Plasma Fractionation Market Share, Size, Trends, Industry Analysis Report

By Product (Albumin, Immunoglobulins); By Method (Centrifugation, Depth Filtration); By Application; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2591

- Base Year: 2024

- Historical Data: 2020 - 2023

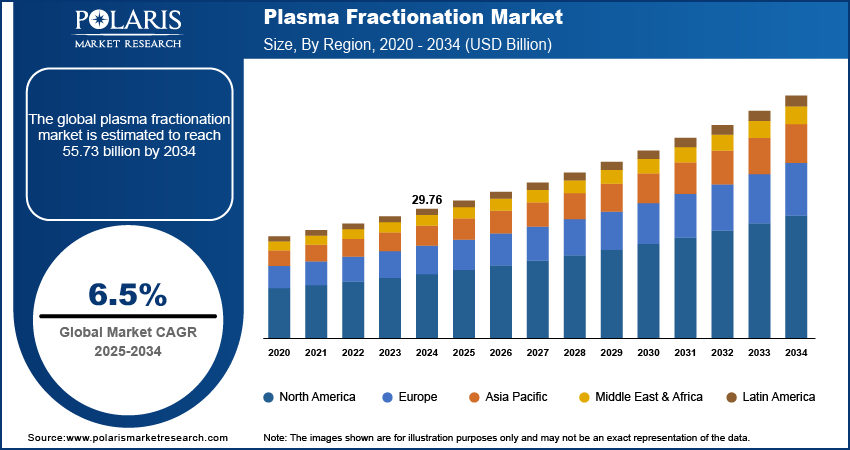

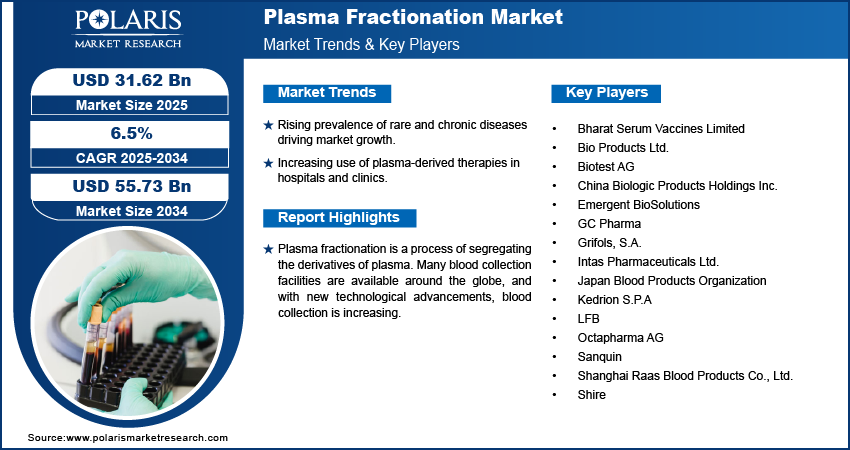

The global plasma fractionation market was valued at USD 29.76 billion in 2024 and is expected to grow at a CAGR of 6.5% during the forecast period. The increasing geriatric population, high prevalence of infectious diseases, increasing disorders related to blood, and growing population of older adults who can get infected easily are the drivers for the market growth.

Key Insights

- Immunoglobulin segment accounted for the largest share in 2024. This is driven by rising prevalence of immunodeficiency disorders and neurological diseases worldwide.

- Oncology segment is expected to spearhead the market growth. The segment is fueled by growing demand for plasma-derived oncology treatments.

- Centrifugation segment shared highest revenue in 2024. This is due to growing need for precise plasma separation techniques in fractionation processes.

- Hospitals & clinics segment is supposed to be bolstering growth of the market. This is driven by improved healthcare infrastructure and rising patient admissions for plasma therapies.

- North America dominates the market during the forecast period. This is due to owing to strong healthcare expenditure, presence of key players, and advanced plasma collection technologies.

Industry Dynamics

- The market is rising prevalence of rare and chronic diseases such as hemophilia, primary immunodeficiency disorders, and alpha-1 antitrypsin deficiency.

- The market is fueling due to increasing use of immunoglobulins, albumin, and coagulation factors across hospitals and clinics.

- Advancements in fractionation techniques creates opportunities for manufacturers to expand their global footprint.

- The major challenges for the market is high cost of plasma-derived products, complex regulatory frameworks, and limited plasma collection infrastructure.

