Open Gear Lubricants Market Size, Share, & Industry Analysis Report

: By Base Oil (Mineral Oil, Synthetic Oil, and Bio Based Oil), By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5687

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

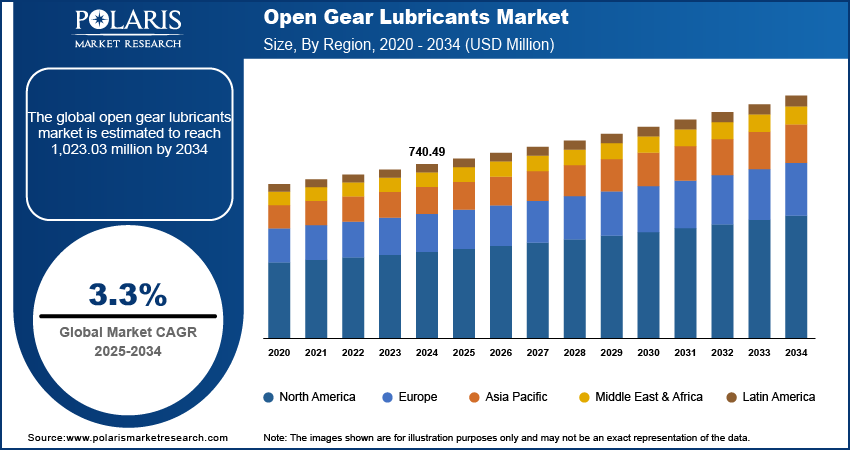

The global open gear lubricants market size was valued at USD 740.49 million in 2024 and is expected to grow at a CAGR of 3.3% during 2025–2034. The mining, cement, and steel industries extensively use large open gear systems in equipment such as ball mills, kilns, and crushers. Growth in these sectors, especially in emerging economies, directly boosts demand for high-performance open gear lubricants.

The open gear lubricants refer to the segment of the industrial lubricants industry that focuses on the production, distribution, and application of specialized lubricants designed for use in open gear systems. Open gears are large, externally toothed mechanical components that operate without an enclosed housing, exposing them to environmental contaminants such as dust, moisture, and temperature extremes. These gears are commonly used in heavy-duty machinery across industries such as mining, cement, steel, pulp & paper, and construction.

Open gear lubricants are formulated to provide high load-carrying capacity, extreme pressure protection, adhesion, and resistance to water washout and corrosion. They help reduce friction, wear, and power loss, thereby extending equipment life and improving operational efficiency.

To Understand More About this Research: Request a Free Sample Report

Many industrial facilities are upgrading older machinery rather than replacing it entirely. These aging systems often require specialized lubrication to maintain efficiency and reliability, supporting the demand for open gear lubricants. Moreover, regulatory bodies are imposing stricter norms regarding equipment efficiency and environmental impact. This encourages the adoption of eco-friendly, energy-efficient, and long-lasting lubricant solutions.

Market Dynamics

Growth in Infrastructure and Construction Activities

Global infrastructure development is accelerating, particularly across Asia Pacific, Latin America, and Africa, where governments and private sectors are investing heavily in roads, railways, ports, and energy projects. For instance, according to U.S. Census Bureau, construction spending in March 2025 was estimated at USD 2,196.1 billion, 2.8% higher than March 2024. Total construction spending for the first quarter of 2025 reached USD 485.7 billion, up 2.9% from the same period in 2024. This surge is boosting demand for heavy construction equipment, much of which relies on open gear systems for operation. These systems require consistent lubrication to prevent wear, reduce friction, and ensure long-term functionality in harsh working environments. As a result, consumption of high-performance lubricants is on the rise, especially in emerging economies where large-scale construction is reshaping urban and industrial landscapes. This trend is encouraging manufacturers to tailor lubricant solutions to meet region-specific operational challenges.

Technological Advancements in Lubricant Formulations

Recent innovations in lubricant technology are significantly enhancing industrial performance and reliability. Synthetic lubricants, solid film coatings, and bio-based alternatives are being engineered to withstand extreme temperatures, pressures, and contamination levels found in demanding environments. These advanced formulations offer superior load-carrying capacity, extended service intervals, and improved resistance to oxidation and thermal degradation. Industrial users are increasingly adopting these next-generation lubricants to minimize downtime and boost efficiency across applications such as mining, manufacturing, and construction. Additionally, environmental regulations and sustainability goals are driving interest in biodegradable and nontoxic lubricant options, further accelerating the shift toward technologically advanced, high-performance lubricant solutions, such as open gear lubricants.

