Recloser Market Size, Share, Trends, & Industry Analysis Report

: By Control Type (Electronic and Hydraulic), By Phase Type, By Voltage Rating, By Installation Medium, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 113

- Format: PDF

- Report ID: PM3051

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

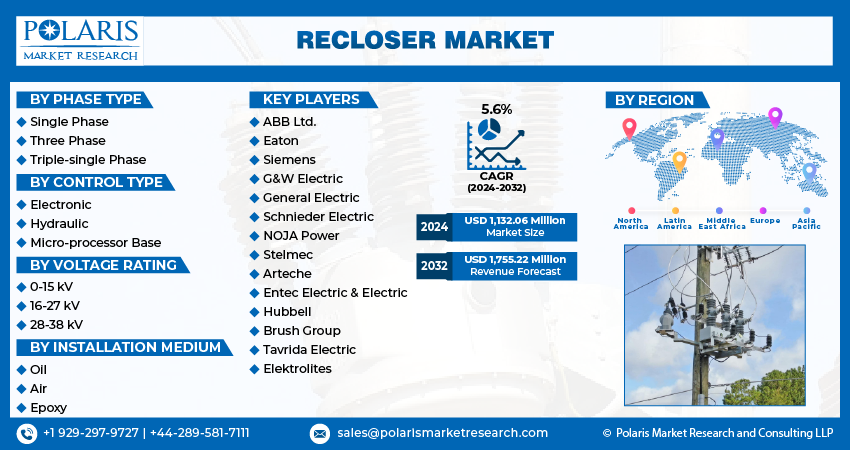

The global recloser market size was valued at USD 1.63 billion in 2024, growing at a CAGR of 5.7% during 2025–2034.

The market growth is driven by the rising need for a stable electricity supply and minimizing power losses. Additionally, improving power infrastructure and stronger rules for energy efficiency are further expanding recloser demand.

Recloser is an automatic, high-voltage electric switch used in power distribution systems. It detects and interrupts temporary faults and restores power quickly. Reclosers play a crucial role in maintaining electrical service reliability, especially in overhead distribution lines. Utilities install these devices at strategic points across the electrical network to isolate faults and minimize the number of customers affected. The device significantly reduces outages and downtime caused by lightning strikes or tree branches.

To Understand More About this Research: Request a Free Sample Report

Recloser detects the abnormal flow of current, usually an overload or a short circuit. It opens the circuit, just like a circuit breaker, when it detects a short circuit and automatically attempts to restore the connection after a brief delay without the need for manual intervention. Power utilities rely on reclosers to enhance the efficiency and reliability of their distribution systems. These devices reduce the workload on field operators as they resolve many temporary faults automatically. Reclosers also improve safety by isolating faulted sections of the network, preventing damage to other parts of the system.

The growing global population is driving the demand for reclosers. The United Nations published data stating that the world's population is projected to continue growing for the next 50 to 60 years, peaking at approximately 10.3 billion by mid-2080. This growing population is driving demand for electricity, forcing utility companies to enhance and expand their power distribution networks. Reclosers serve as a critical component in power distribution networks as they automatically detect and interrupt temporary faults and help prevent prolonged outages, thus maintaining electricity reliability in areas with dense populations and high electricity consumption. Therefore, as the global population increases worldwide, the demand for reclosers also spurs.

Governments across the globe are investing heavily in industries to fulfill demands for goods, services, and employment. This adds pressure on power distribution systems in industries, data center power infrastructure, and processing plants to enhance productivity. Reclosers protect power distribution systems in industries, data centers, and processing plants by reducing the impact of minor electrical faults and provide the required stable and continuous power needed to enhance productivity, especially when integrated with power SCADA. Therefore, the rising industrial growth worldwide is driving the recloser industry expansion.

Market Dynamics

Increasing Urbanization Globally

The increasing urbanization globally is propelling the recloser market growth. The World Economic Forum stated that the share of the world’s population living in cities is expected to rise to 80% by 2050, from 55% in 2022. Urbanization requires more infrastructure, including residential buildings, commercial complexes, industrial zones, and transportation networks. Each of these infrastructures depends heavily on a stable and consistent power supply, which reclosers offer by detecting temporary faults in power distribution systems and automatically restoring electricity.

