Pulverizing Systems Market Share, Size, Trends, Industry Analysis Report

By Type (Hammer, Ball, Pin, Impact, Attrition, Fluid Energy Pulverizers, and Others); By Capacity; By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 119

- Format: PDF

- Report ID: PM3608

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

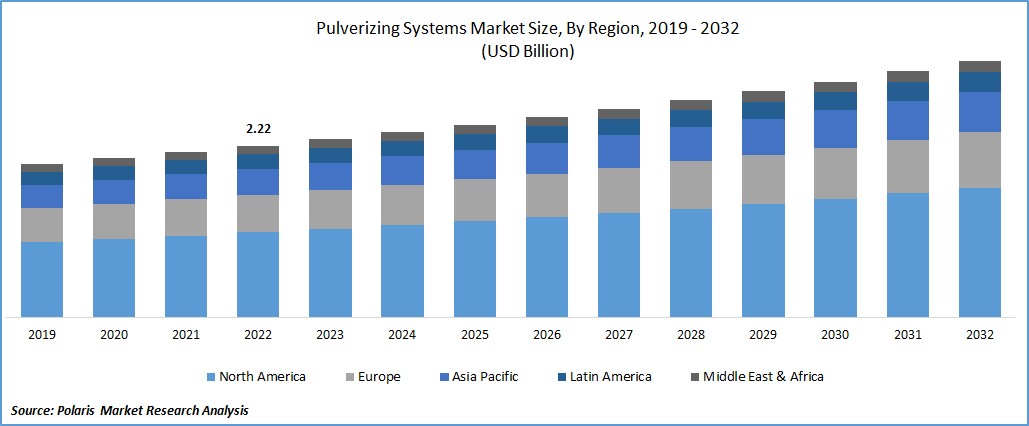

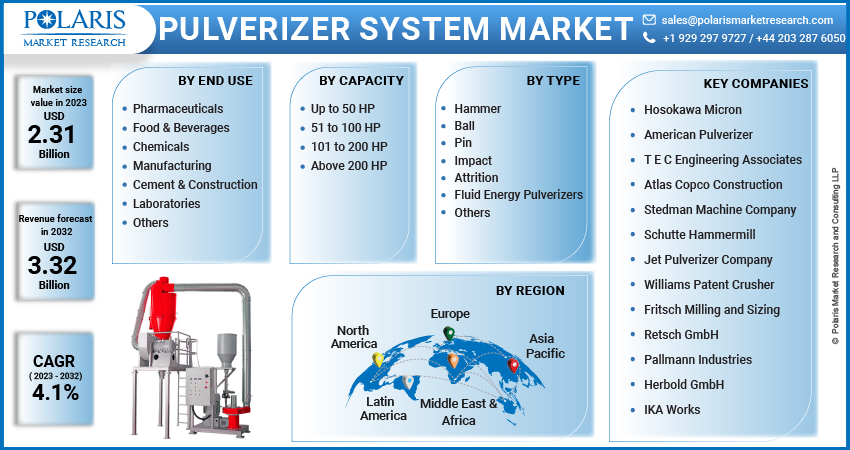

The global pulverizing systems market was valued at USD 2.22 billion in 2022 and is expected to grow at a CAGR of 4.1% during the forecast period. Increasing need and demand for effective size reduction processes across the globe, mainly to transform the raw materials into small particles or powders, and the heavy reliance of the power & energy generation sector on pulverizing systems, particularly for the coal pulverization, are key factors likely to drive the global market at a rapid pace. In addition, the growing emphasis on environmental sustainability and regulations to reduce emissions and waste have boosted the popularity of these systems, as they enable efficient recycling, waste management, and utilization of secondary materials, thereby encouraging manufacturers to implement and introduce these systems into their product offerings, that will help market players to gain a competitive edge.

To Understand More About this Research: Request a Free Sample Report

For instance, in February 2022, Pallmann unveiled its new pulverizing system named “PKM800”, which delivers greater throughput, better productivity, cleanliness, and reduced material cost for products made of PVC. The new system offers uniform particle size distribution to manufacture more intricate and detailed profiles.

Moreover, the growing proliferation of the integration of digital technologies such as the Internet of Things, artificial intelligence, and data analytics and the emerging trend of digitalization globally can enhance process control, predictive maintenance, and optimization of pulverizing systems due to improved efficiency and reduced downtime are gaining significant traction and popularity in the recent years.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the pulverizing systems market. The emergence of the deadly coronavirus globally has resulted in significant delays in construction and development activities and the postponement and cancellation of several projects or investments. Additionally, the pandemic has led to huge disruptions in the global supply chains and shortages of raw materials, which has negatively influenced market growth.

For Specific Research Requirements, Speak With a Research Analyst

Industry Dynamics

Growth Drivers

- Increasing Investments in Industrialization

The rising investments towards infrastructure development, continuous expansion in the food processing industry, rapid rate of industrialization urbanization, and increased number of favorable government initiatives coupled with the growing focus of pulverizing systems market players on developing more efficient pulverizer devices consuming less energy and easily complement the constantly changing sustainability norms, are driving the global market growth. Furthermore, pulverizing systems are now designed to focus on energy efficiency and reduce carbon footprint. Manufacturers are incorporating energy-saving features such as high-efficiency motors, advanced control systems, and optimized grinding processes. Thus, the rapid development of pulverizing systems that consume less energy and emit fewer emissions is a notable trend in the market and is likely to create significant growth opportunities for the market in the forecast period.

