Plasma Powder Market Share, Size, Trends, Industry Analysis Report

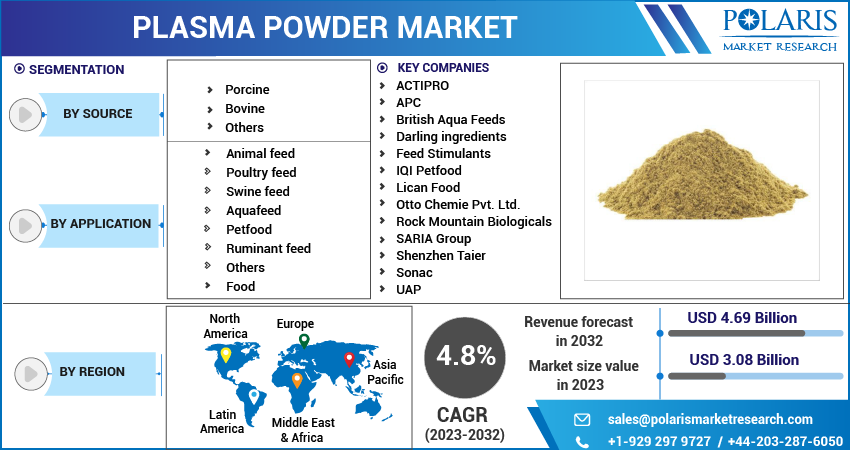

By Source (Bovine, Porcine, Others); By Application (Animal Feed, Food, Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 116

- Format: PDF

- Report ID: PM3402

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

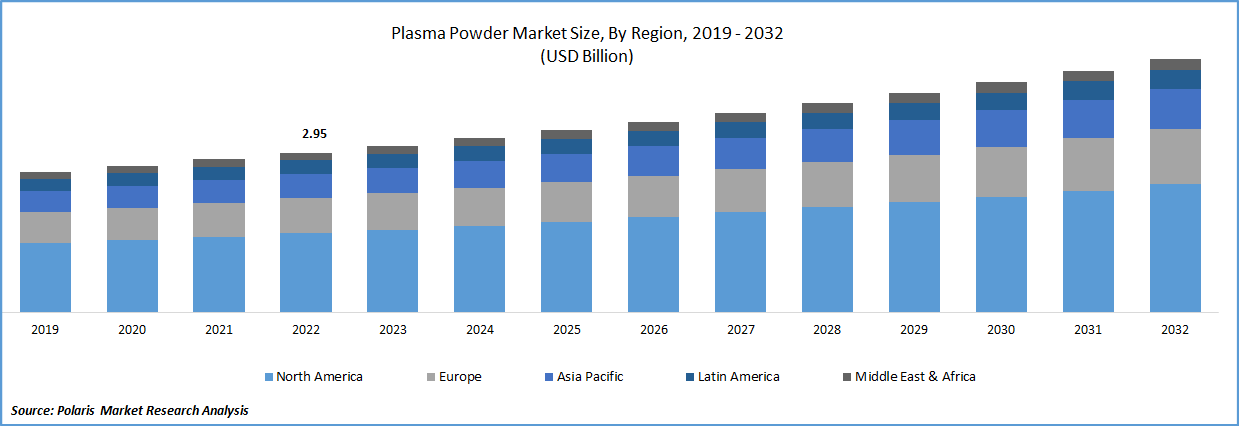

The plasma powder market was valued at USD 2.95 billion in 2022 and is expected to grow at a CAGR of 4.8% during the forecast period. The desire for unique ingredients from pet product makers, the rise in pet adoption, and the rising concern for pet health are just a few of the reasons driving the growth of the worldwide market. The right texture and ingredient balance are crucial for improving pet food flavor, especially for cats. The growing need for high-quality protein feeds is another factor driving up market demand. As pet owners become more aware of the importance of protein in their pets' diets, they are seeking out higher-quality protein sources to provide their pets with the best possible nutrition. This trend is particularly prevalent in developed countries where pet ownership rates are high, and pet owners have more disposable income to spend on premium pet food products.

