Octyl Alcohol Market Share, Size, Trends, Industry Analysis Report

By Product, By Application (2-Ethylhexanol, 1-Octanol, 2-Octanol), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3577

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

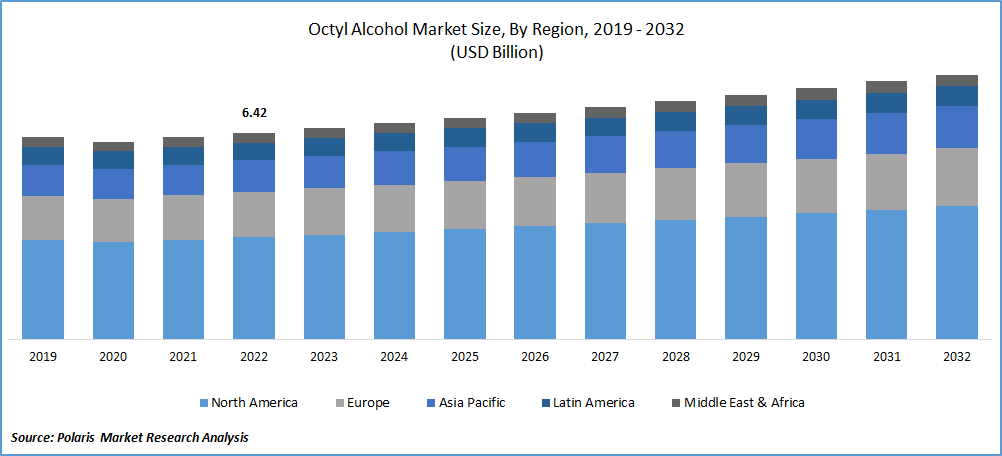

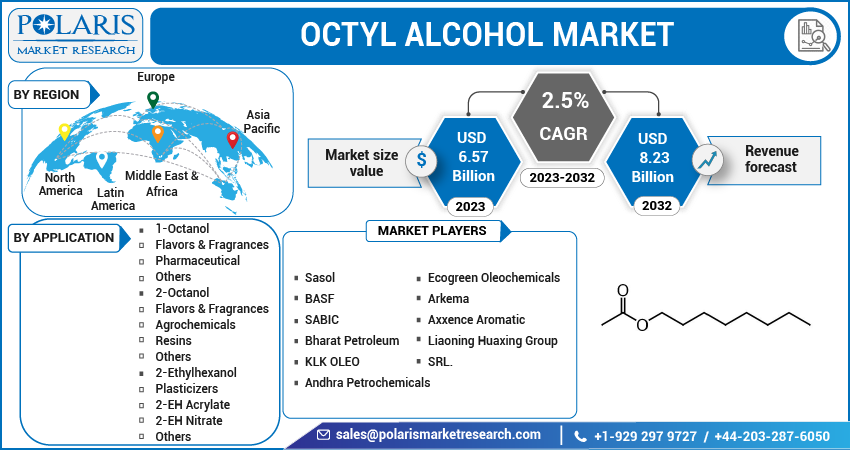

The global octyl alcohol market was valued at USD 6.42 billion in 2022 and is expected to grow at a CAGR of 2.5% during the forecast period. Octyl alcohol is widely used in various industries, including pharmaceuticals, cosmetics, cleaning chemicals, and paint and coatings, contributing to its market growth. In the fragrance industry, it serves as an intermediate in producing esters with pleasant, sweet, fruity, and floral aromas. Octyl alcohol is also utilized in the pharmaceutical industry to evaluate the lipophilicity of drugs and as a solvent in certain manufacturing processes. Its significant role in surfactant production, which is an essential component in manufacturing detergents, shampoos, and other cleaning products, makes it crucial in creating stable foam, increasing detergency, and enhancing the overall performance of cleaning products. In producing personal care products such as shampoos, octyl alcohol contributes to the formulation of effective surfactants that can cleanse the hair and scalp while providing a rich and luxurious lather. It's versatility, and wide range of applications across multiple industries make it in high demand.

Know more about this report: Request a Free Sample Report

Industry Dynamics

Growth Drivers

2-Ethylhexanol is a precursor in producing plasticizers like dioctyl phthalate (DOP). Plasticizers are additives that impart flexibility and softness to various materials, including plastics and rubbers. The use of 2-Ethylhexanol as a raw material for plasticizer production further drives its demand in the octyl alcohol market. Furthermore, it serves as a raw material for producing acrylate esters, which are widely used in manufacturing emulsion paints and surface coatings. Acrylate esters provide excellent adhesion, weather resistance, and durability to paint and coating formulations, making them suitable for various applications.

