Phenolic Resins Market Size, Share, Trends, Industry Analysis Report

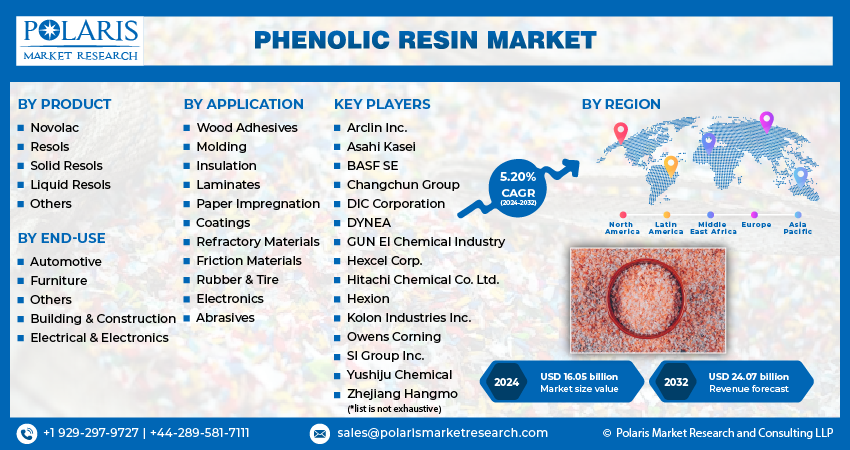

By Product (Novolac, Resols, Other Phenolic Resins), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM1512

- Base Year: 2024

- Historical Data: 2020-2023

Overview

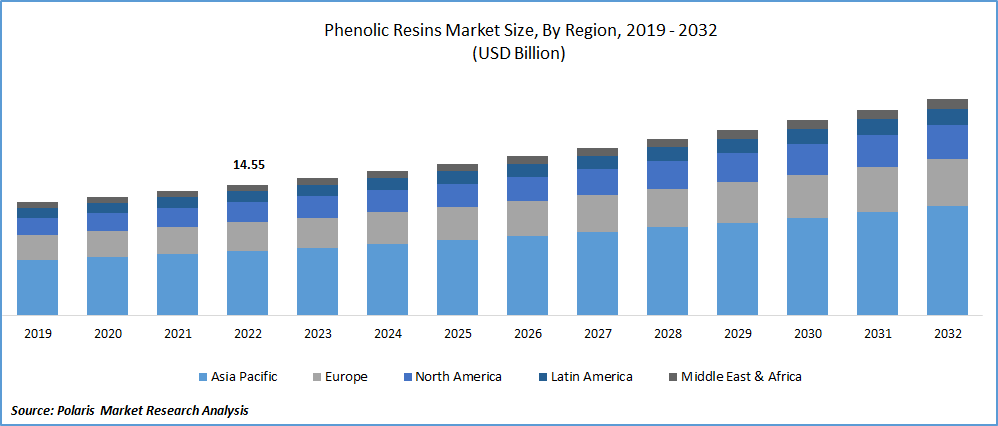

The global phenolic resins market size was valued at USD 16.36 billion in 2024, growing at a CAGR of 4.0% from 2025 to 2034. Key factors driving industry growth include rising demand for fire-safe materials, automotive industry expansion, sustainable insulation & engineered wood products, and demand for rubber & friction materials in transportation.

Key Insights

- The novolac segment captured a revenue share of 47.65% in 2024. This is due to its increased utilization in applications that require excellent mechanical strength, heat stability, and chemical resistance.

- The molding applications segment is projected to grow at highest CAGR, reaching 6.8% during the forecast period. This is due to the demand for lightweight and durable heat-resistant applications from various industries continuous to increase.

- The automotive applications segment led with a market share of 42.48% in 2024, attributed to the important role of phenolic resins in automotive friction materials, composite components, and high-temperature parts.

- In 2024, North America accounted for 29.77% of global phenolic resin demand. This is due to robust demand from end-use sectors that support high-performance materials.

- U.S. accounted for 77.76% of consumption in the region in 2024, with end-use sectors such as the construction, automotive, and aerospace industries experiencing strong demand.

- The Asia Pacific market is expected to grow at a CAGR of 6.2% between 2024 and 2034 driven by expeditious industrialization, infrastructure investments, and growth in automotive and electronics manufacturing in the region.

- India's market growth reflects the increasing utilization of engineered wood products in plans for growing infrastructure projects in residential and commercial construction applications.

Industry Dynamics

- The rise in demand for eco-friendly insulation and engineered wood has increased the use of phenolic resin due to its fire resistance and durability, which are ideal for insulation foams and wood products, supporting green building trends.

- Phenolic resins are essential for brake linings and rubber parts in vehicles due to their heat and wear resistance meet strict performance needs in automotive applications.

