Photovoltaics Market Size, Share, Trends, & Industry Analysis Report

Type (Rigid, Flexible), By Material Type, By Cell Type, By Installation Type, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM5948

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

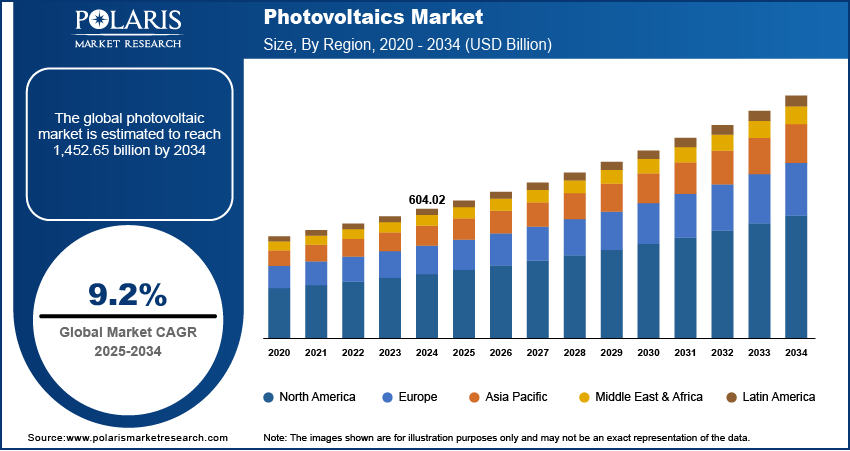

The global photovoltaics market size was valued at USD 604.02 billion in 2024, growing at a CAGR of 9.2% during 2025–2034. Rising demand for photovoltaic systems is fueled by growing government investments in clean energy and increasing global consumption of renewable power sources.

Photovoltaics refers to the method of generating electricity by converting sunlight into direct current using semiconductor-based solar cells. This technology is primarily integrated into solar panels and modules that are deployed across residential, commercial, industrial, and utility-scale power generation systems. These systems are used in various applications such as rooftop installations and ground-mounted solar farms along with off-grid energy setups for reliable and sustainable power generation. The modules are manufactured using materials such as monocrystalline silicon and polycrystalline silicon coupled with cadmium telluride as well as perovskites to improve performance and reduce costs. These systems work quietly and require minimal maintenance that makes it suitable for different weather conditions.

To Understand More About this Research: Request a Free Sample Report

Photovoltaic installations are used across diverse sectors to provide energy for homes and commercial buildings, as well as to support agricultural operations, telecom towers, and remote infrastructure. Additionally, photovoltaics serves as a dependable source of electricity in remote or disaster-prone regions where conventional power access is limited. The modular design of these systems allows for easy customization to meet specific requirements, which further drives the demand for the photovoltaics across the globe.

Urbanization is boosting demand for the photovoltaic (PV) market by increasing the need for clean and decentralized energy solutions in urban areas. This is accelerating the requirement for reliable and sustainable power infrastructure in residential, commercial, and factories. Urban planners and municipal bodies are rapidly adding renewable energy rules to building codes to reduce reliance on the main power grid and meet climate goals. According to the United Nations, over 68% of the world’s population is expected to live in urban areas by 2050. This trend is creating sustained demand for distributed photovoltaic systems capable of supporting growing energy loads while minimizing land use and transmission losses.

Additionally, the integration of phase change materials (PCMs) with AI-driven energy, exergy, economic, and environmental (4E) analysis is driving the PV industry by improving efficiency and making systems more stable. These technologies enhance thermal energy storage and overall system performance that enables smarter energy management. As a result, PV systems become more stable and cost-effective, making them suitable for both grid-connected and off-grid applications. This advancement is expanding the use of PV systems across various sectors that require clean and reliable energy solutions.

