Petroleum Sorbent Pads Market Size, Share, Trends, Industry Analysis Report

By Material Type (Organic, Inorganic, Synthetic), By Absorbency, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5981

- Base Year: 2024

- Historical Data: 2020-2023

Overview

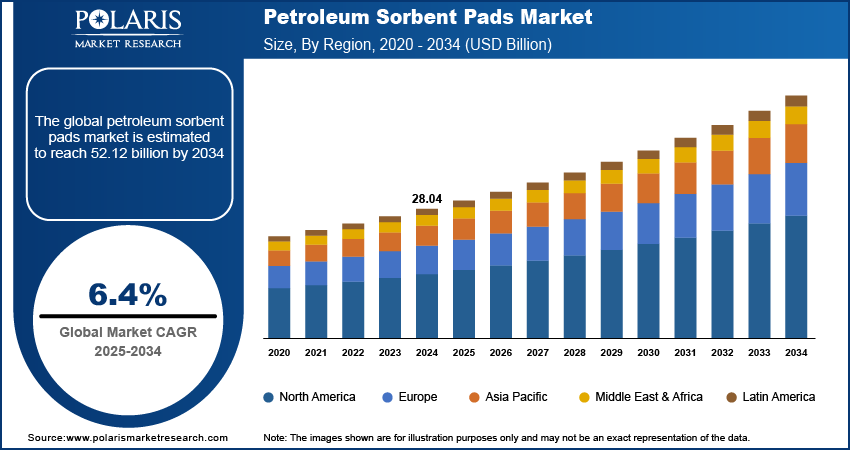

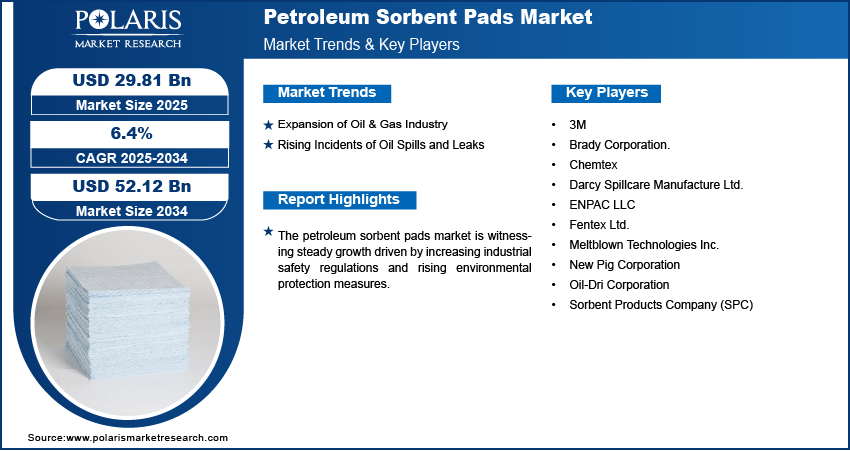

The global petroleum sorbent pads market size was valued at USD 28.04 billion in 2024, growing at a CAGR of 6.4% from 2025 to 2034. Key factors driving demand for petroleum sorbent pads include the growing pace of industrialization and infrastructure development, growth of the oil & gas industry, and the increasing incidents of oil spills and leaks.

Key Insights

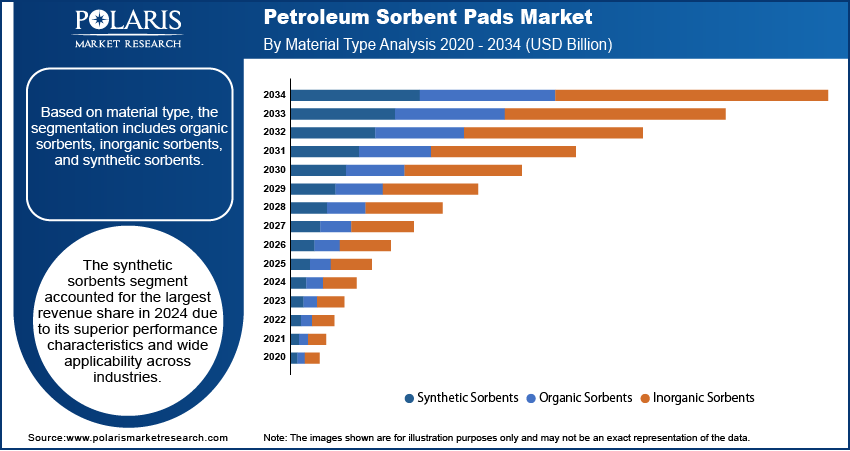

- The synthetic sorbents segment accounted for the largest revenue share in 2024.

- The transportation & logistics segment is expected to witness the fastest growth during the forecast period.