- Fluctuating prices and supply chain disruptions of inputs such as phenol and formaldehyde impact profit margins, which create price instability for manufacturers.

- The growing demand for eco-friendly materials in the construction and automotive sectors addresses environmental concerns by developing sustainable, lignin-modified phenolic resins from renewable biomass.

Market Statistics

- 2024 Market Size: USD 16.36 billion

- 2034 Projected Market Size: USD 24.16 billion

- CAGR (2025–2034): 4.0%

- North America: Largest market in 2024

Phenolic resins are synthetic polymers which are produced by the reaction of phenol with formaldehyde. They have good thermal stability and mechanical properties, and they exhibit flame resistance. The need for fire-safe materials across sectors is driving growth in the use of phenolic resins. Their flame-retardance, low smoke generation, and retention of structural integrity when exposed to high temperatures make them an ideal material when fire-safety must be considered. Their recent demand for rapid adoption is for laminates, insulation panels, and coatings. Furthermore, regulations and standards concerning safety in the construction, transportation, and electrical & electronics markets also align with the adoption of phenolic resins. In parallel to these sectors developing, the market will take its place in the adoption of phenolic resins as the industries trend toward fire-safe alternatives.

Automotive industry's shift toward lightweight, durable, and high-performance materials is increasing. Phenolic resins are fundamental in improving efficiency, performance, and safety in applications such as brake pads, clutch facings, under-the-hood parts, and composites. For instance, in November 2022, LF GmbH & Co. KG, unveiled its LIQFRIC technology for brake systems that reduces CO2 emissions by 85% and minimizes fine particle emissions (PM10). This alternative technology is intended for sustainable automotive brake systems and automotive clutch facings with closed material loops. Specifically, phenolic resins can withstand high temperatures, reduce wear and tear on contacting surfaces, and maintain dimensional stability under dynamic loads, which are essential qualities in next-generation vehicles. Additionally, as the automotive sector shifts towards energy-efficient and sustainable alternatives, phenolic resins can contribute toward weight reduction and enhanced fuel consumption, which are key objectives for the industry to achieve over the long term. In both instances, the relevance of phenolic resins will grow, demonstrating a balance between performance demands and factors that constrain materials use in the automotive sector.

Drivers & Opportunities

Sustainable Insulation & Engineered Wood Products Driving Growth: The increased focus on sustainable insulation and engineered wood products has boosted the expansion opportunities. These materials increasingly align with global sustainability and energy-efficiency goals. Phenolic resins are widely utilized in the production of insulation foams, particleboards, and plywood due to their excellent bonding strength, durability, and inherent fire resistance. Manufacturers are turning to phenolic resin-based solutions to meet both performance and environmental standards, with stricter building codes and a rising focus on green construction. For instance, the 2024 German Building Energy Act imposes stringent efficiency standards, requiring new buildings to reduce primary energy demand to 55%. It also required that 65% of new building heating systems should be based on renewable energy. The low thermal conductivity and high dimensional stability provide outstanding insulation performance, while the durability and moisture resistance promote confidence in new engineered wood products as manufacturers continue to pursue alternate, yet high performance building materials.

Demand for Rubber & Friction Materials in Transportation: The transportation sector's increasing demand for rubber and friction materials enhances growth prospects. Its crucial role in manufacturing brake linings, clutch facings, and other rubber products is attributed to these materials' ability to provide heat resistance, wear resistance, and mechanical stability in rigorous conditions. In August 2024, allnex launched ALNOVOL PN 870, a cobalt- and resorcinol-free phenolic resin, for tire and rubber applications. The product improves adhesion, aging resistance, and processability while addressing environmental concerns associated with previous systems. Phenolic resins for friction materials will deliver reliability and durability for automotive applications to support vehicles with increased performance requirements and higher safety standards. The lightweighting trend in transportation will also support phenolic resin-based composites' use without compromising strength. Thus, the combination of performance, safety, and efficiency reinforces the importance of phenolic resins as a key material to address the changing demands of contemporary transportation systems.

Segmental Insights

Product Analysis

The segmentation based on product type consists of novolac, resols, and other phenolic resins. The novolac segment held a revenue share of 47.65% in 2024 due to significant usage in applications that demand high levels of mechanical strength, thermal stability, and chemical resistance. Novolac resins are popular for coatings, adhesives, and molding compounds due to their stable molecular structure that halogenated structures can be cured by hexamethylenetetramine (HMTA). Additionally, novolac resins have important value due to superior bonding capabilities and wear resistance in friction materials and abrasives in the automotive and construction industries. The market position of novolac resins is supported further by superior dimensional stability providing reliability in high-temperature and adverse environments

Resols are projected to exhibit a CAGR of 5.7 % during the forecast period as a result of their versatility and efficiency in a range of applications. This is due to the fact that resols self-cure with heat and pressure, they are being used in insulation applications, laminates, and wood adhesives where ease of processing and high-bonding strength is essential. Furthermore, their ability to cure rapidly and provide excellent heat resistance make laughts their ideal use for high-performance industrial applications. Thus, the durable materials for construction and the electrical industry supports their use geometric resins as a successful growth phenomenon within the overall phenolic resins system.

