Ready-To-Drink Packaging Market Size, Share, & Industry Analysis Report

By Product Type (RTD Cans, Liquid Cartons, Plastic Bottles, and Glass Bottles), By Material, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6328

- Base Year: 2024

- Historical Data: 2020-2023

Overview

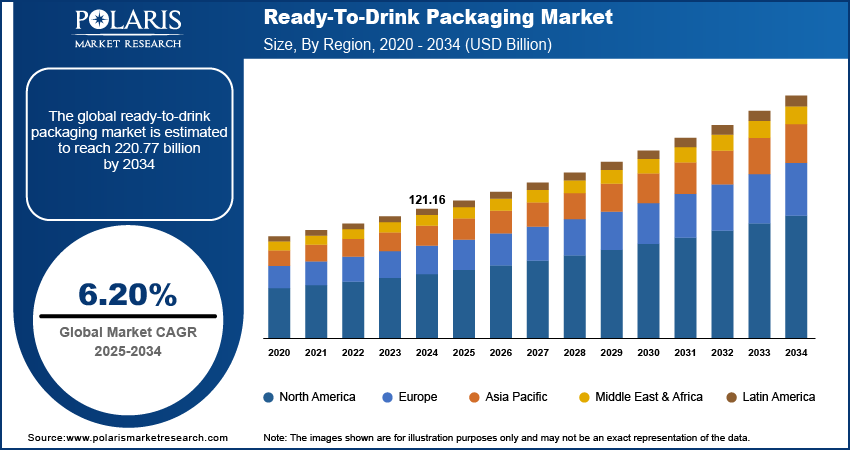

The global ready-to-drink packaging market size was valued at USD 121.16 billion in 2024, growing at a CAGR of 6.20% from 2025–2034. Rising global population and urbanization are driving packaged beverage consumption, while the expansion of e-commerce platforms is driving higher distribution of RTD beverages.

Key Insights

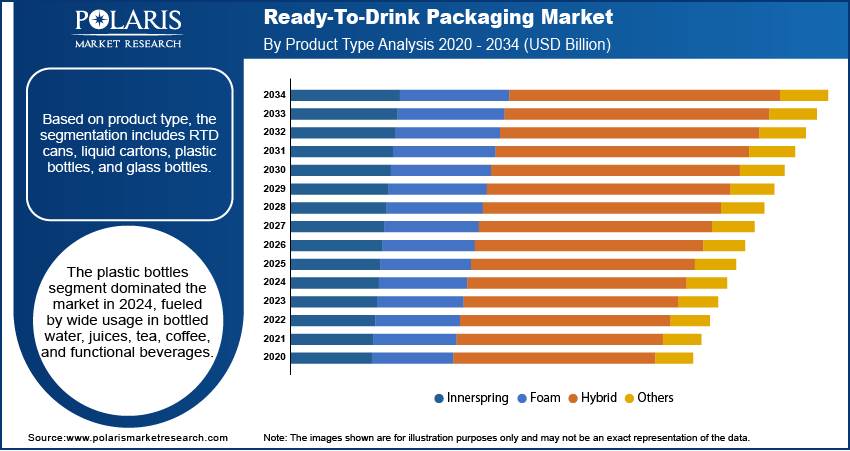

- The plastic bottles segment dominated the global RTD packaging market share in 2024.

- The RTD cans segment is projected to grow at the fastest CAGR during the forecast period, fueled by rising demand for portability, recyclable aluminum materials, and growth in energy drinks and functional beverages.

- North America RTD packaging market dominated the global share in 2024, driven by high ready-to-drink beverage consumption, advanced retail and e-commerce infrastructure.

- The U.S. RTD packaging market accounted for the largest regional share in North America in 2024, driven by strong consumer demand, sustainable packaging initiatives, and presence of key industry players.

- Asia Pacific RTD packaging market is projected to grow at the fastest CAGR during the forecast period, fueled by urban population growth, rising disposable incomes and expansion of modern retail and online channels.

- The China RTD packaging market is expanding rapidly, propelled by growing consumption of packaged beverages, and increasing adoption of PET bottles, cartons and cans.

Industry Dynamics

- Rising global population and urbanization are driving higher consumption of packaged beverages, creating demand for efficient RTD packaging solutions.

- Expansion of e-commerce platforms is supporting wider distribution of RTD beverages, increasing the need for durable and portable packaging formats.

- Technological advancements such as biodegradable, plant-based and compostable packaging solutions creates opportunity for the RTD packaging market.

