Polyurea Market Size, Share, Trends, & Industry Analysis By Raw Material (Aromatic, and Aliphatic, By Product, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5965

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

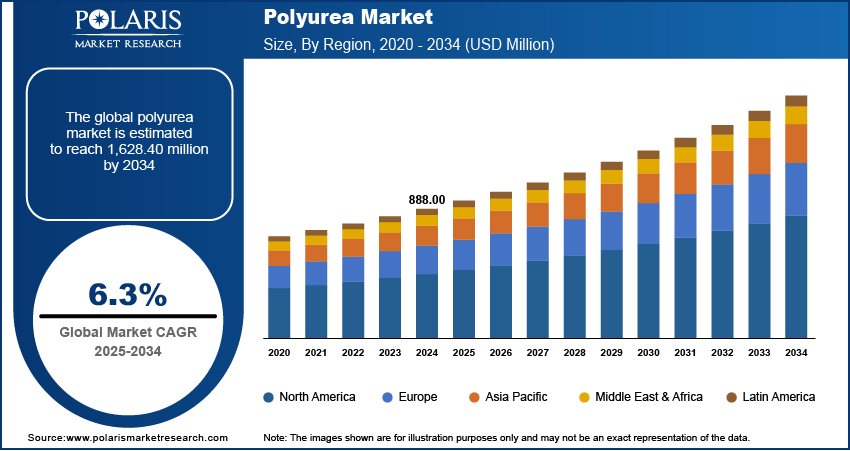

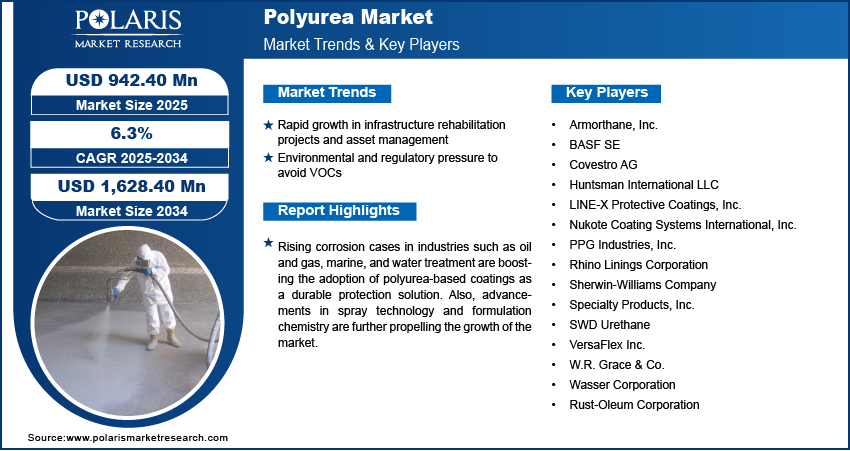

The polyurea market size was valued at USD 888.00 million in 2024, growing at a CAGR of 6.3% during 2025–2034. Rapid growth in infrastructure rehabilitation projects and asset management coupled with environmental and regulatory pressure is propelling the market growth.

Polyurea is a two-component elastomeric material formed by the rapid reaction of an isocyanate component and a resin blend. It is primarily used in spray applications to form protective barriers on concrete, steel, and other substrates. Unlike traditional coatings, polyurea cures within seconds and delivers excellent resistance to abrasion, corrosion, and moisture ingress. These characteristics make it suitable for waterproofing membrane, containment, pipeline coatings, roof membranes, and tank linings. Additionally, polyurea delivers long-term durability and flexibility even under extreme temperatures and harsh environmental conditions, making it a preferred choice across industrial and commercial applications.

The construction industry remains the largest consumer of polyurea in applications such as roofing, flooring, bridge decks, parking garages and tunnel coatings. In these areas, the material’s rapid curing ability combined with its high tensile strength and chemical resistance, allows efficient project execution. Polyurea’s seamless finish also prevents water penetration and mechanical damage, offering enhanced structural protection in exposed environments.

