Primary Cells Market Size, Share, Trends, & Industry Analysis Report

By Source, By Type (Animal Source, Human Source), By Application, By End Users, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM1840

- Base Year: 2024

- Historical Data: 2020-2023

Overview

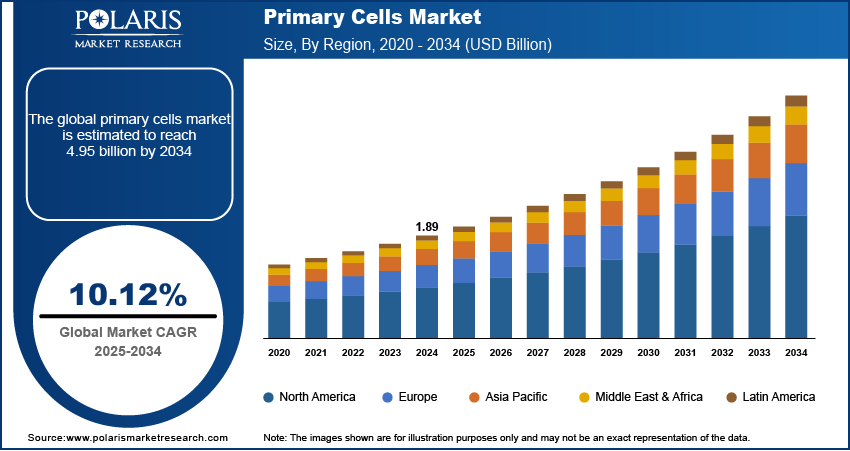

The global primary cells market size was valued at USD 1.89 billion in 2024, growing at a CAGR of 10.12% from 2025–2034. Key factors driving demand include the increasing adoption of personalized medicine and cell-based therapies, growing government funding and investments in biomedical research, a rising prevalence of chronic diseases and cancer conditions, and advancements in cell culture technologies and research tools.

Key Insights

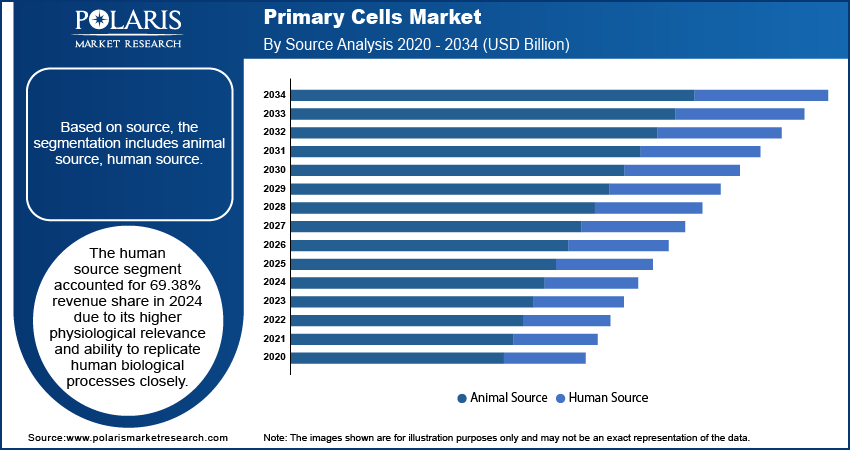

- The human source segment held a dominant 69.38% revenue share in 2024, owing to its superior physiological relevance for accurately modeling human biological processes.

- The hepatocytes segment is projected to grow at the fastest CAGR of 12.6%, driven by their critical role in drug metabolism and toxicity testing.