Market Statistics

- 2024 Market Size: USD 29.76 Billion

- 2034 Projected Market Size: USD 55.73 Billion

- CAGR (2025–2034): 6.5%

- North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Plasma fractionation is a process of segregating the derivatives of plasma. Many blood collection facilities are available around the globe, and with new technological advancements, blood collection is increasing. The rising government initiatives and investment in R&D in the biotechnology and pharmaceutical sectors are anticipated to boost industry growth.

The growth of the plasma fractionation market was negatively impacted during the COVID-19 pandemic. Raw material shortage and slowdown of supply chain at several places hampered the industry growth. Worldwide lockdown and social distancing impacted the blood donation camp; a shortfall was seen in the blood donation programs; thus, the availability of plasma was restrained. This fractionation therapy was also used in the treatment of COVID-19 and showed a high success rate. However, as activities resumed, the rise in blood donation was noticed and is further expected to grow over the forecast period.

As the R&D in the pharmaceutical & biotechnology sectors is increasing involving plasma treatments, many major players have started working together. The treatment of COVID-19 through plasma fractionation was conducted, and observed that people were fully recovered through this fractionation therapy. It is anticipated that the cost of the fractionation therapy will rise owing to decreasing number of blood donors prone to various diseases.

Industry Dynamics

Growth Drivers

Collaboration of significant players in the market for producing plasma-based products, with many governments and corporate initiatives and investments, and increasing R&D activities in various sectors are the major drivers of the industry’s growth. Many awareness programs are conducted to encourage people to blood donation. Government and corporates are taking initiatives to increase the awareness among people regarding the use of this fractionation therapy-based products.

The increasing prevalence of infectious diseases among the geriatric population across the globe has initiated much R&D in the sector. Many respiratory infections are increasing due to the changing lifestyle and spreading of disease. New methods are used for treating diseases, and with technological advancement, the industry is expected to flourish. This fractionation therapy is now used for many treatments, and positive success has been noticed.

Report Segmentation

The market is primarily segmented based on product, application, method, end-use, and region.

|

By Product |

By Application |

By Method |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

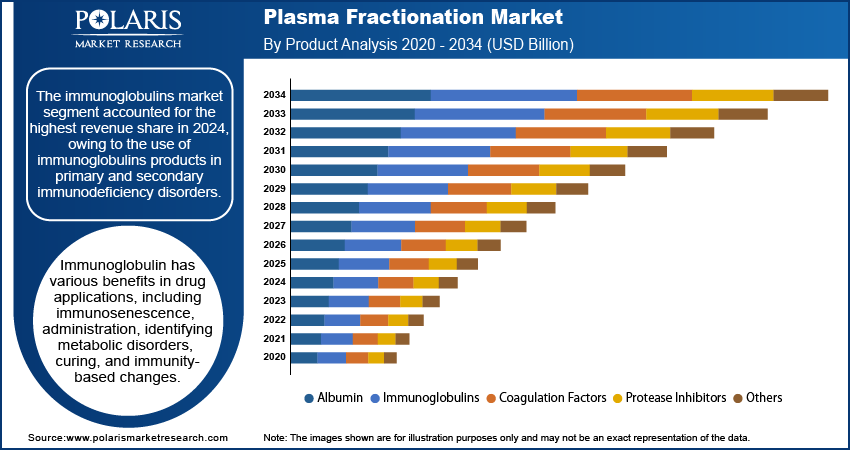

Immunoglobulin Segment Accounted for the Largest Share in 2024

The immunoglobulins market segment accounted for the highest revenue share in 2024, owing to the use of immunoglobulins products in primary and secondary immunodeficiency disorders. Immunoglobulin has various benefits in drug applications, including immunosenescence, administration, identifying metabolic disorders, curing, and immunity-based changes. With the increasing prevalence of infectious diseases, the use of immunoglobulins is expected to expand over the forecast year.

Furthermore, it is also expected that the market for coagulation factors will expand with high blood donation or transplantation, approvals of new medicines, and high bleeding disorders. The coagulation factors are majorly used in bleeding disorders like Hemophilia and Von Willebrand disease.

Oncology Segment are Expected to Spearhead the Market Growth

Based on application, neurology accounted for the highest share, with an increasing prevalence of neurological diseases and treatment of those by fractionation therapy. Additionally, the rising neurovascular illness like strokes and Alzheimer's in older people is leading to the increased use of plasma-based products for treatment.

