Reciprocating Pumps Market Share, Size, Trends, Industry Analysis Report

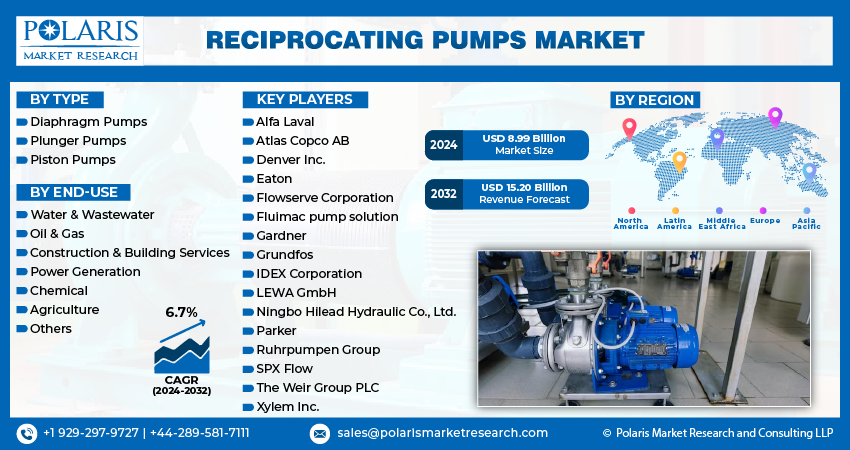

By Type (Diaphragm Pumps, Plunger Pumps, Piston Pumps); By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4311

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

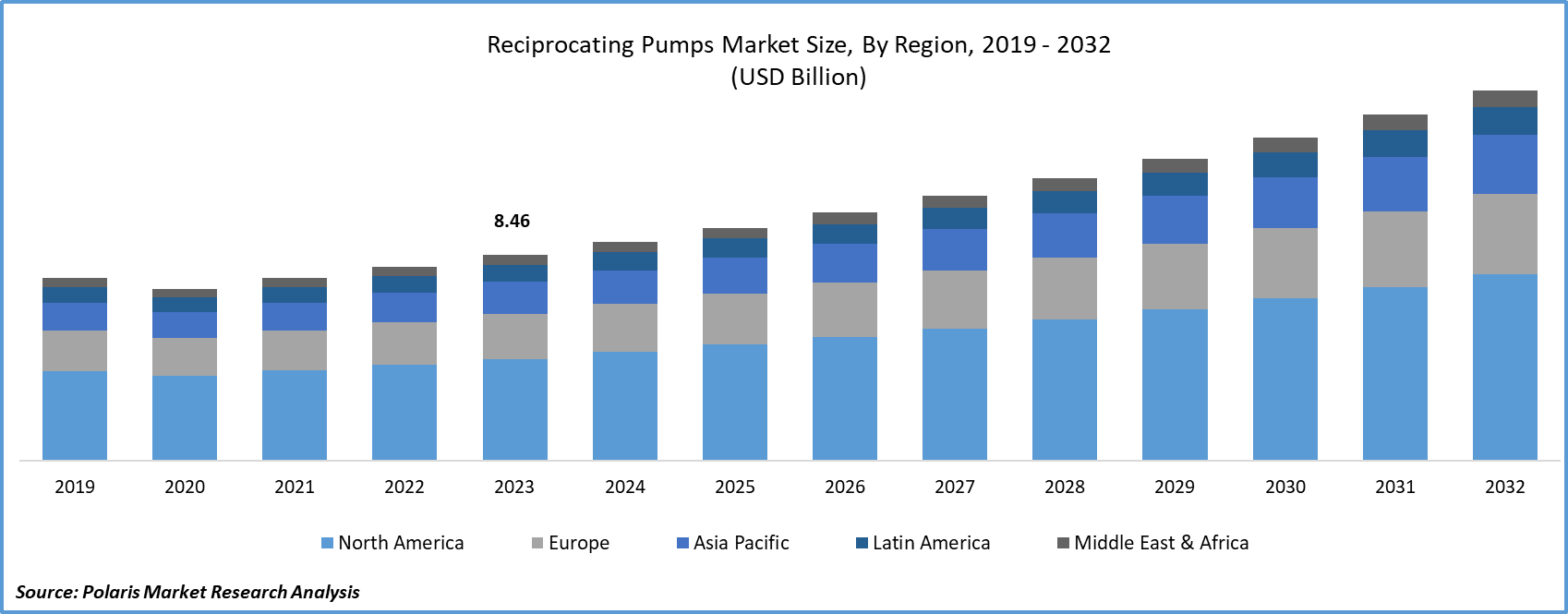

The global reciprocating pumps market size and share was valued at USD 8.46 billion in 2023 and is expected to grow at a CAGR of 6.7% during the forecast period.

