Planters Market Size, Share, Trends, Industry Analysis Report

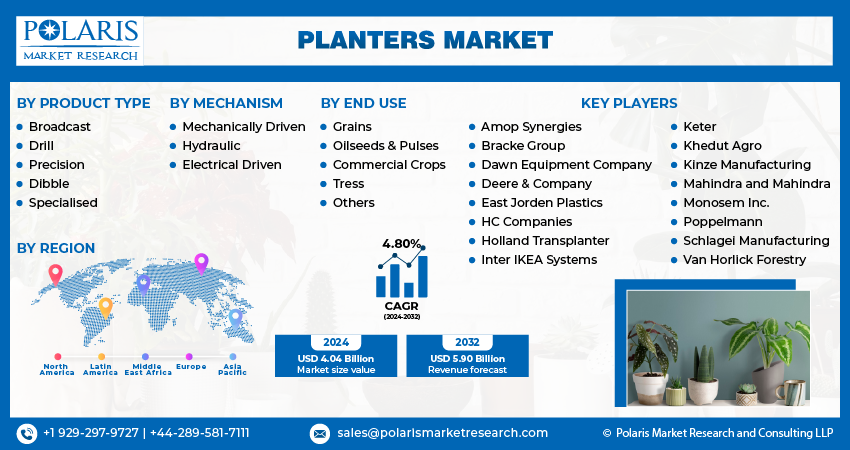

By Product Type (Broadcast, Drill, Precision, Dibble, Specialized), By Mechanism, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3825

- Base Year: 2024

- Historical Data: 2020-2023

Overview

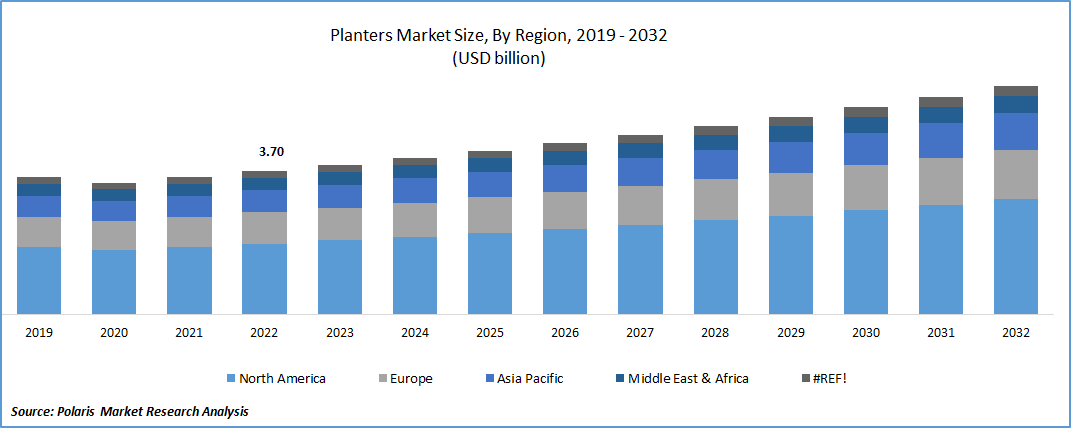

The global planters market size was valued at USD 4.05 billion in 2024, growing at a CAGR of 4.8% from 2025 to 2034. Key factors driving demand for planters include the precision farming adoption, government subsidies & support, increasing labor costs in agriculture, and rising global food demand.

Key Insights

- The drill segment held the largest share of global revenue in 2024, owing to its adaptability and effectiveness in seed placement.

- The mechanically driven segment is anticipated to experience substantial growth in the coming years, due to its affordability and dependable performance across various farming conditions.

- North America dominated the global market share in 2024, supported by the region’s advanced farming infrastructure and widespread adoption of mechanized agriculture.

- The U.S. captured a major share of the North American landscape in 2024, driven by its highly mechanized farming industry and emphasis on precision agriculture.

- The Asia Pacific market is expected to grow at the fastest rate during the forecast period, fueled by the ongoing modernization of agriculture and increased utilization of arable land.

- The market in India is growing as a result of initiatives to upgrade traditional farming practices and mitigate labor shortages.

