Pumpkin Seed Protein Market Share, Size, Trends, Industry Analysis Report

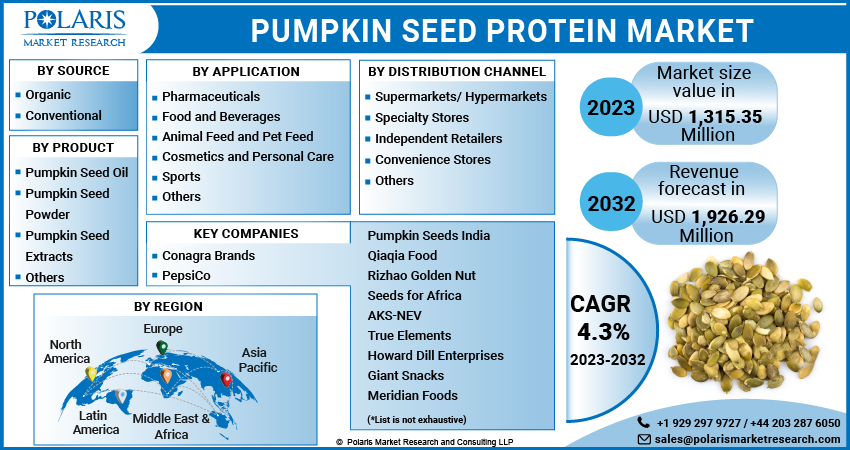

By Product (Pumpkin Seed Oil, Pumpkin Seed Powder, Pumpkin Seed Extracts, Others); By Source; By Application; By Distribution Channel; By Region; Segment Forecast, 2023-2032

- Published Date:Jul-2023

- Pages: 112

- Format: PDF

- Report ID: PM3640

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

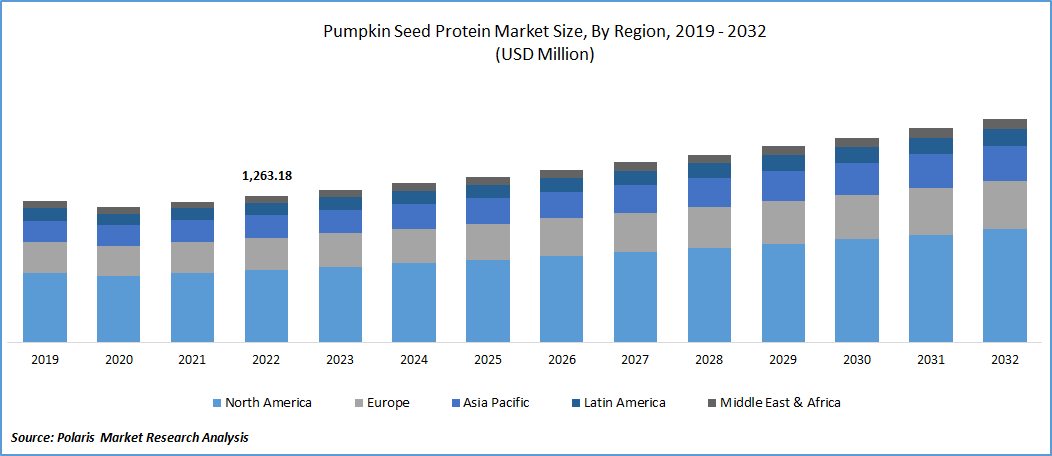

The global pumpkin seed protein market was valued at USD 1,263.18 million in 2022 and is expected to grow at a CAGR of 4.3% during the forecast period.

Product innovations in the market are fundamentally broadening the market's revenue globally. The outstanding health benefits of the pumpkin seed have led loads of key players to contribute to the market by innovating various products. For instance, in January 2023, the new peanut butter line from WOW Life Science offers a unique twist. After extensive customer research, the internal innovation team created India's first superfood-infused peanut butter. The company has two new varieties: sattu (roasted chana powder) and super seeds (chia, pumpkin, watermelon, and sunflower). Such innovations are dynamically helping businesses to improve their customer base and advance their revenue stream. This is heightening the popularity of the seed protein from pumpkin and proliferating the market's growth.

