Plastic Antioxidants Market Size, Share, & Industry Analysis Report

: By Antioxidant Type, By Resin Type, By Application (Automotive, Food & Beverage, Pharmaceutical, Construction, and Others), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5700

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

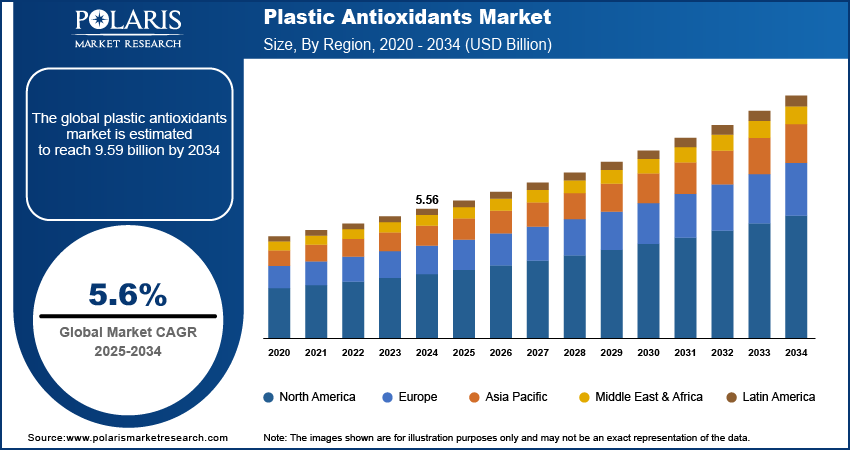

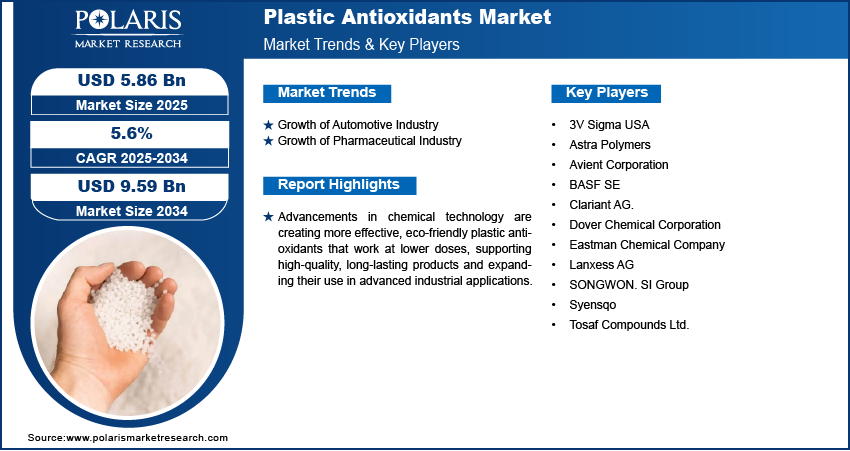

The global plastic antioxidants market size was valued at USD 5.56 billion in 2024, growing at a CAGR of 5.6% during 2025–2034. The market is driven by the growing automotive, food and beverage industries and rising focus on sustainability.

Plastic antioxidants are chemical additives used to prevent the degradation of polymers caused by heat, oxygen, and UV exposure during processing and throughout the product's lifecycle. They help maintain the material's strength, color, and flexibility, thereby extending the durability and performance of plastic products.

The growth in polymer production is driving the demand for antioxidants. Polymers are the raw materials used to make most types of plastic. Global polymer production is increasing as various industries, including packaging, electronics, and household goods, use plastics for different applications. During the manufacturing and processing of polymers, high heat, and pressure can lead to oxidation, which weakens the material. Antioxidants are added to prevent this, ensuring the polymer remains stable and functional. The more polymers are produced, the higher the need for antioxidants, making polymer production growth a direct driver for the plastic antioxidants market.

To Understand More About this Research: Request a Free Sample Report

New developments in chemical technology are supporting the development of better plastic antioxidants. These advanced additives are more effective at protecting plastics from heat, oxygen, and UV damage. Some are designed to work at lower concentrations, making them cost-effective while still offering strong protection. Others are more environmentally friendly or safer for food contact. Manufacturers are turning to these new-generation antioxidants as industries demand higher-quality, longer-lasting plastic products. These innovations are supporting the expansion of the use of plastic antioxidants into more advanced applications and give companies a competitive edge, driving growth in the overall market.

