Pipette Calibrators Market Share, Size, Trends, Industry Analysis Report

By Offering (Devices, Software); By Method; By Channel Type; By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 120

- Format: PDF

- Report ID: PM4826

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

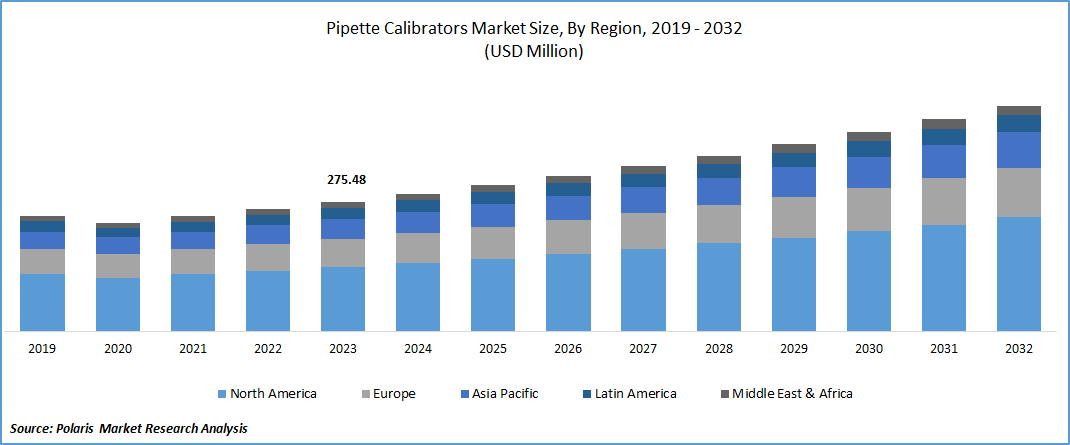

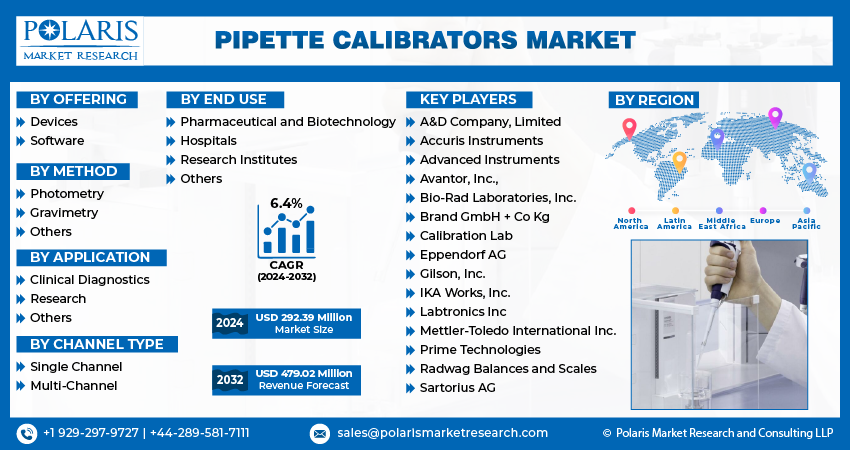

Pipette Calibrators Market size was valued at USD 275.48 million in 2023. The market is anticipated to grow from USD 292.39 million in 2024 to USD 479.02 million by 2032, exhibiting the CAGR of 6.4% during the forecast period.

Market Introduction

The escalating trend of laboratory automation is a key factor propelling the pipette calibrators market size. Laboratories are increasingly turning to automation to boost efficiency, accuracy, and productivity. Automated systems offer advantages like reduced labor costs and minimized errors, driving their adoption. Pipette calibrators are essential in this process, ensuring the accuracy of pipettes used in liquid handling tasks. With automated liquid handling systems becoming more prevalent, the demand for reliable calibrators has surged. These tools guarantee optimal performance, delivering precise volumes crucial for various laboratory applications. Integration of advanced technologies like robotics and AI further enhances calibration processes, driving market growth to meet the demands of modern laboratory automation.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in January 2023, Radwag Balances and Scales introduced the AP-12.1.5Y, the inaugural automated tool engineered to calibrate both single and multi-channel micropipettes with an accuracy of 1 µg, adhering to ISO 8655 specifications.