Segment Insights

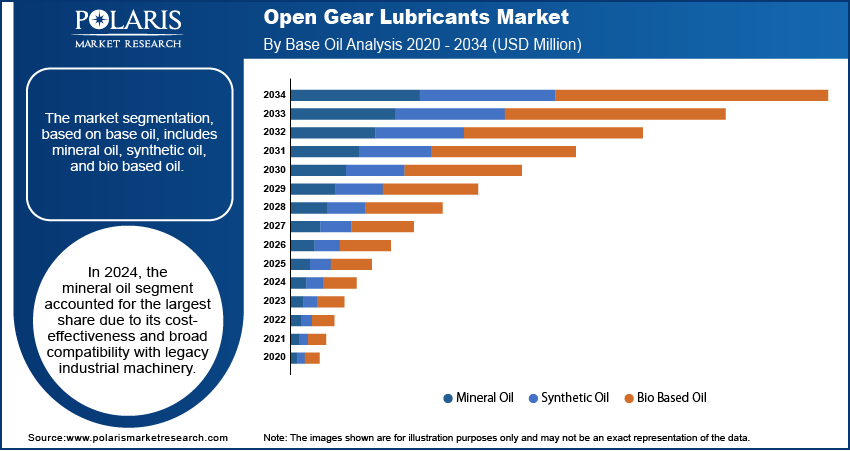

Market Assessment by Base Oil

The segmentation, based on base oil, includes mineral oil, synthetic oil, and bio based oil. In 2024, the mineral oil segment accounted for the largest share due to their cost-effectiveness and broad compatibility with legacy industrial machinery. These lubricants are widely used in heavy-duty applications where maintenance cycles are short and operational budgets are tightly controlled, such as in mid-sized mining and cement plants. Mineral oils also offer sufficient load-carrying capacity and film strength under moderate operating conditions, making them a practical choice in environments where synthetic alternatives are considered excessive. Additionally, well-established supply chains and standardized formulations have made mineral oil lubricants a readily available solution across diverse geographical regions.

Market Evaluation by End-Use Industry

The segmentation, based on end-use industry, includes mining, construction, power generation, oil and gas, cement, marine, and others. The power generation segment is expected to witness the highest CAGR during the forecast period due to the increasing deployment of large-scale wind turbines, hydroelectric stations, and thermal plants. Open gear lubricants play a vital role in maintaining the efficiency and reliability of critical gear-driven equipment such as ball mills, coal pulverizers, and rotary kilns. Growing emphasis on grid reliability and operational uptime is encouraging utilities to invest in high-performance gear lubricants that extend maintenance intervals and withstand variable load conditions. Moreover, the transition toward cleaner energy sources is prompting the upgrade of legacy systems, which often requires more advanced lubrication solutions tailored to newer mechanical configurations.

Regional Analysis

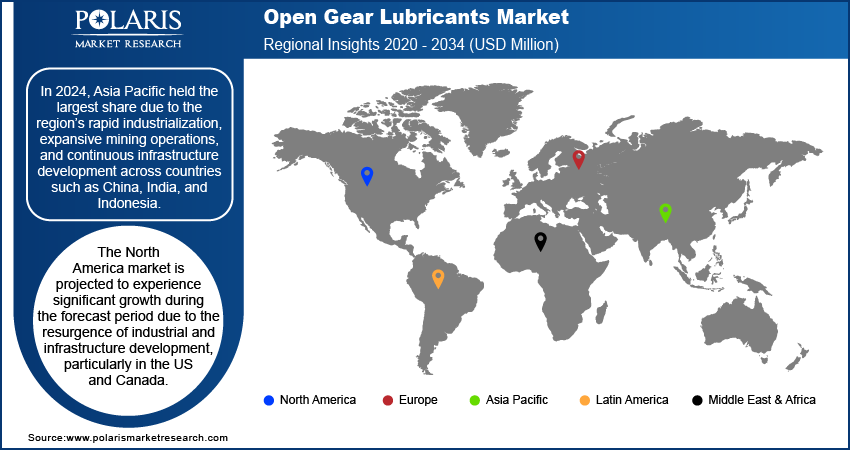

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific open gear lubricants market held the largest share due to the region’s rapid industrialization, expansive mining operations, and continuous infrastructure development across countries such as China, India, and Indonesia. According to the India Brand Equity Foundation, India is expanding its road network significantly, with the government aiming to construct 27,000 km of national highways during FY22–FY25 under the Bharatmala Pariyojana. In FY24 alone, over 10,000 km of highways were completed. Thus, high demand for heavy machinery used in cement manufacturing, steel production, and coal mining has directly contributed to elevated consumption of open gear lubricants. Further, the presence of key manufacturing hubs and favorable government investments in large-scale construction and energy projects are strengthening lubricant demand. The combination of a growing industrial base and a robust aftermarket for maintenance has positioned Asia Pacific as a dominant force in the global market.

The North America open gear lubricants market is projected to experience significant growth during the forecast period due to the resurgence of industrial and infrastructure development, particularly in the US and Canada. Increased investment in renewable energy projects, such as wind and hydroelectric power, along with upgrades to aging thermal power plants, is boosting demand for open gear lubricants used in turbines, mills, and gear-driven equipment. For instnace, according to the American Clean Power, from August 2022 to July 2024, the US clean energy sector reported USD 500 billion in newly committed investments, significantly advancing the transition toward sustainable energy technologies and infrastructure 500 billion in new investments Additionally, the region's robust mining sector, driven by rising demand for critical minerals and metals, is contributing to sustained lubricant consumption. Stringent equipment maintenance standards and a shift toward high-performance, environmentally compliant lubricants are further accelerating growth across North America.