Market Dynamics

Growth of Automotive Industry

The automotive industry is increasingly using plastic components to make vehicles lighter, more fuel-efficient, and cost-effective. From dashboards and bumpers to under-the-hood parts, plastics are utilized to withstand high temperatures, mechanical stress, and long-term exposure to air and sunlight. Antioxidants are essential in protecting these materials, helping them last longer without degrading. According to the US Bureau of Labor Statistics, the automotive sector in the US alone employed 4,486,300 people in 2024. The demand for high-performance antioxidants is increasing as the global automotive sector is growing especially electric vehicles, thereby driving the market growth.

Growth of Pharmaceutical Industry

Pharmaceutical packaging and medical devices use specialized plastic materials due to their safety, sterility, and durability. Plastics used in this industry have to remain stable during storage and handling, and they cannot degrade when exposed to light or air. Antioxidants play a key role in preserving the integrity and safety of these plastics. The use of plastic in this sector is expanding as the global pharmaceutical sector is expanding rapidly. According to MedTech Europe, the European pharmaceutical industry has around 900,000 people. As a result, the need for pharmaceutical-grade plastic antioxidants is growing, driving the market growth.

Segmental Insights

By Antioxidant Type Analysis

The phenolic segment dominated with largest share in 2024 due to their excellent thermal stability and effectiveness in preventing oxidation during polymer processing and product use. They are effective in stabilizing plastics exposed to heat and oxygen, making them widely used in high-performance applications such as automotive parts, electrical components, and packaging. Their compatibility with a broad range of resins and ability to maintain color and mechanical strength over time make them a preferred choice. The dominance of phenolic antioxidants is further supported by ongoing innovations in high-molecular-weight and non-staining variants tailored for modern plastic formulations.

By Resin Type Analysis

The polyvinyl chloride segment is experiencing significant growth during the forecast period due to its expanding use in construction, electrical wiring, medical devices, and consumer goods. While PVC is naturally flame-resistant and durable, it is also prone to thermal degradation during processing. Antioxidants help maintain its physical properties, color, and performance by preventing heat- and light-induced breakdown. The demand for stabilized PVC products is growing as infrastructure projects and healthcare demands is rising globally. All these factors are fueling the need for effective antioxidants and driving PVC segment.

The polyethylene segment dominated with the largest share in 2024, driven by its extensive use across industries such as packaging, agriculture, construction, and consumer goods. Polyethylene requires antioxidants to maintain its mechanical and visual properties during processing and throughout its product life. The polymer’s susceptibility to oxidation under UV exposure makes antioxidants essential for preventing brittleness and discoloration. The high global production volumes of polyethylene, combined with its versatility and broad application scope, is creating strong demand for antioxidants.

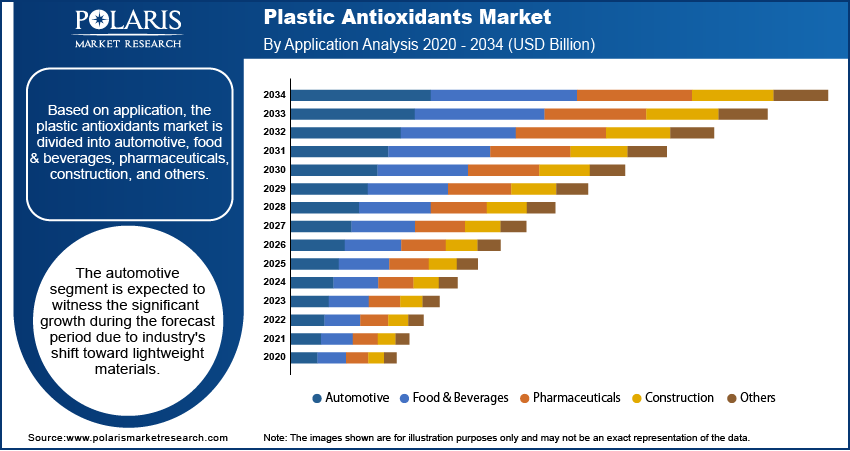

By Application Analysis

The automotive segment is expected to witness significant growth during the forecast period due to the industry's shift toward lightweight materials to improve fuel efficiency and reduce emissions. Plastics in vehicles are used in components such as interiors, under-the-hood parts, and exterior trims, all of which face exposure to heat, chemicals, and UV radiation. Antioxidants help protect these materials from degradation, extending their functional life and maintaining performance. The use of specialty plastics and antioxidants is expected to grow rapidly with the rise of electric vehicles and advanced automotive technologies, driving the segment growth.