To Understand More About this Research: Request a Free Sample Report

Pumpkin seed protein is often processed into powder form and used as an ingredient in protein powders and dietary supplements. These products are popular among athletes, fitness enthusiasts, and individuals looking to supplement their protein intake. This can also be used in beverage formulations, including protein shakes, smoothies, and dairy-free milk alternatives. This protein is suitable for dairy-free, vegan applications and for producing nutritional bars and meal replacement products.

The COVID-19 pandemic has had a mixed impact on the global market. A heightened focus on health and wellness has been promoted during the pandemic. Consumers have become more conscious of their dietary choices and seek healthier food options. Plant-based proteins like pumpkin seed protein have gained popularity as people look for nutritious and immune-boosting ingredients. However, the pandemic brought about changes in consumer purchasing patterns. Panic buying, stockpiling, and changes in spending habits influenced the overall food market, including the pumpkin seed protein sector. Fluctuations in consumer demand and uncertainties surrounding the pandemic's impact on the economy could have affected market dynamics.

As global vaccination efforts progress and restrictions ease, the food industry is expected to recover. Consumer confidence is likely to return, leading to a rebound in the market. The focus on health and wellness and the growing interest in plant-based proteins are expected to continue driving the demand for pumpkin seed protein.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

The market for functional foods and nutraceuticals is expanding as consumers seek products that offer additional health benefits beyond basic nutrition. Pumpkin seed protein fits into this trend with its potential health-promoting properties such as muscle support, antioxidant content, and nutrient profile. Consumers increasingly seek functional foods that can support their overall health and well-being, whereas pumpkin seed protein is considered a health-promoting ingredient that can be incorporated into useful food products. This is improving the overall market value globally.

Flourishing demand for pumpkin seed oil among a huge population is another factor likely to surge the market's value worldwide. Pumpkin seeds oil is one of the less popular cooking oils. According to studies, this oil has a lot of antioxidants, which aid in the body's detoxification process and protect cells from harm. It also has monounsaturated and polyunsaturated fats, which make it a fantastic food for the heart. As a result, it lowers bad cholesterol and reduces the risk of heart disease, Type 2 diabetes, and even other conditions. Such health benefits of oil are gaining huge momentum and generating revenue in the market.

Report Segmentation

The market is primarily segmented based product, source, application, distribution channel, and region.

|

By Product |

By Source |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Pumpkin seed oil segment held largest share in the global market in 2022

In fiscal year 2022, the pumpkin seed oil segment held the largest share 2022 as it is commonly used in cooking, baking, and salad dressings. It has a rich, nutty flavor that can enhance the taste of various dishes. Its versatility in culinary applications may contribute to its popularity and demand. Pumpkin seed protein is well known for its nutritional benefits. It is a good source of essential fatty acids, such as omega-3 and omega-6, and antioxidants, like vitamin E. These nutrients are valued for their potential health benefits, including heart health and anti-inflammatory properties. It also has a long history of traditional use in certain regions, particularly Central Europe.

Organic segment is emerged as largest segment in the global market in 2022

The organic segment is the largest revenue accounting segment of the global market. There has been an increasing consumer focus on health and sustainability, leading to increased demand for organic products. Organic foods are perceived as healthier because they are produced without synthetic pesticides and fertilizers. Consumers who prioritize their well-being and environmental sustainability may opt for organic products.

In a competitive food market, offering organic pumpkin seed protein can be a way for manufacturers or brands to differentiate themselves from others. The organic label carries a certain premium and may attract consumers seeking organic products. This market differentiation strategy may contribute to the dominance of the organic segment in the pumpkin seed protein market.