To Understand More About this Research: Request a Free Sample Report

Plasma powder has a wide range of uses in the food business due to its high-quality protein content, texture, taste, and overall nutritional value. Because of its versatility as a binder, fat replacement, and emulsifier, it is frequently used to manufacture meat products, baked goods, and pasta with added protein. For instance, plasma powder is used as a binder in baked products to enhance the end product's texture and moistness. In the meat business, plasma powder is used as a fat and protein substitute in sausages as well as an emulsifier and replacement for protein in emulsified meat systems.

Moreover, its high nutritional value makes it a popular addition to protein-enriched pasta, providing customers with a good source of important amino acids. In general, plasma powder's adaptability makes it a valuable component in the food business, promoting a balanced diet and improving the flavor and texture of many food products.

In April 2021, Plasma LytePro was launched by Novozymes. This product is designed to improve the health and performance of young animals, reduce mortality rates, and increase weight gain and feed intake. The global market has been impacted by the COVID-19 epidemic in several ways. The supply chain was one of the key effects since it was hampered by lockdowns, travel restrictions, and border closures. Due to these delays in the supply of both raw materials and completed goods, manufacturers found it challenging to fulfill consumer demand. For example, in March 2020, Darling Ingredients, a major producer of plasma powder, reported difficulties in moving raw materials from South America to the United States as a result of border restrictions, resulting in a brief scarcity of raw materials. Also, the lockdowns that forced the closure of eateries and the food service sector decreased consumer demand for animal goods, particularly pet food, which had an impact on the market for plasma powder.

Yet, the pandemic has also opened new business potential for plasma powder. During the lockdowns, individuals spent more time at home, which raised the demand for items with animal-based proteins and pet food, which in turn increased the need for plasma powder. Also, the pandemic's increasing focus on health and well-being has raised the demand for high-quality protein products, which has benefitted the plasma powder business. The ability of plasma powder to strengthen the immune system and enhance general health has made it a desirable element in the animal feed and pet food industry. Due to the rising demand for plasma powder, certain producers have boosted their manufacturing capacity.

For Specific Research Requirements, Request a Customized Report

Industry Dynamics

Growth Drivers

The plasma powder market is being driven by the increasing demand for high-quality protein-rich animal feed products, the rising demand for high-quality pet food, the growing utilization of plasma powder in the food industry, and the increasing demand for aquafeed products. The increasing consumption of meat and dairy products, coupled with the growing awareness of the benefits of protein-rich animal feed products, is driving the demand for plasma powder in the animal feed industry. For example, in 2020, Darling Ingredients, a global leader in sustainable food, feed, and fuel solutions, announced the expansion of its plasma protein production capacity to meet the growing demand for animal feed products.

Moreover, the growing focus on pet health and wellness drives the demand for high-quality pet food products rich in protein and other essential nutrients. Plasma powder is a popular ingredient in pet food products due to its high protein content and nutritional benefits. For example, in 2020, Cargill launched a new line of plasma protein products for the pet food industry. Also, the increasing utilization of plasma powder in the food industry as a protein source. For example, in 2021, Sonac introduced a new range of plasma protein products for the food industry.

Additionally, the increasing demand for seafood, coupled with the growing trend of aquaculture, is driving the demand for aquafeed products that are rich in protein and other essential nutrients. Plasma powder is a popular ingredient in aquafeed products due to its high protein content and immunoglobulins, which promote health and improve immune response in aquatic animals.

Report Segmentation

The market is primarily segmented based on form, product, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Porcine segment is expected to witness largest growth over the forecast period

The porcine segment has seen significant growth due to the demand for porcine-derived spray-dried plasma in canned pet food. For example, pet food manufacturer Blue Buffalo uses porcine plasma powder in some of its canned pet food products to provide a high-quality protein source for pets. The growth of the swine feed market has also contributed to the growth of the porcine plasma powder segment, as the intensive swine production industry utilizes porcine plasma powder to improve animal growth rates and reduce fetal growth restriction in weaners.