According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for approximately 49.1% of the total pharmaceutical sales in 2021. Among the countries in North America, the U.S. had the largest share, accounting for 64.4% of the total sales of new medicines worldwide. The dominance of the U.S. pharmaceutical market and the continuous growth of the pharmaceutical industry in North America are expected to drive the demand for various products, including octyl alcohol, in the region. The pharmaceutical industry uses chemicals and compounds for drug development and manufacturing processes. Octyl alcohol, with its diverse applications and uses, finds relevance in this industry as an intermediate, solvent, and tool for evaluating lipophilicity.

For Specific Research Requirements, Request for a Customized Report

Report Segmentation

The market is primarily segmented based on application, and region.

|

By Application |

By Region |

|

|

Know more about this report: Speak to Analyst

2-Ethylhexanol segment accounted for the largest market share in 2022

The 2-Ethylhexanol segment accounted for the largest market share. This dominance can be attributed to the wide range of applications for 2-Ethylhexanol in various industries. One of the primary uses of 2-Ethylhexanol is in producing plasticized polyvinyl chloride (PVC), particularly in the automotive sector. It is a key component in formulating plasticizers, such as dioctyl phthalate (DOP), added to PVC to enhance flexibility, durability, and workability. This makes 2-Ethylhexanol crucial for the manufacturing of PVC-based automotive components. It also serves as a solvent in surface coatings and inks. It helps to dissolve and disperse various substances, contributing to the formulation of coatings and inks with desirable properties, such as adhesion, flow, and pigment dispersion.

The 1-Octanol segment is projected to witness steady growth. 1-Octanol, a fatty alcohol, is predominantly used to synthesize esters, which have extensive use in perfumes and flavorings. This makes 1-Octanol a crucial ingredient in food, beverages, and cosmetics. In the food and beverages industry, 1-Octanol imparts specific flavors and aromas to products. It is commonly used in producing artificial flavors and fragrances, contributing to developing unique and appealing taste profiles in various food and beverage products. Similarly, in the cosmetics industry, 1-Octanol is employed to formulate perfumes and fragrances. Its chemical properties allow it to serve as a key component in creating pleasant scents for perfumes, colognes, body sprays, and other cosmetic products.

APAC region dominated the global market in 2022

APAC region dominated the global market with a considerable market share. This growth can be attributed to the advancements in the region's cosmetics, cleaning chemicals, and pharmaceutical industries. The robust growth in China's beauty and personal care sector has been driven by increasing disposable income, changing consumer preferences, and the popularity of beauty and wellness products.

The rising consumer awareness, urbanization, and changing lifestyles drive India's demand for cosmetics and personal care products. Japan is also a significant contributor to the market in the region. The country has a well-established cosmetics industry known for its innovation and high-quality products. The demand for octyl alcohol in Japan is driven by the need for ingredients used in cosmetics and personal care products.

North America registered a robust growth rate. Canada has a strong presence in the pharmaceutical sector and is considered one of the most innovative industries in the country. The Government of Canada states that the pharmaceuticals sector is the 9th largest worldwide, highlighting its significance in the global market. The pharmaceutical industry in Canada is known for its research and development capabilities, advanced manufacturing processes, and high-quality products. These factors contribute to the increasing demand for octanol in pharmaceutical applications within the region.

Competitive Insight

Some of the major players operating in the global market include Sasol, BASF, SABIC, Bharat Petroleum, KLK OLEO, Andhra Petrochemicals, Ecogreen Oleochemicals, Arkema, Axxence Aromatic, Liaoning Huaxing Group, and SRL.

Recent Developments

- In March 2023, Andhra Petrochemicals & Bharat Petroleum Corporation Limited implemented price increases for 2-ethyl hexanol in India. This price hike can be attributed to multiple factors, including the rise in raw material prices and the strong demand for the product in the market.

Octyl Alcohol Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 6.57 billion |

|

Revenue forecast in 2032 |

USD 8.23 billion |

|

CAGR |

2.5% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Sasol, BASF, SABIC, Bharat Petroleum, KLK OLEO, Andhra Petrochemicals, Ecogreen Oleochemicals, Arkema, Axxence Aromatic, Liaoning Huaxing Group, and SRL. |

FAQ's

key companies in Octyl Alcohol Market are Sasol, BASF, SABIC, Bharat Petroleum, KLK OLEO, Andhra Petrochemicals, Ecogreen Oleochemicals, Arkema.

The global octyl alcohol market expected to grow at a CAGR of 2.5% during the forecast period.

The Octyl Alcohol Market report covering key are application, and region.

key driving factors in Octyl Alcohol Market are Rising demand for pharmaceutical industry.

The global octyl alcohol market size is expected to reach USD 8.23 billion by 2032.