Pre-Insulated Pipes Market Size, Share, & Industry Analysis Report

: By Product, By Installation (Below Ground and Above Ground), By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5937

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

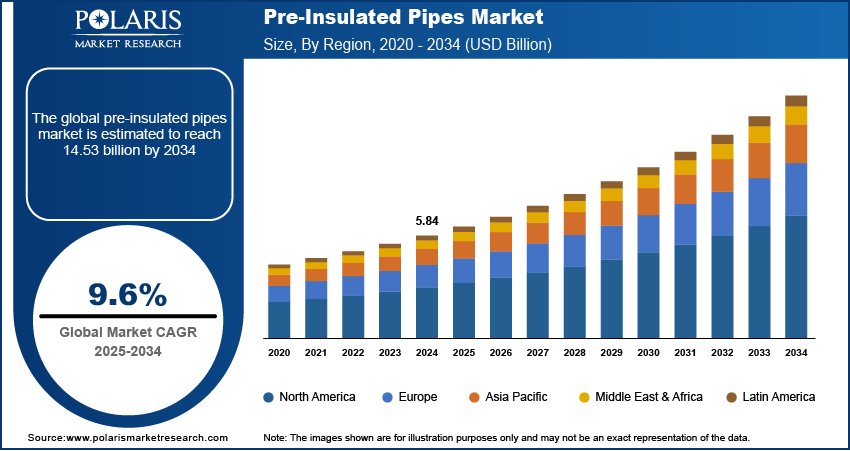

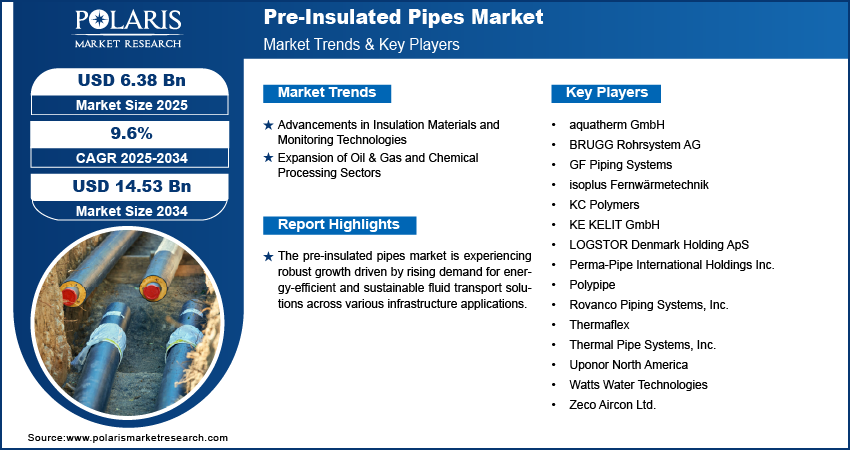

The global pre-insulated pipes market size was valued at USD 5.84 billion in 2024, growing at a CAGR of 9.6% during 2025–2034. The growth is driven by the increasing demand for district heating and cooling systems.

Pre-insulated pipes, which are piping systems that come with thermal insulation and an outer protective jacket pre-applied in the factory, play a pivotal role in modern heat distribution networks and fluid transport systems. The increasing focus on energy-efficient infrastructure is propelling the adoption of pre-insulated pipes as industries and urban planners prioritize sustainable development. According to a December 2024 IEA report, global energy intensity improved by 2% in 2022, as achieving net-zero goals requires doubling progress to 4% yearly this decade through improved energy efficiency measures. These pipes are engineered to minimize thermal losses, thereby improving energy conservation in district heating, cooling networks, and industrial applications. Developers and utilities are integrating pre-insulated piping systems to achieve long-term cost savings and operational efficiency in both new and retrofitted infrastructures with strict environmental regulations and the growing demand for optimized energy usage.

