Premium Bottled Water Market Share, Size, Trends, Industry Analysis Report

By Product (Spring Water, Mineral Water, Sparkling Water), By Distribution Channel (Supermarket & Hypermarkets, Specialty Store, Online), By Region, And Segment Forecasts, 2023 - 2032

- Published Date:Sep-2023

- Pages: 119

- Format: PDF

- Report ID: PM3765

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

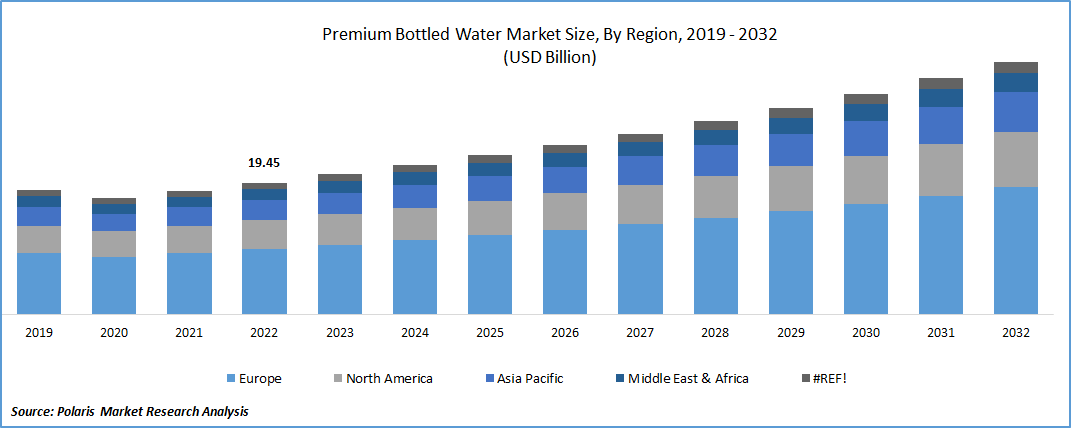

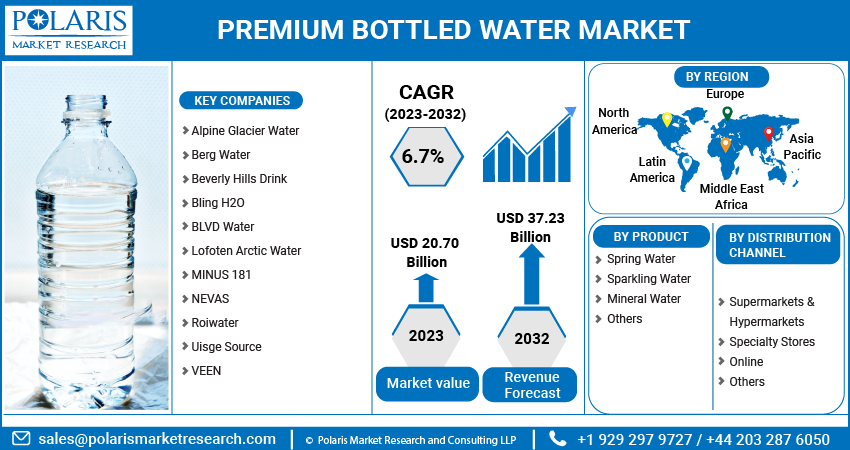

The global premium bottled water market was valued at USD 19.45 billion in 2022 and is expected to grow at a CAGR of 6.7% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Consumers are increasingly in search of premium mineral water sourced from natural and pristine origins. This trend emphasizes water that undergoes minimal processing and retains its natural mineral composition. The preference for pure, authentic, and additive-free products aligns with the growing awareness of leading a healthy lifestyle. As a result, many individuals are switching from regular water to premium bottled water. Sparkling water and mineral water, which contain a variety of minerals such as sodium, magnesium, and calcium, are particularly favored over plain bottled water.

In recent years, the increasing number of commercial advertisements promoting bottled water has significantly contributed to raising brand awareness and product visibility. These advertisements focus on highlighting the quality and hydrating benefits of premium sparkling and natural water, while also emphasizing taste and convenience.

For instance, Nestlé's Pure Life brand campaign uses the slogan "Drink Better. Live Better" to promote its Pure Life Sparkling Water, which contains zero calories and zero sweeteners and is available in original and various fruit flavors.

In countries like Brazil, restaurants are actively encouraging customers to choose mineral-rich or premium bottled water, which is expected to drive the demand for such products in the forecast period. Unique selling points such as mineral content, water source, and additional composition play a vital role in creating a premium image for bottled water.

Premium bottled water offers various benefits, including potential improvements in digestion and potential relief from constipation. Studies have also indicated that premium glacier or natural water may have less negative impact on dental and bone health compared to sodas. As a result, many consumers view carbonated water as a healthier substitute for soda and other sugary carbonated beverages.

Industry Dynamics

Growth Drivers

Consumer Awareness about the Importance of Staying Hydrated and Maintaining a Healthy Lifestyle has Been a Significant Driver of the Premium Bottled Water Market

Premium bottled waters differentiate themselves from mass-market offerings by offering unique features that attract a specific consumer demographic, allowing them to command a higher value in the premium bottled water market. The increasing consumer awareness and preference for high-quality drinking water are driving the demand for premium bottled waters. However, the global foodservice and hospitality industry has been significantly impacted by the COVID-19 pandemic, leading to the closure of many establishments such as hotels, resorts, restaurants, spas, and clubs. As a result, the retailing of food and beverages, including premium bottled water, has been adversely affected, leading to a decline in sales worldwide.

