Synthetic Lubricants Market Share, Size, Trends, Industry Analysis Report

By Type (Polyalkylene Glycol (PAG), Polyalphaolefin (PAO), Esters, Others); By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 115

- Format: PDF

- Report ID: PM4820

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

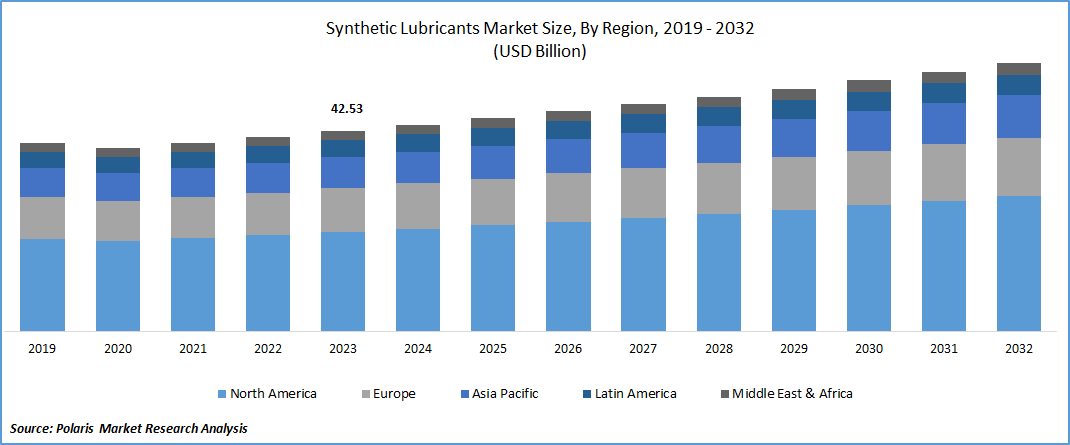

Synthetic Lubricants Market size was valued at USD 42.53 billion in 2023.

The market is anticipated to grow from USD 43.87 billion in 2024 to USD 56.92 billion by 2032, exhibiting the CAGR of 3.3% during the forecast period.

Market Introduction

The synthetic lubricants market size is driven by a focus on energy efficiency. As industries prioritize sustainability, synthetic lubricants offer superior performance, reducing friction and energy consumption in automotive, industrial, and manufacturing applications. Their advanced formulation enhances thermal stability and oxidation resistance, extending equipment life and minimizing downtime. With tightening regulations and a push for operational efficiency, businesses increasingly opt for synthetic lubricants. This shift aligns with broader sustainability goals, making synthetic lubricants essential for environmentally conscious practices worldwide.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in June 2023, Shell launched a new lineup of synthetic engine oils compliant with BS-VI standards, Helix HX6 5W-30 and Shell Helix SUV 5W-30, in India. According to the company, these new oil variants are engineered to offer comprehensive engine protection, improved performance, enhanced fuel efficiency, and prolonged engine lifespan for the passenger car motor oil (PCMO) segment.

Technological advancements drive significant growth in the synthetic lubricants market trends. Innovations in formulation and manufacturing processes have led to high-performance synthetic lubricants surpassing conventional options. These advancements feature innovative base oils, additives, and refining techniques, resulting in lubricants with superior viscosity stability, oxidation resistance, and thermal stability. Synthetic lubricants are now customized to meet specific performance requirements across industries including automotive, aerospace, and industrial machinery. Their ability to withstand extreme conditions, reduce friction, and prolong equipment life fuels adoption in critical applications.

Industry Growth Drivers

Growing Automotive Industry is Projected to Spur the Product Demand

The expanding automotive industry drives the synthetic lubricants market trends. With global automotive growth, there's a rising need for high-performance lubricants to meet modern engine demands. Synthetic lubricants cater to advanced engine designs, including turbocharged engines and vehicles with start-stop systems. They contribute to fuel efficiency and prolong engine life by reducing friction and wear. As automakers aim to meet stringent emissions regulations and enhance fuel economy, synthetic lubricant adoption is expected to increase. Additionally, the rise of electric and hybrid vehicles presents new opportunities for synthetic lubricants in specialized applications.

Rising Industrialization and Manufacturing Activities are Expected to Drive Synthetic Lubricants Market Growth

Industrialization and the expansion of manufacturing activities are key drivers of the market. With global industrialization on the rise, there's an increasing demand for high-performance lubricants capable of withstanding extreme conditions and improving machinery efficiency. Synthetic lubricants, offering superior thermal stability, oxidation resistance, and viscosity control compared to conventional mineral oils, are favored for heavy-duty industrial machinery and automotive engines. Additionally, the focus on energy efficiency and sustainability fuels the adoption of synthetic lubricants, as they reduce friction, wear, and energy consumption, leading to extended equipment lifespan and reduced maintenance costs.

Industry Challenges

Higher Cost Is Likely to Impede the Market Growth

The synthetic lubricants market share faces limitations due to higher costs compared to conventional lubricants. Manufacturing synthetic lubricants is more expensive due to complex formulations and high-quality materials. Consequently, their upfront cost is higher, making them less appealing to price-sensitive consumers and industries. Additionally, the perceived value of synthetic lubricants may not always justify the premium price. Despite their superior properties and long-term savings potential, the higher initial investment can deter adoption, particularly in price-sensitive segments and emerging markets, limiting the market growth.