- High production costs associated with sustainable and biodegradable packaging materials is hindering the growth of the market.

Market Statistics

- 2024 Market Size: USD 121.16 Billion

- 2034 Projected Market Size: USD 220.77 Billion

- CAGR (2025–2034): 6.20%

- North America: Largest Market Share

The ready-to-drink (RTD) packaging industry focuses on solutions that preserve quality, extend shelf life, and enhance convenience for beverages such as juices, tea, coffee, dairy-based drinks, energy drinks, and alcoholic beverages. It spans applications across retail, foodservice, and e-commerce channels. Growth is driven by packaging formats including bottles, cans, cartons, and pouches, along with closures and labeling solutions. These formats improve product safety, ensure regulatory compliance, and address consumer demand for convenience, portability, and sustainable options across developed and emerging economies.

In operational practice, advanced packaging materials such as PET, aluminum, paperboard, and biodegradable polymers provide durability, barrier protection, and recyclability. Manufacturers are integrating green packaging features including QR codes and freshness indicators to improve traceability and consumer engagement. Automation and robotics in filling and sealing processes enhance efficiency, reduce contamination risks, and lower production costs. For instance, beverage producers are increasingly adopting lightweight bottles and recyclable cartons to reduce environmental impact and align with sustainability targets.

The RTD packaging market is expanding as food and beverage companies respond to stricter sustainability regulations and rising consumer preference for eco-friendly solutions. In April 2025, Yoplait introduced clear, recyclable bottles made with 35% recycled PET (rPET) for its Yop yoghurt drink. The new design features an attached cap and a micro-perforated sleeve, enhancing sustainability and user convenience. Investment in circular economy practices and the adoption of plant-based or compostable packaging materials are creating new opportunities. Public–private initiatives and brand-led sustainability programs are supporting large-scale adoption of recyclable and low-carbon packaging. The industry is advancing through innovations in digital printing, smart labeling, and refillable formats, which are expected to drive long-term growth.

Drivers & Opportunities

Rising global population and urbanization driving packaged beverage consumption: The rapid growth of the global population and accelerated urbanization are increasing the demand for packaged beverages, which directly drives the adoption of RTD packaging solutions. A United Nations report projects that urban areas will gain 2.5 billion more people by 2050 due to the ongoing global shift from rural to urban living. Urban lifestyles are characterized by limited time, higher disposable incomes, and a preference for on-the-go consumption, creating strong reliance on ready-to-drink products such as tea, coffee, juices, and functional beverages. Rising health awareness and demand for convenient nutrition are further expanding packaged beverage consumption. This trend is pushing beverage producers to adopt advanced packaging formats that ensure portability, extended shelf life, and regulatory compliance across developed and emerging economies.

Expansion of global e-commerce platforms supporting higher RTD beverage distribution: The growth of global e-commerce platforms is reshaping beverage distribution by providing wider access to RTD products across diverse consumer bases. Online retail channels enable efficient delivery of packaged beverages to urban and semi-urban markets, increasing reliance on durable, lightweight, and spill-proof packaging formats. Subscription models and direct-to-consumer strategies are fueling higher sales of RTD beverages through digital platforms. As per the International Trade Administration (ITA), the global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, growing at a steady 14.4% annual rate. The convenience of doorstep delivery, coupled with promotional pricing, is expanding consumer preference for buying beverages online. This shift is compelling manufacturers to invest in packaging innovations that enhance product protection, improve shelf presentation, and reduce logistics costs.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes RTD cans, liquid cartons, plastic bottles, and glass bottles. The plastic bottles segment dominated the RTD packaging market in 2024, driven by its cost-effectiveness, lightweight nature, and wide compatibility with different beverages. Plastic bottles provide durability, spill-proof sealing, and extended shelf life, making them suitable for retail, e-commerce, and on-the-go consumption. Manufacturers favor plastic bottles for mass production due to their low transportation costs and ease of customization with labels, caps, and shapes. Rising consumer preference for convenient packaging formats and high adoption in developing and urban markets further strengthens the dominance of plastic bottles in the overall RTD packaging market.

The RTD cans segment is projected to grow at the fastest CAGR during the forecast period due to rising demand for portability and enhanced product protection. Cans offer superior barrier properties against light and oxygen, ensuring beverage freshness for longer durations. Increasing adoption in energy drinks, alcoholic RTDs, and functional beverages is driving growth, fueled by lightweight designs that reduce logistics costs. Innovative designs and digital labeling are improving brand visibility, while consumer preference for recyclable aluminum materials to meet sustainability goals, boosting the adoption of RTD cans across developed and emerging regions.

