Pour Point Depressant Market Share, Size, Trends, Industry Analysis Report

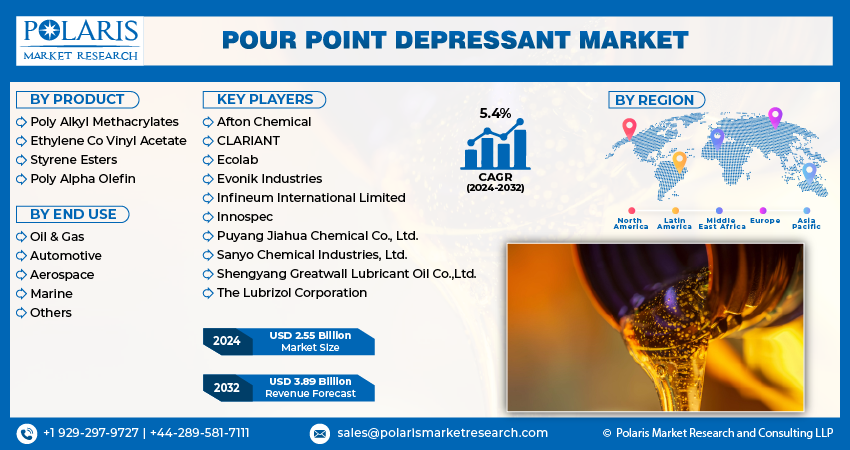

By Product (Poly Alkyl Methacrylates, Ethylene Co Vinyl Acetate, Styrene Esters, Poly Alpha Olefin), By End-use (Oil & Gas, Automotive, Aerospace, Marine, Others), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Mar-2024

- Pages: 117

- Format: pdf

- Report ID: PM4383

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

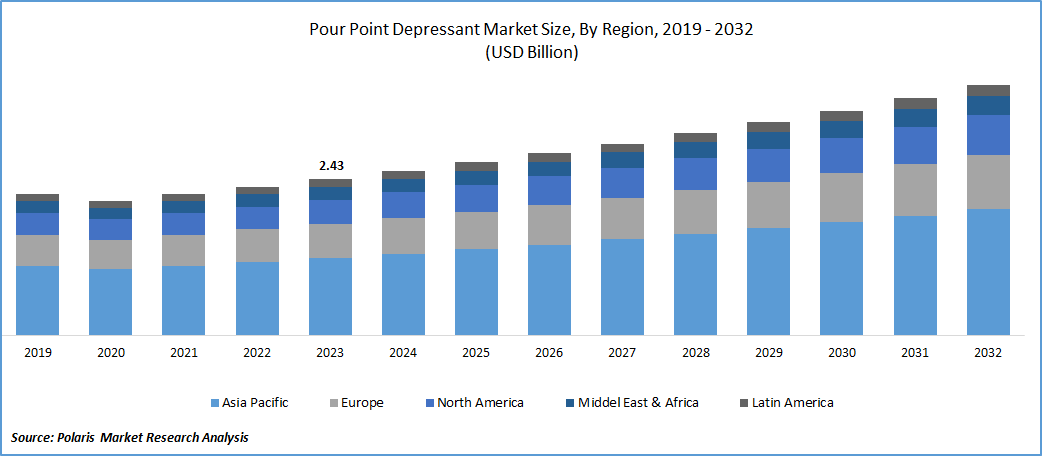

The global pour point depressant market was valued at USD 2.43 billion in 2023 and is expected to grow at a CAGR of 5.4% during the forecast period.

The market growth can be attributed to the increasing pace of industrialization worldwide, growing awareness concerning vehicle maintenance, the expanding scope of the aerospace industry, and the widespread adoption of pour point depressants in lubricant production for the oil and gas sector. Pour point depressants are chemical compounds added to hydrocarbon-based fluids to alter their flow properties at low temperatures. Their primary role is to lower the pour point temperature of a fluid, which is particularly crucial in regions characterized by cold climates. These depressants can be produced in various chemical structures, including polymers, copolymers, and organic compounds with polar functional groups, tailored to the application and characteristics of the base fluid.

Globally, the oil and gas industry stand out as a significant end-use market for pour point depressants. These additives play a crucial role in enhancing the flow characteristics of crude oil and petroleum products, particularly in cold regions such as tundra. The inherent tendency of hydrocarbons to freeze and solidify at lower temperatures necessitates the use of additives. Challenges in maintaining the flow of petroleum products like gasoline, diesel, and aviation fuel can lead to operational disruptions, diminished product quality, and increased maintenance costs.

To Understand More About this Research:Request a Free Sample Report

The demand for the pour point depressants in end-user industries worldwide has been notably propelled by rapid industrialization. These depressants play a crucial role in alleviating the negative impacts of low temperatures on various industrial processes. Key sectors including aviation, marine, and energy production depend on PPDs to guarantee the seamless functioning of their machinery and transportation systems, particularly in extremely cold weather conditions.

Industry Dynamics

Growth Drivers

- Growth in Transportation and Automotive Sector

The automotive and transportation industries are witnessing growth globally. As these industries expand, the demand for high-performance fuels and lubricants that can withstand diverse climatic conditions, including low temperatures, increases.

The significant surge in global vehicle sales constitutes a major driving force for industry. The rapid growth in population, coupled with the increasing trend of urbanization, has been a pivotal factor in the expansion of the automobile industry. According to the International Organization of Motor Vehicle Manufacturers, the total global car sales reached 61.6 million in 2022, reflecting a 6% increase compared to the sales in 2021. This heightened demand for automobiles consequently intensifies the requirement for lubricant additives and pour point depressants.