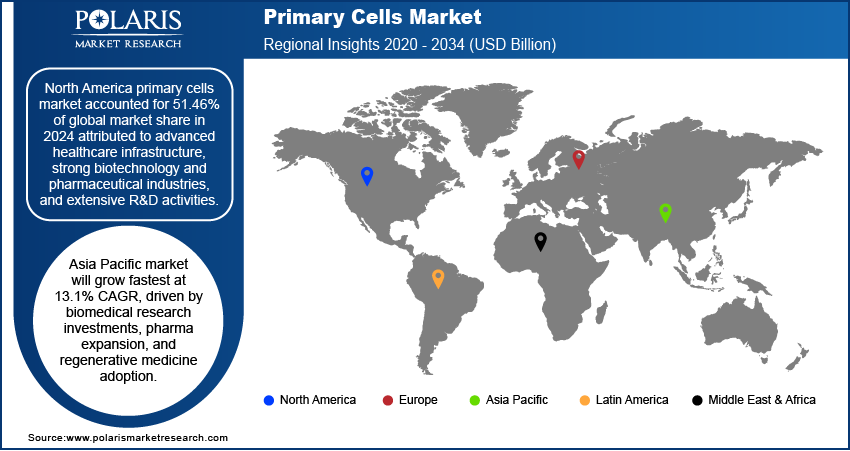

- North America led the global market with a 51.46% share in 2024, attributed to its advanced healthcare infrastructure and robust biopharmaceutical R&D sector.

- The U.S. accounted for 77.79% of the North American market in 2024, fueled by its dense concentration of pharmaceutical firms and advanced research facilities.

- The Asia Pacific market is expected to grow at the highest CAGR of 13.1%, propelled by rising biomedical investments and expanding pharmaceutical manufacturing.

- China's market is expanding rapidly due to significant government investment in biomedical infrastructure and a growing focus on regenerative medicine.

Industry Dynamics

- Rising chronic disease and cancer rates are increasing demand for biologically accurate models to advance research and therapeutic development.

- Primary cells offer superior physiological relevance over cell lines, improving insights into disease mechanisms and treatment efficacy.

- High costs and technical complexities in isolating, culturing, and maintaining primary cells create significant barriers for widespread adoption and scalability.

- Growing demand for personalized medicine and human-relevant drug screening models drives expansion into tailored therapeutic development and precision medicine applications.

Market Statistics

- 2024 Market Size: USD 1.89 billion

- 2034 Projected Market Size: USD 4.95 billion

- CAGR (2025-2034): 10.12%

- North America: Largest market in 2024

Primary cells are directly isolated from living tissues and cultured for experimental or therapeutic purposes, providing greater biological relevance than immortalized cell lines. Their significance is increasingly connected to the growing adoption of personalized medicine and cell-based therapies, as they provide accurate models that closely mimic patient-specific conditions. According to a 2024 Personalized Medicine Coalition report, 18 new personalized medicines were approved in 2024, marking the tenth consecutive year in which such therapies constituted at least 25% of all new drug approvals. Personalized medicine relies on the use of patient-derived cells to evaluate drug efficacy, predict therapeutic responses, and reduce adverse reactions. Similarly, cell-based therapies such as regenerative treatments and immunotherapies utilize primary cells to restore, replace, or enhance biological functions. This advancement has positioned primary cells as an important part in precision healthcare approaches, driving their demand across research and clinical applications.

The growing government funding and investments in biomedical research are boosting advancements in drug discovery, disease modeling, and therapeutic development. Primary cells are essential tools in translational research, as they enable more accurate disease pathway studies and preclinical testing. Research institutions and biotech companies are increasingly leveraging primary cells to enhance innovation pipelines and accelerate the development of novel treatments with rising public and private investment. This financial support expands access to advanced cell culture technologies and also promotes large-scale collaborative projects, thereby boosting the overall market growth.

Drivers & Opportunities

Rising Prevalence of Chronic Diseases and Cancer: The rising prevalence of chronic diseases and cancer conditions requires accurate biological models for research, diagnostics, and therapeutic development. According to a 2024 American Cancer Society report, in 2022, approximately 20 million new cancer cases were diagnosed globally, resulting in 9.7 million deaths. Primary cells, being closer to the in vivo environment, provide superior insights into disease progression, treatment responses, and biomarker identification compared to immortalized cell lines. In cancer research, patient-derived primary tumor cells enable the development of more precise drug screening models and personalized treatment strategies. Similarly, in chronic conditions such as cardiovascular and metabolic disorders, primary cells allow researchers to replicate disease mechanisms with higher fidelity, supporting the creation of targeted and effective therapies. This growing disease burden is directly fueling the demand for primary cells in both academic and clinical settings.

