry forward. Innovations in DNA sequencing, particularly next-generation sequencing (NGS), have drastically reduced the cost and increased the speed and accuracy of genetic analysis. This makes it more feasible for both researchers to conduct in-depth studies and for consumers to access personalized genetic insights. The ability to quickly and affordably map an individual's genetic profile is foundational to providing specific nutrigenomic recommendations.

The global shift toward a preventive healthcare model is significantly boosting the nutrigenomics industry. Instead of only focusing on treating diseases after they occur, there is an increasing emphasis on proactive measures to maintain health and prevent the onset of illness. Nutrigenomics fits perfectly into this paradigm by offering insights into an individual's genetic predispositions to various health conditions, allowing for targeted dietary and lifestyle interventions before symptoms appear.

Industry Dynamics

- Consumers are becoming more knowledgeable about how their unique bodies respond to diet, moving away from general health advice. This growing demand for tailored nutrition solutions, often based on individual genetic makeup, is a significant force pushing the demand for nutrigenomics.

- The increasing global burden of chronic diseases such as obesity and diabetes highlights the limitations of generalized dietary approaches. Nutrigenomics presents a promising approach for personalized interventions that can help prevent or manage these conditions based on an individual's genetic predispositions.

- Ongoing innovations, such as more affordable and accurate DNA sequencing technologies, are making genetic analysis more accessible. These technological improvements enable a deeper understanding of gene-nutrient interactions, which, in turn, fuels the development of more precise nutrigenomic products and services.

- Research in nutrigenomics is costly and time-consuming, which may restrict the industry expansion.

Increasing Consumer Awareness of Personalized Health and Wellness: The public's understanding and interest in personalized health are on the rise, pushing the demand for nutrigenomics solutions. People are shifting from general health advice to recommendations tailored specifically to their bodies and lifestyles. This shift is fueling the desire for products and services that offer individualized insights into diet and health based on genetic information.

A study published in the International Journal of Environmental Research and Public Health in 2022, titled "Trends in Consumer Interest in Personalized Nutrition: A Scoping Review," highlighted the significant increase in consumer demand for personalized dietary approaches. This growing awareness about the connection between diet, genes, and individual health outcomes is directly driving the growth of the nutrigenomics industry.

Rising Prevalence of Chronic Diseases: The increasing prevalence of chronic diseases worldwide is a significant force behind the growth of the nutrigenomics industry. Conditions such as obesity, diabetes, and cardiovascular diseases are major global health concerns, and traditional treatment methods often fall short in providing complete solutions for everyone. Nutrigenomics offers a new approach by providing dietary strategies that are customized to an individual's genetic predispositions, aiming to prevent or better manage these long-term health issues.

The World Health Organization (WHO) reported in 2024 that chronic diseases, including cardiovascular diseases, cancers, chronic respiratory diseases such as chronic obstructive pulmonary disease, and diabetes, are the leading causes of mortality globally. These diseases are often linked to diet and lifestyle. The potential of nutrigenomics to offer targeted dietary interventions based on an individual's genetic profile makes it a crucial tool in treating these widespread health conditions, thereby driving the growth of the nutrigenomics industry.

Segmental Insights

Application Analysis

The obesity segment held the largest share in 2024. This dominance is largely due to the widespread and increasing global issue of obesity, which affects a significant portion of the population across various age groups and regions. With growing awareness of the health risks linked to excess weight, such as diabetes, heart disease, and certain cancers, more individuals are actively seeking effective and personalized weight management strategies. Nutrigenomics offers a unique approach by providing dietary recommendations and lifestyle guidance that are tailored to an individual's specific genetic predispositions, which can influence metabolism, appetite, and fat storage.

The cancer research application segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by the increasing understanding of how diet and genetic factors interact in the development and progression of cancer. Researchers are actively exploring how specific nutrients or dietary patterns, influenced by an individual's genetic profile, can impact cancer risk, treatment effectiveness, and recovery. As the global burden of cancer continues to rise, there is a heightened focus on preventive measures and complementary therapies. Nutrigenomics holds significant promise in identifying genetic susceptibilities to certain cancers and suggesting personalized dietary interventions that could potentially reduce risk or support conventional treatments.