Regional Analysis

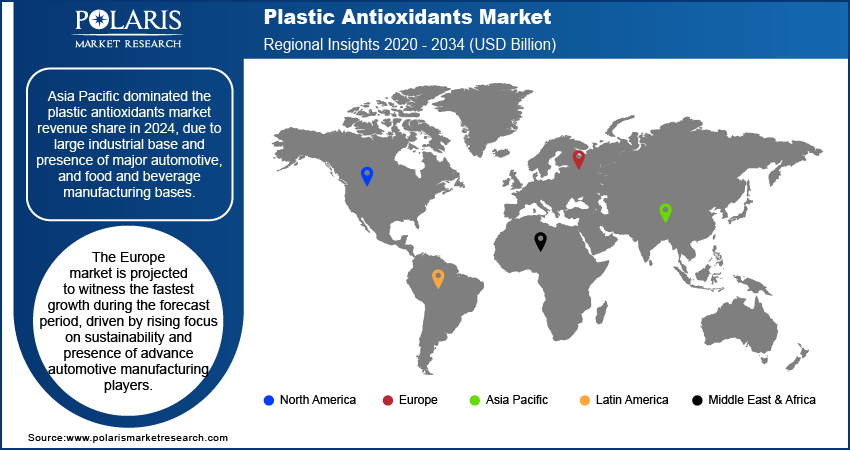

The Asia Pacific plastic antioxidant market recorded the largest share in 2024 due to rapid industrialization, urban development, and manufacturing expansion. Countries such as China, South Korea, and Southeast Asian nations are major hubs for plastics production, automotive, packaging, and electronics industries, which are all major consumers of plastic antioxidants. The growing middle class and demand for consumer goods further boost plastic usage. Additionally, local governments are investing in infrastructure and encouraging domestic manufacturing, increasing the need for durable plastics. Consequently, the demand for antioxidants that improve plastic performance and longevity is rising across the region.

The India plastic antioxidants market is driven by its expanding manufacturing sector and increasing demand for plastics in packaging, automotive, agriculture, and healthcare. The government’s “Make in India” initiative is promoting domestic production, leading to higher polymer and plastic component output. At the same time, rising disposable income is fueling the consumption of plastic-based consumer products. However, India's tropical climate and widespread use of low-cost plastics make antioxidant additives essential to improve heat and UV resistance. These factors are contributing to a steady increase in antioxidant usage across India’s growing plastics industry.

The Europe plastic antioxidants market expansion is attributed to high environmental standards and advanced manufacturing practices. The region places a strong emphasis on sustainability and regulatory compliance, pushing demand for safer, nontoxic, and eco-friendly antioxidant solutions. European countries such as France, Italy, and the UK use plastics heavily in the automotive, packaging, and industrial sectors, where material durability is key. The shift toward circular economy practices is further encouraging the use of high-performance additives to extend the life of recycled plastics. Thus, the focus on quality and sustainability is driving the market in Europe.

The Germany plastic antioxidants market is driven by its advanced automotive and engineering industries. German manufacturers are utilizing high-performance plastics in vehicles, electronics, and machinery, requiring antioxidants to maintain long-term durability and resistance to wear. The country’s strong R&D focus supports the development of innovative antioxidant formulations tailored for precision applications. In addition, Germany's strict environmental and safety regulations drive demand for high-quality, compliant additives, thereby driving the market growth in Germany.

Key Players & Competitive Analysis Report

The plastic antioxidant market features a competitive landscape dominated by key players such as BASF SE, Lanxess AG, Syensqo, and Clariant AG, who lead through innovation, broad product portfolios, and global reach. Companies such as SONGWON, SI Group, and Eastman Chemical Company offer specialized solutions, enhancing market diversity. Mid-sized firms including Astra Polymers, Dover Chemical Corporation, Tosaf Compounds Ltd., and 3V Sigma USA contribute through regional expertise and niche product lines. Avient Corporation strengthens its position via advanced material technologies. Strategic partnerships, product development, and sustainability initiatives are central to competition, as players strive to meet evolving regulatory and performance demands.