To Understand More About this Research: Request a Free Sample Report

The ongoing infrastructure modernization across emerging economies is boosting market expansion. According to a 2024 report by the IEA stated that worldwide energy investments will surpass USD 3 trillion, with ∼USD 2 trillion allocated to clean energy technologies and related infrastructure. Governments in developing regions are investing heavily in urban development and the expansion of utility services, with a strong focus on reliability, longevity, and reduced maintenance costs. Pre-insulated pipes, owing to their durability and resistance to external environmental factors, align perfectly with these modernization goals. Their ease of installation, combined with improved thermal performance, makes them an ideal choice for upgrading outdated water and heating systems. The integration of pre-insulated piping solutions is becoming an essential component of long-term development strategies as emerging markets aim to boost infrastructure standards to meet growing urban demands.

Industry Dynamics

Advancements in Insulation Materials and Monitoring Technologies

Advancements in insulation materials and monitoring technologies improve both the efficiency and reliability of pipeline monitoring systems. Modern insulation materials offer superior thermal resistance, reduced heat loss, and extended service life, which are critical for meeting the evolving demands of energy-efficient infrastructure. In May 2022, Huntsman partnered with BRUGG Pipes to develop an advanced polyurethane foam system (SUPRASEC/DALTOFOAM TE) for flexible, thermally efficient pre-insulated pipes, optimizing connections for heat pumps and district heating in buildings. Additionally, the integration of advanced monitoring technologies, such as fiber optics sensors and real-time diagnostics, allows for proactive maintenance and early detection of faults. This results in minimized operational disruptions and reduced lifecycle costs, making pre-insulated piping systems more attractive for applications in district energy, industrial processing, and utilities. These technological improvements directly support the industry's transition toward smarter, more resilient infrastructure solutions. Hence, advancements in insulation materials and monitoring technologies have boosted the pre-insulated pipes market demand.

Expansion of Oil & Gas and Chemical Processing Sectors

The expansion of the oil & gas and chemical processing sectors is boosting the market size, as these industries demand highly durable and thermally efficient piping systems to support high-temperature and corrosive environments. According to a report by Invest India, in 2023-24, India produced 29.4 MMT of crude oil and 36.4 BCM of natural gas while importing 234.3 MMT of crude oil, 48.7 MMT of petroleum products, and 31.7 BCM LNG to meet growing energy needs. This rising energy production and import dependency highlights the need for reliable pipeline infrastructure. Pre-insulated pipes are especially valuable in these settings due to their ability to maintain product temperature over long distances while minimizing energy loss. There is a heightened need for robust pipeline infrastructure capable of handling complex operational requirements as global energy consumption and chemical output continue to grow. Pre-insulated piping systems provide a cost-effective and efficient solution, ensuring safety, regulatory compliance, and long-term performance under challenging industrial conditions.

Segmental Insights

By Installation Analysis

The global pre-insulated pipes market segmentation, based on installation, includes below ground and above ground. The below ground segment is expected to witness a faster growth during the forecast period due to the increasing preference for buried pipe systems in urban and industrial infrastructure. These systems offer improved protection from environmental damage, reduce the need for above-ground space, and improve aesthetic integration in densely populated areas. Below ground installations also support better thermal insulation and long-term durability, making them ideal for district heating, cooling, and industrial fluid transport. The demand for below ground pre-insulated piping systems continues to gain momentum across new and retrofit projects with rising urbanization and the push for sustainable underground utilities.