Urban areas are witnessing higher population densities, leading to a greater concentration of electrical loads in smaller geographical areas. These dense networks face a higher risk of faults, such as short circuits or equipment failures. Reclosers play a vital role in these scenarios by detecting faults and automatically restoring power after a temporary interruption.

Electric utilities in urban regions are investing heavily in electricity distribution infrastructure to support increasing electricity consumption. According to the data published by the US Energy Information Administration, capital investment in distribution infrastructure increased by USD 31.4 billion, or 160%, from 2003 to 2023. The increasing investment is fueling demand for smart reclosers that offer communication capabilities and data analytics features to help utilities monitor the grid in real time, quickly respond to issues, and plan for future expansions.

Increasing Investments in Renewable Energy Projects Worldwide

Countries are shifting from centralized fossil-fuel-based power generation to decentralized renewable energy systems such as solar panels, wind farms, and others. This is propelling demand for reclosers as they play a crucial role in maintaining grid stability in renewable energy sources. Solar and wind energy sources are consistently irregular. The output of these sources changes rapidly due to environmental factors, causing voltage fluctuations and temporary faults in the system. Reclosers detect these issues and respond instantly by isolating affected sections and restoring power automatically once conditions stabilize. This function reduces the impact of interruptions and keeps the grid resilient despite the variable nature of renewable energy. The International Energy Agency, in its World Energy Investment 2024 report, stated that global clean energy investment is set to exceed USD 2 trillion in 2024. Therefore, as investment in renewable energy sources increases, especially in remote or distributed areas, utilities increase the deployment of reclosers to protect and balance the grid.

Private sectors and governments across the globe are pouring billions into renewable energy projects, including large-scale wind farms, solar parks, and hybrid systems. These installations are usually connected to regional or local grids that are too weak to handle new loads, as these grids were originally designed for lower and more stable loads. Upgrading these grids to handle the new loads requires reclosers that adapt to sudden changes in current flow and quickly isolate faults. Hence, the increasing investments in renewable energy projects by governments and private sectors worldwide are driving the recloser industry growth.

Segmental Insights

By Phase Type Analysis

The three phase segment accounted for 30.5% market share in 2024 due to its widespread use in industrial and commercial applications and higher load handling capability. These reclosers are particularly important in industrial and commercial areas where it is essential to ensure an even distribution of power across all three phases. Urban and industrial zones typically have higher electricity demands, so three-phase reclosers help manage those loads effectively, enhancing overall system reliability. ABB Ltd’s recloser control offers robust protection and control features for complex power networks. As smart grids become more prevalent and utilities aim to minimize outage times, the demand for advanced three-phase reclosers is increasing. These systems are becoming crucial in ensuring efficient and reliable power supply in busy, high-demand areas.

The triple-single segment is projected to grow at a robust pace in the coming years, as these are modern, electronically controlled devices that provide flexible and precise protection for three-phase power distribution systems. Unlike traditional reclosers that operate all phases together, these advanced reclosers can respond to faults on each phase individually. This capability allows utilities to isolate only the affected phase during a fault, keeping the rest of the system operational and reducing power outages.

By Control Type Analysis

The electronic segment accounted for the largest share at 59.5% in 2024, driven by the increasing demand for smarter grid solutions and enhanced operational efficiency. Electronic reclosers are essential in modern power distribution systems, as they quickly detect and respond to faults while seamlessly integrating with advanced communication technologies. Their adaptability to various grid requirements makes them an ideal choice for applications such as integrating renewable energy and upgrading urban infrastructure.

The demand for electronic control reclosers continues to rise, as industries increasingly move toward smarter and more reliable power systems. For instance, Eaton’s Cooper Power series Form 7 recloser control is designed to enhance grid reliability and safety. It features advanced capabilities, including built-in security tools to protect against cyber threats and a flexible design that allows for future upgrades. Thus, the electronic control segment is poised for steady growth, driven by the need for intelligent, efficient, and secure power distribution systems.

