Polyaryletherketone (PAEK) Market Share, Size, Trends, Industry Analysis Report

By Type; By Fillers; By Application (Oil & Gas, Electrical, and Electronics, Aerospace, Automotive, Medical, and Others); By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 115

- Format: PDF

- Report ID: PM3005

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

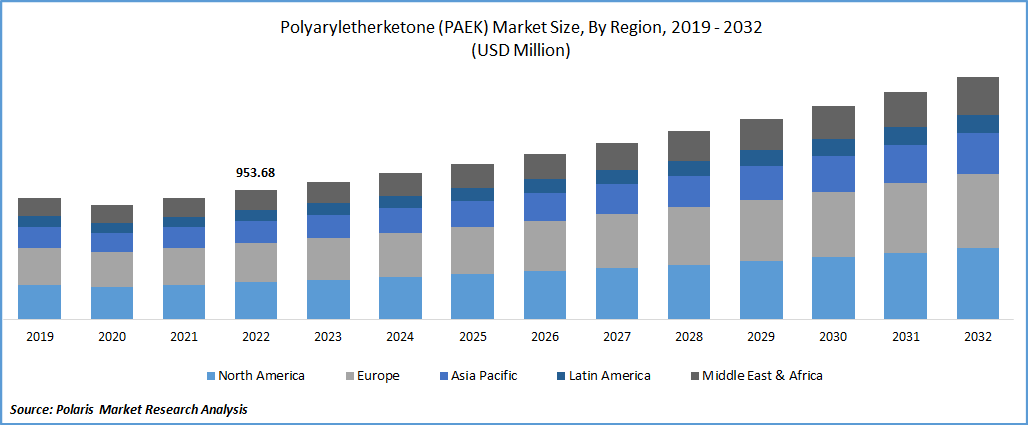

The global polyaryletherketone (PAEK) market was valued at USD 953.68 million in 2022 and is expected to grow at a CAGR of 6.5% during the forecast period.

The global PAEK market is evolving, and companies are now focusing more on strengthening and consolidating R&D activities; thereby there is an increase in the production capacity of PAEK thus, driving the market growth by catering to the need for PAEK in above mentioned end-use industries. Furthermore, PAEK has a linkage of aryl linkage which gives PAEK high stability and flame resistance property.

Know more about this report: Request for sample pages

Polyaryletherketone (PAEK) is a member of the polyether ketone family of high-performance thermoplastics. Polyaryletherketone (PAEK) is obtained from injection molding, extrusion, and compression molding techniques. PAEK occurs in different types named polyether ether ketone (PEEK), polyether ketone (PEK), and polyether ketone ketone (PEKK). In addition, it is a semi-crystalline thermoplastic that possesses high temperature and mechanical strength owing to which it is widely utilized in the automotive, aerospace, medical, and among others.

The outbreak of the COVID-19 pandemic had significantly impacted the growth of the polyaryletherketone (PAEK) market. The shutdown of various manufacturing units and o imposition of strict lockdown has hampered the growth of the PAEK market. In addition, the decrease in the sales of the automotive and aerospace industry during the pandemic has disturbed market revenue. This situation has temporarily hampered the demand and supply chain of the PAEK market. In addition, concern about economic development from several countries, evolving, and recovering markets during 2022 are expected to drive the market post-COVID-19.

Market New.png)

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The utilization of PAEKs has increased in the automotive industry this is attributed to the fact that a growing population coupled with a rise in the consumer demand for vehicles, growing trends for personal vehicles, and government investment and support for automobile manufacturing has escalated the overall sales of PAEK market. For instance, according to a report published by India Brand Equity Foundation in the year July 2022, India’s yearly production of OEMs in the year 2022 was 22.93 million vehicles where PAEK is used to manufacture the auto-components, such as bearings, jet engines, battery assembly, and among others. These factors are expected to enhance the demand for the PAEK market.

Report Segmentation

The market is primarily segmented based on form, product, application, and region.

|

By Type |

By Fillers |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Polyether ether ketone (PEEK) segment is expected to witness fastest growth

The demand for PEEK is an increase in the medical industry owing to the rise in the number of diseases, innovative technology, and an increase in the production rate of medical devices is expected to foster the PEEK market. Physio-chemical properties of PEEK make them an ideal component for medical surgeries. It is mainly used in spine surgeries, orthopedics, facials, and others. Moreover, data revealed by Invest India in the year November 2022, the medical devices market in India is projected to grow 4x fastest by 2030. These supporting factors are strengthening the potential sale of the PEEK market in the coming years.

Furthermore, the demand for PEEK is growing rapidly in the automotive and industrial sectors due to their high strength, lightweight, flexibility, and thermal conductivity attributes This is projected to propel the growth of the PAEK market in the automotive industry. Polyetherketone ketone PEKK is likely to hold the second largest market share over the forecast period, followed by PEEK. PEKK has an excellent source of biocompatibility owing to which it finds a wide range of applications in the dentistry industry. Its high mechanical strength and low toxicity make them best suited for dental implants, dental restoration, endoposts, and among others. These factors are driving the overall market; thus, offering the most lucrative opportunities for the market.