Key Players & Competitive Analysis Report

The competitive landscape of the open gear lubricants market is characterized by intense industry analysis and the implementation of diverse expansion strategies aimed at strengthening global and regional footprints. Companies are actively engaging in joint ventures and strategic alliances to tap into emerging economies and secure raw material access, while mergers and acquisitions are being pursued to consolidate capabilities and broaden lubricant technology portfolios. Post-merger integration is increasingly focused on operational efficiency, global distribution optimization, and harmonization of R&D pipelines.

Technology advancements, especially in the formulation of high-viscosity lubricants with superior film strength, wear protection, and thermal stability, are central to differentiation in this market. Participants are also launching bio-based and synthetic-grade products to align with evolving sustainability standards and industry-specific lubrication requirements across sectors such as cement, mining, and power generation. These innovations are designed to meet the rising demand for extended equipment life, reduced downtime, and high-load gear system performance under extreme conditions. Market players are further refining supply chain strategies and enhancing application-specific product customization to meet the growing demand in both developed and developing regions. The overall landscape is evolving toward more integrated, value-driven offerings shaped by changing industrial lubrication standards and end-user expectations.

Exxon Mobil Corporation is a multinational oil and gas corporation. It was formed in 1999 through the merger of Exxon Corporation and Mobil Corporation, two of the most prominent oil companies in the US. ExxonMobil is headquartered in Irving, Texas. Exxon Mobil is primarily engaged in the exploration, production, refining, and marketing of oil and natural gas, as well as the manufacturing and marketing of petrochemicals and other chemical products. Its core operations span the entire energy value chain. Exxon Mobil is a global energy company with operations in over 70 countries.

Royal Dutch Shell, commonly referred to as Shell, is a global energy and petrochemical industry specializing in oil and gas, chemicals, and energy solutions. The company operates as one of the mobility networks; Shell serves approximately 33 million customers daily across more than 47,000 retail stations worldwide. The company has over 54,000 public electric vehicle (EV) charging points at Shell stations, on-street locations, and key destinations. The company's main operations include oil and natural gas exploration, liquefied natural gas (LNG), gas-to-liquids (GTL) technology, methane emissions management, deep-water exploration, and the development of shale oil and gas. Additionally, it is involved in renewable energy, carbon capture and storage (CCS), and nature-based solutions.

List of Key Companies in Open Gear Lubricants Market

- Bel-Ray Lubricants

- BP P.L.C.

- Carl Bechem GmbH

- Chevron Corporation

- China Petroleum & Chemical Corporation

- CWS Industrials, Inc.

- Exxon Mobil Corporation

- FUCHS SE

- Klüber Lubrications

- Lubriplate Lubricants Company

- Petro-Canada Lubricants LLC

- Petron Corporation

- Shell plc

- Specialty Lubricants Corporation

- TotalEnergies SE

Open Gear Lubricants Industry Developments

In November 2024, FUCHS SE acquired Boss Lubricants GmbH & Co. KG, strengthening its specialty lubricants offerings and boosting its position in the open gear lubricants market.

In November 2024, FUCHS SE completed the acquisition of STRUB & Co. AG, a Swiss lubricants company, gaining direct access to the Swiss market and establishing a local research and production facility.

Open Gear Lubricants Market Segmentation

By Base Oil Outlook (Revenue, USD Million, 2020–2034)

- Mineral Oil

- Synthetic Oil

- Bio Based Oil

By End-Use Industry Outlook (Revenue, USD Million, 2020–2034)

- Mining

- Construction

- Power Generation

- Oil and Gas

- Cement

- Marine

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Open Gear Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 740.49 million |

|

Market Size Value in 2025 |

USD 763.81 million |

|

Revenue Forecast by 2034 |

USD 1,023.03 million |

|

CAGR |

3.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 740.49 million in 2024 and is projected to grow to USD 1,023.03 million by 2034.

The global market is projected to register a CAGR of 3.3% during the forecast period.

In 2024, the Asia Pacific open gear lubricants market held the largest share due to the region’s rapid industrialization; expansive mining operations; and continuous infrastructure development across countries such as China, India, and Indonesia.

A few of the key players in the market are Bel-Ray Lubricants; BP P.L.C.; Carl Bechem GmbH; Chevron Corporation; China Petroleum & Chemical Corporation; CWS Industrials, Inc.; Exxon Mobil Corporation; FUCHS SE; Klüber Lubrications; Lubriplate Lubricants Company; Petro-Canada Lubricants LLC; Petron Corporation; Shell plc; Specialty Lubricants Corporation; and TotalEnergies SE.

In 2024, the mineral oil segment accounted for the largest share due to their cost-effectiveness and broad compatibility with legacy industrial machinery.

The power generation segment is expected to witness the highest CAGR during the forecast period due to the increasing deployment of large-scale wind turbines, hydroelectric stations, and thermal plants.