Advancements in Cell Culture Technologies and Research Tools: Advancements in cell culture technologies and research tools are driving the adoption of primary cells, as they enhance reproducibility, scalability, and functional relevance in scientific studies. Improved techniques in cell isolation, 3D cell culture, and co-culture models allow primary cells to mimic physiological environments better, thereby increasing their value in drug discovery and regenerative medicine. For instance, in May 2023, bit.bio launched Custom ioDisease Model Cells, enabling scientists to commission CRISPR-edited mutations in human iPSC-derived cells. This allows precise attribution of experimental differences to specific disease mutations using a consistent genetic background. Additionally, the integration of advanced imaging, automation, and high-throughput screening technologies has streamlined experimental workflows, enabling more robust and reliable results with primary cells. These technological improvements reduce limitations such as short lifespan and variability, making primary cells more versatile and effective in biomedical applications. Consequently, innovation in supporting technologies is strengthening the role of primary cells in next-generation research and therapeutic development.

Segmental Insights

Source Analysis

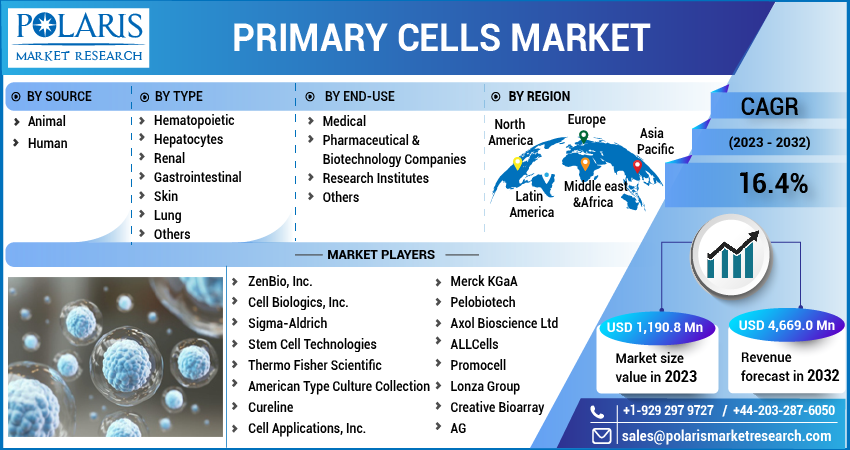

Based on source, the segmentation includes animal source, human source. The human source segment accounted for 69.38% of revenue in 2024, due to its superior physiological relevance in accurately modeling human biological processes. Human-derived primary cells are increasingly preferred in drug discovery, disease modeling, and personalized medicine as they provide more accurate predictions of therapeutic outcomes compared to animal-derived cells. Their use minimizes translational gaps between preclinical and clinical stages, enhancing the reliability of research findings. Furthermore, the growing focus on individualized healthcare solutions and ethical considerations further strengthens the dominance of the human source segment in the market.

Type Analysis

In terms of type, the segmentation includes hematopoietic, hepatocytes, renal cells, gastrointestinal cells, skin cells, lung cells, other types. The hepatocytes segment is expected to witness fastest growth at a CAGR of 12.6% during the forecast period due to their vital role in drug metabolism and toxicity studies, making them essential in pharmacological research and ADME profiling. Hepatocytes are gaining importance in both academic and industrial applications with increasing demand for liver-specific models to evaluate drug efficacy and hepatotoxicity. Additionally, advancements in cell isolation and culture techniques have further improved the usability and availability of hepatocytes, driving their rapid adoption across biomedical research and therapeutic development.

