Protein A Resin Market Size, Share, Trends, Industry Analysis Report

: By Type (Recombinant Protein A and Natural Protein A), By Product, By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3880

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

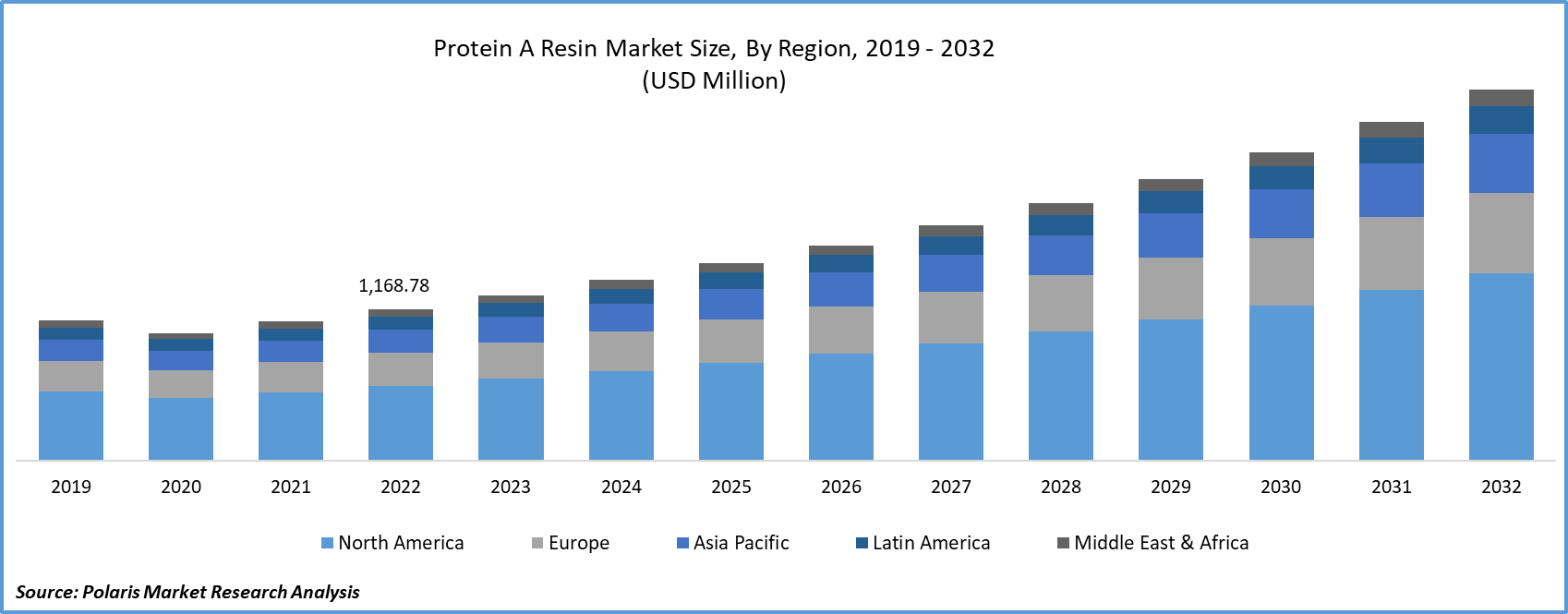

The global protein A resin market was valued at USD 1,525.00 million in 2024, growing at a CAGR of 6.4% during 2025–2034. Rising investments by countries in the expansion of their biomanufacturing capacities, which rely heavily on protein A resin for the purification of antibodies, are a key factor driving market growth.

Key Insights

- The agarose-based protein A segment is anticipated to register the fastest growth. The segment’s growth is driven by its high utilization in various applications across the biotechnology and biopharmaceutical sectors.

- The recombinant protein A segment led the market in 2024, owing to its ability to produce protein A ligands with specific characteristics.

- North America accounted for the largest market share in 2024. The regional market dominance is attributed to rising investments by government organizations and pharmaceutical companies in R&D activities.

- Asia Pacific is projected to register the highest CAGR, primarily due to the presence of supportive government policies and rising healthcare investments in the region.

Industry Dynamics

- The expanding biopharmaceutical industry, driven by aging populations and increasing healthcare needs, is fueling market growth.

- The growing market for biosimilars, which offer similar effectiveness and safety as biological drugs at a lower cost, drives market expansion.

- The rising demand for monoclonal antibodies and other protein-based therapies is expected to create several market opportunities.

- High initial investment associated with protein A resin may present market challenges.

Market Statistics

2024 Market Size: USD 1,525.00 million

2034 Projected Market Size: USD 2,832.54 million

CAGR (2025-2034): 6.4%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Protein A resin is a chromatography medium used to purify monoclonal antibodies by specifically binding to the Fc region of immunoglobulin G (IgG). It enables high selectivity and efficiency in downstream biopharmaceutical processing.

The biopharmaceutical domain is experiencing remarkable growth, with a notable emphasis on advancing biologics, biosimilars, and gene therapies. This expanding sector heavily relies on protein A resin for the purification of antibodies, and the market has observed a surge in biopharmaceutical research and manufacturing facilities as a result. This surge further fuels the demand for protein A resin.

Countries are making substantial investments to expand their biomanufacturing capacities, with a specific focus on establishing advanced bioprocessing facilities. These state-of-the-art facilities necessitate significant quantities of protein A resin to cater to the purification requirements of the burgeoning biopharmaceutical market. Consequently, the protein A resin market benefits significantly from this global expansion in biomanufacturing capabilities.

Market Dynamics

Expansion of Biopharmaceutical Industry

The biopharmaceutical industry is expanding worldwide. According to the International Trade Organization, in the US alone, the industry employed 217,000 people through FDI. This growth is driven by increasing healthcare needs, aging populations, and new innovations in medical science. Companies are producing more complex biologic drugs, including monoclonal antibodies and cell therapies. These drugs require very clean and consistent production processes. Protein A resin plays a central role in purifying these drugs by separating the desired antibodies from other substances. Manufacturers invest in large-scale production as more biologics are entering the market, and this pushes demand for effective and scalable purification materials such as protein A resins. Thus, expansion of the biopharmaceutical industry is driving the protein A resin market growth.

Expansion of Biosimilar Market

Biosimilars are almost identical copies of existing biological drugs developed after the original product’s patent expires. They offer similar safety and effectiveness at a lower cost. According to the Center for Biosimilars, in 2024, 19 new biosimilars were approved by the FDA in various therapeutic areas. As they are less expensive, more patients can afford these treatments, and healthcare systems can save money. Producing biosimilars requires the same purification steps as original biologics, meaning Protein A resin is essential. More companies are entering the biosimilar market as governments and health organizations promote biosimilars to make treatments more affordable. This growth creates a bigger need for cost-effective and reliable purification solutions such as Protein A resin.

Segment Analysis

Market Assessment by Product

The protein A resin market segmentation, based on product, includes organic polymer-based protein A, agarose-based protein A, and glass/silica-based protein A. The agarose-based protein A segment is expected to witness significant growth during the forecast period. Agarose-based protein A resin has extensive utilization in various applications across the biopharmaceutical and biotechnology industries. Its widespread use can be attributed to its versatility, efficiency, and reliability. Agarose-based protein A resin exhibits a high binding capacity for antibodies, enabling the purification of large quantities of proteins in a single run. It offers stability in a wide range of pH and salt conditions, making it adaptable to various purification protocols and allowing for robust and reliable results. Agarose-based protein A resin can be regenerated and reused multiple times without a significant loss of performance, making it a cost-effective option for repeated purification cycles.

Market Evaluation by Type

The protein A resin market evaluation, based on type, recombinant protein A and natural protein A. The recombinant protein A segment dominated the market in 2024. These resins are engineered through recombinant DNA technology, allowing for the production of protein A ligands with specific characteristics optimized for protein purification. Recombinant protein A resins provide high-purity antibody and protein purification due to their efficient binding and selective capture properties. These resins often exhibit improved performance characteristics, such as higher binding capacities and faster kinetics, compared to traditional protein A resins. Recombinant protein A resins are also valuable tools in research and development laboratories for antibody characterization, purification process development, and protein analysis.

Regional Insights

By region, the study provides the protein A resin market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market as pharmaceutical companies, research institutions, and government organizations are channelling substantial investments into research and development activities. This investment spurs the development of new biopharmaceuticals, driving the need for protein A resins. The growing biosimilars market in North America, driven by cost-effectiveness and healthcare affordability concerns, has created a surge in demand for protein A resins. The presence of a substantial number of contract manufacturing organizations (CMOs) services, specializing in biologics production in North America, contributes to the demand for protein A resins. These CMOs rely on advanced purification technologies.

Asia Pacific is expected to record the highest CAGR during the forecast period due to increasing healthcare investments, supportive government policies, and rising demand for biologic drugs. Countries such as China, South Korea, Japan, and Singapore are emerging as major biotech hubs, attracting global pharmaceutical companies. The need for high-quality purification technologies such as protein A resin is growing as more local and international companies set up manufacturing and R&D facilities in the region. Additionally, cost-effective production capabilities and a large patient population are encouraging biologics development, further boosting the demand for protein A resins across Asia Pacific.

The protein A resin market in India is growing rapidly, due to its strong manufacturing capabilities and competitive pricing. The country has seen a rise in biologics and biosimilar production, supported by government initiatives such as “Make in India” and increasing investments in biotechnology parks and R&D infrastructure. The demand for efficient purification processes such as those enabled by protein A resin is growing as Indian pharma companies expand their biologics pipeline. Moreover, collaborations with global firms and a growing domestic healthcare market are accelerating the adoption of advanced technologies, driving the market growth in India.

Key Players and Competitive Analysis

The market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the industry by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers and acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific sectors. The competitive trend is amplified by continuous progress in product offerings. A few major players include Abcam PLC; Agilent Technologies; Bio-Rad Laboratories, Inc.; Danaher Corporation; EMD Millipore; Expedeon Ltd; GenScript Biotech Corp.; Merck KGaA; Novasep Holdings SAS; PerkinElmer, Inc.; Purolite Life Sciences; Repligen Corp.; Thermo Fisher Scientific Inc.; and Tosoh Bioscience.

Bio-Rad Laboratories, Inc. is a US-based company specializing in products for the life science research and clinical diagnostics markets. Founded in 1952 and headquartered in Hercules, California, Bio-Rad operates globally with a workforce of approximately 8,000 employees. The company is organized into two main business segments: Life Science Research and Clinical Diagnostics. The Life Science Research segment supplies instruments, reagents, software, and consumables for applications such as gene expression analysis, protein purification, cell biology, and drug discovery. Its product portfolio includes digital PCR systems, electrophoresis and chromatography equipment, and a broad range of antibodies and related reagents used in research laboratories. The Clinical Diagnostics segment develops and manufactures diagnostic systems and assays used in disease detection, monitoring, and management. Products in this segment include blood typing and screening systems, diabetes monitoring devices (such as HbA1c testing systems), infectious disease assays (including tests for HIV, HCV, and HBV), autoimmune testing kits, and laboratory quality control solutions. Bio-Rad also provides specialized testing products for food safety, veterinary diagnostics, and water quality analysis. These offerings are used by hospitals, public health organizations, and commercial laboratories. Bio-Rad’s operations extend across more than 35 countries, with direct offices and facilities in regions including North America, Europe, Asia Pacific, and Latin America. The company distributes its products through a combination of direct sales channels and a global network of distributors and agents. Bio-Rad’s protein resins offer a range of chromatography media designed for efficient purification and isolation of proteins, peptides, and biomolecules, supporting various applications in life science research and bioprocessing.

Danaher Corporation, founded in 1984 and based in Washington, DC, is a diversified global company operating in the fields of life sciences, biotechnology, and diagnostics. Danaher’s business is structured into three main segments: Biotechnology, Life Sciences, and Diagnostics. The Biotechnology segment includes brands such as Cytiva and Pall, which provide equipment and consumables used in the development and manufacturing of biological drugs. The Life Sciences segment offers instruments and technologies for scientific research and drug discovery, with key brands including Beckman Coulter Life Sciences, SCIEX, Molecular Devices, and Leica Microsystems. The Diagnostics segment focuses on clinical diagnostics and molecular testing, supplying products through brands like Beckman Coulter Diagnostics, Cepheid, and Radiometer. These products are used by pharmaceutical and biotechnology companies, healthcare providers, and research institutions for various applications, including genomics, proteomics, and medical diagnostics. Danaher operates in more than 50 countries with around 700 locations globally. MabSelect PrismA is a protein A chromatography resin designed for efficient, high-capacity purification of monoclonal antibodies in bioprocessing and industrial-scale manufacturing applications.

List of Key Companies in Protein A Resin Market

- Abcam PLC.

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- EMD Millipore

- Expedeon Ltd

- GenScript Biotech Corp.

- Merck KGaA

- Novasep Holdings SAS

- PerkinElmer, Inc.

- Purolite Life Sciences

- Repligen Corp.

- Thermo Fisher Scientific Inc.

- Tosoh Bioscience

Protein A Resin Industry Developments

In August 2024, Purolite launched DurA Cycle protein A resin, engineered using Jetting technology to enhance purification performance, caustic stability, and sustainability, while reducing manufacturing costs for monoclonal antibody processes.

In September 2024, JSR Life Sciences launched Amsphere A+, a next-generation protein A resin, to enhance antibody drug purification with improved binding capacity, alkali stability, and process efficiency.

Protein A Resin Market Segmentation

By Type Outlook (Revenue USD Million, 2020–2034)

- Recombinant Protein A

- Natural Protein A

By Product Outlook (Revenue USD Million, 2020–2034)

- Organic Polymer-Based Protein A

- Agarose-Based Protein A

- Glass/Silica-Based Protein A

By Application Outlook (Revenue USD Million, 2020–2034)

- Immunoprecipitation

- Antibody Purification

By End User Outlook (Revenue USD Million, 2020–2034)

- Academic Research Institutes

- Pharmaceutical Companies

- Others

By Regional Outlook (Revenue USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protein A Resin Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,525.00 million |

|

Market Size Value in 2025 |

USD 1,620.31 million |

|

Revenue Forecast by 2034 |

USD 2,832.54 million |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The market size was valued at USD 1,525.00 million in 2024 and is projected to grow to USD 2,832.54 million by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

North America held the largest share of the global market in 2024.

A few key players in the market are Abcam PLC; Agilent Technologies; Bio-Rad Laboratories, Inc.; Danaher Corporation; EMD Millipore; Expedeon Ltd; GenScript Biotech Corp.; Merck KGaA; Novasep Holdings SAS; PerkinElmer, Inc.; Purolite Life Sciences; Repligen Corp.; Thermo Fisher Scientific Inc.; and Tosoh Bioscience.

The recombinant protein A segment dominated the market in 2024, as these resins are engineered through recombinant DNA technology, allowing for the production of protein A ligands with specific characteristics optimized for protein purification.

The agarose-based protein A segment is expected to witness significant growth during the forecast period due to its extensive utilization in various applications across the biopharmaceutical and biotechnology industries