Technological innovations are influencing the pipette calibrators market trend, enhancing laboratory precision and efficiency. Automation, including automated calibration and real-time monitoring, reduces errors and boosts productivity. Integration with laboratory information systems streamlines data management, improving workflow. Miniaturization and portability cater to field research and point-of-care testing demands. Enhanced connectivity enables remote monitoring and collaboration. Moreover, the rise of digitalization and artificial intelligence introduces smart calibrators capable of self-learning and adaptive calibration. These advancements ensure accuracy, reliability, and compliance with regulatory standards.

Industry Growth Drivers

Advancements in Biotechnology and Pharmaceutical Research are Projected to Spur the Product Demand

Advancements in biotechnology and pharmaceutical research have heightened the demand for precise laboratory equipment, notably pipette calibrators. These instruments ensure accuracy in critical procedures like DNA sequencing and drug discovery. The pharmaceutical industry's focus on precision medicine and automation has intensified this demand, requiring highly accurate calibrators. Technological innovations in these devices, including automated calibration and real-time monitoring, meet stringent regulatory standards. As research in biotechnology and pharmaceuticals progresses, the market is poised for sustained growth, driven by the need for reliable instruments supporting scientific breakthroughs.

Rising Demand for Quality Control in Healthcare is Expected to Drive Pipette Calibrators Market Growth

The healthcare sector's escalating need for quality control has spurred the growth of the pipette calibrators market share. These devices are essential for ensuring the accuracy of pipettes used in diagnostic procedures. With healthcare standards becoming more stringent, precise measurements are indispensable for accurate diagnoses and effective treatments. As a result, healthcare facilities are increasingly investing in advanced pipette calibrators to maintain rigorous quality control. Automated calibrators, equipped with cutting-edge technology, have streamlined the calibration process, minimizing errors and enhancing efficiency.

Industry Challenges

High Initial Investment Cost is Likely to Impede the Market Growth

High initial investment costs act as a limiting factor in the market. While essential for ensuring accurate pipette measurements, the upfront expenses for purchasing calibration systems and training personnel can be prohibitive for smaller laboratories. Ongoing maintenance costs further add to the overall expenses. Consequently, some facilities may resort to manual calibration methods or outsourcing services to mitigate costs, despite potential accuracy risks. Thus, while demand for pipette calibrators remains strong, market growth may be hampered by financial constraints faced by potential buyers, particularly those with limited budgets.

Report Segmentation

The pipette calibrators market analysis is primarily segmented based on offering, method, channel type, application, end use, and region.

|

By Offering |

By Method |

By Application |

By Channel Type |

By End Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Offering Analysis

Devices Segment Held Significant Market Revenue Share in 2023

The devices segment held significant revenue share in 2023 due to its indispensable role in maintaining accuracy and compliance in laboratories. With increasing adoption driven by technological advancements, stringent regulatory requirements, and growing laboratory infrastructure globally, demand remains robust. Advanced features such as digital interfaces and automated processes attract customers seeking efficiency and reliability. In emerging markets, expanding healthcare and life sciences sectors further propel demand. Intense competition among established players fuels innovation, driving sustained revenue growth.

By Method Analysis

Photometry Plays a Significant Role in the Market

Photometry plays a significant role in the market. It ensures accuracy by precisely measuring light absorption or emission, crucial for verifying pipette volumes. Calibration validation is achieved through photometric methods, ensuring correct liquid dispensing. Photometric standards establish reference points, enhancing calibration reliability and consistency. The traceable data provided by photometric measurements aligns with international standards, vital for regulatory compliance. Integration into automated systems streamlines calibration processes, particularly beneficial for high-throughput labs. Photometry is especially useful for calibrating multi-channel pipettes, ensuring uniformity. Real-time monitoring enables immediate adjustments, enhancing quality control.