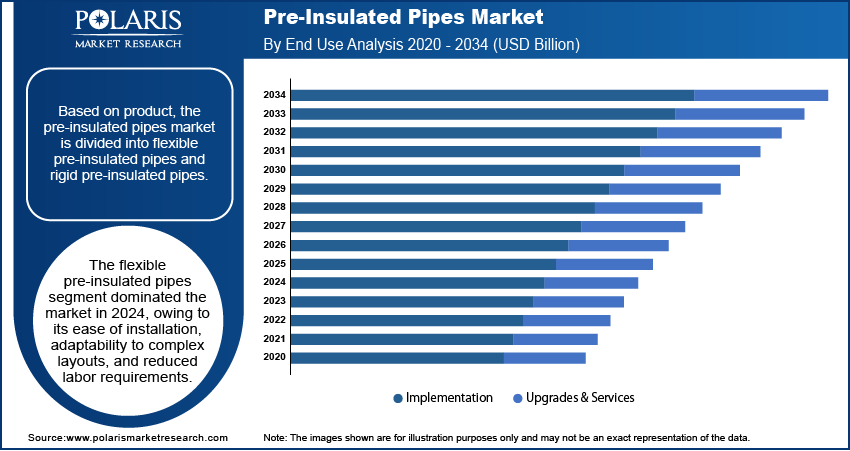

By Product Analysis

The global market segmentation, based on product, includes flexible pre-insulated pipes and rigid pre-insulated pipes. The flexible pre-insulated pipes segment dominated the market in 2024 owing to its ease of installation, adaptability to complex layouts, and reduced labor requirements. These pipes are particularly suitable for residential and small-scale district energy applications where routing flexibility is crucial. Their lightweight structure and factory-fitted insulation offer cost-effective and time-efficient solutions, especially in constrained environments. Moreover, flexible systems typically require fewer joints and fittings, leading to a lower risk of leakage and improved operational efficiency. Their increasing adoption in modern heating and cooling networks solidified their position as the leading product type.

By End-Use Industry Analysis

The market segmentation, based on end-use industry, includes district heating & cooling, oil & gas, infrastructure & utility, and others. The district heating & cooling segment is expected to witness substantial growth during the forecast period, driven by the rising adoption of centralized energy distribution systems for improved efficiency and environmental performance. District networks are being expanded and modernized, creating a strong demand for thermally efficient piping solutions as cities aim to reduce carbon emissions and improve energy security. Pre-insulated pipes, with their excellent insulation and long service life, are essential to minimizing thermal losses in such systems. This growing focus on sustainable urban energy distribution is fueling the segment’s growth across both developed and developing regions.

Regional Analysis

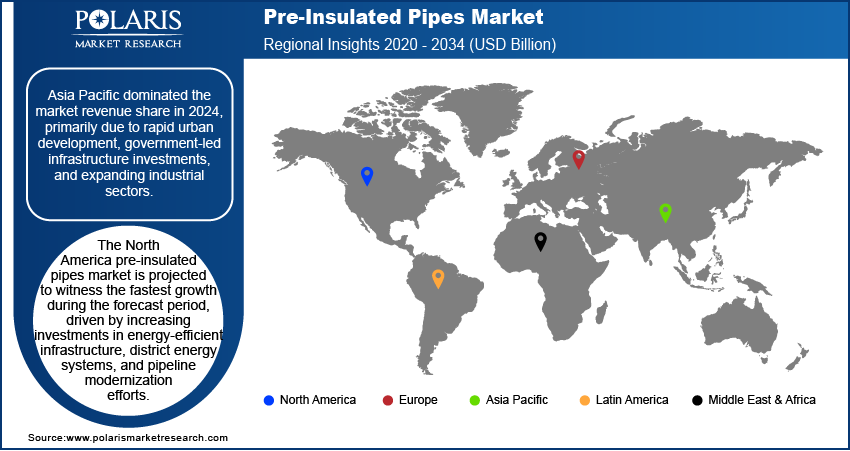

The report provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific pre-insulated pipes market dominated the revenue share in 2024, primarily due to rapid urban development, government-led infrastructure investments, and expanding industrial sectors. The region's strong focus on improving energy efficiency in utility and industrial systems has accelerated the adoption of advanced piping technologies. Countries such as China, India, Japan, and South Korea are at the forefront of this growth, with extensive district heating and cooling projects, manufacturing expansion, and modernization of water and waste systems. In December 2024, SP Group received a 10-year contract of ~ USD 16.7 million to operate Chengdu Future Medical City’s district cooling/heating system. The 4,800 RT system will deliver chilled/hot water and steam, supported by smart controls for efficiency and reliability. These developments, supported by favorable regulations and rising energy demand, have established Asia Pacific as the top regional market.