Report Segmentation

The market is primarily segmented based on product, end use, and region.

|

By Product |

By End Use |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Product Analysis

Ethylene co-vinyl acetate segment accounted for the largest market share in 2023

Ethylene co-vinyl acetate segment accounted for the largest share. This is primarily driven by its extensive use in biomedical engineering and drug delivery applications. The expansion of the drug delivery industry in recent years can be attributed to technological advancements and heightened research and development efforts. Moreover, the growth of the drug delivery sector is further supported by the rising incidence of chronic diseases and an aging population.

Styrene esters are obtained through an esterification process applied to styrene. These esters offer flexibility, adhesion, and serve as pour point depressants in the automotive and aerospace sectors. The rising adoption of electric vehicles has contributed to an increased demand in the automotive industry for styrene esters, particularly in the construction of engines and other components.

Poly alkyl methacrylates find extensive applications in the automotive and healthcare sectors, owing to their distinctive properties, including excellent thermal stability and resistance to various chemicals. The increasing preference for bio-based and environmentally friendly alternatives has emerged as a significant factor driving the utilization of this product in the polymer industry.

By End Use Analysis

- Oil & gas segment held the significant market share in 2023

Oil & gas segment held the significant market share. The substantial growth in the oil & gas industry is attributed to the escalating energy demand in developing nations. Factors such as rapid industrialization, an increase in the number of automobiles, and swift urbanization have played pivotal roles in expanding oil & gas extraction activities. According to the International Energy Agency, the demand for oil products is projected to rise by 6% from 2022 to 2028, reaching 105.7 million barrels per day by 2028. This surge is expected to drive an increased consumption of pour point depressants within the industry.

In high-altitude flight and space exploration, aircraft encounter extremely low temperatures, which can adversely affect the performance of lubricants and fluids. Pour point depressants are designed to address this issue by preventing the formation of wax crystals and maintaining the fluidity of oils and lubricants. This ensures that critical components, such as engines and hydraulic systems, continue to operate smoothly, reducing the risk of malfunctions or failures that could be caused by the cold-induced thickening of lubricants.

The maritime environment presents challenges such as low temperatures, saltwater exposure, and demanding operational conditions. Pour point depressants play a crucial role in maintaining the fluidity and optimal performance of engine lubricants in these challenging settings. In hydraulic systems, which are integral to the operation of offshore platforms and vessels, efficient lubrication is essential for ensuring smooth and reliable functioning.

By incorporating pour point depressants into engine lubricants and hydraulic systems, the marine industry enhances the resilience and performance of its machinery. These additives mitigate the risk of oil thickening, wax crystallization, and other issues associated with low temperatures, contributing to the overall efficiency and longevity of equipment in maritime transport, offshore activities, and shipping.

Regional Insights

- Asia Pacific dominated the global market in 2023

The regional growth can be attributed to the swift industrialization in the region, which has spurred the demand for lubricants. Developing economies within the region, notably China, India, & Bangladesh, exhibit growing automotive sectors that serve as significant consumers of pour point depressants in engine operations. The implementation of liberal trade policies by economic blocs like the Association of Southeast Asian Nations (ASEAN) and individual countries, such as China, has played a pivotal role in fostering extensive industrial development across the region.

North America will grow with substantial pace. The United States, boasting the world's largest aerospace sector, recorded a total value of USD 391 billion in 2021, as reported by the Aerospace Industries Association (AIA). This positions the U.S. as a major consumer of pour point depressants, utilized in both civilian applications within airliners and military aircraft. Another noteworthy end-user is the oil & gas industry, particularly in the regions of Northern Canada and Alaska. These areas experience extremely cold temperatures for a significant part of the year, necessitating the use of pour point depressants to address challenges related to low-temperature fluidity in oil and lubricant applications.

Europe hosts a substantial automobile industry that extensively utilizes pour point depressants in the production of engines. The region is home to major automotive manufacturing entities, which rely on lubricants to enhance the performance of their product offerings. To uphold safety and environmental standards within defined limits, European authorities impose stringent regulations, such as the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH). These measures are in place to ensure adherence to safety protocols and limit the environmental impact of chemical substances used in various industries, including the automotive sector.

Key Market Players & Competitive Insights

Strategic emphasis on environmentally sustainable practices, including the production of biodegradable pour point depressants, and the commitment to cost-effectiveness opens substantial growth avenues for key players in the industry. This approach not only meets the evolving pour point depressant market demands but also contributes to a more sustainable and responsible industrial landscape.

Some of the major players operating in the global market include:

- Afton Chemical

- CLARIANT

- Ecolab

- Evonik Industries

- Infineum International Limited

- Innospec

- Puyang Jiahua Chemical Co., Ltd.

- Sanyo Chemical Industries, Ltd.

- Shengyang Greatwall Lubricant Oil Co.,Ltd.

- The Lubrizol Corporation

Pour Point Depressants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.55 billion |

|

Revenue forecast in 2032 |

USD 3.89 billion |

|

CAGR |

5.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Pour Point Depressant Market Size Worth $ 3.89 Billion By 2032.

The top market players in Pour Point Depressant Market are include CLARIANT, Afton Chemical, Lubrizol, Evonik, Ecolab, Puyang Jiahua Chemical.

Asia Pacific is region contribute notably towards the Pour Point Depressant Market.

The global pour point depressant market is expected to grow at a CAGR of 5.4% during the forecast period.

Pour Point Depressant Market report covering key segments are product, end use, and region.