Application Analysis

The segmentation, based on application, includes ADME toxicology testing, other applications. The ADME toxicology testing segment held 60.81% share in 2024 due to its central role in pharmaceutical R&D. Primary cells are highly effective in predicting absorption, distribution, metabolism, and excretion patterns of drug candidates, enabling early identification of safety concerns. Their relevance lies in replicating human physiological responses more accurately than conventional models, reducing the possibility of late-stage drug development failures. Additionally, the growing regulatory emphasis on reliable preclinical data enhances the use of primary cells in toxicology testing, thereby ensuring the safety and efficacy of new therapeutics.

End Users Analysis

Based on end users, the segmentation includes, pharmaceutical & biotechnology companies, research institutes. The research institutes segment is projected to witness robust growth at a CAGR of 12.1% during the forecast period driven by the rising demand for primary cells in academic and government-funded research aimed at understanding disease mechanisms, drug responses, and regenerative medicine applications. Research institutes benefit from increased funding and collaborations with industry players, allowing them to expand the use of advanced cell models. Furthermore, primary cells serve as critical tools for translational research, bridging the gap between basic science and clinical application, which strengthens their adoption in institutional research environments.

Regional Analysis

North America primary cells market accounted for 51.46% of global market share in 2024. This dominance is attributed to a strong healthcare infrastructure, strong biotechnology and pharmaceutical industries, and vast research and development activities. The region is equipped with well-established laboratory facilities and has widely adopted innovative cell culture technologies that support both academic and commercial research. Additionally, the high prevalence of chronic diseases and cancer has increased the demand for reliable cell models in drug discovery and therapeutic development. Additionally, the presence of major market players and strong regulatory frameworks improves the integration of primary cells into precision medicine and translational research, consolidating North America’s leading position.

U.S. Primary Cells Market Insight

U.S. held 77.79% market share in North America primary cells landscape in 2024 due to its strong concentration of pharmaceutical companies, advanced healthcare facilities, and vast academic research programs. The high prevalence of chronic diseases and cancer has increased reliance on patient-derived primary cells for accurate disease modeling and drug testing. According to a 2024 CDC report, an estimated 129 million people in the U.S. have at least one major chronic disease. In addition, substantial funding from both government and private sectors continues to accelerate innovation, positioning the U.S. as the core hub for primary cell research and applications in the region.

Asia Pacific Primary Cells Market

The Asia Pacific market is expected to witness fastest growth at a CAGR of 13.1% during the forecast period driven by rising investments in biomedical research, rapid expansion of pharmaceutical manufacturing, and growing adoption of regenerative medicine. Increasing healthcare expenditure and supportive government initiatives are boosting the use of advanced research tools, such as primary cells, in regional laboratories. According to World Bank Group data, China's health expenditure accounted for 5.37% of its GDP. Moreover, the region’s growing burden of lifestyle-related diseases has boosted the need for effective disease models, accelerating demand for patient-derived cell types. Additionally, collaboration between academic institutions and industry players is further strengthening innovation pipelines, making Asia Pacific a high-growth hub for primary cell applications.

China Primary Cells Market Overview

The market in China is expanding due to rapid growth in biomedical research infrastructure, increasing government investment, and rising focus on regenerative medicine. China’s expanding pharmaceutical and biotechnology sector is adopting primary cells for drug discovery and toxicity testing, enhancing the reliability of preclinical studies. Moreover, growing collaborations between domestic research institutions and international players are contributing to advancements in cell culture technologies, further fueling demand for primary cells across the country.

Europe Primary Cells Market

The primary cells landscape in Europe captured 23.92% share of the market in 2024 attributed to a strong focus on biomedical innovation, supportive regulatory standards, and a growing focus on precision medicine. European research institutions are increasingly integrating primary cells into preclinical studies to improve translational accuracy and reduce reliance on animal models. Widespread funding support from public and private sectors has further encouraged advancements in cell-based research for oncology, toxicology, and regenerative medicine. Moreover, Europe’s well-established pharmaceutical and biotechnology ecosystem ensures robust adoption of primary cells, reinforcing the region’s role as a growing contributor to the global market.