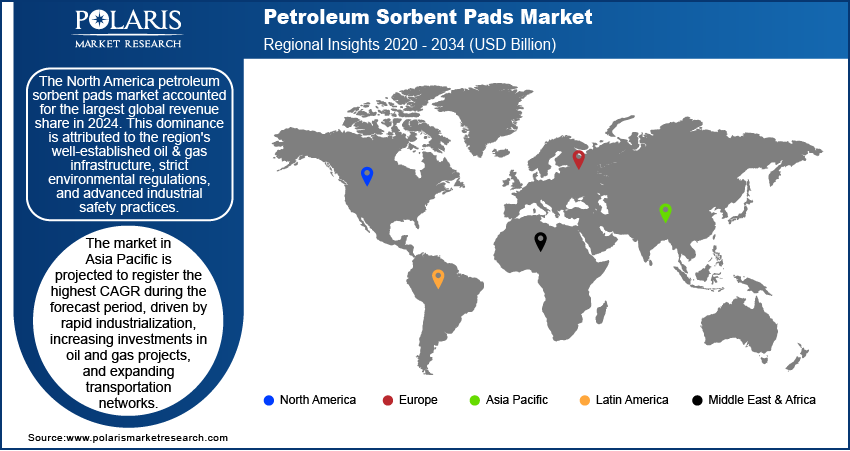

- North America accounted for the largest revenue share of the global petroleum sorbent pads market in 2024.

- The U.S. held the largest share of North America petroleum sorbent pads landscape in 2024.

- The market in Asia Pacific is projected to register the highest CAGR during the forecast period.

- The market in China is expanding due to rapid industrialization, increasing oil handling activities, and increased regulatory focus on environmental protection.

To Understand More About this Research: Request a Free Sample Report

Petroleum sorbent pad is a type of absorbent material designed specifically to clean up petroleum-based liquids such as oil and fuel. These pads are increasingly utilized across various industrial sectors for effective spill containment and cleanup. The growing pace of industrialization and infrastructure development is boosting the growth opportunities. According to the IMF's January 2025 report, global industrial production (IP) growth rose to 2.0% in the first three quarters of 2024, up from 0.9% in 2023. Emerging markets (EMDEs) drove the increase with 3.3% growth. The risk of oil leakage, lubricant spillage, and related hazards increases as heavy machinery, manufacturing plants, and construction sites proliferate. This has created a critical need for effective containment solutions to ensure operational continuity and protect on-site equipment and ecosystems. Consequently, the demand for petroleum sorbent pads is rising, as they offer a quick, efficient, and cost-effective method for managing industrial spills.

The increasing awareness of environmental protection and workplace safety regulations is driving the adoption of petroleum sorbent pads. Regulatory frameworks in many regions now mandate strict compliance with spill response protocols to minimize environmental contamination and ensure employee safety. According to a November 2024 report by the U.S. Department of Labor, private sector employers reported 2.6 million nonfatal occupational injuries in 2023. Organizations across various sectors are thus pushed to adopt preventive and responsive measures, with sorbent pads emerging as the preferred choice due to their portability, ease of use, and high absorbency. This growing focus on responsible environmental management and occupational health is reinforcing the growth by positioning sorbent pads as essential safety equipment in industrial and commercial operations.

Industry Dynamics

- The oil & gas industry expansion directly correlates with rising demand for spill control solutions, such as petroleum sorbent pads.

- Recurrent spills from technical or human failures amplify the urgency for advanced containment systems.

- Strict environmental regulations are increasing compliance costs for sorbent pad manufacturers. Companies must invest in eco-friendly materials and certifications, squeezing profit margins while meeting sustainability standards.

- Growing demand in emerging markets offers expansion potential. Rising industrial activity and new oil/gas projects in these regions create new demand for cost-effective spill solutions.

Expansion of Oil & Gas Industry: The growth of the oil & gas industry is driving an increase in demand for spill containment and remediation products, such as petroleum sorbent pads. According to a March 2025 IEA report, global oil demand is expected to grow by just over 1 million barrels per day (mb/d) during 2025, up from an increase of 830,000 barrels per day (kb/d) in 2024. This would bring the total oil demand in 2025 to 103.9 mb/d. Additionally, natural gas demand grew by 2.5% during 2024. The probability of petroleum-based fluid discharge increases with the expansion of upstream and downstream activities, ranging from exploration and drilling to refining and distribution, occurring on a broader scale. Sorbent pads provide a reliable and easy-to-deploy solution for minimizing these risks by absorbing hydrocarbons without retaining water, making them indispensable in both onshore and offshore operations. Thus, reinforcing the relevance of petroleum sorbent pads in routine safety and maintenance protocols as energy producers expand their global footprint, the necessity for spill management tools grows.