BASF SE is a global chemical corporation with seven distinct business segments: chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The chemical segment supplies petrochemicals and their intermediates. Advanced materials and their precursors for applications such as polyamides and isocyanates are available through the Materials section, inorganic basic products and specialties for the plastic and plastic processing industries. The industrial solutions sector deals with the development and sale of various ingredients and additives such as polymer dispersions, resins, electronic materials, pigments, light stabilizers, antioxidants, mineral processing, oilfield chemicals, and hydrometallurgical chemicals. On the other hand, Surface Technologies provides chemical solutions and automotive OEM services to the automotive and chemical sectors. This includes surface treatment, battery materials, refinishing coatings, catalysts, and base metal services. The Nutrition and Care sector provides ingredients for food and feed producers, pharmaceutical, detergent, cosmetics, and cleaner industries. Lastly, the Agricultural Solutions segment offers seeds and crop protection products, such as herbicides, fungicides, insecticides, seed treatment products, and biological crop protection products. BASF offers a range of antioxidants for polymers, including primary, secondary, and multifunctional types, designed to protect plastics and rubber from oxidation, degradation, and loss of properties during processing, storage, and end use. Its key products include Irganox and Irgafos.

Clariant AG is a Swiss specialty chemicals company headquartered in Muttenz, Switzerland. Founded in 1995 as a spin-off from Sandoz, the company operates in 36 countries with 68 subsidiaries and manufacturing sites in Europe, North America, South America, China, and India. Clariant’s business is divided into three main units: Care Chemicals, Adsorbents & Additives, and Catalysts. The company produces specialty chemicals used in various sectors, such as personal care, automotive, packaging, and industrial applications. Geographically, Clariant’s sales are distributed with 41% in Europe and the Middle East, 30% in Asia Pacific, and 29% in North and Latin America. The company follows a local-for-local approach, focusing on regional sourcing and production to address supply chain challenges and local market requirements. The company offers AddWorks PKG 158, which is an advanced antioxidant solution for polyolefins, offering excellent color protection, heat stability, and enhanced resin performance during processing and recycling. It is supplied as moisture-resistant granules, ideal for high-temperature thermoplastic applications.

Key Players

- 3V Sigma USA

- Astra Polymers

- Avient Corporation

- BASF SE

- Clariant AG.

- Dover Chemical Corporation

- Eastman Chemical Company

- Lanxess AG

- SONGWON. SI Group

- Syensqo

- Tosaf Compounds Ltd.

Plastic Antioxidants Industry Developments

In December 2023, BASF launched Irgastab PUR 71, a high-performance, amine-free antioxidant that enhanced regulatory compliance, reduced emissions, and improved foam quality, offering a sustainable, low-VOC solution for polyol and polyurethane foam producers across automotive and comfort industries.

In September 2022, SONGWON Industrial Co., Ltd. launched SONGNOX® 9228 antioxidant and SONGSORB 1164 UV absorber at K 2022, reinforcing its commitment to innovation and enhancing its polymer stabilizer portfolio for packaging, construction, agriculture, and personal care applications.

Plastic Antioxidants Market Segmentation

By Antioxidant Type Outlook (Revenue, USD Billion, 2020–2034)

- Phenolic

- Phosphite & Phosphonite

- Antioxidant Blends

- Amines

- Others

By Resin Type Outlook (Revenue, USD Billion, 2020–2034)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Food & Beverages

- Pharmaceuticals

- Construction

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Plastic Antioxidants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.56 Billion |

|

Market Size Value in 2025 |

USD 5.86 Billion |

|

Revenue Forecast by 2034 |

USD 9.59 Billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.56 billion in 2024 and is projected to grow to USD 9.59 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are BASF SE, Lanxess AG, Syensqo, Clariant AG, SI Group, Astra Polymers, Dover Chemical Corporation, Tosaf Compounds Ltd., 3V Sigma USA, Avient Corporation, and Eastman Chemical Company.

The Polyethylene segment dominated the market share in 2024.

The automotive segment is expected to witness the significant growth during the forecast period.