Industry Dynamics

Rising Government Investment in Clean Energy Worldwide

Rising government investment in clean energy to lower carbon emissions and improve energy security is driving the growth of the photovoltaic market. This support includes funding for large-scale solar power plants, distributed rooftop systems, and related technologies such as inverters and energy storage solutions. According to the International Energy Agency (IEA), global energy investment reached USD 2.8 trillion in 2023, with over USD 1.7 trillion allocated toward clean energy technologies such as renewables, grids, and energy efficiency. Additionally, the IEA estimates that approximately USD 1.2 trillion in total investment will be required by 2030 to expand clean energy manufacturing and support government initiatives to increase solar PV capacity. These investments are lowering project risks, attracting private capital, and speeding up the growth of solar PV across residential, commercial, and utility-scale sectors.

Moreover, high capital investment in clean energy is boosting supply chains, promoting high-efficiency solar panels, and speeding up project timelines. As a result, making photovoltaic systems more readily available and economically viable for a wider audience. Furthermore, rising investment in research and development (R&D) and the expansion of domestic manufacturing are significantly improving supply chain reliability and reducing dependence on imported components. The steady flow of public funding is helping expand solar infrastructure, lower costs, and boost the role of solar PV in future energy systems.

Increasing Global Consumption of Renewable Energy Sources

The global shift toward low-emission energy sources is increasing the consumption of renewables across electricity, transport and industrial applications that is fueling the PV market. According to the International Energy Agency (IEA), renewable energy accounted for 30% of global electricity generation in 2023, with solar contributing the highest share of new capacity additions. This is driving the demand for scalable and cost-efficient photovoltaic systems, due to the expansion of grid-connected and decentralized clean energy infrastructure across countries.

Moreover, the rising renewable energy consumption is also leading to upgrades in transmission networks, pushing demand for grid-stable PV technologies that offer high-capacity factors and improved operational control. The growing electricity demand is increasing the role of solar PV power sources and cutting down overall emissions.

Segmental Insights

Type Analysis

The segmentation, based on type includes, rigid and flexible. The rigid segment is projected to reach substantial revenue share by 2034. This is due to its established deployment in large-scale solar farms and rooftop installations. Its solid structure allows for stable placement and durability in extreme weather conditions. Rigid panels, generally made from crystalline silicon, exhibit higher efficiency rates, and are considered a preferrable option for ground-mounted and fixed installations in utility-scale and commercial projects. The demand continues to grow in regions investing in grid-tied solar power, where structural reinforcement and long-term output reliability are essential.

The flexible PV segment is projected to expand at a notable pace through 2034, as weight constraints or irregular surfaces limit the use of traditional panels. Its ability to be integrated into curved building facades, portable devices, and vehicle surfaces widens the scope across mobile, off-grid, and architectural use cases. Therefore, innovation in thin-film materials is enhancing output performance, and helping expand market reach.

Material Type Analysis

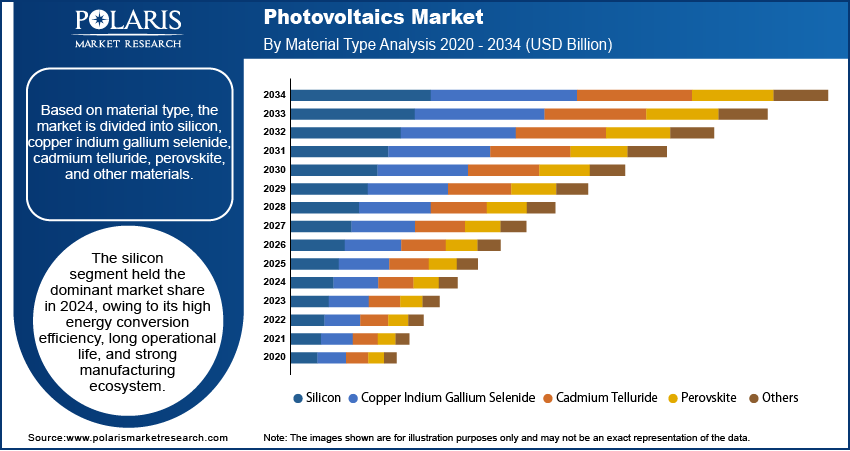

The segmentation, based on material type includes, silicon, copper indium gallium selenide, cadmium telluride, perovskite, and other materials. The silicon segment held the dominant market share in 2024, owing to its high energy conversion efficiency, long operational life, and strong manufacturing ecosystem. Monocrystalline and polycrystalline silicon panels are widely adopted in residential and utility-scale installations in countries emphasizing net-zero targets. Technological improvements such as passivated emitter rear cell (PERC) and bifacial technologies continue to improve module performance, making silicon a benchmark material across the industry. The dominance of silicon is fueled by a mature supply chain, consistent quality standards, and declining production costs, which together continue to position silicon as the industry benchmark for PV module manufacturing.

The cadmium telluride (CdTe) segment is estimated to hold a significant market share in 2034, due to its low production cost, and favorable thermal performance. CdTe thin-film modules are effective in hot and humid environments where conventional silicon panels experience efficiency losses. The high tolerance to temperature fluctuations and reduced performance degradation in low-light conditions makes it suitable for large-scale, utility-driven projects.

Cell Type Analysis

The segmentation, based on cell type includes, full-cell PV modules, and half-cell PV modules. The half-cell PV module segment is projected to grow at a substantial CAGR during the forecast period, driven by its superior efficiency, reduced power loss, and enhanced temperature performance. These modules are designed by splitting full cells into two halves, which reduces internal resistance and increases energy output. The ability to deliver higher performance in limited space, led to widespread deployment across utility-scale solar parks and high-capacity commercial installations. The electrical design reduces the risk of hot spots and improves durability under thermal stress, which is essential for long-term reliability in large-scale field environments. The rising land-use efficiency requirements and growing focus on levelized cost of electricity, boost the demand for the half-cell modules among developers and EPC firms.

The full-cell PV module segment is estimated to hold a significant market share in 2034, due to its standardized design, ease of integration, and cost-effectiveness in small to mid-sized installations. These modules remain popular in residential and low-capacity commercial settings where the focus is on straightforward installation and proven system performance. The simpler configuration allows for easier system planning and quicker deployment, making it suitable for rooftop projects with basic electrical setups.

Installation Type Analysis

The segmentation, based on installation type includes, ground mounted, building-integrated photovoltaic, and floating PV. The ground-mounted segment is projected to grow at a robust CAGR during the forecast period, owing to its widespread application in utility-scale solar projects and large commercial installations. Ground-mounted PV systems allow for optimal tilt, orientation, and spacing, which contributes to higher energy yield and improved system performance. These installations are deployed in open landscapes, industrial zones, or solar parks where land availability supports large-scale solar panel setups. For instance, in June 2025, Aerocompact launched a ground-mounted PV solution designed for small projects and varied terrain, reflecting growing innovation aimed at improving flexibility and expanding deployment potential. Ground-mounted systems are also favored for its ease of maintenance and scalability, making it suitable for governments and developers targeting gigawatt-scale renewable capacity additions. The ability to support high-voltage connections and bulk power delivery positions this configuration as a foundational element of national solar energy programs.

The building-integrated photovoltaics (BIPV) segment is estimated to hold a significant market share in 2034, driven by increasing focus on sustainable architecture and energy-efficient buildings. BIPV systems function as a building material and a source of renewable energy. Its integration into facades, rooftops, and skylights allows architects and developers to meet clean energy targets without compromising on design aesthetics. BIPV is also utilized in urban areas where space constraints limit the feasibility of ground-based systems. Its role in reducing building energy dependency and enabling decentralized power generation is expanding across developed and emerging markets.

End User Analysis

The segmentation, based on end user includes, residential, commercial and industrial, and utilities. The residential segment captured significant market share in 2024, due to declining solar panel costs, favorable net metering policies, and rising consumer interest in energy independence. Rooftop PV systems are adopted across suburban and urban households to offset rising electricity tariffs and reduce reliance on conventional grid power. The integration of smart home energy management systems and battery storage solutions is further strengthening residential demand. Moreover, governments are offering offer tax incentives and subsidies are fueling adoption in single-family and multi-unit dwellings.