Material Analysis

Based on material, the segmentation includes metal, glass, plastic, pet, and cartons. The plastic dominated the RTD packaging market in 2024 due to its affordability, lightweight properties, and versatility. It is widely used in bottles, pouches, and closures for multiple beverages, providing durability and ease of transport. Plastic packaging allows mass customization, supports efficient production processes, and ensures compliance with safety and hygiene standards. Its extensive adoption in urban and semi-urban regions, along with compatibility with automation and filling systems, pushes its dominance. Rising demand for on-the-go beverages and e-commerce distribution channels further strengthens the role of plastic materials in RTD packaging.

The PET material segment is projected to grow at the fastest CAGR during the forecast period due to its recyclability and environmental advantages. PET provides high clarity, strength, and chemical resistance, making it suitable for beverages such as water, juices, and functional drinks. In May 2025, Faerch launched a hot drink lid made from up to 85% recycled PET, fully recyclable and designed for a secure, sustainable, and leak-resistant fit. Increasing consumer awareness of sustainability and brand commitments to reduce carbon footprint are driving PET adoption. Lightweight and durable PET bottles reduce transportation costs and improve logistics efficiency. Manufacturers are increasingly integrating PET into innovative packaging formats, including single-serve and multi-pack solutions, to meet evolving market demand and regulatory sustainability requirements.

Application Analysis

Based on application, the segmentation includes alcoholic beverages, tea & coffee, bottled water, fruit juices, milk and milk products, and carbonated drinks. The bottled water dominated the RTD packaging market in 2024, driven by rising consumption due to urbanization, health awareness, and convenient lifestyle trends. Bottled water requires durable, lightweight, and spill-proof packaging, making it compatible with plastic and PET materials. High demand across retail and e-commerce channels, coupled with frequent consumption patterns, ensures steady market revenue. Manufacturers prioritize innovative packaging designs and labeling to improve brand visibility. Adoption of recyclable materials and portion-controlled formats further strengthens bottled water’s position, driven its dominance in the RTD packaging industry across developed and emerging markets.

The tea and coffee segment is projected to grow at the fastest CAGR during the forecast period due to rising demand for ready-to-drink functional beverages. Increasing preference for convenient, on-the-go consumption and flavored beverages is driving growth. Innovative packaging solutions such as cans, cartons, and PET bottles preserve taste, aroma, and freshness while enabling easy portability. Adoption of sustainable materials, smart labeling, and portion-controlled packaging supports brand differentiation. Growth is further accelerated by e-commerce platforms and cold-brew coffee trends, enabling wider distribution and catering to health-conscious and busy urban consumers globally.

Regional Analysis

North America ready-to-drink packaging market dominated the global market in 2024. This is due to the high consumption of ready-to-drink beverages and strong retail and e-commerce infrastructure. Moreover, increasing consumers preference towards convenience-based packaging formats such as plastic bottles and cans to support on-the-go lifestyles is driving the industry. In addition, stringent regulatory standards regarding food safety and packaging recyclability are driving manufacturers to adopt advanced packaging solutions, ensuring compliance and sustainability. Furthermore, growing investments in automation and smart labeling technologies by beverage companies are improving operational efficiency and product traceability.

The U.S. Ready-To-Drink Packaging Market Insight

The U.S. held a dominating market share in the North America ready-to-drink packaging landscape in 2024, due to high per capita consumption of ready-to-drink beverages and a preference for convenient on-the-go packaging formats. For instance, in July 2025, Avient launched ColorMatrix Amosorb Oxyloop-1, an oxygen-scavenging additive that improves PET packaging recyclability. It works with up to 100% recycled PET, maintains clarity, and meets global food contact regulations. Moreover, extensive retail and e-commerce infrastructure is supporting wider product distribution and faster market penetration. In addition, growing consumer awareness about recyclable and lightweight packaging materials is driving adoption of PET bottles, plastic bottles, and cans. Furthermore, investments in automation, smart labeling, and digital tracking by beverage manufacturers are improving operational efficiency and traceability.

Europe Ready-To-Drink Packaging Market

The ready-to-drink packaging landscape in Europe is projected to hold a substantial share in 2034. This is owing to the rising demand for sustainable and recyclable packaging materials is driving growth in plastic and aluminum cans. As an example, in December 2024, the European Union (EU) adopted the Packaging and Packaging Waste Regulation (PPWR - Regulation (EU) 2025/40) to promote a circular and competitive economy for packaging and packaging waste. Moreover, growing consumer preference for premium ready-to-drink beverages such as cold-brew coffee and flavored teas is supporting market expansion. In addition, stringent government regulations on environmental sustainability are pushing manufacturers to adopt innovative packaging formats that minimize waste and carbon footprint.