Reciprocating pumps play a vital role in generating high-pressure fluid transmission within hydraulic systems, manufacturing facilities, and injection and dosing systems. These pumps are indispensable for various industries, including manufacturing, chemicals, and wastewater treatment, contributing to the growth of the reciprocating pump market. Functioning as positive displacement pumps, reciprocating pumps displace a consistent volume of fluid under pressure, facilitating the transfer of fluid from one location to another by elevating its pressure. These pumps can be tailored to achieve constant discharge rates, making them versatile for applications in commercial, industrial, and residential settings, where they are utilized for the transfer of gases and liquids.

The surge in the U.S. oil and gas industry plays a pivotal role in driving the demand for reciprocating pumps. These pumps find extensive use in various facets of the oil and gas sector, including hydrocarbon exploration, production, and refining. The robust growth of the oil and gas industry in the U.S. is a major catalyst for the expansion of the reciprocating pump market. Additionally, the adoption of hydraulic fracturing for shale gas exploration further fuels market growth.

Anticipated future trends in the market reflect the evolving requirements of end-use industries and an increasing focus on energy efficiency and sustainability. To address these needs, key market players are innovating by developing energy-efficient pumps with a reduced carbon footprint. These newly designed pumps incorporate variable frequency drivers (VFDs) to enhance pump speed and flow control. Specific industries like chemical processing, dealing with highly corrosive, viscous, and acidic fluids, demand specialized reciprocating pumps. Manufacturers are responding to these demands by offering customization options and specialized expertise.

To Understand More About this Research: Request a Free Sample Report

Moreover, a modular design approach has been widely adopted by major market players in the development of reciprocating pumps. Additionally, companies are placing significant emphasis on providing Internet of Things (IoT)-based pump solutions, showcasing a commitment to technological advancements in the industry.

The reciprocating pump sector is characterized by intense competition and concentration, featuring numerous players with proficiency in product design and development. Global market entities are actively directing their efforts toward substantial investments in research and development, particularly in the realm of diaphragm pumps. This strategic focus allows them to sustain their market share, thereby contributing significantly to the overall growth of the market.

Industry Dynamics

Growth Drivers

Contemporary architectural trends in both developed and developing nations.

The modernization of architecture in both developed and emerging nations is poised to fuel the growth of the construction sector and the mechanical hand tool industry. Various factors, including increasing industrialization, expansion in application industries, heightened demand from sectors like chemical, oil and gas, pharmaceuticals, food and beverages, along with notable advancements in machinery and equipment industries, are driving an escalating requirement for reciprocating pumps. A noteworthy market demand factor is manufacturers' focus on mitigating the risks associated with the installation of chemical handling equipment during projects, aiming to streamline processes and save time.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

The Diaphragm Pumps segment held the largest revenue share in 2022

A diaphragm pump employs a flexible diaphragm made of materials like rubber or plastics in lieu of a piston to transfer fluids. The activation of diaphragm pumps, based on end-use pressure and flow rate requirements, can be achieved either through mechanical means or compressed air. Noteworthy advantages of diaphragm pumps encompass their capacity to handle a diverse range of fluids, including viscous and abrasive substances. They are recognized for their leak-tight operation, rendering them suitable for applications where fluid containment is of utmost importance. Moreover, diaphragm pumps are self-priming, eliminating the need for external priming to initiate pumping. Their adaptability, reliability, and capability to manage challenging fluids position them as a valuable choice for handling a broad spectrum of substances in industries such as food processing, pharmaceuticals, oil & gas, and chemical processing.

The piston pump segment is poised to exhibit the most rapid CAGR. Functioning as a type of positive displacement pump, piston pumps facilitate fluid transfer through the reciprocal motion of a piston within a cylinder. These pumps are integral for generating high-pressure fluid flow and find common usage in precision-demanding industries and applications, including hydraulic systems and manufacturing machinery. Renowned for their capability to generate exceptionally high pressures, piston pumps are frequently employed in applications requiring such characteristics, such as high-pressure water jetting, oil and gas well stimulation, and pressure testing. Additionally, the piston pump excels in handling viscous and abrasive fluids more efficiently when compared to other reciprocating pumps. Its design proves less susceptible to wear and damage when pumping fluids containing solid particles or exhibiting high viscosity. Consequently, piston pumps are the preferred choice in industries like oil & gas extraction and wastewater treatment.