Application Analysis

In terms of application, the segmentation includes wood adhesives, molding, insulation, laminates, paper impregnation, coatings, refractory materials, friction material, rubber & tire, electronics, and abrasives. The wood adhesives segment dominated the market with 22.83% revenue share. This is attributed to the rise demand for engineered wood products, such as furniture. Phenolic resins are particularly sought after in wood adhesives, given their performance properties such as high bond strength, water resistance, and durability, which are important for various engineered wood products such as, particleboards, plywood, laminated veneer lumber. Phenolic-based adhesives provide reliability concerning their performance properties and are environmentally driven, as demand for high-performance furniture and sustainable construction continues to increase. Furthermore, along with performance attributes, phenolic-based adhesives resist high-temperature and moisture-based conditions, which provides excellent performance and reliability with long-lasting properties, resulting in increased use in various wood uses across residential, commercial, and industrial-based uses.

Molding segment is projected to witness the highest CAGR of 6.8% by 2034. This is attributed to the demand for lighter, stronger, and heat resistant molded components have gained acceptance. Phenolic molding compounds are typically utilized in the production of electrical housings, automotive components, and household appliances owing to their mechanical strength and superior insulating properties. Furthermore, phenolic resin-based molded solutions provide a viable cost-competitive option as industries focus on materials that provide safety, performance, and design flexibility.

End Use Analysis

The segmentation comprises building and construction, automotive, electrical and electronics, furniture, and other uses. The automotive segment dominated the segment in 2024, with a revenue share of 42.48% due to the high utilization of phenolic resins in friction materials, lightweight composites, and under-the-hood parts. The phenolic resins resist high temperatures, offer wear resistance, and provide safety during rigorous operating conditions are vital to automotive manufacturing. Phenolic resins contribute to increased efficiency and safety of automobiles through applications ranging from brake pads and clutch facings to structural composites. The industry's focus on lightweighting and performance improvement further encourages the usage of phenolic resins, reinforcing industry leadership within this segment.

It is anticipated that the building & construction segment is expected to witness significant growth at a CAGR of 5.5% over the forecast period, driven by the need for long-lasting infrastructures that use fire-resistant and energy-efficient materials. Phenolic resins have moisture resistant, thermal stability, and durability properties, and are used in insulation, laminates, and engineered wood products. The use of these resins is being driven by a need for sustainable construction practices and adherence to strict safety regulations. Moreover, large scale infrastructure development projects in urban settings are still supporting an increase in the need for phenolic resins as a critical material in the changing construction environment.

Regional Analysis

In 2024, the North America phenolic resins market represented 29.77% of the global market. This can be attributed to North America having significant demand from construction, automotive, and electronics - all performance required markets. Stringent safety requirements and fire resistant standards in building and transport applications have helped create a large potential market for phenolic resins. Furthermore, advances in engineered wood products and insulation material developments have further supported the use of phenolic resins in North American construction.

U.S. Phenolic Resins Market Insights

The U.S. captured 77.76% of North America phenolic resins market share in 2024. This is due to significant demand from construction, automotive, and aerospace. The U.S. demand is motivated by energy efficiency, focus on fire-safe materials, and engineered wood product development.

Asia Pacific Phenolic Resins Market Trends

The Asia Pacific region is anticipated to witness a CAGR of 6.2% over the forecast period. This is due to the rapidly increasing industrialization and infrastructural development seen in the region, as well as significant growth in automotive and electronics manufacturing in the region. A report published by NITI Aayog in July 2024 stated that the electronics industry in India has experienced phenomenal growth, reaching a market size of USD 155 billion in FY23, with the production output sector reaching USD 101 billion in FY23. This growth indicates that this industry has a vast number of opportunity for growth. This growth in demand for high-performance adhesives, laminates, and molding compounds is anticipated to assist in advancing the adoption of phenolic resins. Moreover, the growing construction industry in this region with the continuous preference for energy-efficient insulation products will support growth further.

India Phenolic Resins Market Overview

Rapid infrastructure development, along with the increasing adoption of engineered wood products in residential and commercial construction, is contributing to the expansion in India. Factors such as urbanization and the growing requirement for durable and economical products have also increased the use of phenolic resins in adhesives, laminates and insulation. In addition, the expanding automotive sector is reflected in the market growth, as phenolic resins have significant applications in friction materials and high-performance composites.