Asia Pacific Ready-To-Drink Packaging Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is expanding due to the rapid urban populations and increasing disposable incomes are boosting the demand for packaged beverages, driving adoption of PET bottles and cartons. Moreover, rapid growth of e-commerce and modern retail channels in urban centers is supporting wider distribution of RTD products. In addition, the focus on eco-friendly and lightweight packaging solutions is fueling beverage manufacturers to innovate, enhancing consumer acceptance.

China Ready-To-Drink Packaging Market Overview

The market in China is expanding due to rising urbanization and increasing disposable incomes, which are boosting packaged beverage consumption. According to the U.S. Energy Information Administration (EIA), China's per capita disposable income is projected to increase from USD 12,236 in 2025 to USD 19,156 in 2035. This represents a growth of approximately 56.5% over the 10-year period. Moreover, rapid growth of e-commerce and modern retail channels in urban centers is enabling wider distribution of RTD beverages. In addition, government initiatives promoting sustainable and recyclable packaging materials are driving manufacturers to invest in PET bottles, cartons, and cans.

Key Players & Competitive Analysis Report

The ready-to-drink packaging market is moderately fragmented, with leading players focusing on innovative packaging solutions, automation, and smart labeling to enhance operational efficiency and product traceability. Companies are expanding their portfolios with recyclable PET bottles, aluminum cans, cartons, and biodegradable materials to meet sustainability goals and growing consumer demand. Moreover, collaborations between beverage manufacturers, packaging providers, and technology companies are enabling product innovation and supporting the adoption of region-specific packaging formats, strengthening long-term competitiveness across retail, e-commerce and foodservice channels worldwide.

Major companies operating in the ready-to-drink packaging industry include Tetra Laval Group, Crown Holdings, Inc., Amcor Limited, Ball Corporation, Ardagh Metal Packaging, Smurfit Kappa, SIG Combibloc, Elopak, Vetropack Group, Graphic Packaging International, Graham Packaging Company, and WestRock Company.

Key Players

- Amcor Limited

- Ardagh Metal Packaging

- Ball Corporation

- Crown Holdings, Inc.

- Elopak

- Graham Packaging Company

- Graphic Packaging International

- SIG Combibloc

- Smurfit Kappa

- Tetra Laval Group

- Vetropack Group

- WestRock Company

Industry Developments

- May 2025: Faerch introduced an rPET hot drinks lid designed for the coffee and beverage industry, aiming to reduce plastic waste and promote a circular economy. This development aligns with the company's commitment to sustainability and addresses the growing demand for eco-friendly packaging solutions.

- May 2025: Westrock Coffee opened North America’s largest roast-to-ready-to-drink (RTD) facility in Conway, Arkansas. The 570,000 sq. ft. USD 315 million plant combines roasting, extraction and packaging under one roof that is boosting production capacity for the growing RTD beverage market.

Ready-To-Drink Packaging Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- RTD Cans

- Liquid Cartons

- Plastic Bottles

- Glass Bottles

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Metal

- Glass

- Plastic

- PET

- Cartons

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Alcoholic Beverages

- Tea & Coffee

- Bottled Water

- Fruit Juices

- Milk and Milk Products

- Carbonated Drinks

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Ready-To-Drink Packaging Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 121.16 Billion |

|

Market Size in 2025 |

USD 128.51 Billion |

|

Revenue Forecast by 2034 |

USD 220.77 Billion |

|

CAGR |

6.20% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 121.16 billion in 2024 and is projected to grow to USD 220.77 billion by 2034.

The global market is projected to register a CAGR of 6.20% during the forecast period.

North America dominated the RTD packaging market in 2024, driven by high consumption of ready-to-drink beverages and e-commerce infrastructure.

A few of the key players in the market are Tetra Laval Group, Crown Holdings, Inc., Amcor Limited, Ball Corporation, Ardagh Metal Packaging, Smurfit Kappa, SIG Combibloc, Elopak, Vetropack Group, Graphic Packaging International, Graham Packaging Company, and WestRock Company.

The plastic bottles segment dominated the market in 2024, fueled by cost-effectiveness, durability and compatibility with various beverages across retail and on-the-go consumption channels.

The plastic segment dominated the RTD packaging market in 2024, driven by affordability, lightweight properties, versatility and wide adoption in urban and semi-urban regions.