Pyrogen Testing Market Share, Size, Trends, Industry Analysis Report

By Product (Instruments, Consumables, Services); By Test Type; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4662

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

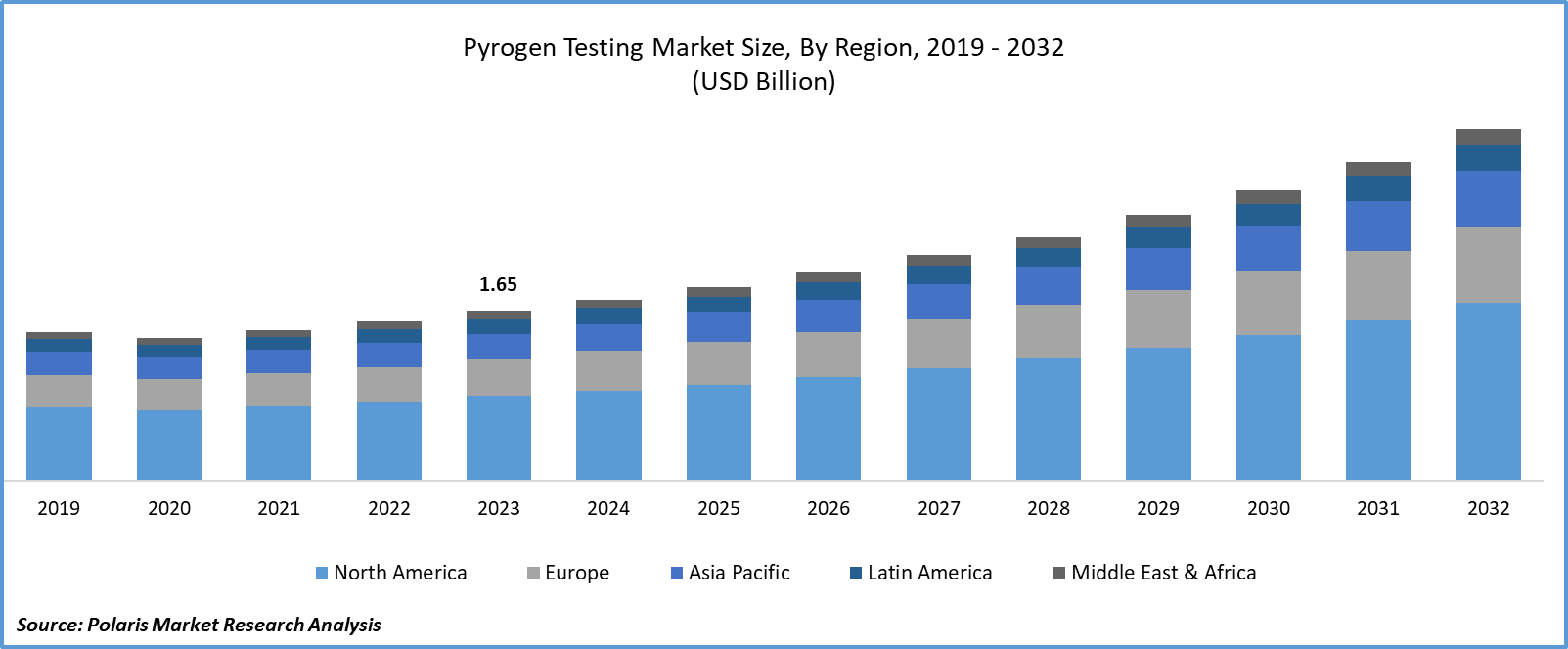

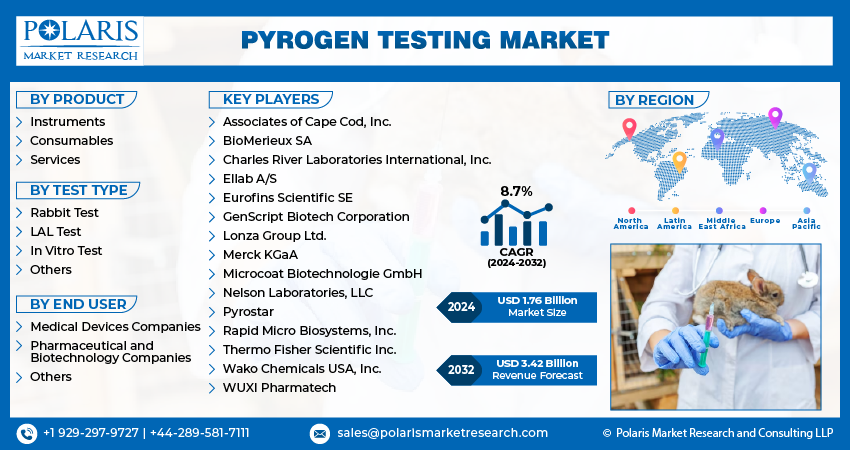

- Pyrogen Testing Market size was valued at USD 1.65 billion in 2023.