Industry Dynamics

- Rising farm labor expenses are accelerating planter adoption as mechanization reduces costs and improves planting consistency versus manual methods.

- Growing global food needs drive planter demand, enabling precise seeding to maximize yields on limited farmland.

- High upfront costs of advanced planters limit adoption among small farmers, particularly in developing regions where financing options are scarce and farm incomes are volatile.

- Growing demand for precision planting technologies in emerging markets creates potential for affordable, scaled-down solutions tailored to smallholder farmers needs and budgets.

Market Statistics

- 2024 Market Size: USD 4.05 billion

- 2034 Projected Market Size: USD 6.45 billion

- CAGR (2025–2034): 4.8%

- North America: Largest market in 2024

AI Impact on Planters Market

- AI is increasingly integrated with innovations in the planter market, especially in smart agriculture and consumer horticulture.

- AI enables variable rate seeding based on soil moisture, health, and crop type, which improves yield and reduces waste.

- AI algorithms and sensors help track planting depth, spacing, and speed.

- From autonomous field equipment to tech-savvy indoor gardening systems, the technology is reshaping the designing, deployment, and management of planters.

Planters are agricultural implements designed to uniformly sow seeds in the soil at specific depths and spacing, optimizing crop emergence and yield potential. The growing adoption of precision farming technologies propels the planters market growth, as it directly enhances the functionality and demand for advanced seeding equipment. Precision farming enables farmers to apply data-driven decisions in seed placement, ensuring efficient land use and reducing input costs. Modern planters offer greater accuracy and consistency with the integration of GPS-guided systems and variable-rate seeding technology, aligning with the evolving needs of high-efficiency agriculture. According to a December 2024 USDA report, U.S. farms significantly increased precision agriculture adoption in 2023, with 52% of midsize and 70% of large crop farms utilizing guidance auto steering systems on equipment. This shift toward automation and real-time monitoring in field operations continues to boost the demand for technologically equipped planters across global farming landscapes.

The industry growth is accelerated due to the increasing focus on sustainable agricultural practices. Precision farming, when combined with advanced planter systems, allows for targeted seed application, reducing seed wastage and minimizing environmental impact. These practices support soil health preservation, optimal resource utilization, and reduced carbon footprint, all of which are critical components of sustainable farming. Farmers are adopting precision-based planters to meet regulatory standards and improve long-term productivity as governments and agricultural bodies encourage eco-friendly farming practices. This trend reinforces the role of planters as essential components in precision-driven and environmentally responsible farming systems.

Drivers & Opportunities

Increasing Labor Costs in Agriculture: Increasing labor costs in agriculture are driving the expansion opportunities, as farmers aim to offset rising operational expenses through mechanization. Manual planting is labor-intensive and time-consuming, often leading to inconsistencies in seed placement and reduced productivity. The need for efficient and reliable alternatives becomes more pressing as wages continue to rise and labor availability fluctuates, especially during peak seasons. According to a July 2025 U.S. Department of Agriculture report, farm employment grew in 2023, with the livestock sector adding 29,000 jobs with a 12% increase, and crop support services gaining 17,400 positions, with a 6% rise. Planters offer a practical solution by automating the seeding process, enabling faster operations with fewer workers while maintaining high levels of accuracy. This shift enhances overall efficiency and also helps in optimizing resource use and reducing long-term operational costs, making advanced planting equipment a strategic investment for modern farms.

Rising Global Food Demand: Rising global food demand is a crucial factor driving the growth opportunities, as it boosts the need for high-efficiency agricultural practices. There is an increasing pressure on farmers to boost crop production on limited arable land. Planters play a critical role in achieving this by enabling uniform seed distribution, precise depth control, and optimal spacing, which collectively enhance crop emergence and yield. Advanced planter technologies support large-scale food production systems aimed at meeting global consumption needs by facilitating faster and more accurate planting cycles. According to the 2024 Global Report on Food Crises, approximately 282 million people, or 21.5% of the population across 59 countries/territories, experienced severe acute food insecurity in 2023, necessitating immediate food aid and livelihood support. This demand-driven expansion highlights the importance of planters in ensuring food security through enhanced agricultural productivity.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes broadcast, drill, precision, dibble, and specialized. The drill segment accounted for the largest global revenue share in 2024 due to its versatility and efficiency in seed placement. Drill planters allow for precise sowing of seeds at consistent depths and spacing, which enhances germination rates and crop uniformity. Their adaptability across various soil types and crop varieties makes them highly preferred by farmers aiming to optimize yield. Additionally, drill planters often integrate well with precision farming technologies, further driving their widespread adoption. This combination of accuracy, efficiency, and compatibility with modern agricultural practices has solidified the drill segment’s domination in the planters market.