Europe Phenolic Resins Market Outlook

In 2024, Europe's contribution to the global phenolic resins market stood at 24.43%. The market is shifting due to the growing interest relating to sustainability, energy efficiency, and strict safety standards from leading edge companies spanning throughout Europe's industries. The higher rates of ethyl phenol resins usage, in construction, insulation, laminates, and wood applications, for instance, can be attributed to European support for green building practices and strict industrial safety regulations. Furthermore, through these industries, Europe demands high performing phenolic resins, which drives the market share expectations on the global scale.

Germany Phenolic Resins Market Analysis

Germany largely drives this emerging market as it's an automotive and industrial manufacturing hub, where phenolic resins are heavily relied upon for high-performing applications. The growth, largely due to its attention to precision engineering and strict safety standards, has been in wide use for friction materials, coatings, and molding. In addition, the demand for energy efficiency in construction materials and demand for innovative insulation solution over the past several years have likewise increased demand prospects for energy efficiency opportunities associated with phenolic resins. The cumulative consumption attributable to automotive applications represents a larger market share to even the countries participating in the European phenolic resins market.

Key Players & Competitive Analysis

The phenolic resins sector is witnessing competition. This is due to the new markets entrants which are developing and value chains become more sustainable. Companies like BASF SE and Sumitomo Bakelite are making strategic investments in bio-based polymers as responses to economic and geopolitical drivers, as well as addressing precision environmental requirements. While developed markets continue to be important for high-performance applications pertaining to automotive and electronics, growth projections signify Asia Pacific as being a hotbed due to emerging industrialization.

Competition intelligence and strategic pathways are changing through disruption and trends; for instance, there is now systematic pressure for cobalt-free adhesives in tires. Small and medium businesses are focusing on niche segments such as wood adhesives, while larger businesses are focusing on opportunities for growth to improve technological advances.

A few major companies operating in the phenolic resins industry include Arclin Inc., Arizona Chemical Company LLC (Kraton Corporation), Ashland Inc., BASF SE, DIC Corporation, Georgia Pacific Chemicals, Hexcel Corp., Hexion, Hitachi Chemical Co. Ltd, Kolon Industries Inc., Momentive Specialty Chemicals (Hexion Inc), Olympic Panel Product LLC, Owens Corning, SI Group, and Sumitomo Bakelite Co. Ltd.

Key Players

- Arclin Inc.

- Arizona Chemical Company LLC (Kraton Corporation)

- Ashland Inc.

- BASF SE

- DIC Corporation

- Georgia Pacific Chemicals

- Hexcel Corp.

- Hexion

- Hitachi Chemical Co. Ltd

- Kolon Industries Inc.

- Momentive Specialty Chemicals (Hexion Inc)

- Olympic Panel Product LLC

- Owens Corning

- SI Group

- Sumitomo Bakelite Co. Ltd.

Phenolic Resins Industry Developments

- June 2025: Sumitomo Bakelite commercialized the world's first solid Novolac-type phenolic resin modified with lignin from non-edible biomass. Targeting automotive applications, this innovation supports GHG reduction and resource circulation while maintaining performance standards, aligning with global sustainability goals.

- February 2025: the Phéno-recycle project by ICGM and Saint-Gobain developed novel methods to recycle phenolic resin waste, traditionally incinerated or landfilled.

Phenolic Resins Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Novolac

- Resols

- Liquid Resols

- Solid Resols

- Other Phenolic Resins

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Wood Adhesives

- Molding

- Insulation

- Laminates

- Paper Impregnation

- Coatings

- Refractory Materials

- Friction Material

- Rubber & Tire

- Electronics

- Abrasives

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Building & Construction

- Automotive

- Electrical & Electronics

- Furniture

- Other End Uses

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Phenolic Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 16.36 Billion |

|

Market Size in 2025 |

USD 17.25 Billion |

|

Revenue Forecast by 2034 |

USD 24.16 Billion |

|

CAGR |

4.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.36 billion in 2024 and is projected to grow to USD 24.16 billion by 2034.

The global market is projected to register a CAGR of 4.0% during the forecast period.

North America accounted for 29.77% of global market share in 2024.

A few of the key players in the market are Arclin Inc., Arizona Chemical Company LLC (Kraton Corporation), Ashland Inc., BASF SE, DIC Corporation, Georgia Pacific Chemicals, Hexcel Corp., Hexion, Hitachi Chemical Co. Ltd, Kolon Industries Inc., Momentive Specialty Chemicals (Hexion Inc), Olympic Panel Product LLC, Owens Corning, SI Group, and Sumitomo Bakelite Co. Ltd.

The novolac segment accounted for 47.65% revenue share in 2024.

The molding segment is expected to witness the highest CAGR of 6.8% during the forecast period.