Rising Incidents of Oil Spills and Leaks: The increasing number of oil spill and leak incidents, resulting from equipment failure, human error, or natural disasters, highlights the growing need for rapid-response containment solutions. According to a 2024 ITOPF report, tanker incidents resulted in six large oil spills, each exceeding 700 tonnes, and four medium spills, ranging from 7 to 700 tonnes. These incidents occurred in various locations, including Asia, West Africa, and the Mediterranean, with most of the large spills taking place in the second and third quarters of 2024, highlighting ongoing regional risks in high-traffic maritime routes. Such spills pose severe threats to ecosystems, human health, and corporate reputations, driving the need for immediate intervention to limit the spread and impact of contaminants. Petroleum sorbent pads are widely adopted in these scenarios for their high absorbency, portability, and compatibility with various oil-based substances. Their ability to support compliance with environmental standards and minimize cleanup times has made them a critical component of emergency response kits, thereby fueling their demand across sectors vulnerable to accidental discharges.

Segmental Insights

Material Type Analysis

Based on material type, the segmentation includes organic sorbents, inorganic sorbents, and synthetic sorbents. The synthetic sorbents segment accounted for the largest revenue share in 2024 due to its superior performance characteristics and wide applicability across industries. Synthetic materials such as polypropylene are preferred for their high oil absorbency, water repellency, and durability under harsh operating conditions. These sorbents are engineered to absorb multiple times their weight in hydrocarbons, making them highly efficient for large-scale industrial use. Their lightweight nature, chemical resistance, and ability to be reused or burned after use further enhance operational convenience and cost-effectiveness, positioning them as the preferred choice for spill response and environmental management applications.

Absorbency Analysis

In terms of absorbency, the segmentation includes less than 5 oz, 5–10 oz, and above 10 oz. The above 10 oz segment is projected to witness robust growth by 2034, driven by the increasing need for high-capacity spill response products in heavy-duty industrial and transportation operations. Larger-scale oil handling facilities and high-risk environments require sorbent pads that absorb substantial quantities of petroleum products in a single application. These high-absorbency pads reduce the number of materials needed during spill events, improving response efficiency and reducing labor costs. Additionally, the growing scale of industrial infrastructure and the focus on rapid containment are reinforcing demand for sorbents with higher fluid absorbance capacities.

End Use Analysis

The segmentation, based on end use, includes oil & gas, transportation & logistics, industrial & manufacturing, and others. The transportation & logistics segment is expected to witness the fastest growth during the forecast period due to the increasing movement of petroleum-based products via road, rail, and maritime routes. The potential for spills during loading, unloading, and transit has grown, as supply chains expand globally. Companies are prioritizing preventive safety measures and spill response tools to comply with environmental regulations and maintain operational continuity. Moreover, petroleum sorbent pads provide an effective and immediate solution for managing accidental spills during transportation, making them essential in warehouses, shipping yards, and freight terminals.

Regional Analysis

The North America petroleum sorbent pads market accounted for the largest global revenue share in 2024. This dominance is primarily attributed to the region's well-established oil and gas infrastructure, strict environmental regulations, and advanced industrial safety practices. The widespread presence of refineries, pipelines, and drilling operations has led to the consistent adoption of spill management solutions. According to an IADC report published in March 2025, 74 drilling contractors contributed data to the Incident Statistics Program in the U.S. in 2024, collectively reporting 418.38 million person-hours of operational activity. Furthermore, regulatory agencies in the region enforce strict standards for spill preparedness and environmental protection, driving the routine use of sorbent products across industrial and transportation sectors. These factors collectively support the dominant market position of North America.

U.S. Petroleum Sorbent Pads Market Insight

The U.S. held the largest regional market share in 2024 due to its extensive oil and gas infrastructure, high frequency of industrial operations, and strict environmental safety regulations. The country's robust regulatory framework emphasizes rapid spill response and workplace safety, encouraging the widespread deployment of petroleum sorbent pads. Additionally, the presence of established manufacturing and logistics sectors supports consistent demand for effective absorbent solutions across diverse end-use industries.

Asia Pacific Petroleum Sorbent Pads Market Trends

The market in Asia Pacific is projected to register the highest CAGR during the forecast period, driven by rapid industrialization, increasing investments in oil and gas projects, and expanding transportation networks. In April 2025, the Union Budget 2025-26 allocated USD 640.46 million to the Petroleum and Natural Gas Ministry for Phase II of ISPRL, which aims to expand India's underground crude storage capacity by converting two caverns into strategic reserves. The increasing focus on environmental compliance and workplace safety across emerging economies is contributing to the greater adoption of sorbent technologies. The demand for reliable, cost-effective spill containment solutions such as petroleum sorbent pads is expected to increase as the region continues to develop its energy and logistics infrastructure. Additionally, the growing awareness of environmental impacts and spill mitigation is also influencing this accelerated regional growth.