Moreover, premium bottled water, including sparkling water, offers various benefits such as aiding digestion and potentially relieving constipation. Additionally, studies have indicated that premium glacier or natural water is less detrimental to dental and bone health compared to sodas and sugary carbonated beverages. Consequently, carbonated water is increasingly viewed as a healthier alternative to traditional carbonated drinks.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Mineral Water Segment Accounted for the Largest Market Share in 2022

Premium mineral water is known for its higher content of essential minerals such as calcium, magnesium, sodium, and zinc, and is often presented in innovative and elegant packaging. The increasing awareness of the health benefits associated with mineral water, combined with a rise in consumer expenditure on premium products, is projected to drive the demand for mineral water in the coming years.

Sparkling water segment is projected to gain substantial growth rate. As the global population increasingly embraces a healthy lifestyle, there is a growing shift towards healthier and more innovative beverage choices. Sparkling water has gained popularity as an alternative to traditional sodas and sugary carbonated drinks due to its perceived health benefits. Sparkling water is believed to aid digestion, promote weight loss, and enhance hydration levels in the body. This trend towards healthier beverage options is driving the demand for sparkling water across the globe.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Segment Held the Significant Market Share

Food segment held the maximum market share. This can be attributed to the increasing preference of consumers for shopping hypermarkets, driven by the convenience they offer. These retail outlets provide a one-stop shopping experience for consumers, with a wide range of products available under a single roof. Moreover, supermarkets and hypermarkets have been adopting innovative services such as click & collect and home delivery, which further enhance the convenience factor for customers.

The presence of knowledgeable staff members in these retail establishments helps customers make informed decisions and provides them with a sense of assurance about the products they are buying. Furthermore, the checkout points in hypermarkets and supermarkets often display attractive products and offers, leading to impulsive purchases by shoppers. Major global supermarket chains such as Carrefour, Walmart, Woolworths, and Magnit have established themselves as leaders in the industry, providing a wide range of products and services to cater to the diverse needs of consumers.

Online segment is anticipated to grow at fastest growth rate. To achieve this, companies have been investing in the development and enhancement of their online networks. For instance, Uisge Source collaborated with the Fabrica to create a new e-commerce website that offers scalability and ease of updates, enabling the internal team to effectively manage online operations. This strategic move reflects the industry's recognition of the importance of online platforms and their commitment to providing a seamless and user-friendly online shopping experience.

Regional Insights

Europe Region Dominated the Global Market in 2022

Europe dominated the global market. Leading brands are employing strategic approaches to set themselves apart. They are leveraging unique selling propositions, sophisticated packaging designs, and compelling brand narratives to cultivate an image of exclusivity, purity, and sophistication. These strategies serve to differentiate their products and attract the discerning consumers. The growing emphasis on health and wellness among consumers has contributed to the increased demand for premium bottled water in the UK. More individuals are seeking healthier beverage alternatives, such as mineral-rich and natural spring water, to maintain hydration and support their overall well-being.

Asia Pacific is projected to be the fastest emerging region. The region presents significant opportunities, particularly in countries like India & China, driven by factors such as a growing population, improving living standards, and increasing concerns about water contamination-related diseases. Consumers' inclination towards choosing bottled water over tap water is expected to contribute to the market growth. This has led to the emergence of functional water products, featuring added vitamins, electrolytes, & other ingredients catering to the healthier needs. Brands operating in the region are taking advantage on concerned demand by introducing innovative & specialized options to align with the evolving preferences & wellness goals of consumers.

The United Nations recently released data in 2023, indicating that India has positioned itself as the 12th largest market globally for bottled water in terms of market value. This data underscores the substantial demand for premium bottled water in the Indian market, which is driven by factors such as the country's expanding population, rapid urbanization, and evolving consumer preferences.

Key Market Players & Competitive Insight

Market is marked by the presence of select companies that hold a strong market presence in both the United States & Europe. These companies have been actively introducing premium bottled water offerings to broaden their consumer base in this specialized market segment. The introduction of new products and innovative strategies by these players has had a favorable influence on the overall market.

Some of the major players operating in the global market include

- Alpine Glacier Water

- Berg Water

- Beverly Hills Drink

- Bling H2O

- BLVD Water

- Lofoten Arctic Water

- MINUS 181

- NEVAS

- Roiwater

- Uisge Source

- VEEN

Recent Developments

- In January 2021, Lofoten Arctic Water has unveiled a collection of aluminum bottles, which are produced by the Ball Corporation, a renowned global manufacturer of aluminum cans. These aluminum bottles are designed to be infinitely recyclable, aligning with the growing consumer preference for sustainable packaging solutions.

Premium Bottled Water Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 20.70 billion |

|

Revenue forecast in 2032 |

USD 37.23 billion |

|

CAGR |

6.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in premium bottled water market are Bling H2O, Uisge Source, Roiwater, NEVAS, Lofoten Arctic Water.

The global premium bottled water market is expected to grow at a CAGR of 6.7% during the forecast period.

The premium bottled water market report covering key segments are product, distribution channel, and region.

key driving factors in industrial premium bottled water market are consumer awareness about the importance of staying hydrated and maintaining a healthy lifestyle

The global premium bottled water market size is expected to reach USD 37.23 billion by 2032.