Plastic Processing Machinery Market Share, Size, Trends, Industry Analysis Report

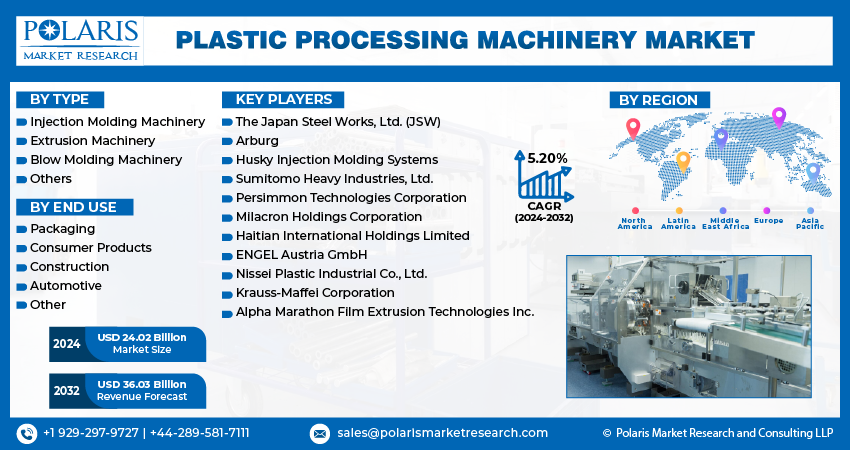

By Type (Injection Molding Machinery, Blow Molding Machinery, Extrusion Machinery, Others); By End Use; By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4120