By Product Analysis

The Oil & Gas segment accounted for the highest market share during the forecast period

Reciprocating pumps are essential in the upstream exploration and production (ExoPE) sector of the oil and gas industry, especially in the hydraulic fracturing process. Their primary function is to inject fluids at significant depths to enhance the recovery of hydrocarbons. In the stages of oil refining, reciprocating pumps with high-pressure capabilities play a vital role in transferring crude oil, whether from the wellhead to storage tanks or within a production facility, facilitating movement from one location to another. Furthermore, reciprocating pumps are pivotal in the natural gas compression process, aiding in the compression of natural gas for transportation through pipelines. This compressed gas is commonly injected into reservoirs to optimize oil recovery (EOR). Additionally, reciprocating pumps are integral in the transfer of liquefied petroleum gas (LPG) and natural gas liquids (NGLs) from production facilities to storage tanks or transportation vessels.

The chemical sector is poised to achieve the highest CAGR during the forecast period. Reciprocating pumps are widely employed in the chemicals industry due to their versatility in handling a diverse range of chemicals with varying pH levels. In chemical processes, the corrosive nature of acidic fluids poses a challenge to the internal components of pumps. To address this issue, diaphragm pumps are utilized to mitigate the corrosive impact of acidic fluids on the pump's inner components. Additionally, these pumps ensure precise control over fluid discharge rates and demonstrate reliable operation under diverse conditions. The meticulous quality control required in chemical processing often necessitates the accurate metering of chemicals for precise dosing. This enables the enhancement of product quality by managing process variables such as discharge rates and fluid pressure. Reciprocating pumps offer ease in controlling these process variables, making them instrumental in injecting catalysts with precise quantities to produce high-quality compounds in the chemical processing industry.

Regional Insights

Asia Pacific dominated the largest market in 2023

The expected increase in market potential is driven by swift industrialization and a rising need for fluid handling in various countries, with a notable focus on China and India. Notably, the Asia Pacific region is witnessing substantial growth in the agriculture, chemical, and food processing sectors, propelled by factors like urbanization and increasing per capita income. Reciprocating pumps play a significant role in the agriculture sector, especially in equipment used for herbicide and pesticide spraying.

Moreover, the economies of the Asia Pacific region are anticipated to flourish in the forecast period, supported by increased government investments in key sectors such as agriculture, power generation, and construction. The continuous expansion of end-use industries, including the hydraulic and pneumatic machinery sector and hydrocarbon exploration, is expected to result in a heightened demand for fluid-handling equipment. Consequently, this trend will contribute to the overall growth of the reciprocating pump market.

The expected growth of the European market is significantly shaped by its robust industrial sector. Reciprocating pumps are integral to diverse industrial processes, elevating fluid pressure, especially for liquids. Their applications encompass a range of processes, including paint and coating applications, hydraulic systems, and ultrahigh pressurized water cutting. With the ongoing expansion of demand for these processes, a simultaneous increase in the demand for pumps is anticipated in the region. Moreover, the push to reduce the carbon footprint in industrial operations and improve carbon credit has driven the market for more efficient reciprocating pumps in the region.

Key Market Players & Competitive Insights

The reciprocating pumps market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Alfa Laval

- Atlas Copco AB

- Denver Inc.

- Eaton

- Flowserve Corporation

- Fluimac pump solution

- Gardner

- Grundfos

- IDEX Corporation

- LEWA GmbH

- Ningbo Hilead Hydraulic Co., Ltd.

- Parker

- Ruhrpumpen Group

- SPX Flow

- The Weir Group PLC

- Xylem Inc.

Recent Developments

- In June 2021, Alfa Laval introduced the DuraCirc Circumferential Piston Pump, featuring flow rates of up to 150 m3/h and the capability to withstand operating pressures of up to 580 psi (40 bar). Notably, its optional ports facilitate the seamless replacement of existing pumps from Alfa Laval and other brands with the DuraCirc, eliminating the need for adjustments to the pipework.

- In March 2021, In response to the demand for pumps with reduced pulsation, KNF, a diaphragm pump manufacturer, introduced the FP 70 to its smooth-flow liquid pump series. This latest product enhances both the pump's efficiency and the overall fluidic system for the customer.

Reciprocating Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 8.99 billion |

|

Revenue Forecast in 2032 |

USD 15.20 billion |

|

CAGR |

6.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

Uncover the dynamics of the reciprocating pumps sector in 2024 with detailed statistics on market share, size, and revenue growth rate meticulously curated by Polaris Market Research Industry Reports. This all-encompassing analysis extends to a forward-looking market forecast until 2032, complemented by a perceptive historical overview. Immerse yourself in the profound insights offered by this industry analysis through a complimentary PDF download of the sample report.

FAQ's

The Reciprocating Pumps Market report covering key segments are type, end-use, and region.

Reciprocating Pumps Market Size Worth $15.20 Billion By 2032

The global Reciprocating Pumps market is expected to grow at a CAGR of 6.7% during the forecast period.

Asia Pacific is leading the global market

key driving factors in Reciprocating Pumps Market are contemporary architectural trends in both developed and developing nations