Glass filled segment accounted for the largest market share in 2022

Glass-filled PAEK is an ideal component for automotive, aerospace, manufacturing, oil & gas, and industrial sectors where high strength, structural integrity, stiffness, and stability requires. It is a high-performance thermoplastic obtained with glass-filled technology. Furthermore, the growth of glass filled PAEK market has increased due to the establishment of industrial, aerospace, medical, construction, electrical, and other end-use sectors. This may act as one of the key drivers responsible for the growth of the PAEK market.

The increase in the emerging surgical operation of humans, and the robust growth of the medical devices manufacturing industry have played a significant role in market growth. Moreover, factors such as the rise in population across the globe and well-established industries in both developed and developing economies have enhanced the performance of glass-filled PAEK. This factor is expected to increase the potential sales of PAEK; thus, offering the most remunerative opportunities for the future.

Automotive application segment accounted for the largest market share in 2022

The utilization of PAEK has increased in the automotive industry due to the growing population coupled with a rise in the production rate of vehicles, increase in the logistics and transportation activities has driven the market. For instance, the Indian automobile industry contributes almost 6.4% of India's GDP and 35% of the manufacturing GDP. PAEK offers high mechanical strength, excellent hydrolysis resistance, and superior thermal and electrical stability owing to which it is widely used during the manufacturing process of auto components, engines, seal rings, bearings, wear pads, and others.

These supporting factors are boosting the market growth. In addition, its ability to withstand high temperatures because of is used in the chemical pump industry. Furthermore, PAEKs are used for increased strength & weight reduction of vehicles to have better fuel efficiency. These factors together increase the usage of PAEK in the growing automotive industry.

Moreover, the oil & gas application segment has accounted for the second largest segment in the PAEK’s market. This is attributed to the fact that growing transportation activity, an increase in the demand for crude oil, and well establishment of the petrochemical industry is the key market trend for the PAEK market. PAEK is widely used in oil drilling material, such as valve parts, seals, bearings, compressor seals, wire coatings, and others.

Europe accounted for largest market share in 2022

European region tend to show considerable growth due to the strong existence of top automobile manufacturers such as Volkswagen BMW, Audi, Mercedes-Benz, and Porsche which are constantly adding value by producing attractive cars where PAEKs are used for sealing and increasing the aerodynamics of vehicles. Furthermore, several manufacturers such as Solvay, Evonik Industries, Arkema, and others are constantly engaged in product launches, partnerships, business expansion, and other strategic key development which in turn led to a rise in the production rate of the PAEK market.

Growing consumer demand for electric vehicles, an increase in the production rate of electronic gadgets, and electrically based household appliances have escalated the PAEK market during the forecast period. Additionally, PAEK is used in the designing and production process of electronic devices. Furthermore, European medical technology is growing at a rapid pace owing to the adoption of innovative technology, and artificial intelligence has enhanced the performance of the PAEK market.

Asia Pacific expected to register the highest growth rate over the study period. Countries such as China, Japan, India, and others have significant contributions to the growth of the PAEK market in the region. North America and the LAMEA region have shown positive growth in the PAEK market owing to a rise in government support, R&D activities on PAEK have spurred the market growth. In addition, the increase in the population and the rise in demand for automobiles and electric vehicles in the region.

Competitive Insight

Some of the major players operating in the global market include Amco Polymers., Arkema, Caledonian Industries Ltd, Ensinger GmbH, Evonik Industries AG, Gharda Chemicals Ltd, J.K. Overseas, Jilin Zhongyan High-Performance Plastic Co., Ltd., NANOCHEMZONE, Nanorh, Panjin Zhongrun High-Performance Polymer Co., Ltd, Quadrant AG, Solvay, URMA, Victrex plc, and Solvay S.A.

Recent Developments

- In September 2020, Evonik Industries has launched the next-generation polyether ether ketone implant material for medical technology under the trade name of VESTAKEEP Fusion. This PEEK improves the fusion between the bone and implants. This strategic product launch is projected to enhance the PAEK market in Europe.

- Furthermore, in July 2020, Victrex Company which is a global leader in the manufacturing of PEEK launched a new product named VICTREX AM 200 filament. This new product is optimized for additive manufacturing. This strategic product launch is projected to strengthen the potential sales of the PAEK market in China.

- In November 2021, SEQUENS entered into a strategic partnership with Arkema for the development of IMPEKK. This IMPEKK is widely used in 3D printing and long-term medical implants. This strategic partnership is anticipated to boost the company’s potential sales for PEEK.

Polyaryletherketone (PAEK) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,015.09 million |

|

Revenue forecast in 2032 |

USD 1,795.23 million |

|

CAGR |

6.5% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Fillers, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Amco Polymers., Arkema, Caledonian Industries Ltd, Ensinger GmbH,Evonik Industries AG, Gharda Chemicals Ltd, J.K. Overseas, Jilin Zhongyan High-Performance Plastic Co., Ltd., NANOCHEMZONE, Nanorh, Panjin Zhongrun High-Performance Polymer Co., Ltd, Quadrant AG, Solvay, URMA, Victrex plc, and Solvay S.A. |

FAQ's

The expected size of the Polyaryletherketone (PAEK) Market is $1,795.23 Million By 2032

Global Polyaryletherketone (PAEK) Market is estimated to grow at 6.5% CAGR through 2030.

Europe is expected to grow at a high CAGR over the projected period on account of to the strong presence of top automobile manufacturers.

Automotive sector is expected to hold the significant market share over the forecast period due to the growing population coupled with a rise in the production rate of vehicles, increase in the logistics and transportation activities has driven the PAEK market.