The rising corrosion-related losses in oil and gas, marine, and water treatment sectors are accelerating the demand for polyurea-based coatings. According to the World Corrosion Organization, global corrosion-related damages account for over USD 2.5 trillion annually, pushing industries to invest in advanced protective solutions. Polyurea helps mitigate these losses by providing seamless, non-porous coatings that prevent chemical exposure and moisture penetration. Asset owners are focusing long-term durability and cost efficiency to boost wider adoption of polyurea coatings for quick application, mechanical strength and extended service life.

In addition, technological developments in spray equipment and formulation chemistry are accelerating new product launches and expanding polyurea applications. Manufacturers are focusing on customized formulations for verticals such as defense, automotive and wastewater management, where protective coatings are required to meet strict performance and compliance standards. Growing emphasis on sustainability manufacturers are working towards low-VOC and eco-friendly polyurea systems that meet with regulatory standards and corporate ESG commitments.

Industry Dynamics

Rapid Growth in Infrastructure Rehabilitation Projects

The growing infrastructure rehabilitation projects across the globe is driving the growth of the polyurea market. Governments and private developers are prioritizing investment in essential public assets such as bridges, tunnels, highways, and water treatment plants. These projects require durable protective materials that withstand exposure to water, chemicals, vibration, and high loads conditions where polyurea performs effectively due to its fast-curing, abrasion-resistant, and waterproof characteristics. For instance, in March 2024, Amazon India partnered with the Centre for Ecology Development and Research (CEDAR) and India Water Project to launch a water replenishment initiative in Delhi. This project aims to improve groundwater recharge through check dams and ecosystem restoration, reflects a broader push toward long-term infrastructure sustainability.

Also, in April 2024, Vortex Companies announced the launch of a dedicated water division focused on advancing infrastructure rehabilitation in aging municipal water systems. The new division aims to deploy advanced materials, including polyurea, in restoring pipelines, tanks, and treatment facilities. The corrosion-resistant and crack-bridging properties of polyurea make it suitable for protecting internal surfaces of assets exposed to moisture and chemical flow. Therefore, the growing pace of public works construction and accelerated project timelines are making polyurea a preferred choice for contractors seeking fast application, reduced downtime and extended protection in demanding environments.

Environmental and Regulatory Pressure to Avoid VOCs

Stringent environmental regulations and growing awareness related to indoor and outdoor air quality are further propelling the market growth. For instance, in December 2023, the US Environmental Protection Agency (EPA) introduced the Super Emitter Program aims to significantly cutting methane emissions and other harmful air pollutants from the oil and gas sector. Polyurea coatings are emerging as a viable solution due to minimal volatile organic compound (VOC) content, fast curing rates and safe application profiles. Polyurea formulations offer a safer and more environmentally responsible alternative compared to conventional coatings. The shift toward sustainable construction practices coupled with green building certifications and stricter compliance requirements is increasing demand for coating technologies that meet environmental goals.

Regulations influencing construction and repair product choices are steadily increasing the market growth. Polyurea coatings are adopted among industry professionals and regulatory bodies to address the growing need for materials that support sustainability goals without compromising on performance. Its compatibility with low-VOC standards, resistance to chemical degradation and quick application process contribute to its strong growth in the market.

