Oyster and Clam Market Share, Size, Trends, Industry Analysis Report

By Oyster Type (Slipper Oyster, Pacific Cupped Oyster), By Clam Type, By Form, By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Jul-2023

- Pages: 114

- Format: PDF

- Report ID: PM3612

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

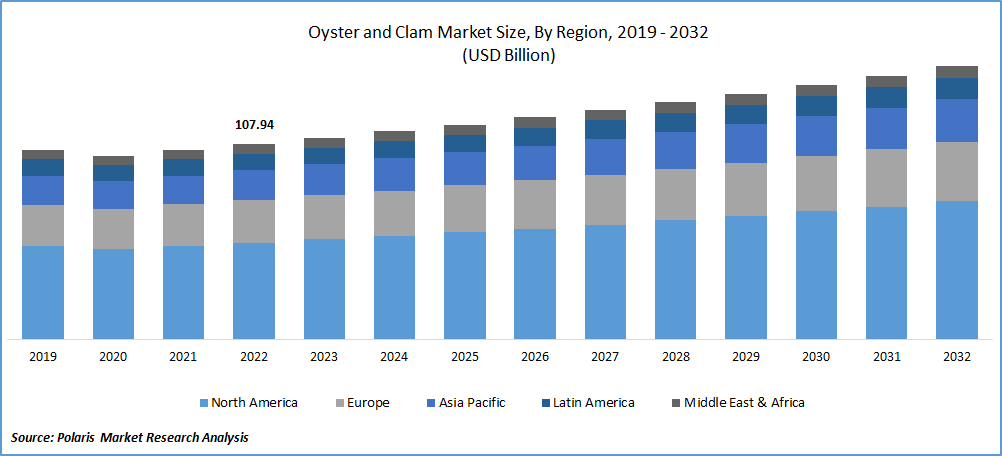

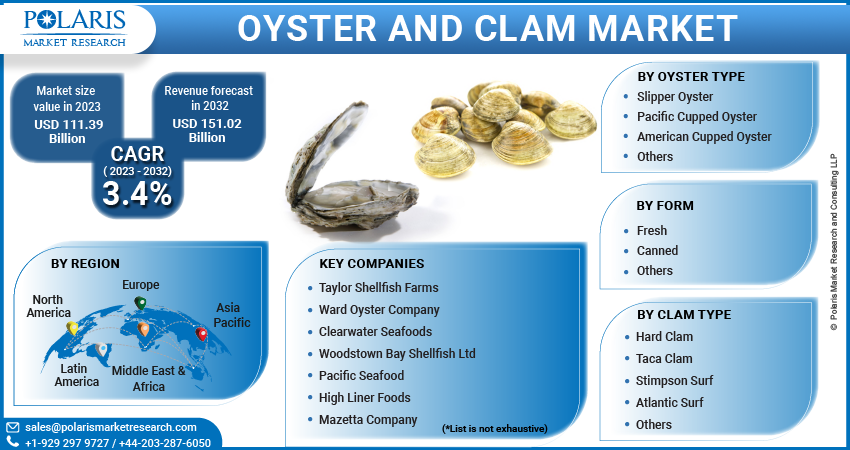

The global oyster and clam market was valued at USD 107.94 billion in 2022 and is expected to grow at a CAGR of 3.4% during the forecast period. The rising popularity of seafood and the increasing awareness of the health benefits provided by clams and oysters are the primary drivers behind the growing demand for these products. Oysters and clams are recognized as valuable sources of essential nutrients. They contain high-quality protein, which is necessary for building and repairing tissues in the body. Additionally, oysters and clams are rich in vitamins and minerals, including iron and zinc. Iron is crucial for maintaining healthy blood and preventing iron-deficiency anemia, while zinc plays a vital role in immune function and wound healing.

To Understand More About this Research: Request a Free Sample Report

Moreover, oysters & clams are considered a healthy food option due to their low-calorie content. It makes them appealing to consumers who are conscious about maintaining a balanced and nutritious diet while enjoying delicious seafood. As a result, the demand for oysters and clams has been steadily increasing, driving the growth of the global oyster and clam market.

The high content of omega-3 fatty acids in oysters and clams is beneficial for brain and heart health. Omega-3 fatty acids have been linked to various health benefits, including reducing the risk of heart disease, improving cognitive function, and promoting overall well-being. The awareness of these health benefits has further fueled the demand for oysters and clams among health-conscious consumers. The farm-to-table movement, emphasizing locally sourced and sustainable ingredients, has gained significant traction in recent years. This trend has led to a surge in demand for locally produced oysters and clams as consumers prioritize supporting local producers and reducing their ecological footprint. By sourcing these shellfish locally, restaurants can offer their customers fresh, high-quality products while promoting sustainability and contributing to the local economy.

For Specific Research Requirements, Speak to Research Analyst

Industry Dynamics

Growth Drivers

Companies in the oyster and clam industry are actively investing in research and development (R&D) to enhance their product's health benefits and sustainability. They are undertaking initiatives such as developing innovative farming techniques to reduce environmental impacts. One example is Taylor Shellfish Farms, a U.S.-based company implementing a recirculating seawater holding system. This system can accommodate approximately 30,000 dozen oysters during critical temperature periods. Such advancements in farming techniques contribute to improved environmental sustainability and enable companies to maintain optimal conditions for their oyster production.

Moreover, to meet the increasing consumer demand for seafood, companies in the industry are expanding their production capacity. They are investing in infrastructure and processes that allow them to double their oysters and clams' output effectively. This expansion is essential to keep pace with the growing market and ensure a consistent supply of these sought-after seafood products.