China Petroleum Sorbent Pads Market Overview

The market in China is expanding due to rapid industrialization, increasing oil handling activities, and rising regulatory focus on environmental protection. The risk of petroleum leaks and spills has grown, necessitating efficient spill response mechanisms as the country continues to invest in infrastructure and renewable energy projects. Growing awareness of environmental sustainability and compliance with national safety standards is also prompting industries to adopt petroleum sorbent pads as part of their standard operational protocols.

Europe Petroleum Sorbent Pads Market Assessment

The market in Europe is shaped by strong environmental regulations, a high focus on sustainability, and active participation in clean-up initiatives. Industries in the region prioritize eco-friendly practices and invest heavily in technologies that align with the principles of a circular economy. European regulations concerning hazardous waste management and spill control are among the most rigorous globally, necessitating the use of efficient and compliant sorbent materials. As a result, the market is characterized by innovations in biodegradable sorbents and a shift toward sustainable product offerings that reduce ecological footprints while maintaining high performance.

Germany Petroleum Sorbent Pads Market Assessment

The petroleum sorbent pads industry in Germany plays a key role in Europe, driven by its strong commitment to environmental stewardship and compliance with industrial safety standards. The country’s well-regulated industrial ecosystem promotes the use of advanced spill control products, including high-performance sorbents. German industries are actively integrating petroleum sorbent pads to minimize environmental risks and support sustainable operational practices, with a focus on eco-friendly manufacturing and spill prevention technologies.

Key Players and Competitive Analysis

The petroleum sorbent pads sector is witnessing strategic investments and revenue growth, driven by rising demand in emerging markets and strict environmental regulations. Major players are leveraging competitive intelligence to capitalize on latent demand, particularly from small and medium-sized businesses adopting spill management solutions. Developed markets remain dominant, but economic and geopolitical shifts are accelerating adoption in Asia and the Middle East. Disruptions and trends such as biodegradable materials and IoT technology-integrated pads are reshaping sustainable value chains, while technological advancements enhance absorption efficiency. Consequently, vendor strategies focus on expanding opportunities through partnerships and targeting regional market sizes. Revenue opportunities lie in serving niche segments, such as the marine and industrial sectors, with future development strategies highlighting R&D for high-performance materials. Furthermore, expert insights highlight the necessity for agile business transformation to mitigate supply chain disruptions and maintain a competitive edge in this rapidly evolving landscape.

A few major companies operating in the petroleum sorbent pads market include 3M, Brady Corporation, Chemtex, Darcy Spillcare Manufacture Ltd., ENPAC LLC, Fentex Ltd., Meltblown Technologies Inc., New Pig Corporation, Oil-Dri Corporation, and Sorbent Products Company (SPC).

Key Players

- 3M

- Brady Corporation.

- Chemtex

- Darcy Spillcare Manufacture Ltd.

- ENPAC LLC

- Fentex Ltd.

- Meltblown Technologies Inc.

- New Pig Corporation

- Oil-Dri Corporation

- Sorbent Products Company (SPC)

Industry Developments

- June 2025: Sellars, a Milwaukee-based manufacturer of absorbents and wipers, invested USD 15 million to open a 100,000-sq-ft production facility in Milwaukee. The site includes two machines and will create 20 jobs in operations, maintenance, and logistics.

- March 2025: Wilhelmsen launched the SORBENT PADS U9450, designed for rapid oil spill containment. With extremely high absorption rates, these pads work quickly and efficiently, even when fully saturated. Their durable shape ensures easy handling, while the larger size tackles widespread spills effectively.

Petroleum Sorbent Pads Market Segmentation

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Organic Sorbents

- Inorganic Sorbents

- Synthetic Sorbents

By Absorbency Outlook (Revenue, USD Billion, 2020–2034)

- Less than 5 oz

- 5–10 oz

- Above 10 oz

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Oil & Gas

- Transportation & Logistics

- Industrial & Manufacturing

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Petroleum Sorbent Pads Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 28.04 Billion |

|

Market Size in 2025 |

USD 29.81 Billion |

|

Revenue Forecast by 2034 |

USD 52.12 Billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 28.04 billion in 2024 and is projected to grow to USD 52.12 billion by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

North America dominated the market in 2024.

A few of the key players in the market are 3M, Brady Corporation, Chemtex, Darcy Spillcare Manufacture Ltd., ENPAC LLC, Fentex Ltd., Meltblown Technologies Inc., New Pig Corporation, Oil-Dri Corporation, and Sorbent Products Company (SPC).

The synthetic sorbents segment accounted for the largest revenue share in 2024.

The transportation & logistics segment is expected to witness the fastest growth during the forecast period.