Bovine segment is expected to grow rapidly over the study period, due to its use in the food industry, cattle-feed products, and immune-stimulating components. For example, Nutreco uses bovine plasma powder in some of its cattle-feed products to improve the digestive function of young calves. The demand for immune-stimulating components in cattle feed to prevent animals from losing efficiency has also contributed to the growth of the bovine plasma powder segment.

Animal feed segment accounted for the largest market share in 2022

The animal feed application segment accounted for the largest market share. This growth is being driven by the increasing demand for high-quality animal feed products that support health and wellness in animals. Plasma powder is a popular ingredient in various animal feed formulations including poultry, swine, pet food, and aquafeed due to its protein and immunoglobulin content, which supports animal immune response and growth rate. It is used in the production of broiler feed, piglet feed, and fish and shrimp feed to improve the immune system, gut health, growth rate, and disease resistance. Moreover, with the growth in livestock-rearing practices and the high demand for animal products in countries like China, India, and Brazil, the demand for plasma powder in animal feed products is expected to increase significantly.

In addition, Pet owners' increasing focus on pet health and nutrition is driving demand for high-quality pet food products formulated with plasma powder. Plasma powder is used in the production of pet food products such as dog food and cat food, which are marketed as nutritionally balanced and support overall pet health. Plasma powder is also used in aquafeed formulations to improve seafood product quality and safety by enhancing growth rate and disease resistance in fish and shrimp.

The demand in Asia Pacific is expected to witness significant growth

The Asia Pacific is expected to witness significant growth in the coming years, driven by increasing awareness about animal nutrition, growing demand for animal feed products, and rising consumer interest in high-quality protein-rich food products. In China, plasma powder is used in pig feed to improve growth performance and support the animal's immune system. In Japan and South Korea, plasma powder is used in the production of protein-enriched food products such as pasta, noodles, snacks, and baked goods marketed as healthier and nutritious alternatives. These trends are expected to drive significant growth in the market for plasma powder in the coming years.

The North American region dominates the industry due to increased demand for animal feed and pet food products that promote animal health and wellness. In the US, plasma powder is extensively used in the production of pet food products and in aquafeed formulations. For instance, Mars Petcare and Nestle Purina use plasma powder as an ingredient in their pet food products, which are sold across North America. In Canada, plasma powder is used in piglet feed to improve gut health, while in the US, it is used in broiler feed to improve growth performance and support the immune system.

Competitive Insight

Some of the major players operating in the global plasma powder market include ACTIPRO, APC, British Aqua Feeds, Darling ingredients, Feed Stimulants, IQI Petfood, Lican Food, Otto Chemie, Rock Mountain Biologicals, SARIA Group, Shenzhen Taier, Sonac, and UAP.

Recent Developments

- In May 2022, Darling Ingredients Inc, a US-based company specializing in sustainable natural ingredients, made an undisclosed acquisition of Valley Proteins. The acquisition aims to bolster Darling Ingredients' business and expand its offerings of low-carbon intensity feedstocks.

Plasma Powder Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 3.08 billion |

|

Revenue forecast in 2032 |

USD 4.69 billion |

|

CAGR |

4.8% from 2023 - 2032 |

|

Base year |

2021 |

|

Historical data |

2019- 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Component, By Railway Type, By Operation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ACTIPRO, APC, British Aqua Feeds, Darling ingredients, Feed Stimulants, IQI Petfood, Lican Food, Otto Chemie Pvt. Ltd., Rock Mountain Biologicals, SARIA Group, Shenzhen Taier, Sonac, UAP. |

FAQ's

The plasma powder market size is expected to reach USD 4.69 billion by 2032.

Key players in the plasma powder market are ACTIPRO, APC, British Aqua Feeds, Darling ingredients, Feed Stimulants, IQI Petfood, Lican Food, Otto Chemie, Rock Mountain Biologicals.

Asia Pacific contribute notably towards the global plasma powder market.

The plasma powder market is expected to grow at a CAGR of 4.8% during the forecast period.

The plasma powder market report covering key segments are source, application, and region.