By Voltage Rating Analysis

The 0-15 kV segment dominated the market, valued at USD 786.06 million in 2024. This dominance is attributed to the increasing demand for reliable power distribution in residential areas and small-scale industrial setups. These low-voltage reclosers are designed to detect and resolve faults in lower-power systems, which helps reduce service interruptions and enhances overall grid reliability. The growing adoption is also supported by government initiatives aimed at expanding electrification in rural and semi-urban areas, where these devices provide a cost-effective solution to improve power quality and decrease outage durations.

A key trend driving this segment is the development of compact and efficient reclosers specifically designed for low-voltage networks. For instance, in July 2022, NOJA Power launched the OSM15-12-630-310 recloser, engineered for 15 kV systems with improved fault-handling capacity and enhanced operational performance. Innovations such as these demonstrate the industry's commitment to creating reclosers that address the unique needs of low-voltage power systems, offering improved safety, easier installation, and reduced maintenance requirements.

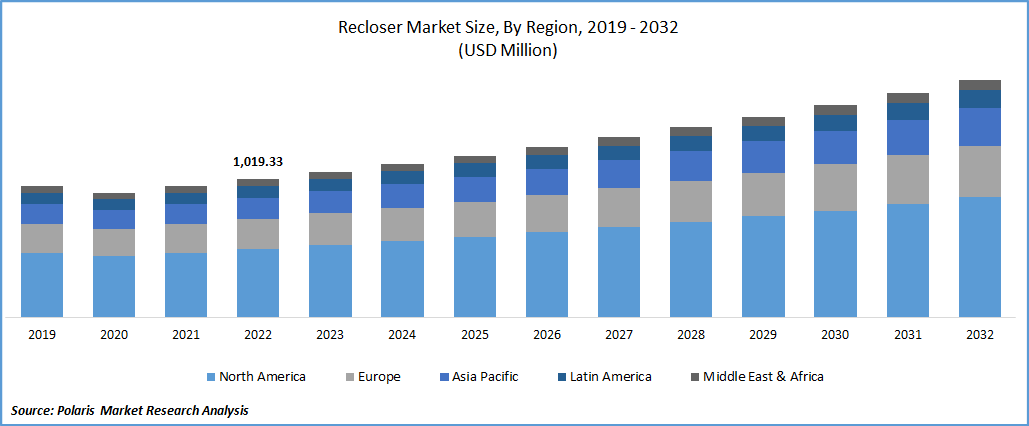

Regional Analysis

The Asia Pacific recloser market size reached USD 750.94 million in 2024 and is estimated to register a CAGR of 6.1% during the forecast period. The growth is driven by rapid urbanization and industrialization, expanding power distribution networks, and increasing integration of renewable energy. Countries are prioritizing the modernization of their power grids, the use of renewable energy, and the enhancement of energy reliability. As urban areas expand, industries develop, and populations increase, the pressure on national electricity networks intensifies. To overcome these challenges, smarter technologies such as reclosers and advanced electricity meters are becoming essential.

China Recloser Market Insight

The recloser market in China dominated in Asia Pacific, capturing 33.5% regional market share. This dominance is driven by the country’s large-scale investment plan of USD 800 billion over six years to upgrade its aging electricity grid. This initiative aims to enhance efficiency, better support renewable energy sources, and decrease the country's reliance on coal. A crucial aspect of this investment involves the installation of intelligent switchgear, such as reclosers, which automatically manage power issues. As China aims to become carbon-neutral by 2060, the demand for reliable and automated systems will continue to grow, driving the need for reclosers in the coming years.

Europe Recloser Market

The recloser market in Europe is projected to reach USD 663.10 million by 2034, owing to increasing focus on smart grid development, electrification, and digital transformation. According to the International Energy Agency, the European Commission introduced the EU action plan titled "Digitalization of the Energy System" at the end of 2022. The Commission anticipates that approximately USD 633 billion will be invested in the European electricity grid by 2030. Of this amount, about USD 184 billion is expected to be allocated specifically for digitalization efforts, which include automated grid management, smart meters, and digital technologies for metering and improving field operations. This strong policy support emphasizes the growing demand for smart infrastructure in Europe, which is essential for enhancing grid resilience and minimizing outage durations.