- Base Year: 2023

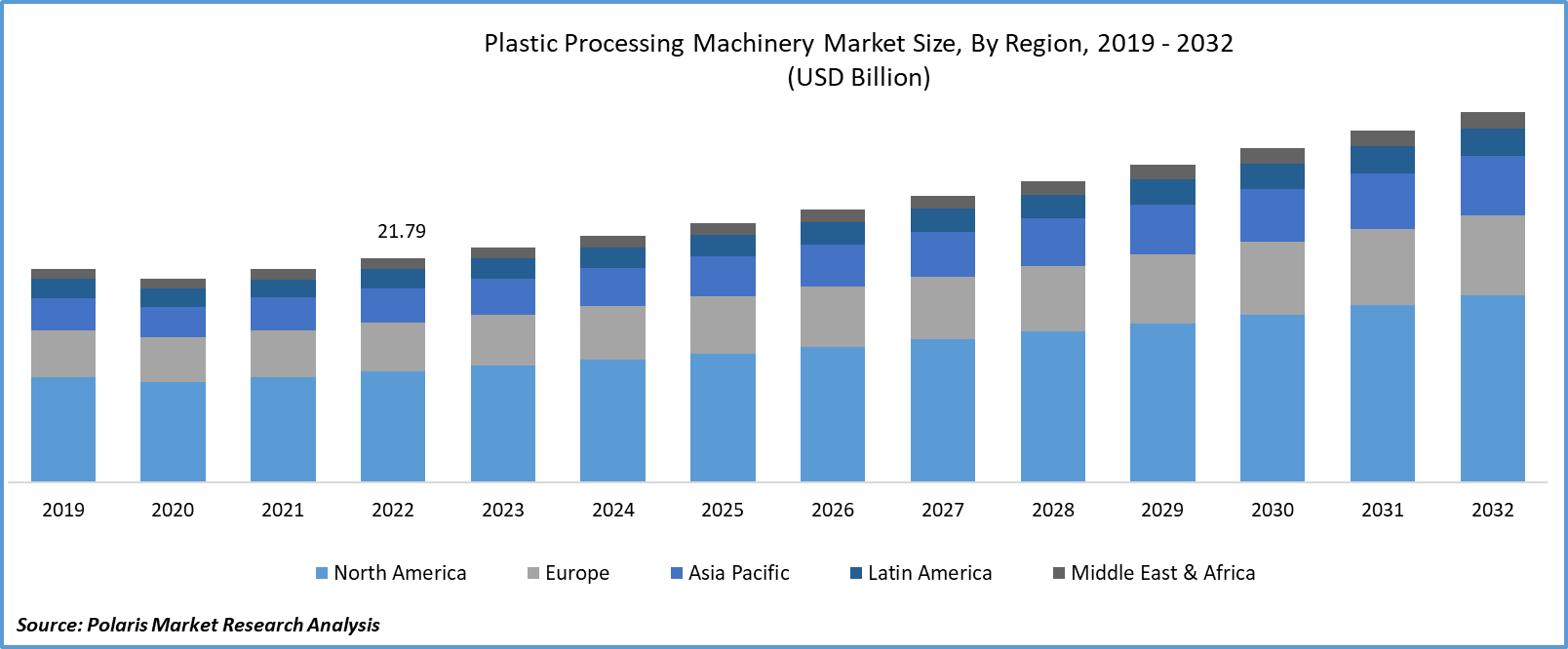

- Historical Data: 2019-2022

Report Outlook

The global plastic processing machinery market was valued at USD 22.87 billion in 2023 and is expected to grow at a CAGR of 5.20% during the forecast period.

The increasing significance of lightweight materials in the automotive industry is poised to have a substantial impact on the use of plastic materials in the manufacturing of vehicle components. This trend is expected to drive significant growth in the industry. Plastic processing machines play a vital role in this scenario. These machines are utilized to create a diverse array of vehicle components, ranging from exterior body panels and bumpers to spoilers, dashboards, and electrical housings. In essence, these machines enable the automotive industry to craft intricate and essential parts of vehicles using plastic materials. This shift towards lightweight and versatile plastics signifies a broader trend in the industry, emphasizing efficiency, cost-effectiveness, and adaptability in the production of automotive components.

To Understand More About this Research: Request a Free Sample Report

Plastic offers distinct advantages like affordability and flexibility, setting it apart from materials such as metal, stone, and wood. Due to these traits, plastic finds extensive applications in both the economy and everyday life. Plastic products and the industry itself hold a crucial global position. The market's growth is expected to be influenced by several trends, notably the increasing demand for reinforced plastics, which offer enhanced strength, and biodegradable plastics, addressing environmental concerns. Additionally, the industry is evolving through the integration of "Industry 4.0" principles. This concept refers to the fourth industrial revolution, where digital technologies such as IoT (Internet of Things), artificial intelligence, and data analytics are seamlessly merged with manufacturing processes, including those in the plastic industry.

By embracing Industry 4.0, plastic manufacturers can optimize their operations, enhance efficiency, and create innovative products. The integration of digital technologies allows for real-time monitoring, predictive maintenance, and intelligent automation, due to improved quality, reduced costs, and increased sustainability. This digital transformation is reshaping the plastic industry, making it more responsive, efficient, and environmentally friendly.

For Specific Research Requirements: Request for Customized Report

Plastic processing machinery promotes the production of plastic packaging tailored for diverse applications and in various forms. This technology is versatile, creating packaging for food and beverages, innovatively designed body care products, and even containers for household chemicals. Anticipated market growth is driven by increased demand for packaging in sectors such as healthcare, personal care, cosmetics, and consumer goods.

Industry Dynamics

Growth Drivers

- Expanding Packaging Industry

The packaging industry is a major consumer of plastic processing machinery. The increasing demand for packaged goods, especially in the food and beverage sector, drives the need for advanced machinery for the production of various packaging materials. The residential construction sector in the U.S. is expected to experience significant growth in the coming years, particularly driven by the construction of single-family homes. This uptick in construction endeavors is creating a heightened demand for extruded products. These products, essential for various construction elements like curtain walls, window frames, door frames, exterior cladding, roofing, canopies, space frame systems, and arches, are in high demand. This increasing need for extruded products within the construction industry is anticipated to influence the growth market positively.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- In 2022, the injection molding machine segment held the largest market share.