Food and beverages segment is dominating the global market during forecast period

Food and beverages are dominating the market during the forecast period. There has been a growing trend towards plant-based diets and a rising demand for plant-based protein sources. The food and beverages industry, responsible for catering to consumer dietary needs and preferences, plays a significant role in meeting this demand by incorporating pumpkin seed protein into their products. The protein can be incorporated into a wide range of food and beverage products, and such versatility in food application is creating popularity in the market.

Online segment is emerged as fastest growing segment during the forecast period

During the forecast period, the online segment is expected to be a major contributor to the global market, growing at the highest rate. Online platforms offer consumers the convenience and accessibility to browse and purchase products from the comfort of their own homes. This enables consumers to access various pumpkin seed protein products from different brands and suppliers regardless of location. Due to this convenience factor, the online segment is expected to experience rapid growth. The growth of e-commerce has significantly impacted various industries, including the food and supplement markets. As online shopping becomes more popular and accessible, consumers rely on e-commerce platforms to buy their dietary supplements and health foods.

North America dominated the market in 2022

In the fiscal year 2022, North America dominated the market due to increased consumer preference towards protein-rich food, a wide range of products used across many applications, product launches, and many other factors attributed to the market growth. Expanding production of pumpkin in the region is one of the foremost factors helping the market to account for the largest revenue. For instance, the United States has a diverse distribution of pumpkin output. With 15,900 acres harvested, Illinois continued to be the top state for pumpkin production in 2021, producing more than twice as many acres as any of the other top States. California, Indiana, Michigan, Texas, and Virginia all harvested between 4,500 and 7,400 acres in the same calendar year. This is dramatically fostering the growth of the market across the region.

Asia Pacific is the fastest-growing region contributing to the market with the highest CAGR during the assessment years. The region continues to lead the world in food and nutrition growth for health and wellness. Fortified foods targeted at athletes and fitness enthusiasts frequently incorporate pumpkin seed protein to support muscle, aid recovery, and enhance athletic performance. Pumpkin seed protein is recognized for its muscle-building properties and is often used in sports nutrition products. This is helping the market in the Asia Pacific to grow at a rapid pace.

Competitive Insight

The global pumpkin seed protein market involves Conagra Brands, PepsiCo, Pumpkin Seeds India, Qiaqia Food, Rizhao Golden Nut, Shandong Jinsheng Cereals & Oils, Seeds for Africa, AKS-NEV, True Elements, Howard Dill Enterprises, Giant Snacks, Meridian Foods, and Nature’S Harvest & Geniuscentral.

Recent Developments

- In October 2020, a new line of tastes for products, including plant-based protein, was introduced by Synergy, a top worldwide flavor supplier with nutritional knowledge. The Paired to Perfection line includes variations of the staple flavors of sports nutrition—strawberry, vanilla, and chocolate—specially created for plant-protein bases like pea, brown rice, hemp, pumpkin seed, and sunflower seed.

Pumpkin Seed Protein Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,315.35 million |

|

Revenue forecast in 2032 |

USD 1,926.29 million |

|

CAGR |

4.3% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2023– 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Segments covered |

By Product, By Source, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Conagra Brands, PepsiCo, Pumpkin Seeds India, Qiaqia Food, Rizhao Golden Nut, Shandong Jinsheng Cereals & Oils, Seeds for Africa, AKS-NEV, True Elements, Howard Dill Enterprises, Giant Snacks, Meridian Foods, and Nature’S Harvest & Geniuscentral |

FAQ's

The global pumpkin seed protein market size is expected to reach USD 1,926.29 million by 2032.

Top market players in the Pumpkin Seed Protein Market are involves Conagra Brands, PepsiCo, Pumpkin Seeds India, Qiaqia Food, Rizhao Golden Nut, Shandong Jinsheng Cereals & Oils.

North America contribute notably towards the global Pumpkin Seed Protein Market.

The global pumpkin seed protein market is expected to grow at a CAGR of 4.3% during the forecast period.

The Pumpkin Seed Protein Market report covering key are product, source, application, distribution channel, and region.