Mechanism Analysis

In terms of mechanism, the segmentation includes mechanically driven, hydraulic, and electrical driven. The mechanically driven segment is expected to witness significant growth during the forecast period due to its cost-effectiveness and reliability in diverse farming environments. Mechanically driven planters operate through ground-engaged mechanisms that require complex power sources, making them suitable for small to medium-scale farms and regions with limited access to advanced infrastructure. Their straightforward design reduces maintenance requirements and operational costs, attracting farmers who prioritize durability and ease of use. Moreover, the growing focus on sustainable and resource-efficient farming further supports the adoption of mechanically driven planters, as they offer an energy-efficient alternative without compromising on planting accuracy.

End Use Analysis

Based on end use, the segmentation includes grains, oilseeds & pulses, commercial crops, trees, and others. The oilseeds & pulses segment is expected to witness the fastest growth by 2034, driven by the increasing demand for protein-rich crops and their role in crop rotation practices. Oilseeds and pulses are essential components in global nutrition and agriculture, contributing to soil health through nitrogen fixation and serving as major ingredients in food and industrial applications. The rising consumer preference for plant-based proteins and the expansion of processed food industries drive the need for more efficient planting solutions tailored to these crops. Therefore, planters designed specifically for oilseeds and pulses facilitate uniform seed distribution and depth control, which are essential for maximizing yield and quality in these sensitive crop categories.

Regional Analysis

The North America planters market accounted for the largest global revenue share in 2024. This dominance is driven by the region’s advanced agricultural infrastructure and high mechanization levels. Extensive adoption of precision farming technologies, combined with favorable government policies supporting modern farming practices, has fueled demand for refined planting equipment. Additionally, large-scale commercial farming operations in North America require reliable, high-capacity planters that cover vast tracts of land efficiently. The presence of leading manufacturers and continuous innovation in planter design and automation further contribute to the region’s dominance.

U.S. Planters Market Insights

The U.S. held a significant market share in the North America planters landscape in 2024 due to its highly mechanized agricultural sector and strong focus on precision farming. Advanced farming practices and widespread adoption of advanced planter technologies have enabled farmers to improve efficiency and crop yields. Additionally, robust infrastructure and rising investments in agricultural research contribute to the U.S.’s leadership position in the market.

Asia Pacific Planters Market Overview

The market in Asia Pacific is projected to witness the fastest growth during the forecast period due to the increasing modernization of agriculture and expanding arable land utilization. Rapid population growth and rising food demand are pushing farmers in the region to adopt mechanized planting solutions to improve productivity and reduce labor dependency. Government initiatives promoting agricultural mechanization, coupled with growing investments in precision farming technologies, are facilitating the penetration of advanced planters in key markets. In September 2024, India's Union Cabinet approved the Digital Agriculture Mission with a total budget of USD 340 million, including a central share of USD 233 million to develop digital farming infrastructure, including advanced crop estimation systems and IT initiatives for government and research institutions. Furthermore, the diverse climatic and cropping conditions in Asia Pacific necessitate adaptable and efficient planter systems, creating strong growth opportunities for the market.

India Planters Market Overview

The market in India is expanding due to increasing efforts to modernize traditional farming methods and address labor shortages. Government initiatives promoting agricultural mechanization and growing awareness of the benefits of precision farming are encouraging farmers to adopt efficient planting equipment. Furthermore, the rising demand for food production to support a large population is driving the need for improved seeding solutions.