- The market is anticipated to grow from USD 1.76 billion in 2024 to USD 3.42 billion by 2032, exhibiting the CAGR of 8.7% during the forecast period.

Market Introduction

The pyrogen testing market is growing due to the increasing incidence of infectious diseases worldwide. Pathogens such as bacteria and viruses can produce pyrogens, posing risks if present in pharmaceuticals or medical devices. Stringent regulatory mandates from agencies like the FDA and EMA require pyrogen testing to ensure product safety. The emergence of new infectious agents and antibiotic-resistant strains underscores the need for effective testing methods. Pyrogen testing helps identify and quantify pyrogen contamination, ensuring compliance with regulatory standards and mitigating risks to patient safety.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

- For instance, in August 2023, Lonza introduced the Nebula Absorbance Reader, a microplate reader for absorbance, enhancing the company's range of specialized instruments tailored for efficient endotoxin and pyrogen analysis.

To Understand More About this Research: Request a Free Sample Report

Technological advancements are propelling substantial growth in the pyrogen testing market. Industries like pharmaceuticals, biotechnology, and medical devices require more efficient and accurate detection methods. Rapid testing technologies such as Limulus Amebocyte Lysate (LAL) assays offer quick results without compromising accuracy, reducing testing time and enhancing productivity. Automation and robotics streamline workflows, minimizing errors and improving throughput. Advanced analytical techniques like mass spectrometry and chromatography enable sensitive detection of endotoxins, ensuring higher specificity. Innovative materials and coatings for pyrogen-free laboratory consumables enhance testing accuracy and reduce interference from contaminants.

Industry Growth Drivers

Stringent regulatory guidelines are projected to spur product demand

Stringent regulatory guidelines are driving growth in the pyrogen testing market. Regulatory bodies like the FDA and EMA enforce strict standards mandating pyrogen testing to ensure the safety and quality of pharmaceuticals, medical devices, and healthcare products. Compliance with these guidelines is essential for manufacturers to obtain regulatory approvals and market their products effectively. Harmonized standards across regions simplify compliance efforts for global manufacturers. The increasing complexity of pharmaceutical formulations and the prevalence of chronic diseases fuel the demand for robust pyrogen testing methods.

Growth in pharmaceutical and biotechnology industries is expected to drive pyrogen testing market growth

The pyrogen testing market is growing due to the expansion of the pharmaceutical and biotechnology industries. With these sectors continuously innovating and developing new drugs, vaccines, and medical devices, stringent pyrogen testing is imperative to ensure product safety and regulatory compliance. Detecting harmful endotoxins produced by certain bacteria, pyrogen testing is crucial in preventing severe adverse reactions in patients. As the focus shifts towards biologics and biosimilars, which are highly susceptible to endotoxin contamination, the demand for pyrogen testing escalates.

Industry Challenges

High cost of testing equipment and reagents is likely to impede the market growth

The pyrogen testing market faces limitations due to the high costs of testing equipment and reagents. Essential instruments and materials are expensive, posing challenges for smaller laboratories and organizations with limited budgets. Recurring expenses for equipment maintenance, calibration, and consumables further contribute to financial burdens. These high costs act as significant barriers for new market entrants and deter existing entities from expanding pyrogen testing capabilities. Healthcare facilities and pharmaceutical companies struggle to allocate funds amidst competing priorities. Addressing these constraints requires innovative strategies like developing affordable testing solutions, exploring bulk purchasing or leasing options, and fostering collaboration among stakeholders to alleviate financial barriers hindering market growth.

Report Segmentation

The pyrogen testing market analysis is primarily segmented based on product, test type, end user, and region.

|

By Product |

By Test Type |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Consumables segment held a significant market revenue share in 2023

The consumables segment held a significant revenue share in 2023 due to continuous demand for essential components like test tubes, reagents, and kits in laboratories and manufacturing facilities. Pyrogen testing is integral to quality control processes in pharmaceutical, biotechnology, and medical device industries, ensuring consistent demand for consumables. These products have wide applications across various pyrogen testing methods, including LAL assays, MAT, and rFC assays, further bolstering their revenue share. Stringent regulatory requirements mandate frequent pyrogen testing to ensure product safety and compliance, driving the demand for consumables. Additionally, technological advancements lead to the development of innovative consumables with improved performance, prompting investment from companies to enhance testing efficiency and accuracy.