The commercial and industrial segment is estimated to grow at a significant CAGR from 2025-2034, driven by strong demand from corporate facilities, warehouses, and manufacturing plants seeking long-term energy savings. On-site PV installations are helping businesses stabilize operating costs, achieve ESG goals, and gain protection from volatile energy markets. For instance, in September 2024, Trina Solar introduced advanced rooftop modules such as lightweight, anti-dust n-type Vertex N TOPCon panels, designed to improve efficiency and adapt to diverse installation environments.

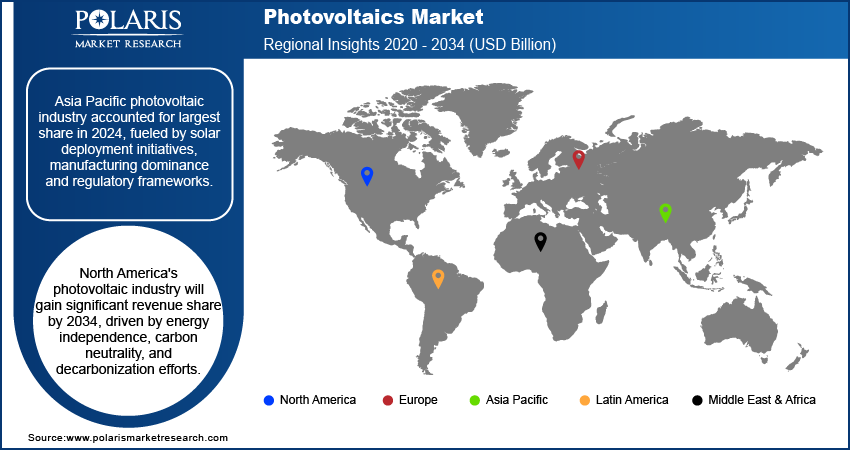

Regional Analysis

Asia Pacific photovoltaic industry accounted for largest share in 2024, fueled by solar deployment initiatives, manufacturing dominance and regulatory frameworks. The rising focus by countries such as China, India, Japan, and South Korea continue to expand solar capacity to meet rising energy demand and reduce reliance on fossil fuels. Also, China’s vertically integrated PV manufacturing along with cost-effective labor and supportive government policies is driving the growth of the solar exports globally. At the same time, rapid urbanization and growing industrial electrification across emerging Asia Pacific economies are accelerating the adoption of both rooftop and utility-scale photovoltaic systems.

China Photovoltaic Market Insight

The China dominated the regional market, capturing largest regional market share. This is driven by continuous expansion in domestic PV capacity, module exports, and large-scale grid-connected projects. According to China’s National Energy Administration (NEA), the country added a record 277 GW of solar capacity in 2024, representing a 28% increase compared to the 216 GW installed in 2023. The government’s push for energy transition along with land availability in western provinces for solar farms, supports utility-scale project growth.

North America Photovoltaic Market Trend

The North America photovoltaic industry is projected to reach at a significant revenue share by 2034. The region’s focus on energy independence, carbon neutrality, and decarbonization targets is propelling PV installation across residential, commercial and industrial sectors. The US leads regional demand, backed by investment tax credits (ITC), falling levelized cost of electricity (LCOE), and solar integration into corporate ESG strategies. According to the Solar Energy Industries Association (SEIA), commercial solar segment grew by 4% in Q1 2025 compared to Q1 2024, while adding 486 MWdc of new capacity in the US. Additionally, grid modernization along with battery storage integration is accelerating utility-scale PV deployment across this region.

Europe Photovoltaic Market Overview

The market in Europe growth is driven, owing to strong policy commitments and rapid modernization of the energy grid. National-level clean energy mandates and the EU’s emphasis on energy sovereignty, significantly accelerating solar PV deployment across member states. For instance, under Germany’s Renewable Energy Sources Act (EEG), the country aims to reach 215 GW of installed solar PV capacity by 2030, up from approximately 81 GW in 2023. Moreover, European manufacturers are focusing on developing high-efficiency modules and grid-integrated solutions that meet performance and sustainability benchmarks under REPowerEU and related climate frameworks. The shift toward localized production and solar component innovation continues to enhance regional competitiveness and help in long-term market expansion.