Segmental Insights

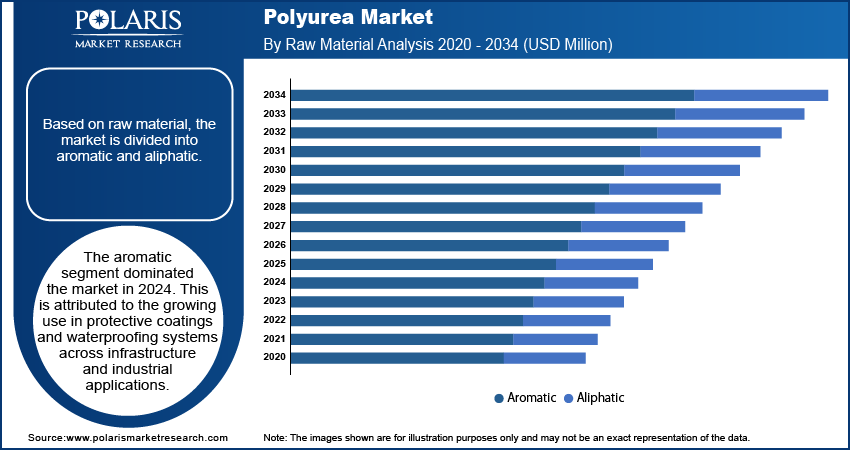

Raw Material Analysis

The segmentation, based on raw material includes, aromatic and aliphatic. The aromatic segment dominated the market in 2024. This is attributed to the growing use in protective coatings and waterproofing systems across infrastructure and industrial applications. Aromatic polyurea is preferred for applications where UV exposure is limited, such as in buried structures, secondary containment, wastewater systems, and internal linings. Its cost-effectiveness, rapid curing time and compatibility with various substrates make it suitable for large-scale usage in infrastructure rehabilitation and maintenance. Contractors use aromatic formulations for excellent adhesion and resistance to moisture, which are essential in high-volume civil projects where performance and speed are equally critical.

The aliphatic segment is projected to grow at the fastest rate during the forecast period, driven by its superior UV resistance and color stability. This type of polyurea is increasingly used in applications where aesthetic durability and weather exposure are key concerns, such as architectural coatings, decorative surfaces and transportation assets. Also, the ability of aliphatic polyurea to maintain gloss, prevent discoloration and resist environmental degradation is further accelerating the market growth.

Product Analysis

The segmentation, based on product includes, coating, lining, adhesives & sealants, and others. The coating segment dominated the market, in 2024. This dominance is attributed to the rising use across construction, utility infrastructure and transportation sectors. Polyurea coatings are extensively applied on concrete and metal surfaces to provide a seamless, waterproof and abrasion-resistant protective barrier. Infrastructure projects such as parking structures, tunnels, pipelines and bridges use polyurea coatings for fast application, long-term durability and strong bonding strength. These coatings offer chemical resistance, making it suitable for environments exposed to industrial effluents or aggressive cleaning agents. The growing need for asset protection and reduced downtime is pushing developers to choose polyurea coatings over conventional alternatives.

The adhesives & sealants segment is expected to witness the fastest growth during the forecast period. The rapid curing ability and high tensile strength of polyurea is increasing adoption in bonding and sealing applications across manufacturing, automotive and civil construction industries. Polyurea adhesives are used for assembling composite panels, metal fixtures and flexible joints, while sealants are applied in expansion joints, pipeline penetrations, and facade insulation. These materials offer resistance to water ingress, vibration and thermal cycling, which makes it reliable for long-term performance in dynamic environments.

Application Analysis

The segmentation, based on application includes, construction, industrial, transportation, others. The construction segment dominated the market, in 2024. This dominance is attributed to the widespread usage in flooring, roofing, foundation waterproofing and concrete protection. Polyurea’s fast-curing property reduces project downtime, making it well-suited for large-scale construction schedules. It offers long-term resistance to moisture, chemical exposure, and surface erosion, which are critical in commercial and civil infrastructure projects. Contractors are applying polyurea in bridges, commercial buildings, parking decks and stadiums to ensure longevity and reduced lifecycle maintenance. The expansion of urban infrastructure and increasing focus on asset protection continue to strengthen its use in the construction sector.

The transportation segment is projected to grow at the fastest pace over the forecast period. Rising investments in roadways, railways, and transit infrastructure are driving demand for protective materials that withstand mechanical wear, environmental exposure and dynamic loading. Polyurea is used in railway car linings, truck bed coatings, underbody protection, and marine vessels to safeguard surfaces from corrosion, saltwater, and abrasion. Its lightweight properties and ability to conform to complex geometries make it ideal for vehicles and equipment where weight and durability are critical. Growing investment from public and private sectors in transportation infrastructure is boosting the adoption of polyurea for asset protection and maintenance.