By Test Type Analysis

LAL test segment held a significant market revenue share in 2023

The Limulus Amebocyte Lysate (LAL) test segment held a significant revenue share in 2023 due to its industry-standard status and regulatory mandates by agencies like the FDA and EMA. Renowned for its high sensitivity in detecting pyrogens, LAL tests are trusted by manufacturers and regulators, offering versatility across product types and testing platforms. Ongoing research aims to further enhance sensitivity, specificity, and reliability, ensuring continued relevance and adoption.

By End User Analysis

Pharmaceutical and biotechnology companies segment held a significant revenue share in 2023

The pharmaceutical and biotechnology companies segment held significant revenue share in 2023 due to stringent regulatory mandates, extensive product portfolios requiring pyrogen testing, and involvement in clinical trials. With in-house testing facilities equipped for advanced pyrogen testing, they conduct rigorous testing to ensure compliance and patient safety. Continuous investment in research and development further drives demand for advanced testing methods.

Regional Insights

Asia-Pacific is expected to experience significant growth during the forecast period

Asia-Pacific is expected to experience growth during the forecast period due to expanding pharmaceutical and biotechnology sectors, increased healthcare expenditure, and growing regulatory stringency. Technological advancements are making pyrogen testing more accessible and efficient, further driving adoption. Moreover, the region's expanding clinical research activities, particularly in emerging markets like India and China, require robust pyrogen testing services to ensure participant safety and regulatory compliance.

In 2023, the North America region accounted for a significant market share due to its well-established healthcare infrastructure, stringent regulatory standards enforced by agencies like the FDA, and the presence of key industry players. Moreover, the region's high healthcare expenditure underscores its investment in healthcare services and products, including pyrogen testing. Additionally, there's widespread awareness among healthcare professionals and regulatory bodies regarding the importance of pyrogen testing in ensuring product safety. Robust research and development initiatives in North America drive innovation in pyrogen testing methodologies and products, consolidating its position in the market.

Key Market Players & Competitive Insights

The pyrogen testing market consists of a diverse array of participants, and the expected entry of new players is poised to intensify competitive dynamics. Major leaders in the market continuously enhance their technologies, striving to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These entities prioritize strategic actions, including forming alliances, improving product portfolios, and participating in collaborative ventures. Their primary goal is to outperform competitors within the industry, ultimately securing a significant pyrogen testing market share.

Some of the major players operating in the global pyrogen testing market include:

- Associates of Cape Cod, Inc.

- BioMerieux SA

- Charles River Laboratories International, Inc.

- Ellab A/S

- Eurofins Scientific SE

- GenScript Biotech Corporation

- Lonza Group Ltd.

- Merck KGaA

- Microcoat Biotechnologie GmbH

- Nelson Laboratories, LLC

- Pyrostar

- Rapid Micro Biosystems, Inc.

- Thermo Fisher Scientific Inc.

- Wako Chemicals USA, Inc.

- WUXI Pharmatech

Recent Developments

- In October 2023, Lonza unveiled two innovative rapid monocyte activation test (MAT) platforms: the PyroCell MAT Rapid System and PyroCell MAT Human Serum (HS) Rapid System, aimed at enhancing and streamlining pyrogen testing without the use of rabbits.

- In May 2020, Sanquin Reagents B.V. and Lonza Sales AG forged a strategic alliance to market a variety of specialized reagents tailored for pyrogen testing of parenteral pharmaceuticals and medical devices through the monocyte activation test (MAT).

- In June 2021, The European Pharmacopoeia Commission (EPC) initiated steps toward phasing out the rabbit pyrogen test (RPT) from the European Pharmacopoeia (Ph. Eur.) over about five years.

Report Coverage

The pyrogen testing market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, products, test types, end users, and their futuristic growth opportunities.

Pyrogen Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.76 billion |

|

Revenue forecast in 2032 |

USD 3.42 billion |

|

CAGR |

8.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Pyrogen Testing Market report covering key segments are product, test type, end user, and region.

Pyrogen Testing Market Size Worth $3.42 Billion By 2032

Pyrogen Testing Market exhibiting the CAGR of 8.7% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in Pyrogen Testing Market are Stringent regulatory guidelines are projected to spur product demand