The injection molding machine segment held the largest market share in 2022. This leadership position is attributed to the growing automotive production sector and the rising demand for lightweight automotive components, which are driving market expansion. Furthermore, advancements in injection molding machine technologies, such as Electrical Discharge Machining (EDM) & high-speed Computer Numerical Control (CNC) processes, have significantly reduced lead times. This reduction has increased the adoption of injection molding machines within the automotive industry.

Injection molding machines are essential for producing a wide range of consumer goods, including personal hygiene products, houseware, toys, cosmetics, & convenience items. In recent years, there has been a significant shift away from traditional materials like glass, wood, and metal, with high-quality plastics taking their place. This shift has substantially increased the demand for these machines.

By End-Use Analysis

- The packaging segment is expected to witness the fastest market during the forecast period.

The packaging segment is expected to witness the fastest plastic processing machinery market during the forecast period, driven by the reliance on plastic processing machines. These machines play a pivotal role in the creation of diverse packaging materials, containers, and bottles. Within the packaging industry, plastic processing machines are extensively used for manufacturing items such as beverage bottles, food containers, cosmetic packaging, and flexible materials like bags and films.

In the automotive sector, these machines are essential for producing various plastic components integral to vehicles. It includes the manufacturing of interior panels, bumpers, dashboards, and engine components. Furthermore, in the construction industry, plastic processing machines find applications in creating plastic pipes, fittings, profiles, and other building materials. The machinery contributes to the production of items such as window frames, PVC pipes, structural components, and insulation materials.

Regional Insights

- APAC region accounted for the largest market share in 2022

In 2022, APAC accounted for the largest market share. Region's growth is primarily due to escalating healthcare needs, swift industrialization in emerging economies & the rising requirement for plastic molds in electric vehicles. Additionally, the rapid expansion of the automotive and packaging sectors in the region is anticipated to drive demand further throughout the forecast period.

As per the India Brand Equity Foundation (IBEF), the plastics industry in India includes over 2,000 exporters and encompasses over 30,000 processing units. Notably, around 85-90% of these units are classified as small & medium-sized enterprises.

According to Eurostat, the construction industry represented 5.6% of the market share in 2021, which slightly decreased to 3.6% in 2022. This sector's expansion was propelled by a 3.4% growth in the residential market and a 3.7% growth in the non-residential market. These trends are projected to continue with annual growth rates ranging from 0.6% to 2.1% until 2024. Consequently, due to the escalating demands in the construction industry, there is an anticipated increase in the need for plastic processing machinery.

Latin America region will grow at the fastest rate in the upcoming period. The region is becoming a global center for automotive production due to substantial investments and internal development projects. Brazil plays a significant role as it is the primary hub for automobile manufacturing, encouraging the growth of automotive operations throughout the region.

Key Market Players & Competitive Insights

Major manufacturers employ various strategies such as product launches, geographic expansions, and mergers and acquisitions to expand their plastic processing machinery market presence and meet evolving technical requirements.

Some of the major players operating in the global market include:

- The Japan Steel Works, Ltd. (JSW)

- Arburg

- Husky Injection Molding Systems

- Sumitomo Heavy Industries, Ltd.

- Persimmon Technologies Corporation

- Milacron Holdings Corporation

- Haitian International Holdings Limited

- ENGEL Austria GmbH

- Nissei Plastic Industrial Co., Ltd.

- Krauss-Maffei Corporation

- Alpha Marathon Film Extrusion Technologies Inc.

Recent Developments

- In June 2022, ENGEL collaborated with ALPLA Group, IPB, and Brink Printing to launch K 2022, representing a significant advancement for the packaging sector. This innovation enables the production of PET thin-walled containers in a single injection molding step for the very first time.

- In May 2022, Husky Technologies introduced an innovative system called RTMP (HyPET HPP5e Recycled Melt to Preform). This groundbreaking concept demonstrates the seamless integration of a preform injection molding system with the melt de-contamination unit. This integration enables washed flake to transform into a preform, showcasing a highly efficient recycling process.

Plastic Processing Machinery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 24.02 billion |

|

Revenue forecast in 2032 |

USD 36.03 billion |

|

CAGR |

5.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |