Protein Purification and Isolation Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Consumables), By Technology, By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6198

- Base Year: 2024

- Historical Data: 2020-2023

Overview

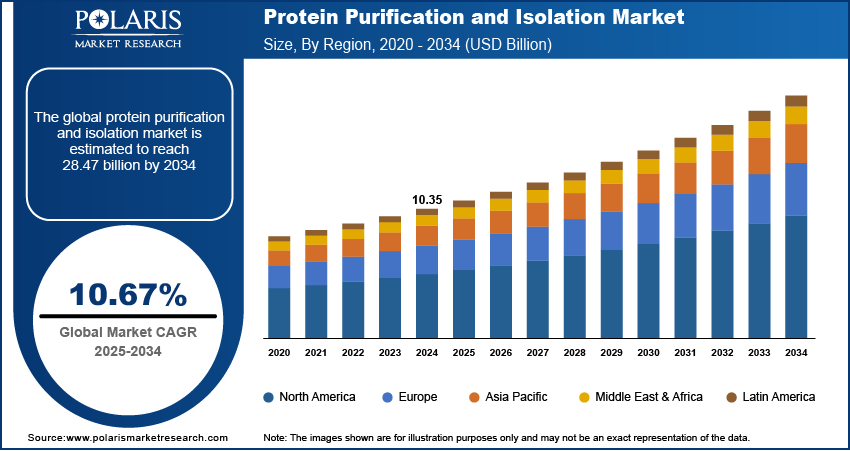

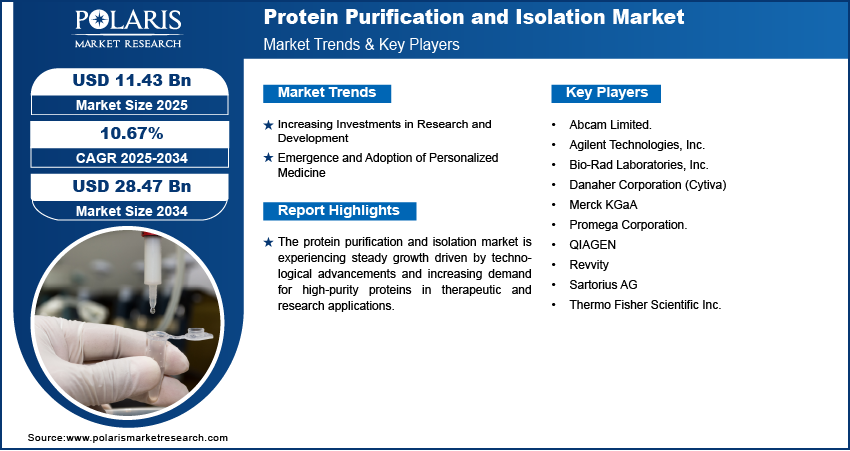

The global protein purification and isolation market size was valued at USD 10.35 billion in 2024, growing at a CAGR of 10.67% from 2025 to 2034. Key factors driving demand for protein purification and isolation include advancements in purification methods and technologies, increasing investments in research and development, and emergence and adoption of personalized medicine.

Key Insights

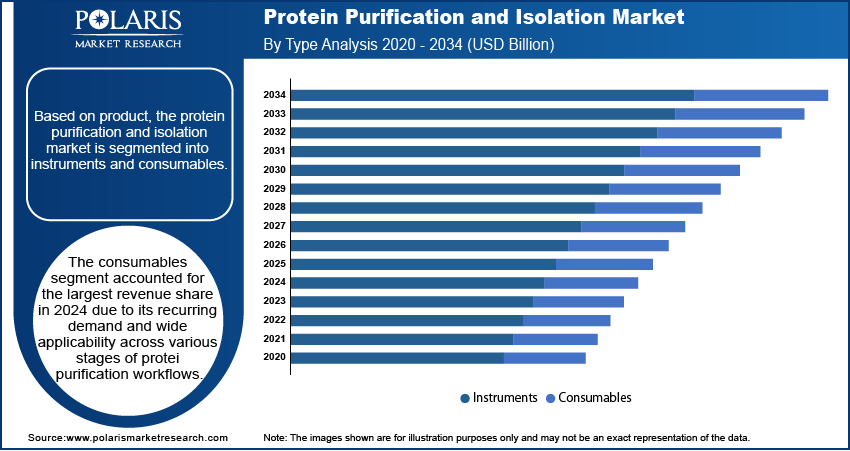

- The consumables segment accounted for the largest revenue share in 2024 due to its recurring demand and wide applicability across various stages of protein purification workflows.

- The electrophoresis segment is projected for robust expansion, due to precise protein analysis. Its accuracy in assessing molecular properties drives adoption in research and quality control.

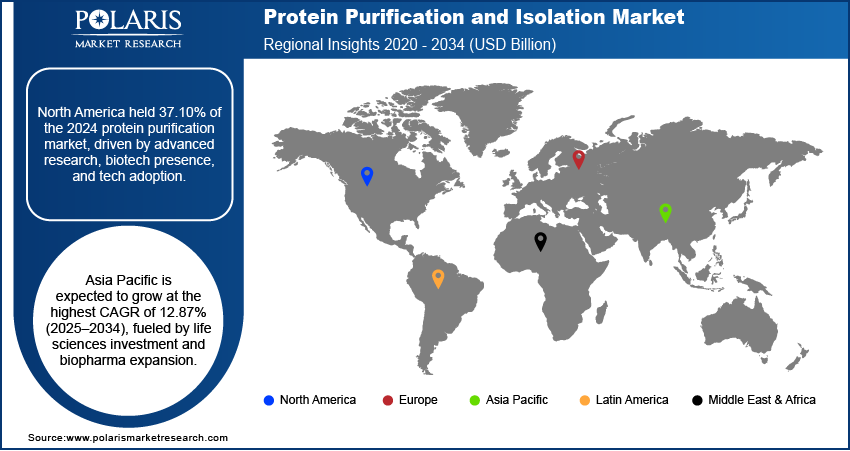

- The North America protein purification and isolation market accounted for 37.10% of market share in 2024 due to its advanced research infrastructure, strong presence of biotechnology and pharmaceutical companies, and high adoption of innovative technologies.

- The U.S. held the largest market share in the North America protein purification and isolation landscape in 2024 due to its advanced biotechnology sector, high research output, and widespread adoption of advanced purification technologies.

- The market in Asia Pacific is projected to register the highest CAGR of 12.87% from 2025 to 2034, owing to increasing investments in life sciences research, expanding biopharmaceutical manufacturing capabilities, and supportive regulatory frameworks

- The market in China is expanding due to increasing focus on biopharmaceutical development and growing investments in proteomics and molecular biology research.

Industry Dynamics

- R&D investments fuel market growth by enabling the discovery and production of innovative therapeutics and bio molecular tools.

- Personalized medicine adoption accelerates demand, driving the need for targeted, patient-specific therapies.

- High equipment costs and complex purification processes limit accessibility for smaller labs and emerging markets. This creates barriers to widespread adoption, particularly in resource-constrained research environment.

- Rising demand for biologics and personalized medicine drives innovation in scalable, cost-effective purification technologies. Advances in automation and AI-powered systems could streamline workflows and expand market reach.

Market Statistics

- 2024 Market Size: USD 10.35 billion

- 2034 Projected Market Size: USD 28.47 billion

- CAGR (2025-2034): 10.67%

- North America: Largest market in 2024

AI Impact on Protein Purification and Isolation Market

- The adoption of AI tools streamlines protein purification workflows and enhances precision.

- The technology enables automation in chromatography and electrophoresis.

- AI tools recommend purification steps, buffer compositions, and temperature settings, which streamlines purification workflows and minimizes resource waste.

- AI systems identify and analyze patterns in failed or successful experiments. It helps avoid redundant trials by predicting results based on previous data. This boosts lab efficiency and reduces development timelines.

- In large organization, AI integration with robotic platforms enables parallel processing of multiple samples.

Protein purification and isolation refer to the process of separating a specific protein of interest from a complex mixture, enabling its detailed study or application in research and therapeutic development. The market for protein purification and isolation is witnessing growth, primarily driven by advancements in purification methods and technologies. Modern techniques, such as chromatography, electrophoresis, and affinity tagging, have enhanced the precision, efficiency, and scalability of protein isolation processes. These innovations are essential for meeting the evolving demands of proteomics research, structural biology, and functional protein analysis. Furthermore, the integration of automation and high-throughput systems has enabled researchers to streamline workflows, reduce contamination risks, and enhance reproducibility, making these technologies essential in both academic and industrial environments.

The rising demand for biopharmaceuticals, which rely heavily on high-purity proteins for formulation and production, further drives the growth opportunities. Biopharmaceutical companies are focusing on the development of targeted therapies, many of which are protein-based, such as monoclonal antibodies, hormones, and vaccines, as the global burden of chronic and rare diseases continues to increase. A February 2025 EU report revealed that there are 36 million rare disease patients in Europe, with 80% genetically linked. Nearly 70% emerge in childhood, yet 95% lack treatments, highlighting urgent medical needs. The need for effective purification techniques becomes even more critical in ensuring the safety, efficacy, and regulatory compliance of these biologics. Consequently, this demand is fueling investments in advanced protein isolation platforms, further boosting growth in the market across research laboratories, contract manufacturing organizations, and pharmaceutical firms.

Drivers & Opportunities

Increasing Investments in Research and Development: Increasing investments in research and development support the discovery and production of novel therapeutics and biomolecular tools. Research institutions and pharmaceutical companies are allocating greater resources toward protein-based studies with a growing focus on understanding cellular mechanisms and disease pathways at the molecular level. In March 2022, Thermo Fisher Scientific and Symphogen (Servier’s antibody center) extended their collaboration to deliver advanced tools and workflows for streamlined characterization of complex therapeutic proteins, supporting biopharma R&D labs. These efforts necessitate high-quality, purified proteins for applications such as drug screening, biomarker identification, and functional analysis. As a result, advanced purification and isolation systems are in high demand to support the depth and complexity of modern research initiatives. Hence, increasing investments in research and development drives the market expansion.

Emergence and Adoption of Personalized Medicine: The emergence and adoption of personalized medicine accelerate the growth opportunities by highlighting the need for targeted and patient-specific therapies. Personalized medicine relies on detailed molecular profiling, often involving proteomic analysis, to tailor treatment strategies to individual patients. In January 2025, UK Biobank launched a study analyzing up to 5,400 proteins per sample from 600,000 participants, including longitudinal data, to revolutionize disease research and treatment development. This approach demands accurate isolation of specific proteins to identify disease-related biomarkers and therapeutic targets. Protein purification technologies play a crucial role in supporting diagnostic development, treatment customization, and therapeutic protein production, driving increased utilization across clinical research and biopharmaceutical development as healthcare shifts toward precision-based models.

Segmental Insights

Product Analysis

Based on product, the segmentation includes instruments and consumables. The consumables segment accounted for the largest revenue share in 2024 due to its recurring demand and wide applicability across various stages of protein purification workflows. Consumables such as reagents, kits, columns, filters, and resins are essential components in every experiment, leading to their frequent replenishment in laboratories and industrial environments. Their standardized formats and compatibility with a range of purification instruments further enhance their utility. Additionally, the increasing scale of protein research and production across pharmaceutical and academic institutions supports sustained consumption, driving higher revenue contribution from this segment.

Technology Analysis

In terms of technology, the segmentation includes ultrafiltration, precipitation, chromatography, electrophoresis, western blotting, and others. The electrophoresis segment is expected to witness significant growth during the forecast period owing to its accuracy in analyzing protein size, purity, and molecular weight. Electrophoresis enables detailed protein characterization, which is essential for understanding structure-function relationships, as a widely used technique in both research and clinical diagnostics. The development of automated and high-resolution electrophoresis systems is enhancing throughput and reproducibility, making the method more appealing for laboratories handling large sample volumes. Its versatility and reliability in both qualitative and quantitative protein analysis are major factors supporting its expanding adoption.

Application Analysis

The segmentation, based on application, includes drug screening, biomarker discovery, protein-protein interaction studies, and diagnostics. The protein-protein interaction studies segment dominated the market in 2024 due to the growing importance of understanding cellular signaling pathways and complex biological processes. Identifying and analyzing interactions between proteins provides critical insights into disease mechanisms, therapeutic target identification, and functional proteomics. This application demands highly purified and functional proteins, increasing reliance on advanced purification technologies. Therefore, as drug discovery becomes more focused on molecular targets and pathway modulation, protein interaction studies play a central role, driving robust demand in both academic and industrial research environments.

End Use Analysis

In terms of end use, the segmentation includes academic and research institutes, hospitals, pharmaceutical and biotechnology companies, and CROs. The hospitals segment is projected to witness the fastest growth during the forecast period, primarily due to the increasing integration of protein analysis in clinical diagnostics and personalized treatment strategies. Hospitals are increasingly adopting protein-based tests to detect disease biomarkers, monitor treatment response, and guide therapeutic decisions. The growing presence of specialized laboratories within hospitals, along with the adoption of in-house diagnostic capabilities, contributes to the rising demand for protein purification tools. Moreover, the shift toward precision medicine further amplifies the need for accurate and rapid protein isolation techniques in clinical environments.

Regional Analysis

The North America protein purification and isolation market accounted for 37.10% of global market share in 2024. This dominance is attributed to its advanced research infrastructure, strong presence of biotechnology and pharmaceutical companies, and high adoption of innovative technologies. In November 2023, Cytiva launched Protein Select, a breakthrough protein purification technology using a self-cleaving traceless tag and universal resin, eliminating the need for protein-specific affinity partners and accelerating recombinant protein workflows. The region benefits from a well-established ecosystem that supports continuous innovation, government and private funding, and a skilled scientific workforce. These factors collectively drive extensive application of protein purification tools in drug development, academic research, and clinical diagnostics, reinforcing North America's market leadership.

U.S. Protein Purification and Isolation Market Insights

The U.S. held the largest market share in North America protein purification and isolation landscape in 2024 due to its advanced biotechnology sector, high research output, and widespread adoption of advanced purification technologies. Strong government and private investments in life sciences, coupled with the presence of leading pharmaceutical companies and academic institutions, continue to drive demand for efficient protein analysis and purification systems across the country.

Asia Pacific Protein Purification and Isolation Market Trends

The market in Asia Pacific is projected to register the highest CAGR of 12.87% from 2025 to 2034, owing to increasing investments in life sciences research, expanding biopharmaceutical manufacturing capabilities, and supportive regulatory frameworks. Rapidly developing healthcare infrastructure, particularly in countries with growing biotech sectors, is encouraging local production and research activities. According to an April 2025 IBEF report, India's healthcare market is expected to grow from USD 110 billion to USD 638 billion by 2025. Additionally, rising focus on academic collaborations and the emergence of contract research and manufacturing organizations in the region are contributing to the growing demand for protein purification and isolation technologies.

China Protein Purification and Isolation Market Overview

The market in China is expanding due to increasing focus on biopharmaceutical development and growing investments in proteomics and molecular biology research. Rapid growth of the domestic biotech industry, supported by rising infrastructure development and skilled talent, is boosting the adoption of advanced protein purification tools. Additionally, the expansion of contract research organizations is enhancing access to innovative technologies within the country.

Europe Protein Purification and Isolation Market Assessment

The protein purification and isolation landscape in Europe is projected to hold a substantial share by 2034, supported by strong research funding, regulatory focus on biologics, and the presence of established academic institutions and biotech firms. The region’s focus on high-quality standards and compliance boosts the adoption of advanced purification technologies in both research and clinical applications. Moreover, ongoing initiatives aimed at promoting biomedical research and therapeutic development in Europe are expected to sustain demand for reliable protein isolation tools across multiple end-use sectors.

UK Protein Purification and Isolation Market Outlook

The growth of the UK market is driven by strong academic research capabilities and the country's focus on translational medicine and biologics development. A well-integrated healthcare system and collaborations between universities, research institutes, and industry players are supporting the rising demand for high-quality protein purification solutions. Moreover, the regulatory support for biologics and increased funding for life sciences research further strengthen expansion opportunities in the UK.

Key Players & Competitive Analysis

The protein purification and isolation industry is witnessing dynamic growth driven by technological advancements, emerging markets, and strategic investments from major companies. Companies, such as Thermo Fisher Scientific, Merck KGaA, and Danaher are leveraging competitive intelligence and strategy to strengthen their positions through acquisitions and innovative product launches. Revenue growth is fueled by increasing demand in drug discovery, diagnostics, and biopharmaceutical research, with developed markets leading adoption while emerging markets present untapped potential. Disruptions and trends, such as automation and AI-driven purification systems, are reshaping workflows, creating expansion opportunities for both established firms and small and medium-sized businesses. Sustainable value chains and economic and geopolitical shifts further influence procurement and regional market strategies. Moreover, growth projections highlight rising demand for chromatography and electrophoresis technologies, with latent demand and opportunities in biomarker discovery and precision medicine. Companies must align with future development strategies to capitalize on high-growth markets and emerging technologies, ensuring long-term leadership in this competitive landscape as industry trends evolve.

A few major companies operating in the protein purification and isolation industry include Abcam Limited; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation (Cytiva); Merck KGaA; Promega Corporation; QIAGEN; Revvity; Sartorius AG; and Thermo Fisher Scientific Inc.

Key Players

- Abcam Limited.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation (Cytiva)

- Merck KGaA

- Promega Corporation.

- QIAGEN

- Revvity

- Sartorius AG

- Thermo Fisher Scientific Inc.

Protein Purification and Isolation Industry Developments

- March 2025: Momentum Biotechnologies acquired OmicScouts GmbH, a Munich-based proteomics CRO. This expands Momentum’s mass spectrometry services, adds validated assays, and accelerates European market entry, strengthening its global drug discovery offerings.

- January 2025: Quantum-Si launched Platinum Pro, its latest benchtop protein sequencer, offering unparalleled efficiency and accessibility. Building on the original Platinum, it simplifies proteomics research with an integrated workflow, making advanced protein sequencing available to labs worldwide.

Protein Purification and Isolation Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Consumables

- Kits

- Reagents

- Columns

- Magnetic Beads

- Resins

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Ultrafiltration

- Precipitation

- Chromatography

- Ion Exchange Chromatography

- Affinity Chromatography

- Reversed Phase Chromatography

- Size Exclusion Chromatography

- Hydrophobic Interaction Chromatography

- Electrophoresis

- Gel Electrophoresis

- Isoelectric Focusing

- Capillary Electrophoresis

- Western Blotting

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug Screening

- Biomarker Discovery

- Protein-Protein Interaction Studies

- Diagnostics

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Academic and Research Institutes

- Hospitals

- Pharmaceutical and Biotechnology Companies

- CROs

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Protein Purification and Isolation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.35 Billion |

|

Market Size in 2025 |

USD 11.43 Billion |

|

Revenue Forecast by 2034 |

USD 28.47 Billion |

|

CAGR |

10.67% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.35 billion in 2024 and is projected to grow to USD 28.47 billion by 2034.

The global market is projected to register a CAGR of 10.67% during the forecast period.

The North America protein purification and isolation market accounted for 37.10% of the global market share in 2024.

A few of the key players in the market are Abcam Limited; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation (Cytiva); Merck KGaA; Promega Corporation; QIAGEN; Revvity; Sartorius AG; and Thermo Fisher Scientific Inc.

The consumables segment dominated the market in 2024, holding 28.38% share.

The electrophoresis segment is expected to witness significant growth during the forecast period.