Europe Planters Market Trends

The planters landscape in Europe is projected to hold a substantial share in 2034, owing to the region’s strong focus on sustainable farming and technological innovation. European farmers are increasingly adopting planters that support environmentally friendly practices, such as reduced seed wastage and soil treatment. Integration of smart technologies such as GPS, IoT sensors, and data analytics in planter systems aligns with Europe’s focus on precision agriculture and regulatory compliance. Moreover, the presence of well-established agricultural machinery manufacturers and collaborative research initiatives promotes the continuous development of efficient planting equipment.

UK Planters Market Outlook

The growth of the UK market is driven by a strong focus on sustainable agriculture and regulatory support for environmentally friendly farming practices. Farmers are increasingly utilizing advanced planters that enable precise seed placement and resource conservation. The integration of smart technologies and data-driven farming solutions further supports the market’s expansion by enhancing productivity and reducing operational costs.

Key Players & Competitive Analysis

The planters sector is witnessing a transformation, driven by technological advancements in precision agriculture and sustainability strategies promoting resource-efficient farming. Developed markets lead in adoption due to high farm mechanization, while emerging markets in Asia Pacific and Latin America show latent demand for cost-effective solutions among small and medium-sized businesses. Companies are leveraging disruptive technologies such as IoT-enabled planters and autonomous machinery to enhance competitive positioning, with strategic investments focused on R&D and regional expansion. Revenue growth is accelerating as farmers prioritize yield optimization amid economic and geopolitical shifts affecting input costs. However, supply chain disruptions pose challenges for manufacturers. Future development strategies highlight partnerships with agtech firms and sustainable value chains to address environmental concerns. Expert insights suggest untapped potential in niche segments such as horticulture and forestry, where expansion opportunities exist for innovative, modular planting systems.

A few major companies operating in the planters market include Bracke Group, Dawn Equipment Company, Deere & Company (John Deere), East Jordan Plastics, HC Companies, Holland Transplanter, Kinze Manufacturing, Mahindra and Mahindra, Monosem Inc., Pöppelmann, Schlagel Manufacturing, and Van Horlick Forestry.

Key Players

- Bracke Group

- Dawn Equipment Company

- Deere & Company (John Deere)

- East Jordan Plastics

- HC Companies

- Holland Transplanter

- Kinze Manufacturing

- Mahindra and Mahindra

- Monosem Inc.

- Pöppelmann

- Schlagel Manufacturing

- Van Horlick Forestry

Planters Industry Developments

- March 2025: Singapore’s Ministry of Sustainability and the Environment launched Growy’s indoor vertical farm with 500 tonnes annual yield, highlighting large-scale adoption of automated planter systems.

- February 2025: John Deere introduced three new planter technologies, seed-level sensing, fertilizer-level sensing, and active vacuum automation, to improve planting efficiency. These innovations help farmers optimize operations during limited planting windows caused by weather or other constraints.

- January 2024: Precision Planting launched the CornerStone Planting System, a factory-built solution (excluding the planter bar) with integrated technology. They also expanded Panorama with two API connections, introduced a larger 20|20 monitor, and provided updates on the Radicle Agronomics platform.

Planters Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Broadcast

- Drill

- Precision

- Dibble

- Specialized

By Mechanism Outlook (Revenue, USD Billion, 2020–2034)

- Mechanically Driven

- Hydraulic

- Electrical Driven

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Grains

- Oilseeds & Pulses

- Commercial Crops

- Trees

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Planters Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.05 Billion |

|

Market Size in 2025 |

USD 4.24 Billion |

|

Revenue Forecast by 2034 |

USD 6.45 Billion |

|

CAGR |

4.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.05 billion in 2024 and is projected to grow to USD 6.45 billion by 2034.

The global market is projected to register a CAGR of 4.8% during the forecast period.

North America planters market accounted for the largest global market share in 2024.

A few of the key players in the market are Bracke Group, Dawn Equipment Company, Deere & Company (John Deere), East Jordan Plastics, HC Companies, Holland Transplanter, Kinze Manufacturing, Mahindra and Mahindra, Monosem Inc., Pöppelmann, Schlagel Manufacturing, and Van Horlick Forestry.

The drill segment accounted for the largest global revenue share in 2024

The mechanically driven segment is expected to witness significant growth during the forecast period