Product Analysis

The reagents and kits segment held the largest share in 2024. This dominance is attributed to the fundamental role these products play in the core process of nutrigenomic analysis. Reagents are the chemical substances used to conduct tests, while kits bundle these reagents along with other necessary components, such as collection tubes and instructions, for genetic testing. The widespread adoption of direct-to-consumer genetic testing has significantly boosted the demand for these products, as they provide the essential tools for individuals to collect samples and for laboratories to process them. These kits make it possible to extract and analyze DNA, which then provides the genetic data needed to generate personalized nutritional insights.

The services segment, on the other hand, is anticipated to register the highest growth rate during the forecast period. While reagents and kits are crucial for obtaining genetic data, the true value of nutrigenomics lies in the interpretation of this complex information and the creation of actionable, personalized dietary plans. This is where services play major role. These services include genetic counseling, personalized nutrition consultations, and ongoing support to help individuals understand their genetic predispositions and implement appropriate dietary and lifestyle changes. As more consumers engage with genetic testing, the demand for expert guidance to translate raw genetic data into meaningful health outcomes is surging.

Technique Analysis

The saliva segment held the largest share in 2024. This dominance can be attributed to its noninvasive nature, making it a highly convenient and comfortable option for individuals undergoing genetic testing. Unlike blood draws, saliva collection avoids the need for needles, which significantly reduces discomfort and apprehension for many people. This ease of collection also allows for at-home sample submission, broadening accessibility and making personalized nutrition insights available to a wider population without requiring a visit to a clinic or laboratory.

The blood collection technique segment is anticipated to register the highest growth rate during the forecast period. While more invasive than saliva or buccal swabs, blood samples offer superior DNA yield and quality, providing a more comprehensive and detailed genetic profile. This higher quality DNA is particularly beneficial for more intricate genetic analysis such as whole-genome sequencing or the detection of rare genetic markers, which may not be as accurately or feasibly analyzed with other sample types. As the understanding of complex gene-nutrient interactions deepens, and as researchers delve into more detailed genetic predispositions, the need for high-quality, abundant DNA becomes paramount.

End Use Analysis

The hospitals & clinics segment held the largest share in 2024, due to the increasing integration of nutrigenomic insights into mainstream healthcare practices. Hospitals and clinics serve as central hubs for patient care, where medical professionals are well-positioned to leverage genetic information for personalized dietary recommendations. These settings offer a structured environment for genetic testing, interpretation, and follow-up, ensuring that patients receive comprehensive and medically supervised nutritional guidance. The credibility and established infrastructure of hospitals and clinics also build patient trust, encouraging the adoption of nutrigenomics for managing various health conditions, from chronic diseases to general wellness.

The other segment, which includes direct-to-consumer online platforms and wellness centers, is anticipated to register the highest growth rate during the forecast period. This rapid expansion is driven by the increasing accessibility and convenience offered by these channels. Online platforms, in particular, enable individuals to access genetic testing and personalized nutrition advice from the comfort of their homes, bypassing traditional healthcare settings. This appeals to a broader consumer base that is proactive about their health and seeking convenient, personalized solutions. The lower barriers to entry and the widespread reach of digital platforms enable a more rapid scaling of nutrigenomics services.

Regional Analysis

The North America nutrigenomics market accounted for the largest share of the global market in 2024, largely driven by a high level of consumer awareness regarding personalized health and the strong adoption of advanced healthcare technologies. The region benefits from a well-developed healthcare infrastructure and substantial investments in research and development, particularly in genomics and biotechnology. The increasing prevalence of chronic diseases, such as obesity and cardiovascular conditions, also contributes to the demand for personalized dietary interventions. Furthermore, the widespread availability and growing popularity of direct-to-consumer genetic testing kits have made nutrigenomics more accessible to the general public, fostering a proactive approach to health management.

U.S. Nutrigenomics Market Insight

In North America, the U.S. is a major contributor to the nutrigenomics industry. The country's large health-conscious population, coupled with a high incidence of chronic diseases, fuels the demand for tailored nutritional solutions. The U.S. market benefits from a robust ecosystem of biotechnology firms and academic institutions that are actively involved in advancing nutrigenomics research and development. Consumers in the U.S. are increasingly seeking preventive healthcare measures and personalized wellness strategies, leading to a greater acceptance and adoption of genetic testing services that inform dietary choices. This strong consumer interest, combined with technological progress, continues to drive the nutrigenomics industry in the U.S.

Europe Nutrigenomics Market Trends

Europe is a growing region in the nutrigenomics industry, characterized by its advanced healthcare systems and increasing focus on preventive medicine. The region benefits from a rising awareness among its population about the link between diet, genes, and health outcomes. European countries are witnessing interest in personalized nutrition as a way to address lifestyle-related diseases and promote overall well-being. Furthermore, robust research activities and supportive government initiatives in some European nations help integrate nutrigenomics into clinical practice and public health strategies, fostering innovation and adoption across the region.