Report Segmentation

The market is primarily segmented based on type, capacity, end use, and region.

|

By Type |

By Capacity |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Ball segment accounted for the largest market share in 2022

The ball segment accounted for the largest market share in 2022 due to the growing versatility and widespread use of the product across numerous industries, including minerals, ores, chemicals, pigments, and cement, among others, coupled with its ability to achieve fine grinding and micronization of materials, that allows for precise control over the particle size distribution, are among the primary factors driving the segment market growth worldwide.

The hammer segment is anticipated to be the fastest-growing segment over the study period, mainly attributable to the growing prevalence of handling a wider range of materials, including grains, minerals, wood, biomass, and recycled materials, and its significant adoption as a cost-effective solution for pulverizing operations. Besides this, hammer mills are more likely to be customized and adapted to meet several specific application requirements. They can also be equipped in different sizes, making them suitable for various industries and materials.

101 to 200 HP segment is expected to witness the highest growth over the forecast period

The 101 to 200 HP segment is expected to witness the highest growth rate over the forecast period due to the increased rate of industrialization across a wide range of sectors, including pharmaceuticals, chemicals, mining, and construction, and growing penetration among industries regarding higher productivity to meet the rising demands globally. Enterprises across the globe are increasingly focused on meeting regulatory requirements and ensuring safety in their operations. Thus, they are heavily looking for pulverizing systems within the 100 to 200 HP range, as they often incorporate safety features and adhere to industry standards, making them suitable for industries with strict regulatory guidelines, thereby propelling the segment market growth at an exponential rate.

The chemicals segment held a significant revenue share in 2022

The chemicals segment held a significant revenue share in 2022, mainly due to the increased number of shipments of pulverizer machines across the chemical sector due to the surging establishment of new and advanced chemical manufacturing facilities across the globe. Additionally, with the rapidly evolving chemical industry with advancements in material science and nanotechnology, the need for precise and efficient pulverizing systems has drastically grown and positively impacted the market. The cement and construction industry is likely to gain a substantial growth rate over the next coming years due to an increased rate of urbanization and industrialization due to the development of new buildings, roads, dams, and bridges, among others, along with the drastic surge in the number of remodeling and renovation projects in the construction industry.

North America dominated the global market in 2022

The North region dominated the global pulverizing systems market share in 2022. It can be mainly driven by the robust presence of large manufacturing facilities and continuous growth in the pharmaceutical industry due to the rising burden of cardiovascular diseases and high consumption of processed food products across the region.

Furthermore, the stringent environmental regulations in the region encouraging industries to adopt technologies and equipment that minimize emissions and waste generation and the growing introduction to systems with advanced dust collection and control mechanisms, which help businesses meet environmental standards set by government authorities, is further fostering the market growth.

The Asia Pacific region is likely to emerge as the significant growing region during the forecast period, owing to increased demand for energy and power generation and constant expansion of manufacturing sectors, including chemicals, plastics, and food processing to meet the requirement of large population burden across the APAC region. The region has been heavily investing in R&D activities to develop more advanced systems with enhanced capabilities, likely to foster the market and create new growth opportunities over the coming years.

Competitive Insight

Some of the major players operating in the global market include Hosokawa Micron, American Pulverizer, T E C Engineering Associates, Atlas Copco Construction, Stedman Machine Company, Schutte Hammermill, Jet Pulverizer Company, Williams Patent Crusher, Fritsch Milling and Sizing, Retsch GmbH, Pallmann Industries, Herbold GmbH, and IKA Works.

Recent Developments

- In December 2021, TORXX Kinetic Pulverizer announced the launch of its new TORXX Kinetic, which is mainly based on waste processing technology and relies on aerodynamics and matter-on-matter collisions for particle size reduction. With the launch of this new pulverizer, the company will be expanding its market portfolio and broadening its customer reach worldwide.

- In August 2021, Caterpillar, a global construction equipment provider, introduced its six new primary and secondary pulverizers, featuring the industry’s significant technology, which delivers 52% faster cycle times. The new Cat pulverizer line includes three rotary preliminary models and three new fixed secondary models, and both of the series are designed to fit the 18 to 50 tonnes machines.

Pulverizing Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 2.31 billion |

|

Revenue forecast in 2032 |

USD 3.32 billion |

|

CAGR |

4.1% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Capacity, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Hosokawa Micron, American Pulverizer, T E C Engineering Associates, Atlas Copco Construction, Stedman Machine Company, Schutte Hammermill, Jet Pulverizer Company, Williams Patent Crusher, Fritsch Milling and Sizing, Retsch GmbH, Pallmann Industries, Herbold GmbH, and IKA Works. |

FAQ's

The pulverizing systems market report covering key segments are type, capacity, end use, and region.

Pulverizing Systems Market Size Worth $3.32 Billion By 2032.

The global pulverizing systems market is expected to grow at a CAGR of 4.1% during the forecast period.

North America is leading the global market.

key driving factors in pulverizing systems market are increasing construction sites and food processing industries.