The Germany recloser market is witnessing expansion, as the country is demonstrating its commitment to modern grid technology with a robust infrastructure plan. In March 2025, Germany announced the USD 568.25 billion infrastructure fund to support the country's goals of energy transition, digitalization, and achieving carbon neutrality by 2045. Out of this, USD 113.65 billion is allocated to local governments, enabling them to upgrade municipal grids with advanced equipment such as reclosers. Rapid urbanization is exerting pressure on electricity networks, prompting investments in automation and smart fault detection. The demand for reliable power grows as cities expand. Reclosers offer a practical solution by automatically isolating faults and restoring service, thus supporting the efficiency objectives of Germany’s infrastructure investment.

North America Recloser Market Overview

The recloser market in North America accounted for 25.1% share of the global market in 2024, owing to the rising demand for reliable and efficient power distribution systems. Urbanization, rising dependence on uninterrupted electricity, and aging grid infrastructure are driving utility providers to adopt advanced switchgear solutions. Companies are under mounting pressure to modernize their distribution networks with responsive and resilient technologies as electricity consumption rises and the grid becomes more complex in North America.

The escalating demand for uninterrupted power supply has placed a strong emphasis on grid automation, particularly in the US. Smart grid initiatives across the country are transforming conventional power systems into resilient and intelligent infrastructures. Investments in automated technologies are driving demand for reclosers.

Key Players and Competitive Analysis

The global recloser market is highly competitive, with several prominent players working to improve their positions through product innovation, strategic partnerships, and geographic expansion. A few key companies in this sector include ABB Ltd, Eaton, Siemens, G&W Electric, General Electric, Schneider Electric, NOJA Power, Stelmec, Arteche, Entec Electric & Electronic, Hubbell, Brush Group, Tavrida Electric, and Elektrolites. These leading companies demonstrate strong technological capabilities, especially in the development of advanced, automated, and smart recloser systems that enhance grid reliability and facilitate the integration of renewable energy sources.

Key Players

- ABB Ltd

- Arteche

- Brush Group

- Eaton

- Elektrolites

- Entec Electric & Electronic

- G&W Electric

- General Electric

- Hubbell

- NOJA Power

- Schneider Electric

- Siemens

- Stelmec

- Tavrida Electric

Industry Developments

March 2025: G&W Electric upgraded Viper-ST recloser, which supports up to 170kV BIL and 1000A, offering enhanced protection, safety, and flexibility for modern grids integrating distributed energy resources.

March 2024: Eaton introduced HiZ Protect, a solution to detect and mitigate high-impedance faults, strengthening wildfire prevention efforts.

April 2025: Hubbell introduced the LineDefender advanced lateral-protection recloser, improving grid reliability and worker safety. It automatically detects faults, restores power without crew deployment, and enhances fault identification with clear visual indicators.

Recloser Market Segmentation

By Phase Type Outlook (Revenue, USD Billion, 2020–2034)

- Single Phase

- Three Phase

- Triple-Single Phase

By Control Type Outlook (Revenue, USD Billion, 2020–2034)

- Electronic

- Hydraulic

By Voltage Rating Outlook (Revenue, USD Billion, 2020–2034)

- 0–15 kV

- 16–27 kV

- 28–38 kV

By Installation Medium Outlook (Revenue, USD Billion, 2020–2034)

- Epoxy

- Air

- Oil

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Recloser Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.63 Billion |

|

Market Size Value in 2025 |

USD 1.71 Billion |

|

Revenue Forecast by 2034 |

USD 2.82 Billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.63 billion in 2024 and is projected to grow to USD 2.82 billion by 2034.

The global market is expected to register a CAGR of 5.7% during the forecast period.

Asia Pacific held the largest share of the global market in 2024.

• A few key players in the market are ABB Ltd, Eaton, Siemens, G&W Electric, General Electric, Schneider Electric, NOJA Power, Stelmec, Arteche, Entec Electric & Electronic, Hubbell, Brush Group, Tavrida Electric, and Elektrolites.

The three phase segment dominated the market in 2024.

The electronic segment held the largest share of the global market in 2024.