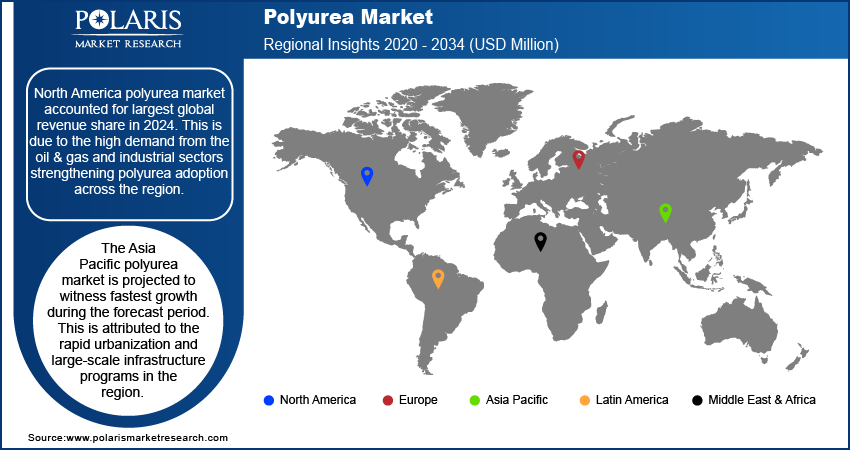

Regional Analysis

North America polyurea market accounted for largest global revenue share in 2024. This is due to the high demand from the oil & gas and industrial sectors strengthening polyurea adoption across the region. The material is widely applied in pipeline protection, secondary containment systems, and chemical storage facilities due to its superior resistance to corrosion, chemical exposure, and mechanical abrasion. Industrial operators are using polyurea over conventional coatings to meet durability and safety standards. Additionally, environmental regulations across the region are accelerating the shift toward low-VOC or VOC-free coating technologies thus driving the market growth. Also, regulatory agencies and sustainability frameworks are mandating stricter emission limits for industrial coatings, pushing asset owners and contractors to replace solvent-based coatings with more eco-efficient alternatives. Which in turn driving the demand for the polyurea industry.

The US Polyurea Market Insight

The US dominated the regional market share in 2024. This growth is owing to the surge in investments under the infrastructure investment and jobs act (IIJA) expanding opportunities for polyurea usage in infrastructure protection. As per the US Federal Aviation Administration, the IIJA invested over USD 25 billion for airport modernization that includes terminal expansion and structural upgrades. These projects require robust coatings that withstand weather exposure, vibration and load stresses. Polyurea fast-curing and long-term performance attributes are making it a suitable choice for sealing and protecting concrete and steel structures in areas with heavy traffic or exposure to water.

Asia Pacific Polyurea Market

The Asia Pacific polyurea market is projected to witness fastest growth during the forecast period. This is attributed to the rapid urbanization and large-scale infrastructure programs in the region. According to UN-Habitat, the region accounted for over 2.2 billion of the global urban population in 2023, and this number is projected to rise by an additional 1.2 billion by 2050. Countries such as China, India, and Indonesia are investing in metro systems, urban roadways and water infrastructure that require durable coatings for foundations, decks, tanks and tunnels. Polyurea offers waterproofing, flexibility and rapid curing benefits that help accelerate project timelines and minimize long-term maintenance needs.

In addition, the rising government budgets for water infrastructure and resource management are propelling polyurea usage in water-related applications. The material is used in the construction and rehabilitation of canals, reservoirs and containment tanks due to its ability to form seamless membranes that prevent leaks, withstand chemical contact and adapt to thermal movement. These properties are crucial for water conservation systems that operate under high stress. Climate variability and growing concerns around water security are pushing infrastructure planners to adopt durable materials such as polyurea to enhance structural reliability and extend service life.

Europe In Polyurea Market Overview

The Europe polyurea market growth is attributed to the stringent building regulations focused on envelope integrity and waterproofing across Europe. The region's regulations focus on using strong, low-emission construction materials that provide long-lasting protection from water damage, temperature changes and structural wear. This highlights the adoption of the polyurea-based products in this region. In May 2024, the European Union implemented the revised Energy Performance of Buildings Directive aims to enhance energy independence, lowering energy bills and improving living conditions across member states. The updated directive was designed to reduce grid investment requirements, support the EU’s target of cutting energy consumption by 11.7% by 2030, and accelerate the deployment of renewable energy technologies in buildings. This initiative fuels the demand for polyurea coatings for various application such as roofs, facades, and foundation structures to meet leak-proofing standards without compromising construction timelines. The fast-curing nature of polyurea also supports energy-efficient retrofitting projects in aging public buildings and infrastructure.