Additionally, the oncology segment is expected to grow at a faster CAGR during the forecast period with the use of therapies for the treatment of cancer. The targets can be easily treated and cured through this fractionation therapy, which was not curable before.

Centrifugation Segment Shared Highest Revenue in 2024

The centrifugation segment dominated the market with a higher revenue share in 2024 and the fastest growth rate over the forecast period. Getting high-quality blood supernatant requires centrifugation. It also helps researchers separate blood consistently, which improves patient clinical outcomes. Thus, the industry expansion would be aided by the rising need for centrifugation tools.

Recently, the use of purification methods and industrial-scale chromatographic fractionation has risen. Coagulation factors, protease inhibitors, and anticoagulants are some of the new therapeutic plasma products that have been created. As a result, chromatography has enabled the development of novel therapeutics for treating patients with congenital or acquired abnormalities in plasma protein levels. It will therefore spur industry expansion.

Hospitals & Clinics Segment is Supposed to Be Bolstering Growth of the Market

In 2024, the hospitals & clinics segment had the most significant revenue share and is expected to grow during the forecast period. The category is predicted to grow considerably because of the rising off-label use of fractionation market products in hospitals to treat several ailments, improved infrastructure, and healthcare services. Furthermore, there is a high demand for these products due to the complicated illnesses that can be addressed in contemporary clinical settings.

North America Dominates the Market during the Forecast Period

North America dominates the regional market with the highest share owing to increasing awareness and numerous advantages of plasma fractionation market among people and increasing respiratory disorders. The expansion of the regional market is also aided by the existence of key players, an increase in the quantity of blood collection facilities, a rise in the consumption of immunoglobulin, and the availability of plasma due to the viability of plasma collections & distribution.

Asia Pacific is expected to expand the plasma fractionation market due to increasing government, private and public investment in R&D, favorable government regulations, an aging population with blood-related disorders, increased immunoglobulin use, and rising target disease prevalence are all contributing factors to the development of therapies.

Competitive Insight

Some of the major players operating in the global market include CSL, Grifols, S.A., Shire, Octapharma AG, Kedrion S.P.A, LFB, Biotest AG, Sanquin, China Biologic Products Holdings Inc., GC Pharma, Bio Products Ltd., Japan Blood Products Organization, Emergent BioSolutions, Shanghai Raas Blood Products Co., Ltd., Intas Pharmaceuticals Ltd., Bharat Serum Vaccines Limited, SK Plasma, Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd., KabaFusion, Centurion Pharma, ADMA Biologics, Inc., PlasmaGen BioSciences Pvt. Ltd., Virchow Biotech Private Limited, Fusion Healthcare, and Hemarus Therapeutics Limited.

Recent Developments

- In July 2024, Biotest partnered with Kedrion to distribute FDA-approved Yimmugo, expanding its immunoglobulin product presence in the U.S.

- In January 2024, Takeda received FDA approval for its 10% IVIG therapy to treat adults with chronic inflammatory polyneuropathy.

- In April 2022, Octapharma AG addressed the unmet needs of Von Willebrand disease, which is a type of bleeding disorder, as a sponsor of the World Federation of Haemophilia (WFH) 2022.

- In June 2022, Permira introduced a new drug in the market against immunodeficiency disorders made with plasma-based products, which are more efficient and quick results.

- In September 2022, Grifols made an agreement with Canadian Blood services to expand the business of Immunoglobulins in Canada and help to be self-sufficient.

Plasma Fractionation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 29.76 billion |

| Market size value in 2025 | USD 31.62 billion |

|

Revenue forecast in 2034 |

USD 55.73 billion |

|

CAGR |

6.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Application, By Method, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Grifols, S.A., Shire, Octapharma AG, Kedrion S.P.A, LFB, Biotest AG, Sanquin, China Biologic Products Holdings Inc., GC Pharma, Bio Products Ltd., Japan Blood Products Organization, Emergent BioSolutions, Shanghai Raas Blood Products Co., Ltd., Intas Pharmaceuticals Ltd., Bharat Serum Vaccines Limited |

FAQ's

? The global market size was valued at USD 29.76 billion in 2024 and is projected to grow to USD 55.73 billion by 2034.

? The global market is projected to register a CAGR of 6.5% during the forecast period.

? North America dominated the market share in 2024.

? The immunoglobulins segment accounted for the largest share of the market in 2024.