By Application Analysis

Research Segment Held Significant Market Revenue Share in 2023

The research segment held significant revenue share in 2023. Increasing research and development activities, stringent regulatory standards, and advancements in life sciences research drive demand. Quality assurance requirements in research settings emphasize the necessity for precise calibration. As research initiatives become more intricate, reliance on accurate pipette measurements grows. Moreover, continuous technological advancements and increasing funding for scientific research further propel market growth. Education and awareness initiatives also contribute to the demand, as educational institutions require reliable pipette calibrators for teaching and training purposes.

By End Use Analysis

Pharmaceutical and Biotechnology Segment Held Significant Revenue Share in 2023

The pharmaceutical and biotechnology segment held significant revenue share in 2023 due to stringent regulatory standards and the critical need for precision in dosage preparation, quality control, and research. These industries rely heavily on accurate pipetting for high-throughput operations, research, and development of new drugs and therapies. Pipette calibrators play a pivotal role in maintaining accuracy and ensuring compliance with quality assurance protocols. With continual industry growth, driven by aging populations and biotechnological advancements, demand for calibration equipment remains robust.

Regional Insights

In 2023, North America Region Accounted for a Significant Market Share

In 2023, North America region accounted for a significant market share owing to technological innovation, stringent regulations, and the presence of key industry players. The region's advanced healthcare infrastructure, coupled with substantial investments in research and development, drives demand for precise calibration equipment. Strong adoption of automation, coupled with collaborative efforts between academia and industry, further boosts market growth. With a focus on compliance and quality, North American laboratories prioritize the use of high-quality pipette calibrators. Additionally, the region's well-established networks for information dissemination and education contribute to heightened market awareness.

Asia-Pacific is expected to experience growth during the forecast period. The region's expanding biotechnology and pharmaceutical industries drive demand for precise laboratory equipment. Increasing research and development activities, particularly in countries like China, India, and Japan, fuel market growth. Rising investments in healthcare infrastructure and research facilities contribute to heightened demand for pipette calibrators. Supportive government initiatives, coupled with the burgeoning life sciences sector, create a conducive environment for market growth in the Asia-Pacific region.

Key Market Players & Competitive Insights

The pipette calibrators market boasts a diverse array of participants, and the expected entry of new competitors is poised to intensify competitive dynamics. Leading players in the industry continuously enhance their technologies, seeking to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These organizations prioritize strategic actions, including forming alliances, improving product portfolios, and participating in collaborative ventures. Their primary objective is to outperform competitors in the field, securing a significant pipette calibrators market share.

Some of the major players operating in the global pipette calibrators market include:

- A&D Company, Limited

- Accuris Instruments

- Advanced Instruments

- Avantor, Inc.,

- Bio-Rad Laboratories, Inc.

- Brand GmbH + Co Kg

- Calibration Lab

- Eppendorf AG

- Gilson, Inc.

- IKA Works, Inc.

- Labtronics Inc

- Mettler-Toledo International Inc.

- Prime Technologies

- Radwag Balances and Scales

- Sartorius AG

Recent Developments

- In April 2023, Mettler Toledo launched the XPR Multichannel Pipette Calibration Balance, XPR105MCP as a high-speed solution for ISO 8655-compliant calibration of multichannel pipettes.

- In February 2024, the Eppendorf Group broadened its reach by inaugurating a new facility in South Africa dedicated to sales and service operations. This new establishment encompasses a modern pipette calibration facility, complete with a service workshop, and a customer experience center designed to exhibit Eppendorf instruments.

Report Coverage

The pipette calibrators market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, offerings, methods, applications, end uses, and their futuristic growth opportunities.

Pipette Calibrators Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 292.39 million |

|

Revenue forecast in 2032 |

USD 479.02 million |

|

CAGR |

6.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Pipette Calibrators Market Size Worth $ 479.02 Million By 2032

The top market players in Pipette Calibrators Market are Radwag Balances and Scales, Mettler-Toledo International Inc., Bio-Rad Laboratories

North America is the region contribute notably towards the Pipette Calibrators Market

Pipette Calibrators Market exhibiting the CAGR of 6.4% during the forecast period.

Pipette Calibrators Market report covering key segments are offering, method, channel type, application, end use, and region.