Report Segmentation

The synthetic lubricants market analysis is primarily segmented based on type, application, end use, and region.

|

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Type Analysis

Polyalphaolefin (Pao) Segment Held Significant Revenue Share in 2023

The polyalphaolefin segment held significant revenue share in 2023 owing to superior performance, wide applicability, and temperature stability. PAO-based lubricants exhibit exceptional characteristics like high viscosity index, oxidative stability, and low volatility, making them versatile across automotive, industrial, aerospace, and marine sectors. With excellent thermal stability, PAO lubricants ensure consistent performance in extreme conditions. Extended service intervals reduce maintenance frequency, while environmental compatibility aligns with regulatory standards. Moreover, PAO lubricants offer enhanced wear protection, reducing friction and extending machinery lifespan. Their adherence to OEM specifications further solidifies their significant revenue share in the market.

By Application Analysis

Engine Oil Segment Held Significant Revenue Share in 2023

The engine oil segment held significant revenue share in 2023 owing to its broad usage across industries like automotive, aerospace, and industrial machinery. Engine oil is indispensable for engine efficiency and longevity, and synthetic lubricants excel in meeting stringent performance demands, including high temperatures and pressures. Their superior properties, such as enhanced viscosity stability and wear protection, make them ideal for engine lubrication. Additionally, synthetic lubricants contribute to fuel efficiency, emission reduction, and longer service intervals, reducing maintenance costs. Continuous innovation and customization further enhance their appeal, catering to diverse engine types, applications, and operational conditions.

By End Use Analysis

Automotive and Transportation Segment Held Significant Revenue Share in 2023

The automotive and transportation segment held significant revenue share in 2023. Synthetic lubricants offer superior performance, extended service intervals, and improved fuel efficiency compared to conventional oils, making them ideal for modern engines. Their ability to withstand extreme temperatures, reduce friction, and provide exceptional protection against wear and corrosion is crucial in demanding automotive environments. Additionally, synthetic lubricants align with OEM recommendations and cater to the evolving needs of complex engine designs. With a growing automotive market globally, the demand for synthetic lubricants continues to rise, driving substantial revenue in this segment.

Regional Insights

Asia-Pacific Region Accounted For a Significant Market Share in 2023

In 2023, Asia-Pacific region accounted for a significant market share. Rapid industrialization and urbanization in countries like China and India propel demand for lubricants across various sectors, including automotive, manufacturing, and construction. Stringent environmental regulations push industries to adopt synthetic lubricants due to their eco-friendly characteristics. Increasing disposable income in the region boosts automotive sales, driving the demand for high-performance lubricants. Moreover, the presence of key market players and expanding distribution networks further solidify the region's dominance.

The market in Europe is influenced by stringent environmental regulations, driving demand for eco-friendly lubricants. The region's focus on technological advancement, particularly in automotive and industrial sectors, fuels the need for high-performance synthetic lubricants. Sustainability priorities among consumers and businesses amplify this demand. With a thriving automotive industry and diverse industrial sectors, including manufacturing and aerospace, synthetic lubricants find extensive application. Increasing awareness about their benefits, coupled with government support for energy efficiency, further propels market growth.

Key Market Players & Competitive Insights

The synthetic lubricants industry encompasses a wide range of participants, and the anticipated entry of new competitors is set to heighten competition. Established frontrunners consistently upgrade their technologies to uphold a competitive edge, focusing on efficiency, dependability, and safety. These companies prioritize strategic initiatives like forging partnerships, enhancing product ranges, and engaging in cooperative ventures. Their objective is to surpass rivals in the sector, securing a notable synthetic lubricants market share.

Some of the major players operating in the global synthetic lubricants market include:

- Amsoil Inc.

- BP plc

- Chevron Corporation

- Exxon Mobil Corporation

- Fuchs SE

- Idemitsu Kosan Co., Ltd.

- LANXESS

- Motul

- Pennzoil

- Penrite Oil Company

- Petroliam Nasional Berhad (PETRONAS)

- Phillips 66

- Royal Dutch Shell plc

- TotalEnergies SE

- Valvoline Inc.

Recent Developments

- In August 2023, Valvoline Global unveiled a new lineup of Valvoline 4-stroke Full Synthetic Premium Motor Oil designed specifically for powersports and marine applications.

- In July 2022, Chevron Marine Lubricants introduced the Clarity Synthetic EA Grease 0, a calcium-thickened lubricant made from biodegradable synthetic esters. This grease complies with the criteria outlined in the 2013 Vessel General Permit (VGP) regulations, established by the U.S. Environmental Protection Agency (EPA) for environmentally acceptable lubricants.

- In June 2022, ExxonMobil Lubricants Pvt launched the Mobil Super, its latest line of passenger vehicle lubricants, featuring enhanced packaging and updated labeling. This advanced series of synthetic lubricants for passenger vehicles incorporates cutting-edge technology to meet the most recent Bharat Stage VI (BS VI) standards while delivering fuel economy advantages through the Mobil Super All-In-One Protection series.

Report Coverage

The synthetic lubricants market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, types, applications, end uses, and their futuristic growth opportunities.

Synthetic Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 43.87 billion |

|

Revenue forecast in 2032 |

USD 56.92 billion |

|

CAGR |

3.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Synthetic Lubricants Market are including Royal Dutch Shell plc, TotalEnergies SE, Amsoil Inc

Synthetic Lubricants Market exhibiting the CAGR of 3.3% during the forecast period.

Synthetic Lubricants Market report covering key segments are type, application, end use, and region.

The key driving factors in Synthetic Lubricants Market are rising Industrialization and manufacturing activities are expected to drive synthetic lubricants market growth

Synthetic Lubricants Market Size Worth $ 56.92 Billion By 2032