The Germany nutrigenomics market is a key market in Europe. It benefits from a strong research landscape and a growing emphasis on personalized healthcare solutions. The country's population is becoming more aware of the importance of genetic factors in dietary responses, which is leading to an increased demand for nutrigenomic testing and personalized nutritional advice. Investments in genetic testing by leading firms and the promotion of probiotic-based supplements are further fueling the development of the nutrigenomics industry in Germany, positioning it as a significant market in the European landscape.

Asia Pacific Nutrigenomics Market Overview

Asia Pacific is emerging as a rapidly expanding region in the global nutrigenomics industry. This growth is primarily driven by rising disposable incomes, increasing health consciousness among the population, and a growing burden of lifestyle-related diseases such as obesity and diabetes. As more people in this region gain access to advanced healthcare and technology, there is a rising demand for personalized health solutions, including those offered by nutrigenomics. The diverse genetic backgrounds within Asia Pacific also present a unique opportunity for tailored dietary recommendations that cater to specific population needs.

India Nutrigenomics Market Analysis

India is a notable country in the Asia Pacific nutrigenomics industry, showing significant potential for growth. Indian dietetic professionals express a strong interest in incorporating nutrigenomics into their practice, as noted in a 2025 study titled "Exploring the future of nutrigenomics: dietitians' perceptions on integration in Indian practice," published in Genes & Nutrition. This interest stems from the recognition that personalized nutrition holds immense potential for addressing India's significant health challenges and improving the overall quality of life. As awareness grows and the healthcare infrastructure continues to develop, the adoption of nutrigenomics in India is expected to increase, particularly for managing diet-related chronic diseases and promoting individual wellness.

Key Players and Competitive Insights

The nutrigenomics industry features a dynamic and competitive landscape with several key players striving to innovate and capture a larger market share. Companies such as Nutrigenomix, Metagenics, Xcode Life, and GX Sciences are prominent, offering various products and services. The competitive environment is characterized by ongoing research and development, particularly in personalized genetic testing and the creation of customized dietary and lifestyle interventions. Companies are focusing on expanding their product portfolios, improving the accuracy and accessibility of their tests, and forging partnerships with healthcare providers to broaden their reach and enhance their service offerings.

A few prominent companies in the industry include Nutrigenomix, Metagenics, Xcode Life, GX Sciences (Fagron), dnalife, Genova Diagnostics, Holistic Health International, Vitagene, and Mapmygenome.

Key Players

- dnalife

- Genova Diagnostics

- GX Sciences (Fagron)

- Holistic Health International

- Mapmygenome

- Metagenics

- Nutrigenomix

- Thermo Fisher Scientific

- Vitagene (1Health.io)

- Xcode Life

Industry Developments

May 2025: Metagenics launched its new HerWellness line of products in May 2025. This line is designed to offer natural approaches to hormone balance for women across different life stages, providing support for various hormonal symptoms from period relief to perimenopause and menopause.

January 2025: GX Sciences (Fagron Genomics US) announced a partnership with ExtendingME. This alliance is expected to further enhance their offerings in personalized health and wellness, likely through advanced genetic insights and tailored health programs.

Nutrigenomics Market Segmentation

By Application Outlook (Revenue – USD Million, 2020–2034)

- Obesity

- Cardiovascular Diseases

- Cancer Research

- Others

By Product Outlook (Revenue – USD Million, 2020–2034)

- Reagents & Kits

- Services

By Technique Outlook (Revenue – USD Million, 2020–2034)

- Saliva

- Buccal Swab

- Blood

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Hospitals & Clinics

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Nutrigenomics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 482.65 Million |

|

Market Size in 2025 |

USD 563.97 Million |

|

Revenue Forecast by 2034 |

USD 2,334.89 Million |

|

CAGR |

17.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 482.65 million in 2024 and is projected to grow to USD 2,334.89 million by 2034.

The global market is projected to register a CAGR of 17.1% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Nutrigenomix, Metagenics, Xcode Life, GX Sciences (Fagron), dnalife, Genova Diagnostics, Holistic Health International, Vitagene, and Mapmygenome.

The obesity segment accounted for the largest share of the market in 2024.

The services segment is expected to witness the fastest growth during the forecast period.