Report Segmentation

The market is primarily segmented based on oyster type, type, form, and region.

|

By Oyster Type |

By Clam Type |

By Form |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

The Slipper Oyster Segment Dominated the Market in 2022

Slipper oyster segment dominated the market in 2022. Slipper oysters are known for their distinct taste, which sets them apart from other varieties. This unique flavor profile appeals to consumers seeking a premium and exceptional culinary experience. Slipper oysters' perceived quality and premium status allow suppliers to command higher prices, making them appealing to consumers willing to pay a premium for high-quality seafood. Furthermore, slipper oysters offer aesthetic appeal due to their appearance. Their shell shape, size, and visual characteristics make them visually appealing, enhancing their desirability among consumers.

Pacific cupped segment is anticipated to register steady growth rate. The increasing demand for Pacific cupped oysters can be attributed to the growing appreciation of oysters as a gourmet food item. Oysters are increasingly recognized for their unique flavor profile and culinary versatility, leading to a rise in their popularity among consumers. Pacific cupped oysters, specifically, have garnered attention and are sought after by individuals looking to enjoy the distinct qualities of this oyster species. As the appeal of oysters continues to grow, driven by their reputation as a gourmet delicacy, consumers are actively seeking out oysters like the Pacific cupped variety. This increased demand has manifested in both restaurant establishments and seafood markets. Restaurants are incorporating Pacific cupped oysters to cater to the growing consumer interest in these flavorful and versatile shellfish.

The Hard Clam Segment Expected to have Largest Revenue Share During Forecast Period

The hard clam segment is anticipated to witness largest market share in the study period. Hard clams are highly desired in the culinary world due to their combination of taste, texture, and versatility in cooking. Their popularity extends to professional chefs and home cooks who appreciate the briny-sweet taste and enjoy exploring different recipes and cooking techniques to showcase the flavors and textures of hard clams.

Atlantic surf clam registered steady growth. The easy availability of Atlantic surf clams contributes to their growing demand. As per the study done by the Science Center for Marine Fisheries (SCEMFIS) in the U.S. alone, in April 2023, it has been determined that these clams are not at risk of being overfished and are abundantly available for the U.S. market. This availability ensures a consistent supply of Atlantic surf clams, meeting the demands of both retailers and consumers.

Fresh Segment is Expected to Hold the Significant Revenue Share During Forecast Period

Fresh segment is projected to witness a significant revenue share in the coming years. increasing availability and accessibility of fresh oysters and clams. Advancements in transportation and distribution methods have significantly improved access to fresh seafood for consumers who reside far from coastal areas. It has resulted in an increased demand for fresh oysters and clams both in restaurants and retail markets. The ability to obtain fresh shellfish contributes to their desirability and allows consumers to enjoy the optimal taste and quality of these seafood products.

Canned segment expected to register steady growth. Canned seafood, including oysters and clams, is pre-cooked and preserved, making them easy to store and have a longer shelf life than fresh alternatives. This convenience factor appeals to consumers as they can readily have oysters and clams for culinary preparations. The pre-cooked nature of canned shellfish also eliminates the need for extensive preparation, saving time and effort in the kitchen. Moreover, the affordability of canned seafood makes it an appealing option for food service providers such as restaurants and cafeterias. Canned oysters and clams offer a cost-effective solution for incorporating these seafood ingredients into various dishes, allowing businesses to manage their expenses without compromising flavor or quality.

Apac has Witnessed Largest Market Share in 2022

APAC garnered the largest revenue share. The region's growth is attributed to the increasing availability of clams and oysters, rising economic growth, growing disposable income, and the cultural significance of seafood in the region. These factors have stimulated the demand for premium seafood products, making clams and oysters highly sought-after items in the region.

North America is projected to witness the higher growth rate for the market. This growth is driven by the increasing number of food service and retail outlets offering various oyster and clam products, catering to diverse consumer preferences. Launching innovative web services and using promotional strategies by companies like Island Seafood Co. further contribute to the market's expansion by enhancing accessibility and creating appealing experiences for consumers.

Competitive Insight

Some of the major players operating in the global market include Taylor Shellfish Farms, Ward Oyster Company, Clearwater Seafoods, Woodstown Bay Shellfish Ltd., Pacific Seafood, High Liner Foods, Mazetta Company, Pangea Shellfish, Colville Bay Oyster Co. Ltd., Five Star Shellfish Inc., Royal Hawaiian Seafood, and Island Creek Oysters.

Recent Developments

- In December 2021, Island Seafood introduced a web service portal. This online platform enables customers to conveniently order packages of 10, 20, or 50 oysters for delivery throughout Canada. In addition, the company has introduced an enticing promotional party package. This package includes complementary items such as a shucking knife, beer, charcuterie, and a curated music playlist. These offerings stimulate demand for the company’s oyster products and services by providing customers with a comprehensive and enjoyable experience.

Oyster and Clam Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 111.39 billion |

|

Revenue forecast in 2032 |

USD 151.02 billion |

|

CAGR |

3.4 % from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Oyster Type, By Clam Type, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Taylor Shellfish Farms, Ward Oyster Company, Clearwater Seafoods, Woodstown Bay Shellfish Ltd., Pacific Seafood, High Liner Foods, Mazetta Company, Pangea Shellfish, Colville Bay Oyster Co. Ltd., Five Star Shellfish Inc., Royal Hawaiian Seafood, and Island Creek Oysters. |

FAQ's

The Oyster and Clam Market report covering key are oyster type, type, form, and region.

Oyster and Clam Market Size Worth $ 151.02 Billion By 2032.

The global oyster and clam market expected to grow at a CAGR of 3.4% during the forecast period.

Asia Pacific is Oyster and Clam Market.

key driving factors in Oyster and Clam Market are Increasing investment in R&D and Production expansion by market players.