Expansion in renewable energy generation such as wind and hydropower installations is further fueling the demand for polyurea in this region. These energy assets require robust protection for towers, underwater supports and transmission infrastructure that are exposed to moisture, salt spray, UV radiation and mechanical loads. Polyurea’s flexibility and adhesion strength makes it suitable for these critical applications. The push toward clean energy adoption is increasing the demand for high-performance protective materials, creating growth opportunities for polyurea applications across critical infrastructure and energy projects.

Key Players & Competitive Analysis Report

The polyurea industry is highly competitive, with companies aims to broaden product lines, advance application techniques and strengthen distribution networks to address changing requirements across diverse end-use sectors. Companies are investing in R&D to formulate advanced polyurea systems that cater to niche applications such as energy infrastructure, marine vessels and industrial flooring. Increasing emphasis on fast-curing, environmentally compliant and high-durability protective coatings is shaping the product development strategies across the market. Leading manufacturers are working closely with applicators and project developers to customize polyurea formulations that meet with regional compliance standards and performance expectations. The market is also witnessing strategic acquisitions and collaborations to expand geographic reach and improving technical capabilities.

Prominent companies operating in the global polyurea market include Armorthane, Inc., BASF SE, Covestro AG, Huntsman International LLC, LINE-X Protective Coatings, Inc., Nukote Coating Systems International, Inc., PPG Industries, Inc., Rhino Linings Corporation, Rust-Oleum Corporation, Sherwin-Williams Company, Specialty Products, Inc., SWD Urethane, VersaFlex Inc., W.R. Grace & Co., and Wasser Corporation.

Key Players

- Armorthane, Inc.

- BASF SE

- Covestro AG

- Huntsman International LLC

- LINE-X Protective Coatings, Inc.

- Nukote Coating Systems International, Inc.

- PPG Industries, Inc.

- Rhino Linings Corporation

- Sherwin-Williams Company

- Specialty Products, Inc.

- SWD Urethane

- VersaFlex Inc.

- W.R. Grace & Co.

- Wasser Corporation

- Rust-Oleum Corporation

Industry Developments

June 2025: Sprayroq introduced Polyurea AR‑3400, a high-performance coating featuring rapid cure time, improved abrasion resistance and exceptional adhesion for heavy-duty industrial applications. It also demonstrated superior chemical resistance, making it ideal for protective lining in harsh environments.

July 2024: Delta Coatings launched a manufacturing plant to drive innovation in polyurea formulation and production. The facility included a new R&D lab focused on developing eco-friendly, low-VOC polyurea variants.

October 2023: Everest Systems launched a new polyurea coating designed for corrosion protection and flexible performance across extreme temperature ranges. The product offered fast-curing capabilities, reducing downtime in critical infrastructure maintenance.

Polyurea Market Segmentation

By Raw Material Outlook (Revenue, USD Million, 2020–2034)

- Aromatic

- Aliphatic

By Product Outlook (Revenue, USD Million, 2020–2034)

- Coating

- Lining

- Adhesives & Sealants

- Others

By Application Outlook (Revenue, USD Million, 2020–2034)

- Construction

- Industrial

- Transportation

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Polyurea Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 888.00 Million |

|

Market Size in 2025 |

USD 942.40 Million |

|

Revenue Forecast by 2034 |

USD 1,628.40 Million |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 888.00 million in 2024 and is projected to grow to USD 1,628.40 million by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Armorthane, Inc., BASF SE, Covestro AG, Huntsman International LLC, LINE-X Protective Coatings, Inc., Nukote Coating Systems International, Inc., PPG Industries, Inc., Rhino Linings Corporation, Rust-Oleum Corporation, Sherwin-Williams Company, Specialty Products, Inc.,

5. Which segment, by raw material, dominated the Polyurea market revenue share in 2024?

The adhesives & sealants segment is expected to witness the fastest growth during the forecast period.