UK Primary Cells Market

The UK market is expected to register significant growth at a CAGR of 12.0% during the forecast period due to its strong focus on translational research and innovation in life sciences. The country’s well-established research institutes and academic centers are actively utilizing primary cells to accelerate drug development and precision medicine initiatives. In addition, supportive regulatory policies and funding frameworks are encouraging broader adoption of cell-based technologies, making the UK a major contributor to the European primary cells market.

Key Players & Competitive Analysis Report

The primary cells market is witnessing intense competition among leaders such as Thermo Fisher Scientific, Lonza, and Merck KGaA, who drive revenue growth through technological advancement in CRISPR engineering and advanced cell culture systems. Competitive intelligence and strategy highlight building sustainable value chains for ethically sourced, high-purity cells, serving to latent demand and opportunities in drug discovery and personalized medicine. Industry trends reveal a shift toward 3D cultures, co-culture platforms, and bioreactors to improve physiological accuracy. Expert's insight highlights that future development strategies must focus on scalability, reproducibility, and batch consistency to comply with strict regulations. Moreover, supply chain disruptions, such as donor scarcity and logistical complexities, pose persistent hurdles. Strategic investments in automation, biobanking, and collaborations with academic institutions are essential for growth, especially in emerging markets with expanding biomedical research investments. Ultimately, success depends on tailoring product offerings to meet the evolving needs of pharmaceutical and biotech firms demanding reliable, human-relevant models.

Major companies operating in the primary cells industry include ALLCells; Axol Bioscience Ltd; Cell Applications, Inc.; Cell Biologics, Inc.; Creative Bioarray; Cureline; Lonza Group, AG; Merck KGaA; Pelobiotech; PromoCell; Sigma-Aldrich; Stem Cell Technologies; Thermo Fisher Scientific; and ZenBio, Inc.

Key Players

- ALLCells

- Axol Bioscience Ltd

- Cell Applications, Inc.

- Cell Biologics, Inc.

- Creative Bioarray

- Cureline

- Lonza Group, AG

- Merck KGaA

- Pelobiotech

- PromoCell

- Sigma-Aldrich

- Stem Cell Technologies

- Thermo Fisher Scientific

- ZenBio, Inc.

Industry Developments

- March 2024: Axol Bioscience launched axoCells Atrial Cardiomyocyte Kit, designed to enhance in vitro modeling of cardiac arrhythmias and drug-induced cardiotoxicity.

- January 2024: Cellcolabs AB and REPROCELL Inc. collaborated for the global distribution of research and clinical-grade mesenchymal stem cells (MSCs). The agreement also grants REPROCELL rights to process, manufacture, and market derivative products using Cellcolabs' MSCs.

Primary Cells Market Segmentation

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Animal Source

- Human Source

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Hematopoietic

- Hepatocytes

- Renal Cells

- Gastrointestinal Cells

- Skin Cells

- Lung Cells

- Other Types

By Application Outlook (Revenue, USD Billion, 2020–2034)

- ADME Toxicology Testing

- Other Applications

By End Users Outlook (Revenue, USD Billion, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Research Institutes

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Primary Cells Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.89 Billion |

|

Market Size in 2025 |

USD 2.08 Billion |

|

Revenue Forecast by 2034 |

USD 4.95 Billion |

|

CAGR |

10.12% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.89 billion in 2024 and is projected to grow to USD 4.95 billion by 2034.

The global market is projected to register a CAGR of 10.12% during the forecast period.

North America primary cells market accounted for 51.46% of global market share in 2024.

A few of the key players in the market are ALLCells; Axol Bioscience Ltd; Cell Applications, Inc.; Cell Biologics, Inc.; Creative Bioarray; Cureline; Lonza Group, AG; Merck KGaA; Pelobiotech; PromoCell; Sigma-Aldrich; Stem Cell Technologies; Thermo Fisher Scientific; and ZenBio, Inc.

The human source segment accounted for 69.38% revenue share in 2024.

The hepatocytes segment is expected to witness fastest growth at a CAGR of 12.6% during the forecast period.