The North America pre-insulated pipes market is projected to witness the fastest growth during the forecast period, driven by increasing investments in energy-efficient infrastructure, district energy systems, and pipeline modernization efforts. In January 2025, Memphis Light, Gas, and Water will modernize South Memphis gas infrastructure with a USD 30 million project. A new 24" high-pressure pipeline of 5.4 miles will replace aging 18" lines. The region is witnessing heightened activity in retrofitting old infrastructure and expanding smart city developments, where thermal efficiency and long-term performance are major priorities. The growing integration of monitoring technologies and sustainability standards further supports the adoption of pre-insulated piping solutions. The US and Canada are leading contributors, supported by strong regulatory frameworks, municipal energy initiatives, and a growing focus on industrial energy optimization.

The Europe pre-insulated pipes market is projected to witness substantial growth during the forecast period due to its long-standing commitment to energy efficiency, carbon neutrality, and sustainable infrastructure development. The region’s advanced district heating and cooling networks, along with strict environmental policies, are driving consistent demand for high-performance piping systems. Renovation of aging pipelines and expansion of renewable-integrated heating grids also contribute to market growth. Countries such as Germany, Sweden, Denmark, and the Netherlands are central to this progress, with strong implementation of low-carbon technologies and widespread adoption of centralized heating solutions across municipalities.

Key Players and Competitive Analysis

The field of pre-insulated pipes is witnessing strong competition shaped by technological advancements, sustainable value chains, and emerging market segments. Major companies such as GF Piping Systems, LOGSTOR, and Uponor are pursuing strategic investments and expansion opportunities to improve their regional presence across both developed and emerging markets. Revenue growth is being driven by increasing demand for energy-efficient infrastructure solutions, though economic and geopolitical shifts, along with supply chain disruptions, present ongoing challenges. Industry leaders are implementing future development strategies such as joint ventures and mergers & acquisitions to address latent demand, particularly in high-growth regions such as Asia Pacific. Expert analysis highlights how disruptive technologies and digitalization are transforming sector dynamics. Competitive differentiation is increasingly determined by product innovation, pricing strategies, and sustainability initiatives, with both established corporations and small-to-medium enterprises competing within evolving macroeconomic conditions. The industry outlook reflects continued transformation as participants navigate complex market forces while capitalizing on new opportunities in heating networks and district energy systems. A few key players are aquatherm GmbH; BRUGG Rohrsystem AG; GF Piping Systems; isoplus Fernwärmetechnik; KC Polymers; KE KELIT GmbH; LOGSTOR Denmark Holding ApS; Perma-Pipe International Holdings Inc.; Polypipe; Rovanco Piping Systems, Inc.; Thermaflex; Thermal Pipe Systems, Inc.; Uponor North America; Watts Water Technologies; and Zeco Aircon Ltd.

BRUGG Rohrsystem AG, operating under the brand BRUGG Pipes, is a global manufacturer and full-service supplier of pre-insulated pipe systems, renowned for its innovative solutions in district and local heating, cooling, industrial, and cryogenic applications. Headquartered in Kleindöttingen, Switzerland, with additional production sites in Germany and the USA, the company offers an extensive portfolio of around 40 pipe systems and over 20,000 products, such as both flexible and rigid pipes made from metals and plastics. Their pre-insulated pipe systems are engineered for maximum thermal efficiency, safety, and reliability, serving critical sectors such as district heating, industrial plants, petrol stations, and cryogenic transport. Notably, the CALPEX PUR KING system stands out with a record-breaking low thermal conductivity value of 0.0199 W/mK, highlighting BRUGG’s commitment to energy efficiency and sustainability. The company’s pipe systems feature advanced insulation, corrosion protection, and sensitive monitoring technology, assuring safe transportation of hazardous or flammable media. BRUGG’s solutions are highly customizable, offering a wide range of accessories and connection technologies, such as weld-free and flameless options for sensitive environments.