Key Players & Competitive Analysis Report

The photovoltaic (PV) market is moderately fragmented, with the presence of several global players and emerging regional manufacturers competing on efficiency, cost, and technological innovation. Companies are primarily focused on expanding production capacity, improving solar cell conversion efficiency, and integrating advanced materials such as perovskite and bifacial modules to strengthen the market position. The demand for PV systems across residential, commercial, and utility-scale projects, led players to diversify the portfolios with smart energy solutions and energy storage integration. Strategic moves such as mergers, joint ventures, and long-term supply agreements are common among key participants to secure raw materials and expand global footprint. Additionally, compliance with international sustainability standards and emphasis on low-carbon manufacturing are becoming crucial differentiators. Regional players are also expanding their presence by offering competitive pricing, government-backed incentives, and localized support infrastructure in high-growth markets.

Key companies in the industry include JinkoSolar Holding Co., Ltd., JA Solar Technology Co., Ltd., Trinasolar Co., Ltd., LONGi, Tongwei Co. Ltd, Hanwha Group, Mitsubishi Electric Corporation, Sharp Corporation, Wuxi Suntech Power Co., Ltd., Huawei Technologies Co., Ltd., SMA Solar Technology AG, and Xiamen Mibet Energy Co.,Ltd.

Key Players

- Hanwha Group

- Huawei Technologies Co., Ltd.

- JA Solar Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- LONGi

- Mitsubishi Electric Corporation

- Sharp Corporation

- SMA Solar Technology AG

- Tongwei Co. Ltd.

- Trinasolar Co., Ltd.

- Wuxi Suntech Power Co., Ltd.

- Xiamen Mibet Energy Co., Ltd.

Industry Developments

June 2025: Mibet New Energy launched its latest floating PV system at SNEC 2025 in Shanghai to expand its product range and strengthen its presence in the global photovoltaic market. This launch is expected to enhance Mibet’s capabilities in providing advanced floating solar solutions for various water surfaces, supporting the company’s growth in the renewable energy sector.

February 2025: JA Solar launched its next-generation n-type TOPCon module, DeepBlue 5.0, to expand its product range and strengthen its presence in the photovoltaic market. This launch is expected to enhance JA Solar’s capabilities in providing high-efficiency and reliable solar modules for utility-scale, commercial, and residential PV projects worldwide.

October 2024: LONGi launched its new Hi-MO X10 module featuring HPBC 2.0 cell technology to expand its product range and strengthen its presence in the photovoltaic market. This launch is expected to enhance LONGi’s capabilities in delivering high-efficiency, reliable, and aesthetically advanced solar modules.

Photovoltaics Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Rigid

- Flexible

By Material Type Outlook (Revenue, USD Billion, 2020–2034)

- Silicon

- Copper Indium Gallium Selenide

- Cadmium Telluride

- Perovskite

- Other Materials

By Cell Type Outlook (Revenue, USD Billion, 2020–2034)

- Full - Cell PV Modules

- Half – Cell PV Modules

By Installation Type Outlook (Revenue, USD Billion, 2020–2034)

- Ground Mounted

- Building – Integrated Photovoltaic

- Floating PV

By End User Type Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial and Industrial

- Utilities

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Photovoltaics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 604.02 Billion |

|

Market Size in 2025 |

USD 658.23 Billion |

|

Revenue Forecast by 2034 |

USD 1,452.65 Billion |

|

CAGR |

9.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 604.02 billion in 2024 and is projected to grow to USD 1,452.65 billion by 2034.

The global market is projected to register a CAGR of 9.2% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are JinkoSolar Holding Co., Ltd., JA Solar Technology Co., Ltd., Trinasolar Co., Ltd., LONGi, Tongwei Co. Ltd, Hanwha Group, Mitsubishi Electric Corporation, Sharp Corporation, Wuxi Suntech Power Co., Ltd., Huawei Technologies Co., Ltd., SMA Solar Technology AG, and Xiamen Mibet Energy Co.,Ltd.

The silicon segment held the dominant market share in 2024.

The full-cell PV module segment is estimated to hold a significant market share in 2034.