Rovanco Piping Systems, Inc., headquartered in Joliet, Illinois, is a privately held manufacturer specializing in pre-engineered, pre-fabricated, and pre-insulated pipe and piping systems. Established in 1969, Rovanco was founded to provide a high-quality alternative to outdated and less efficient field-insulated piping, focusing on innovation, product quality, and customer service. The company operates three manufacturing facilities covering nearly 150,000 square feet on a 20-acre campus. It is recognized for its strong research and development program, which has driven continuous advancements in pre-insulated piping technology. Rovanco’s product range includes pre-fabricated and pre-insulated piping systems, double-wall containment pipe systems, pre-fabricated maintenance holes, leak detection, and heat tracing solutions. A standout offering is the Rhinoflex pre-insulated flexible piping system, designed for efficient hot and cold fluid distribution, featuring NSF approval, energy-efficient foam insulation, and the industry’s heaviest outer jacket. Rhinoflex is available in long continuous lengths, reducing field joints and labor costs by up to 60%. Rovanco serves a broad array of applications, such as district heating and cooling, industrial facilities, and campus energy systems, with a reputation for prompt delivery, custom engineering, and responsive support.

Key Players

- aquatherm GmbH.

- BRUGG Rohrsystem AG

- GF Piping Systems.

- isoplus Fernwärmetechnik

- KC Polymers

- KE KELIT GmbH

- LOGSTOR Denmark Holding ApS

- Perma-Pipe International Holdings Inc.

- Polypipe

- Rovanco Piping Systems, Inc.

- Thermaflex

- Thermal Pipe Systems, Inc.

- Uponor North America

- Watts Water Technologies

- Zeco Aircon Ltd.

Industry Developments

July 2024: REHAU launched RAUVIPEX, a high-performance pre-insulated pipe for district heating networks. Featuring PE-Xa carrier pipes and fine-pored PUR foam, it offers flexibility, low heat loss, and durability while enabling easier installation and faster project completion.

April 2024: BRUGG Pipes and Rovanco Piping Systems collaborated to establish North America's first continuous production line for flexible, polyurethane-insulated district heating/cooling pipes at Rovanco's Chicago facility, combining their technical expertise.

July 2022: Armacell expanded into the pre-insulated pipe market by acquiring Serbian manufacturer A.D. IZOLIR, diversifying its product portfolio and establishing a production base in Southeast Europe.

Pre-Insulated Pipes Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Flexible Pre-Insulated Pipes

- Rigid Pre-Insulated Pipes

By Installation Outlook (Revenue, USD Billion, 2020–2034)

- Below Ground

- Above Ground

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- District Heating & Cooling

- Oil & Gas

- Infrastructure & Utility

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Pre-Insulated Pipes Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.84 billion |

|

Market Size Value in 2025 |

USD 6.38 billion |

|

Revenue Forecast by 2034 |

USD 14.53 billion |

|

CAGR |

9.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.84 billion in 2024 and is projected to grow to USD 14.53 billion by 2034.

The global market is projected to register a CAGR of 9.6% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are aquatherm GmbH; BRUGG Rohrsystem AG; GF Piping Systems; isoplus Fernwärmetechnik; KC Polymers; KE KELIT GmbH; LOGSTOR Denmark Holding ApS; Perma-Pipe International Holdings Inc.; Polypipe; Rovanco Piping Systems, Inc.; Thermaflex; Thermal Pipe Systems, Inc.; Uponor North America; Watts Water Technologies; and Zeco Aircon Ltd.

The flexible pre-insulated pipes segment dominated the market in 2024.

The below ground segment is expected to witness a faster growth during the forecast period.